#9 Civitanavi Systems SpA

GPS is not enough - A pure player in Inertial Navigation Systems

Update: In March 2024, Honeywell announced that they will acquire Civitanavi Systems for EUR 200 million. Honeywell will initiate a voluntary tender offer to acquire all outstanding shares of Civitanavi for a purchase price of EUR 6.30 per share in cash, which represents a premium of nearly 40 % since the write-up. Honeywell has already secured the commitment of Civitanavi’s controlling shareholder, which owns approximately 66% of Civitanavi’s outstanding shares to tender its shares. That’s why I think that the tender offer will be successful although the acquisition requires antitrust clearance, clearances according to the foreign direct investment regulations in Italy, UK and Canada and the tender of at least 95 & of CNS outstanding shares. The transaction is expected to close in the third quarter of 2024.

Disclaimer: The following write-up is no investment advice. The author may own, buy and sell securities mentioned in this post. Please always do your own due diligence! This company is a micro-cap. Keep in mind that even a small investment from your side can move the share price due to the low liquidity of shares. It's not easy to liquidate if you want to get out.

Welcome,

in this issue of Under-Followed-Stocks I will present you Civitanavi Systems SpA ($CNS.MI).

Investment Summary:

Civitanavi is a pure player in Inertial Navigation Systems (INS)

INS represents the only way to autonomously detect the position of any device and the direction of its motion when GPS signals are not available

CNS products are used for space launch systems, military vehicles on land, air & sea and in the mining, oil & gas industry

CNS benefits from increasing military budgets, higher demand for space launchers and trends in the eVTOL & fully autonomous driving sector

Clients are multinational companies like BAE Systems, Leonardo, Rheinmetall, Honeywell or Teledyne

founder-led with high insider ownership of 66.2 %

profitable growth since foundation with a CAGR of 63 % from 2012 - 2022

Growing by over 30 % with EBIT-Margins over 20 % and valued at an NTM EV/EBIT of 10.2x

If you aren’t a subscriber yet and enjoy the content I share, feel free to subscribe so that you won’t miss any new content. The company write-ups I share are free. But if you want to keep up-to-date about the companies in my portfolio, you can voluntarily choose the paid option :)

Let’s go!

1. Introduction

Civitanavi Systems (CNS) is a vertically integrated provider of high-accuracy inertial navigation systems (INS), designed and manufactured using proprietary methods and techniques based on both Fiber Optic Gyroscope (FOG) and Micro Electro Mechanical Systems (MEMS) technology, integrated with satellite navigation devices (GPS). These are a lot of terms and abbreviations. I will try to explain exactly what this means in more detail later on.

Thanks to the founders Andrea Pizzarulli and Michael Perlmutter's years of experience in the field, the Company quickly became a major player in the global market for both aerospace and defense applications as well as commercial applications.

CNS has a unique positioning as a supplier of high-end inertial systems that are ITAR-free (exempt from US export regulation), have true solid-state (safety critical applications) and provide both stabilisation and navigation functions. This makes CNS well-placed to capture growth in the defence market globally, driven by rising military spending and growing demand for ITAR-free procurement, especially in Europe.

CNS is listed on the Euronext Growth Exchange in Milan since 2022 under the ticker $CNS. The current market cap is EUR 137 million (USD 148 million).

2. The company

CNS was founded in 2012 by Andrea Pizzarulli (CEO) and Michael Perlmutter (executive VP) with first sales in the oil & gas sector through a partnership with a leading US company. In 2015 they started their first airborne project for Piaggio Aerospace and two years later they secured the first contract with Leanardo in the helicopter business and a leading Turkish Aerospace & Defence company. In 2020 they entered the space business with Sener/Avio and in 2021 they secured a long-term partnership with Honeywell.

The headquarter and main industrial plant is in Pedaso (FM). Besides the commercial structure and the main research centre, production activities carried out in Pedaso include the manufacturing of fiber optic coils (coil shape can be tailored to customers’ specifications, a unique capability of the company that is hard for competitors to replicate), assembly of the inertial measurement system (IMU), and calibration of the IMU to ensure measurements are accurate. A new headquarter is currently built in Porto Sant’ Elpidio.

The company operates some other smaller sites in Italy and is also currently building up a new subsidiary in UK with additional production capacity.

What are Inertial Navigation Systems?

The Inertial Navigation System (INS) is based on gyroscopes (rotational assessment and angular rotation gauges) and accelerometers (motion sensing and linear acceleration gauges), which provide data on angular and linear motion and together constitute the Inertial Measurement Unit (IMU). Thanks to mathematical algorithms that translate raw data into orientation, attitude and positioning, INS is the only way to autonomously detect the position of any device on which it is installed and the direction of its motion.1

In particular, the INS allows for an accurate calculation of the speed and direction of the device in which it is installed without the need for external data input (i.e. a satellite signal for GNSS/GPS data), making the system intrinsically cyber secure; the inertial stabilisation system, on the other hand, provides the fundamental measurements for trim control. The Inertial System does not require external sensors, so can provide uninterrupted navigation support while allowing autonomous stabilisation. Conversely, GNSS/GPS relies on a clear signal from a satellite to establish navigation and position, cannot produce gyro data for automatic stabilisation, and is prone to jamming and/or spoofing.2

So to put it in easy words: INS are necessary for secure navigation and stabilisation of vehicles & objects when external signals are not available.

Thanks to the application of in-house developed fiber-optics gyroscope (FOG) and Micro Electro Mechanical Systems (MEMS) technologies, INS from Civitanavi allow

autonomous (without GNSS/GPS) and high precision inertial navigation

stabilization as well as

the precise orientation of the mobile device on which it is applied

Full ownership of the know-how developed in-house guarantees Civitanavi a higher quality and reliability of its systems, making it highly competitive compared to much larger international market players.

3. Market & Competitors

The total addressable market for high-end Inertial Systems is expected to reach USD 3.8 billion in 2025, implying a CAGR of 6 % from 2020 - 2025. This is some data the company published in its IPO prosepctus from a study made in 2020. In this study, it is expected that the defence & military market would grow with only 3.3 % during the 5 years. But when the study was made, the situation was completely different given the fact that (especially European) countries will now spent much more money again in this sector since Russia started a war in Ukraine. With its ITAR-free products (more on that later), CNS has a good position to participate from this development so that the TAM for CNS should grow faster than the study suggests.

CNS operates in a global market, dominated by a few big players. The company’s main competitors are US companies Honeywell (approx. 38 % of the global INS market), Northrop Grumman (approx. 21.2 % of the market) and the French company Safran (9.4%). The remaining part of the market (equal to approximately 31%) is divided among the remaining smaller operators. According to the IPO Prospectus CNS’ market share in 2019 was estimated at 0.4 %. Although CNS more than doubled its revenues since 2019, one can imagine that the market share is still very low.

So tough competition for a small company like CNS. But that the dominant market leader (Honeywell) started a cooperation with this niche player could probably mean that the products from CNS have some competitive advantages:

“At Honeywell, we have a long history of delivering high-precision inertial products for use in commercial, military and industrial platforms, and this collaboration with Civitanavi Systems will expand our expertise. The HG2800 IMU will come in multiple variants, utilizing Honeywell nextgeneration MEMS Accelerometer technology, coupled with Civitanavi Systems’ low-cost, highperformance FOG sensors to provide a new suite of products.” - Matthew Picchetti, vice president and general manager, Navigation & Sensors, Honeywell Aerospace

Competitive Advantages

CNS is the only operator able to develop and produce high-performance ITAR-free inertial systems, with technology suitable for both navigation and aircraft stabilisation.

ITAR-Free: ITAR is a regulatory regime imposed by the US government to limit and control the export of military and defense technologies to safeguard the national security of the United States. Binding a product to this regulation means facing various limitations and restrictions on the freedom of circulation of the product. Civitanavi's strategy is precisely aimed at avoiding the use of ITAR components within its systems that certainly make them easier to place on the market.

True solid state: high performance, non-mechanical gyros for safety critical applications (Systems whose failure to function can cause serious and often irreversible damage)

Stabilisation suitability: technology is suitable for both stabilisation and navigation

In 2019, Civitanavi was selected by BAE Systems Plc as a supplier of inertial systems for the flight control of a sixth-generation combat aircraft within the TEMPEST technological demonstration program ("Demonstration Program"), as the only one capable of offering an ITAR-free and certifiable solution from a safety-critical point of view. The TEMPEST program, which could follow the current Demonstration program, has a potential value of EUR 500 million for the entire duration of the program itself.

CNS has won some additional major projects against its much bigger competitors:

Additional advantages of their products are:

Proprietary FOG & MEMS Technology: CNS has in-house developed FOG & MEMS technology and the proprietary related integration into intertial measurement systems (IMS). The proprietary technology refers to multiple patents, but also to non-patentable industrial secrets, software and reprogrammable hardware. Thanks to the application of FOG and MEMS technologies, Civitanavi sensors are particularly effective, as they allow autonomous and high-precision inertial navigation, stabilisation and precise orientation.

Competitive final price: CNS uses a technology that is based on components coming from industries with a very high level of scalability (including telecommunications and automotive) compared to those of the sector in which it operates. These commercially available off -the-shelf components (COTS) have a competitive cost compared to specialist components typically used to design and produce INS.

Customization: CNS offers a high degree of product customization, with reduced delivery times compared to competitors which is possible due to a high level of vertical integration in the production process. In addition, the products have small dimensions, low consumption and high longevity.

If you want to receive monthly updates on CNS and all the other companies in my portfolio, you can upgrade to the paid version.

4. Product portfolio & Business Segments

CNS has developed several products for the various applications for which they are used and has divided its business into segments according to the end markets (Aerospace & Defence and Industrial). I used the revenue split from the last published quarter (Q3 2023), but keep in mind that the split can deviate strongly from quarter to quarter.

Aerospace and Defence (79 % of revenues)

Space (26 % of revenues): Launch vehicle guidance systems used in flight guidance control of space launchers and aboard space transportation systems. Customers are Sener & Avio who are responsible for the navigation units of the Vega rocket, developed by the European Space Agency (ESA).

Aeronautics (11 % of revenues): Products are used for flight stabilization control as well as replacing GNSS/GPS when unavailable in the defence and civil fields (helicopters, jets, eVTOL). Inertial systems are essential for stabilisation, especially when the aircraft is inherently unstable as is the case for eVTOL. Customers are for example Leonardo or BAE Systems.

Naval, Submarine & Guidance (36 % of revenues): These are systems used for the stabilization of ships and for naval navigation. Such systems, with the highest accuracy, are in particular demand for submarines, for which it is not possible to rely on satellite navigation systems. Teledyne Technologies is a customer in this segment.

Land (5 % of revenues): Stabilization and terrestrial navigation systems that are used in the presence or absence of satellite navigation systems (GNSS/GPS) for the stabilisation of moving equipment such as radars and cameras in military vehicles. Rheinmetall is a customers in this segment.

Industrial (19 % of revenues)

Mining, Oil & Gas: Used for tunnelling and horizontal drilling in the mining and oil & gas sectors. Customers are Teledyne, Scientific Drilling or Reflex.

The remaining 2 % are other revenues like grants, insurance and claims recoveries.

5. Growth Driver

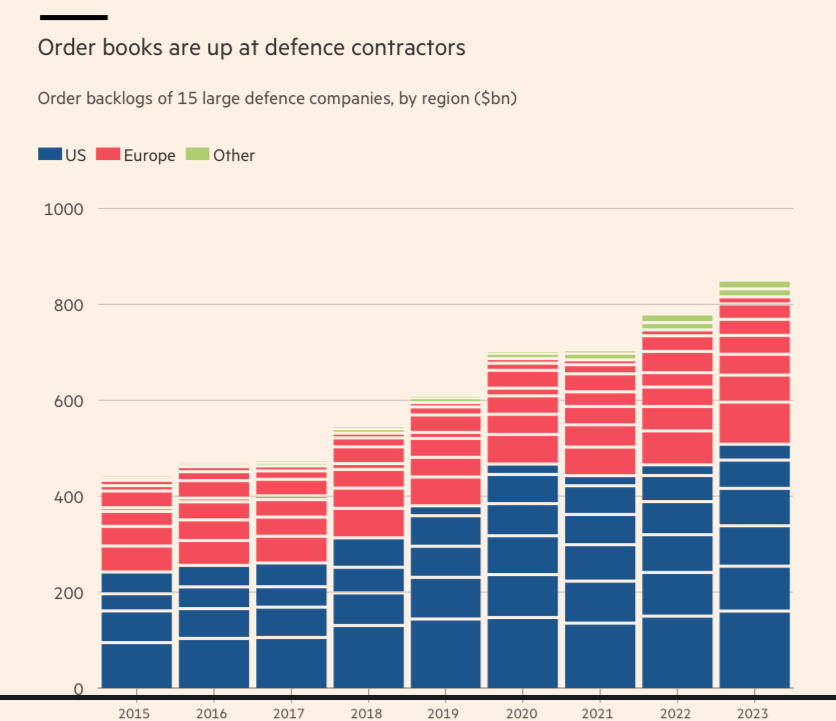

Increasing Military Budgets: World military spending grew for the eighth consecutive year in 2022 to an all-time high of USD 2240 billion. By far the sharpest rise in spending (+13 per cent) was seen in Europe.3 Military aid to Ukraine and concerns about a heightened threat from Russia strongly influenced many other states’ spending decisions, as did tensions in East Asia. The order backlogs of the 15 largest defence companies in Europe increased already significantly and multiple of them are customers from CNS.

Moreover, Europe is slowly realizing that it cannot rely entirely on the US for its own defence. Europe must become more independent from the USA in this respect. As a result, further significant European military spending is unlikely to be affected by US regulations such as ITAR, which is a major advantage for European companies offering ITAR-free products.

In modern warfare, GNSS/GPS jamming is a common strategy to impede enemy operations. Russia is now developing a rocket capable of shooting down satellites, according to recent reports.4 So it becomes more and more important that military vehicles are not reliant on GNSS/GPS data and need an alternative such as INS.

Space launches: Since SpaceX has revolutionized the space launch market with its rockets, the number of launches is rapidly increasing and also the market for space launches itself. The demand for satellite launches is driven by a range of applications, including communication, navigation, earth observation, and scientific research. The military sector is also a significant driver of growth in the space launch services industry, with a growing demand for military satellites for communication, surveillance, and intelligence gathering. The space launch services market is expected to grow with a CAGR of 15.1 % from 2022-2027. With its launch vehicle guidance system, CNS can benefit from this trend.

Urban Air Mobility: Electronic vertical take-off and landing aircraft (eVTOLs) that can be flown by a pilot or self-driven, represent a great opportunity for manufacturers of high-end inertial sensors. The eVTOL market is expected to grow with a CAGR of 35.6 % from 2025-2035.

CNS aims to consolidate its compelling positioning by developing new technologies and components and aims to take on the role of a Tier-1 player in the Urban Air Mobility market. They have developed ONEBOX, an integrated vehicle management system based on inertial sensing with disruptive features in terms of weight, volume and price.

Fully autonomous vehicles: There are 5 different levels of vehicle autonomy. Currently, we are at level 2 - partial automation. The vehicle can perform steering and acceleration, but the human still monitors all tasks and can take control at any time. The higher the level of automation, the more important the accuracy and reliability of the systems and sensors on board are. The autopilot must always know the car's exact position, even when there are no external signals like GNSS/GPS.

While the step to fully autonomous driving will still take time, CNS is well-positioned to benefit from this trend in the future.

Establish partnerships / M&A: CNS growth strategy includes the creation of partnerships to allow them to enter new markets & new geographical areas and benefit from the licensing of technological property or products to partners. As already mentioned, CNS has signed such a partnership with the market leader Honeywell to co-develop a new inertial measurement unit where CNS can benefit from Honeywell’s worldwide distribution network.

In September 2023, CNS also signed a Memorandum of Understanding (MoU) with Hanwha Systems, a Korean manufacturer of Electric Optics Systems for airborne, naval & ground platforms, to develop cutting-edge products that integrate Civitanavis GNSS and Intertial Systems expertise with Hanwha’s products. Hanwha is a listed company and has a market cap of USD 2.25 billion.

In early 2023 CNS also purchased a minority stake of 30 % in PV-Labs Ltd. for USD 2.5 million, including a call option to purchase the remaining 70 % which can be exercised in 5 years. PV-Labs is a privately held company based in Canada, founded by Mark Chamberlain who is the former founder & CEO of WESCAM, which has been acquired by L3Harris. PV-Labs has designed a unique line of Airborne ISR&T (Intelligence, Surveillance, Reconnaissance and Targeting) products based on PV-Labs patented new stabilization technique for gimbals. Key enabling component of the PV-Labs technology are the inertial sensors which will now be supplied by CNS. The investment by CNS significantly reduces the time to market of the product range and the companies will be able to leverage CNS’ established manufacturing capacity. Going forward, the technology synergy between the companies will lead to even tighter integration of the inertial sensors with new-generation camera payloads to ensure the most advanced stabilized imaging and future navigation capabilities even in GNSS/GPS denied environments.

6. Management & Shareholders

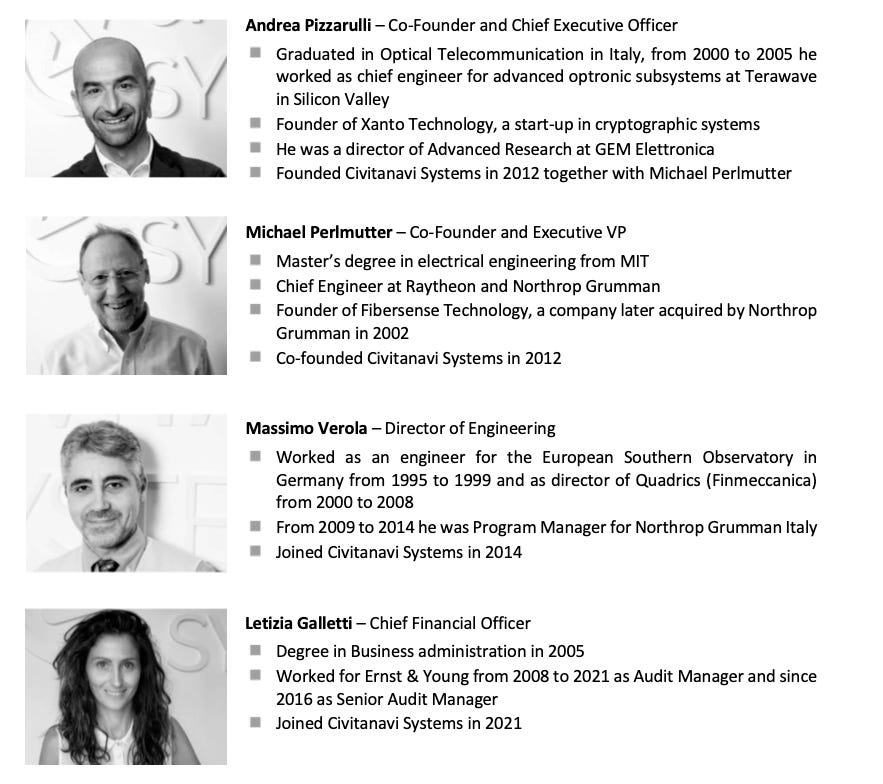

Co-Founder & CEO of Civitanavi Systems is Andrea Pizzarulli. He graduated in optical telecommunication from Polytechnic University of Marche (Ancona, Italy) Later he served as Director of the Advanced Research Center at GEM Elettronica, a privately held company working on Defense Inertial navigation systems based on in-house developed fiber optic gyroscope technology. He worked also at Terawave Communication in Silicon Valley USA as chief engineer for advanced optronic subsystems for telecom industry.

Mike Perlmutter is the executive VP of CNS and also Co-Founder. He worked at Fibersense Technology, a company he co-founded in 1994 in a friendly spin-off from Northrop. Fibersense was one of the world’s leaders in advanced inertial navigation and stabilization technology. In 2002 Fibersense was purchased by Northrop Grumman where Mike continued to work at the Navigation Systems Division as Director of Strategy and Planning until 2007. Before founding Fibersense he worked on the development of various gyroscopes at Raytheon and Northrop Grumman. He has three degrees from MIT and 17 issued patents.

Letizia Galletti is the CFO since 2021 and Massimo Verola is the Director of Engineering.

The main shareholder of CNS is the holding company Civitanavi Ltd. with 66.2 %. Civitanavi Ltd. is owned by the two Co-Founders of CNS (~ 30.6 % each) and the founding investor Thomas Jung / Jung Technologies AG (~ 20.6 %). The remaining shares of Civtianavi Ltd. are held by Civitanavi Ltd. itself.

The official free float of CNS is 33.8 %, but 5.09 % is owned by Athena SpA which received the shares via a convertible loan agreement with Civitanavi Ltd. So real free flow is more like 28.7 %.

7. Financials

Revenues

The revenue model of CNS is a combination of:5

non-recurring development (1-2 years duration) in which CNS is paid by the customer for a bespoke solution to be produced in the future (typically 10-20 year program life after development for A&D and 20-30 years for helicopters)

production phase: fairly constant for each platform/programme over time

licencing: licence fee (one off) to be released based on milestones reached during the development phase and a follow-on royalty stream based on products sold by customers under the licence

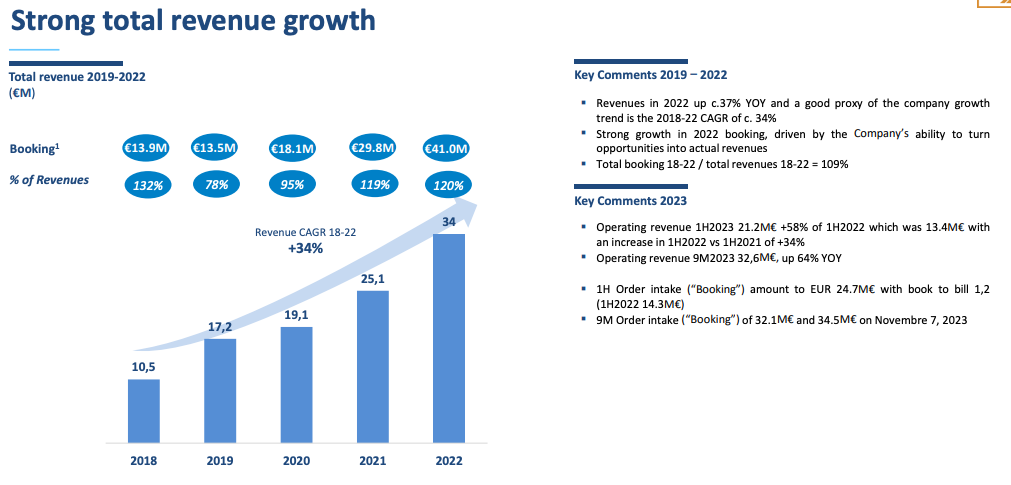

CNS was able to grow its revenues with a CAGR of 34 % between 2018-2022. In H1 2023 revenues grew by 58 % and after 9M 2023 by 64 %. The order intake (“Bookings”) after 9 months stood at EUR 32.1 million which is only an increase of 11 % compared to 2022. As the bookings are an important measurement of growth according to the company, this could be an indication for slower future growth. But it should be noted that the 4th quarter is typically a very important quarter for companies where authorities are end customers. In Q4 2022 CNS added for example EUR 11.2 million in received orders.

Below you can see the revenue stream composition between the type of sales. The vast majority of sales are generated via the sale of goods. The share increased strongly in 2023, mainly due to the sale of navigation system kits. As a result, the revenues from engineering services decreased, which was planned by management for the first half of 2023 with a realignment to historical share (>20 %) in the second half.

The EMEA region (excluding Italy) is CNS core market with a 78 % share in H1 2023, followed by APAC (14 %) and Italy (8 %).

Margin profile

CNS has been profitable since its foundation in 2012. Below you can see the margin profile since 2018 (in 2020 the net income was positively affected by a one-time tax grant). You can see that CNS was able to reach EBIT margins of above 30% & EBITDA margins of over 36 % which makes the business highly profitable but margins can fluctuate due to different sales mixes during the years.

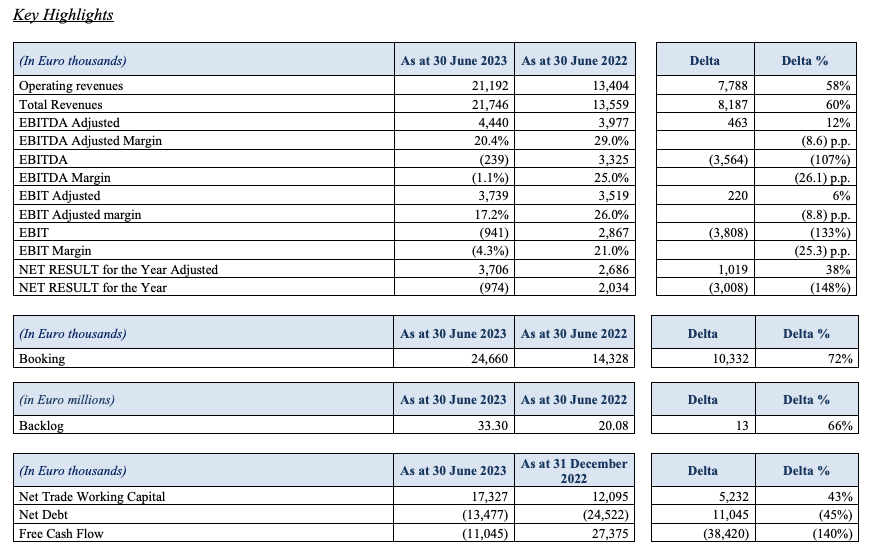

In H1 2023, CNS was able to increase its (adj.) EBITDA by 12 %, but the EBITDA margins decreased from 29 % to only 20.4 %. The negative effect is due to the expected slowdown in engineering services, which is typically a high-margin revenue stream and is expected to return to a higher revenue share in the second half of 2023. In addition, CNS has sold a significant number of navigation kits to leading turkish Aerospace & Defence customer from 2020-2022. The sale of these kits has been at a low margin, but CNS will receive high-margin royalties from these kits when the systems in which they have been implemented, will be delivered. CNS has confirmed the FY 2023 guidance of 29 % adj. EBITDA margins.

As you can see below, the unadjusted results for H1 2023 would have been negative. But this is mainly attributable to the accounting of EUR 4.5 million relating to a stock option plan. While I typically would say that stock options are real costs and would not adjust the results for these costs, in this case, it is different. Typically, the shareholders get diluted due to the stock options (capital increase). But here, the stocks are not distributed by CNS itself, but by its main shareholder Civitanavi Ltd. So the costs are actually paid by the main shareholder of CNS.

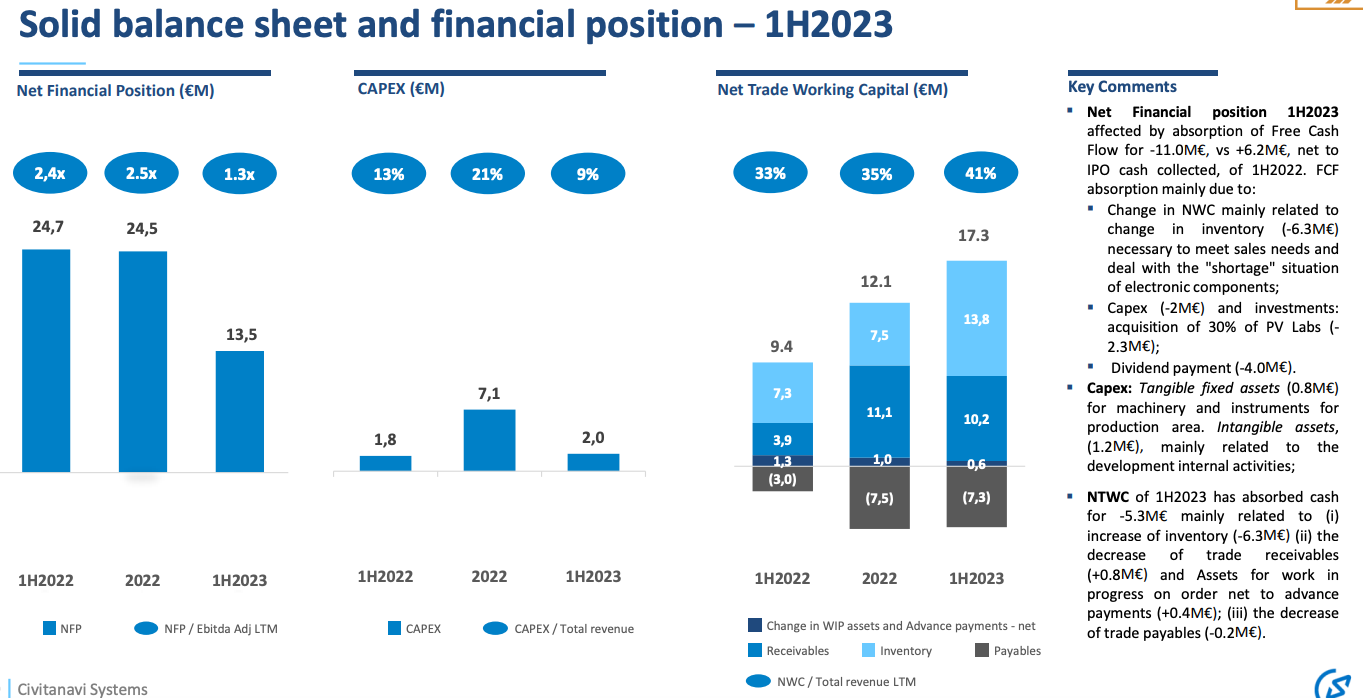

Balance Sheet & Cashflow

CNS has a clean balance sheet with net cash of EUR 13.5 million and low CAPEX requirements.

The operating cashflow increased by 80 % in H1 2023. Due to the rapid growth in revenues, CNS has to invest its operating cashflow mainly in working capital needs resulting in a negative FCF after Working Capital.

Dividends & Share Buybacks

In 2022, CNS paid a dividend of EUR 0.13 per share resulting in a dividend yield of ~ 3 %. In addition, CNS started a share buyback program in June 2023 for up to 1.5 million shares (~ 4 % of total shares).

8. Valuation

The full-year 2023 results are not yet published, but management guided for revenues between EUR 42 - 46 million (+31 % to +44 % yoy) and an adj. EBITDA margin of ca. 29 % which implies Adj. EBITDA between EUR 12.2 - 13.3 million (+23 % to + 34%). This guidance was published at the end of 2022 and has not been revised since then, so the full-year 2023 results should be in line. However, it should be mentioned that this guidance was a strong reduction compared to the expectations they had for 2023 in the IPO prospectus. They previously expected revenues between EUR 61 - 68 million and adj. EBITDA margin of ca. 31 %. The reason for this reduction was the following according to the management:

“The new target for 2023 reflects the changed scenario of energy costs, inflation and the ongoing electronics shortage. It should be noted that some of the significant opportunities, initially planned for 2023, are slipping to the following years due to the slowdown in the supply chain, which in turn leads to a postponement of the market introduction of the product. This slowdown does not represent a loss of market or cancellation of opportunities, but merely a time shift.”

When dealing with large (multi)-national programs, as it is often the case in the space and military sector, it is not unusual for planned projects to progress much more slowly than originally planned (see also risk section below). This makes it hard to forecast revenues for the management (and analysts).

So it seems to be the case that CNS achieved its new 2023 guidance, which is still a very good result. Being cautious, let’s assume that they reached the lower end of the guidance which should result in an EBIT of around EUR 10 million for 2023. Based on that, CNS is currently trading at an EV/EBIT multiple of 12.2x for 2023.

The two analysts that are covering CNS are expecting CNS to grow Revenues & EBIT by over 30 % in 2024. Assuming that the reason for the reduced 2023 guidance was really just a shift in revenue, this does not seem impossible. Expecting only 20 % EBIT growth, EBIT 2024 would end at EUR 12 million which equals an EV/EBIT multiple of ~10 for 2024. Taking into account that CNS has a long history of fast profitable growth (Revenue CAGR of 63 % from 2012-2022), the multiple does not seem to be high.

But let’s put this multiple into some context. Below you can see the multiple, margin and expected growth for some publicly listed companies that I would consider to be similar (at least partially).

You can see that only one company trades on a lower expected 2024 multiple (Avio), but it has a substantially lower EBIT-Margin and CNS is also expected to grow faster. CNS has a leading margin profile, expected growth and trades at a low multiple.

From a product point of view, I think Emcore ($EMKR) would have been a very good comparison to CNS. In August 2022, Emcore acquired the inertial navigation systems unit from KVH Industries for USD 55 million. Emcore has named this subsidiary Emcore Chicago. Below you can see the numbers of this segment for their FY 2022.

So you can see that the INS segment of KVH had a Gross-Profit-Margin of 23.3 %. A number that CNS has already achieved as its EBIT-Margin while KVH’s segment had an EBIT-Margin of -22.6 %.

Emcore acquired the business to become the largest independent supplier of INS and to expand margins by realizing synergies. One and a half years after the acquisition the margins improved slightly, but the business is still operating at an EBIT-Margin of -18 %. So CNS is able to be significantly more profitable than Emcore by selling similar products. Nevertheless, CNS was able to grow its revenues in its INS business by 21 % in the last quarter, but it mentioned some headwinds from export license timing. A problem that CNS probably does not have as it only has ITAR-free products where no special export licenses are necessary.

9. Risks

Customer concentration: Unfortunately we only have data regarding customer concentration from the IPO document. But the customer concentration in September 2021 has been quite significant with 29 % of sales generated with the top 1 customer, 66 % with the top 5 and 79 % with the top 10. So losing one of these bigger customers would have a significant effect on the overall revenues of CNS. But as we have seen in the revenue split of the business segment, the split deviated a lot just in a few months. Similar is the case for the customer concentration. At the end of 2020, CNS had generated 38 % with its biggest customer, only 9 months later, the number was reduced by 9 % to “only” 29 %. As the company is aiming to win at least 3 new clients every year and the expansion into other business areas, it is likely that the customer concentration is currently lower. But the top 5 customers will probably still have a significant share, so customer concentration remains one of the biggest risks.

In-Sourcing: CNS is a small fish in the inertial navigation market and some of their biggest competitors are also their customers or partners. These market leaders could decide to bring the technology in-house. Especially in the defence sector, which is one of the most promising for CNS in the short term, this is not unlikely. All market participants are trying to get a big(ger) share of the cake (value chain) to benefit the most from it. In addition, there are always high requirements for every small part that is installed in a product for the military market. It is easier for these companies to comply with the regulations when they control a large part of the value chain.

Technology risk & scale disadvantage: The speed of new developments in the technology sector continues to increase. As CNS is significantly smaller than some of its competitors, it is also more difficult for them to keep up here (less R&D budget & personnel.

Key personal risk: The founder & CEO Andrea Pizzarulli is very important for the day-to-day operation of CNS with his expertise and experience in the business. CNS had a tax audit for the years 2012-2014. CNS had to pay EUR 228.000 for the undue compensation of non-existent credits. CNS still believes that it has operated correctly. Nonetheless, it cannot be ruled out that the legal representative of CNS (Andrea Pizzarulli) could be charged with the crimes and in the end would not be able to serve as the CEO anymore. But as nothing happened since 2021 in this regard and the amount CNS had to pay for compensation, I think it is unlikely that such will happen.

Delays and long tender processes: When dealing with large (multi)-national programs, as it is often the case in the space and military sector, it is not unusual for planned projects to progress much more slowly than originally planned. A delay of a big project can have a material impact on the short-term results of CNS as it happened in December 2022 when the Board had to reduce its initial guidance for 2023.

CNS had to change its guidance quite significantly by over 30 % as you can see in the picture below.

In addition, these large projects are mostly acquired via tenders. All competitors can apply for the tenders. The decision process is often lengthy and there is no certainty regarding a favorable outcome. Which makes it more difficult for the management of CNS to forecast. On the other hand, once a big project is won, it is often a revenue source for multiple years, which makes it then easier to forecast.

10. Summary

The world has changed dramatically since the war in Ukraine. While the defense industry has had a hard time in recent decades due to declining military budgets, it is now having to expand its production capacities to meet the newly inflamed demand for military equipment. This is particularly true for Europe. A lot of money will flow into the defense industry over the next few years.

With its ITAR-free products & established relationships with some of the biggest companies in this industry, Civitanavi is well positioned to benefit from this. And there are additional strong growth opportunities for CNS outside the defense market. CNS has demonstrated since 2012 that they can survive as a small company in a competitive market. But not just that. They have significantly outgrown its competitors while also being more profitable. Buying such a company at a very low double-digit EBIT-Mutiple could be a good setup for future returns.

Intermonte Civitanavi Initiation Study

Intermonte Civitanavi Initiation Study

https://www.sipri.org/media/press-release/2023/world-military-expenditure-reaches-new-record-high-european-spending-surges

https://www.cnn.com/2024/02/16/politics/russia-nuclear-space-weapon-intelligence/index.html

Intermonte Civitanavi Initiation Study

What a incredible detailed writup. Military companies seem to be coming more and more to the focus and this seems a like a great company with many good competitive advantages etc. Valuation of course reflects that. Will dig deeper into this idea to get a better understanding ( regulatory stuff etc ).

Do you have any idea what the competitors would require to catch up on "true solid state" ?

My 2 cents...I think they may have an edge on the low cost FOG, also based on the fact that the founder has a fiber optic PHD. Honeywell have been and is the unquestionable leader in MEMS (gyroscope solid state) I purchased MEMS gyrosin the 2005 circa for a INS )and honeywell gyros were miles ahead. gyros MEMS is cheaper smaller less power hungry but way less accurate.....than FOG so suspect so by combining both you can consume less power - turning on the FOG on specific events while running the MEMS all the time. Seems like Honeywell is positionning the CNS as low cost FOG. Maybe they have an edge on cost... I think one threat is that MEMS gyros due to advanced slilicon developement replaces FOG - ie achieving parity in performance. This is a long term threat since CNV core tech is on FOG. To be monitored.