Welcome,

in this issue of Under-Followed-Stocks I will present you B3 Consulting Group ($B3.ST).

Investment summary:

19 years of profitable growth

10-year Revenue CAGR of 18 % and EBIT CAGR of 23 %

Sweden’s leading IT career company in 2022

appointed one of Europe’s best workplaces in 2020 & 2021

high insider ownership with recent aggressive purchases by the Chairman of the Board

Revenue grew by 24.5 %, EBIT by 95 % and net profit by 130 % in 2022

LTM EV/EBIT of 12.3x and P/E of 15.9x

If you aren’t a subscriber yet and enjoy the content I share, feel free to subscribe so that you won’t miss any new content. I have no intention of making this a paid substack in the foreseeable future. The content I share is free. But if you want to support me, you can voluntarily choose the paid option :)

Disclaimer: The following write-up is no investment advice. The author may own, buy and sell securities mentioned in this post. Please always do your own due diligence!

Let’s go!

1. Introduction

B3 Consulting Group is an expansive consultancy company with senior consultants within IT and Management. They help businesses and organizations to streamline their IT operations by developing their technology, processes, strategies and organization, and to improve their business operations thanks to smarter IT solutions.

B3’s client assignments include involvement in all stages of digital transformation – from analysis and strategy to realization. This means working with new technology, business models, client behaviors and ways of working.

B3 (B3IT) was founded in 2003 and today, B3 has 800 employees and a recorded turnover of SEK 1.148 million in 2022. It has offices in Stockholm, Warsaw, Cracow, Borlänge, Sundsvall, Gävle, Gothenburg, Malmö, Jönköping, Linköping and Örebro.

B3's shares have been listed on the Nasdaq Stockholm exchange since December 2016 under the ticker $B3. The current market cap is SEK 1.643 million (USD 157 million).

2. The Market

B3 is active in the IT consulting market. IT consulting relates to services aimed at helping clients on how they can utilize information technology (IT) and digital to optimally achieve their business goals. Consulting areas include the overall strategy, technology architecture and implementation.

The Swedish IT consulting and implementation market is expected to grow with a CAGR of 6.46 % from 2023-2027.1 In the past, B3 was able to outgrow the overall market by a lot and it is expected to continue so.

With its subsidiary B3 Consulting Poland, B3 is also active in the polish IT consulting market. That market is expected to grow even faster than the Swedish market with an expected CAGR of 8.26 % from 2023-2027. 2

B3 itself sees increased demand, especially within cloud, security and agile teams. Despite some challenges in the market, they expect IT budgets to increase as digitalization and automation in order to improve processes will be crucial to becoming winners in a more uncertain market.

3. The company

B3’s vision is to be Sweden’s best consulting company - for their clients, employees and owners.

Clients: At the beginning of 2022 B3 had more than 200 active clients of which no individual client represents more than 5 % of the company’s total sales. B3 has many long and strong relationships with customers like Swedbank, Handelsbanken, Vattenfall, Volvo, Scania, Tele2, FAR (institute for the accountancy profession in Sweden), the Swedish transport agency, or the Swedish Public Employment Service.

About 50 % of B3’s sales are related to industries with low or moderate cyclical dependence. The largest share of revenue is generated within the banking, finance & insurance sector (19 % of revenue), followed by government, agencies & municipalities (14 %). Overall B3 has a healthy mix of clients in different industries which provides stability and risk diversification.

Employees: B3 has a strong culture with a focus on freedom, learning, inclusion and wellness. Consulting firms are built on people and their ability to deliver on complex projects. The consulting market is permeated by high personnel turnover and fierce competition for competence. B3 has, through its continuous work with employer branding and company culture, succeeded in attracting and maintaining personnel.

B3 was appointed one of Europe’s best workplaces two years in a row, Sweden’s leading IT Career company in 2022 and has received several awards for the workplace culture where wellness is a key to success. The last employee survey shows 90 % employee satisfaction. Fun Fact: 113 employees of B3 have finished the Ironman.

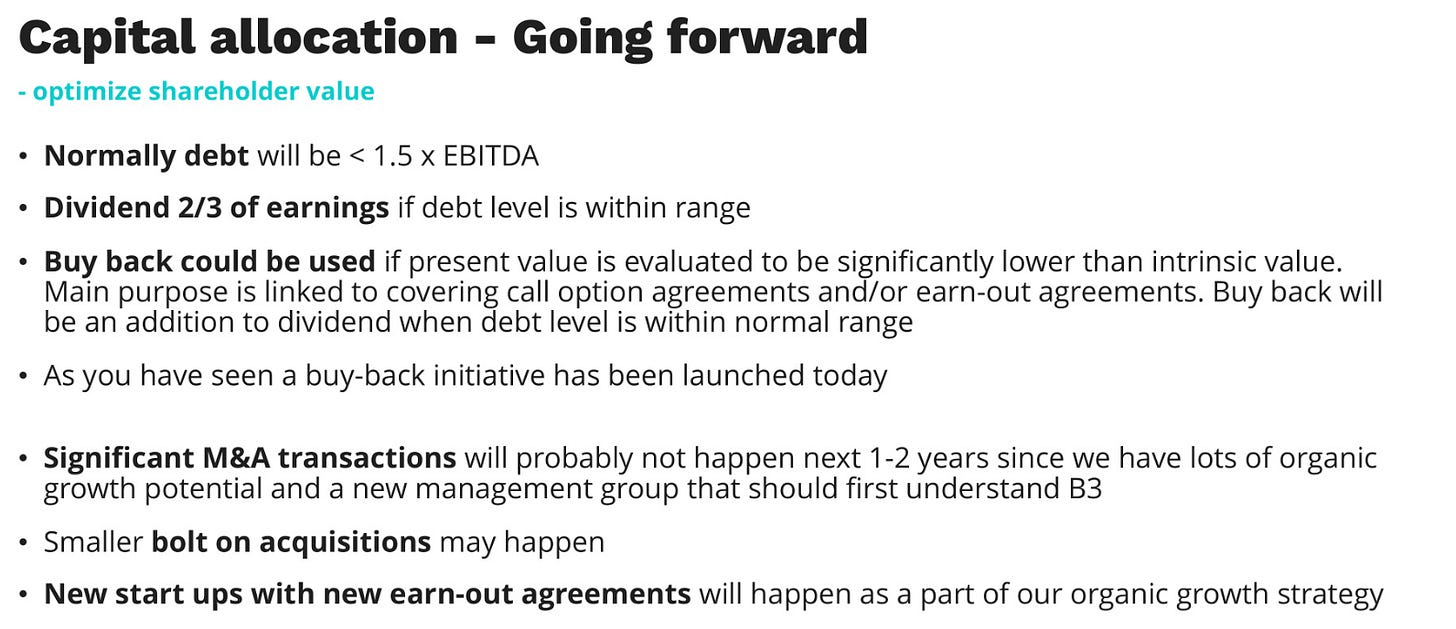

Owners: B3’s capital allocation has the goal of optimizing shareholder value. As long as the debt level is within range, the company will distribute 2/3 of the earnings as dividends. In addition, share buybacks can be used if the present value of the company is evaluated to be significantly lower than the intrinsic value. The Board of Directors has initiated a buy-back program in October 2022 for a total amount of SEK 50 million which was already completed during the 4th quarter. Large M&A transactions are not planned in the next 1-2 years. B3 will focus on organic growth. I will go more into detail on B3’s growth strategy in the “growth driver” section.

4. Business Units & Subsidiaries

The company is divided into 3 segments:

Digital Innovation: Focuses on the development of application software, digital customer experiences, products and services. In 2022, Digital Innovation accounted for 36.7 % of B3’s revenue and 40.6 % of EBIT. The sales increased by 15.3 % compared to 2021 and EBIT by 22.7 % giving an operating margin of 11.6 % (10.1 %).

Digital Management: Focuses on services in digitalization and operations development, agile transformation, change leadership, security, decision support and eHealth. In 2022, Digital Management accounted for 37 % of B3’s revenue and 30.5 % of EBIT. The sales increased by 28 % compared to 2021 and EBIT by 77 % giving an operating margin of 9.8 % (7.1 %).

Cloud & Technology: Focuses on services relating to effective, secure, scalable, and accessible infrastructure. The market is largely driven by the transfer of new and existing solutions to the cloud, where IT security issues are in focus. In 2022, Cloud & Technology accounted for 26.3 % of B3’s revenue and 28.9 % of EBIT. The sales increased by 38.8 % compared to 2021 and EBIT by 93.8 % giving an operating margin of 13.1 % (9.4 %).

B3 is operated as one group of multiple specialized companies. They have currently 24 specialized subsidiaries. This approach combines the small company’s flexibility, speed and attraction value in the recruitment market with the larger company’s security brand and ability to shoulder larger commitments. Many of B3’s most successful subsidiaries have been created by connecting talented entrepreneurs who have built new businesses, thereby strengthening B3's offer, customer base and geographical presence. More on B3’s successful start-up growth strategy in the section below.

5. Growth Driver

Integration of successful start-ups: B3 has established a successful growth model with start-ups and acquisitions. B3 is recruiting entrepreneurs with the prerequisites to start new B3 companies in new specialist areas or new geographic markets. Within ~10 companies, B3 has a call option for these companies in the coming 3-5 years. The total estimated payment for these companies amounts to SEK 250m and will be paid either with cash or with the repurchased shares (or a mix). Prices and valuation are based on financial performance in the coming 3-5 years.

A prime example for this growth model is B3 Consulting Poland. The start-up was established in 2018 by entrepreneurs Martin Nilsson and Rafal Dabkowski. Today the company already has 226 employees with SEK 126 Million in revenue (growing by more than 130 %) and an EBIT-Margin of 16.8 % (which is higher than the other reported units!). The Polish subsidiary is already the second largest of the Group in terms of revenue (after only 4 years on the market!). According to B3, the potential is still not fully utilized as the nearshoring business is still at very low levels, so further strong growth can be expected. B3 currently owns 50 % of B3 Consulting Poland, so these results are not yet included in the group’s results (just with the equity method). During the period 2023-2025, a consolidation of B3 Poland will occur.

Organic growth with a focus on key growth areas: The Management identified 3 areas of growth where they will make greater commitments in the form of enhanced services with a higher margin. They see the biggest opportunities within Multicloud (1), where B3 has recently taken a leading position within the AWS partner network, which along with their collaboration with Microsoft will be important for continued growth and development of B3’s cloud offering. They’ve also established further agile teams (2) for several clients and are strengthening their business in IT security (3), which became more important for B3’s clients due to the continued unrest in the world.

The first results of the focus on higher margin services can already be recognized as the revenue per employee reached a new high in 2022 with 1.53 MSEK per employee.

M&A: Acquisitions have also always been part of B3’s history as you can see below. The current Net Debt / EBITDA ratio of only 0.1x is well below the maximum target of 1.5x, leaving room for further M&A, especially smaller ones.

6. Management & Shareholders

In April 2022 the former CEO & Co-Founder of B3 Consulting Group, Sven Uthorn, handed over the role of CEO to Annette Billing, who has over 30 years of experience in a number of leading positions in the IT consulting industry, including Cybercom or Fujitsu Consulting.

“It is with a warm hand and great confidence that I now hand over the helm to my successor Annette Billing. I'm proud of what we've accomplished so far in developing B3 from a lean startup to a billion-dollar business, thankful for all the amazing people I've had the privilege of working with, and humbled that most of it remains to be done. I look forward to following the company's continued journey to greater heights.” - Sven Uthorn (Founder of B3 Consulting Group)

Together with the new CEO, also a new CFO has been appointed in 2022. Johanna Eriksson has 10 years of experience in leading financial roles, including CFO at Dedicare & Sopra Steria and Senior Manager at Deloitte.

Another interesting insider of B3 Consulting Group is Sverre Bjerkeli, who is the Chairman of the Board since 2021. Sverre Bjerkeli is the Co-Founder of Protector Forsiking ASA, an insurance company from Norway. Until his retirement in 2021, he served as the CEO of Protector where he delivered a 30 % CAGR return to shareholders from 2004 - 2021.

Protector also owns ~17 % of B3 Consulting Group. They have been the largest shareholder of the company for a long time, but recently Sverre Bjerkeli himself took over this position. After B3 published its Year-end-report on 16th February 2023, Sverre Bjerkely added a further 250.000 shares to its already large position at a price of 180 SEK per share (total volume of SEK 45 million / USD 4.29 million). Bjerkeli now owns ~17.7 % of the company. Since Bjerkeli has been appointed as the Chairman of the Board he had bought aggressively shares of the company. On the website of his family office, he is also publishing short one-pager with his investment rationale and presents a target price for B3 of 267 SEK.

The two Co-Founder of B3, Sven Uthorn & Claes Wiberg still own ~8.7 % and ~6.1 % of the company. But both don’t have any positions in the company or the board anymore and have reduced their positions in the past.

7. Financials

As already mentioned, B3 grew its revenues with a CAGR of 18 % in the last 10 years, EBIT by 23 % and the number of employees grew by 16 % in this time.

2022 was again a really successful year for the company. Net sales increased by 24.5 %, EBIT by 95 % with an improved EBIT-Margin of 12 % (vs. 7.7 %), net profit increased by 130.3 % and operating cashflow by 70.3 %.

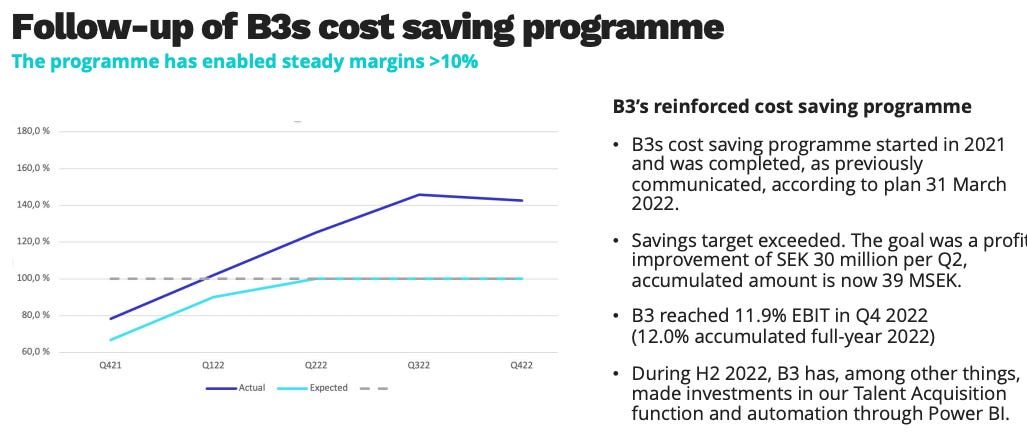

B3 was able to increase its margins significantly in 2022. This was achieved by a cost-saving program that started in 2021. The savings target was even exceeded. The goal was a profit improvement of SEK 30 million per Q2, the accumulated amount is now 39 MSEK. This enabled B3 to achieve its long-term EBIT-Margin target of 12 % already in 2022. I expect that margins will be slightly lower than 12 % in the foreseeable future due to higher salaries and inflation but they should stay above 10 % which is still good for IT-Consulting companies, but don’t expect similar EBIT growth rates in the next years like in 2022. Helpful for the margin profile will probably be the consolidation of B3 Consulting Poland which had better margins than the rest of B3 in 2022, but inflation in Poland is even higher than in Sweden so these high margins are eventually not sustainable.

B3 has a solid balance sheet with a low Net Debt / EBITDA of 0.1x, which is well below their limit of 1.5x EBITDA. That allows B3 to pay out 2/3 of the earnings as a dividend, which results in a current dividend yield of ~4.5 %. The equity-assets ratio in 2022 was 36.6 % and the return on equity was 54.3 %.

The management has set new financial targets for the years 2023-2025. They want to achieve SEK 1.7 billion at the end of the period and an EBIT-Margin of 12 %. This implies a CAGR of ~14 %.

8. Valuation

B3 currently has an Enterprise Value of 1.662 MSEK (USD 158 million) and is valued at an EV/EBIT of 12.3x and EV/FCF of 14.2x and P/E of 15.9x.3 According to the estimates from Tikr.com, B3 is expected to grow by 13.6 % in 2023.

Historically, the mean valuation of B3 was at an EV/EBIT of 14.2x, EV/FCF of 15.8x and P/E of 21.6x. So currently B3 is valued below the historical mean.

Below you can see the valuation of some peers. I have chosen similar companies from the Nordics and also from Poland as the polish subsidiary of B3 is already a large part of the business and also part of the future growth story of B3. B3 is currently valued below the median EV/EBIT & EV/FCF of the peer group, while having a higher EBIT-Margin and expected growth than the group. But note that these figures are just a snapshot and can change fast.

9. Risks

Management risks: B3 has had a new CEO and CFO since April 2022. So the past good performance of the company can therefore not be so simply extrapolated into the future. Although both have a lot of experience in the industry and the first results under their leadership have been very good, they still have to proof that they can deliver these results over a longer time frame.

Recession: In economically challenging times like recessions, most companies must cut their costs, for example for external services like consultants. With 19 years of profitable growth, B3 was able to perform also in more challenging times. Most of their services have the goal to increase the efficiency of a company, which is even more interesting in an economic trough. But no recession is the same as the one that came before, so it's hard to predict how a company will perform in the next one.

Ability to attract new talents: As already mentioned, the consulting market is permeated by high personnel turnover and fierce competition for competence. B3 is doing a lot to present itself as an attractive employer, but competitors are also not standing still.

Finding new start-ups: A big part of B3’s successful history is based on their growth model to recruit motivated entrepreneurs and build with them new successful subsidiaries. While B3 has a solid track record in discovering new verticals & entrepreneurs, the process is difficult and always has certain risks. The same applies to entering new geographies.

10. Summary

B3 Consulting Group has achieved phenomenal results in the past 19 years with its strategy to encourage employees and motivated entrepreneurs to start their own companies under B3’s shield and by keeping the motivation of their consultants high. With the departure of the founder a new chapter started. The new management has big shoes to fill but a successful strategy that focuses on the most promising and profitable areas is implemented and with a fast-growing subsidiary in Poland, the future looks bright. The current valuation below the historical mean and the peer group looks attractive. This is underlined by aggressive insider buys by Sverre Bjerkeli in the past months who knows the company for a long time and has a history of making great investment decisions and creating shareholder value.

https://www.statista.com/outlook/tmo/it-services/it-consulting-implementation/sweden

https://www.statista.com/outlook/tmo/it-services/it-consulting-implementation/poland

Data from TIKR.com (Date: 06.03.2023)

Nice write-up! I would like to go deeper about the public sector customers. You said they represent c15% of total revenue. Do you expect them to keep this percentage? What is the impact of these customer in the working capital? AFAIK, they often have longer terms of payment than private companies. Is this the situation here too?

Thanks again.

Thanks for the idea, Mavix. This looks like a well-run consultancy similar to Italian Reply.

Do you see any times of entry barriers or barriers to success in that business? Why aren't they copied easily?