Welcome,

in this issue of Under-Followed-Stocks I will present you Frequentis ($FQT).

Investment summary:

hidden champion with 30+ years of profitable growth

recession & crisis resilient

90 % governmental customers who subsidize the R&D costs

high insider ownership of 68 %

clean balance sheet

LTM EV/EBIT of 12.8x

If you aren’t a subscriber yet and enjoy the content I share, feel free to subscribe that you won’t miss any new content. I activated the option that you can donate me a gift subscription if you want to support me. But I have no intention of making this a paid substack in the foreseeable future. The content I share is free.

Disclaimer: The following write-up is no investment advice. The author may own, buy and sell securities mentioned in this post. Please always do your own due diligence!

Let’s go!

1. Introduction

Frequentis AG, based in Vienna (Austria), is a global provider of communication and information systems for control centers that perform safety-critical tasks. It develops and markets its “control center solutions” in the Air Traffic Management segment and the Public Safety & Transport segment. Frequentis was founded in 1947, so it has been in business for over 75 years.

Over 90 % of Frequentis customers are government agencies. In more than 150 countries, they have over 500 customers like NASA, the german Bundeswehr, Metropolitan Police, Australian Air Force, FAA, US Army and many more.

As a global group of companies, Frequentis has an international network of companies and local representatives in more than 50 countries. Frequentis’ products and solutions are used in more than 40,000 working positions in around 150 countries. Frequentis estimates that it is the world market leader in voice communication systems for air traffic control with a market share of 30 %. The Frequentis Group's systems are also global leaders in AIM (aeronautical information management) and aeronautical message handling, as well as in GSM-R systems for railways.

The company is listed on the Vienna Stock Exchange ($FQT.VI) and in Frankfurt ($FQT.DE) since 2019. The current market cap is EUR 375 million with a free-float of only 22 %.

2. The Market

Frequentis is active in the safety-critical control centres market. This is a niche market. According to Frequentis, they are the only company focusing solely on this niche. The requirements for safety-critical entail high market entry barriers. The company estimates the total market size at around EUR 13.1 billion (total amount of tenders per year). With the current product portfolio, Frequentis believes that they can address a market of EUR 2.7 billion.

The market in which Frequentis operates is resilient to crisis. None of the major crises in the past 30 years like 9/11, the financial crisis or Covid-19 had a major impact on Frequentis.

As the majority of Frequentis revenues come from Air Traffic Management (ATM) solutions, you might think that the Covid-19 pandemic must have had an impact on Frequentis as the number of flights was drastically reduced during this time. But the products are part of the safety-critical national infrastructure. The infrastructure has to be available and ready for operation at all times. The demand for their products is not dependent on the number of flights or the number of deployments of public safety (police / fire / emergency services). The decisive factor is rather how high the investments in infrastructure are. In the next years especially in Asia and Africa, high investments in the civil ATM infrastructure are expected. Furthermore, the Defence ATM market will probably benefit from higher military expenditures all over the world as a result of Russia’s aggressive war. Management already said in a call, that they recognized increased interest, especially in the European market.

3. Products

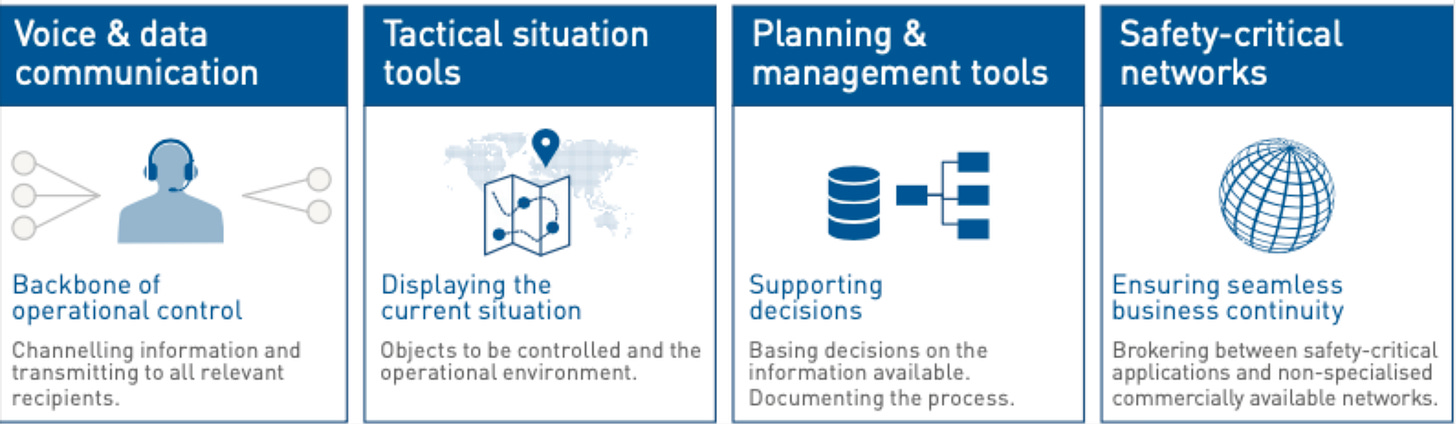

Control center solutions are systems for command centers for safety-critical tasks. The primary objective of a control center is to protect people and property from danger. There are basically four components that always interact:

A communication system to communicate with transport users, emergency services or security forces

A tactical situation report that shows the operator the current situation

A planning and management tool that helps make the right decisions quickly and safely

Safety critical networks to ensure seamless operational continuity

Voice and data communication, an area where Frequentis is the world leader, is an indispensable element of every control centre. The communication system is therefore often a good starting point for the development of fully integrated solutions for customers, using additional products and services from the Frequentis service portfolio. In addition, networks are becoming the centre of communication solutions. For example, traditional voice communication systems are being extended by networked voice and data communication services.

4. Business Model

The company develops state-of-the-art IT components and integrates them into comprehensive communication and information systems that meet the highest requirements for safety-critical applications. In addition, Frequentis provides a range of supplementary services to support customers throughout the entire life cycle of their Frequentis systems. Its products and solutions are marketed through two segments:

The Air Traffic Management (ATM) segment (around 66% of revenues) comprises the following business domains:

Civil air traffic control

Military air traffic control and air defense

AIM (aeronautical information management)

The Public Safety & Transport segment (around 34% of revenues) comprises the following business domains:

Police / fire brigades / emergency rescue services

Railways and local public transport systems

Shipping

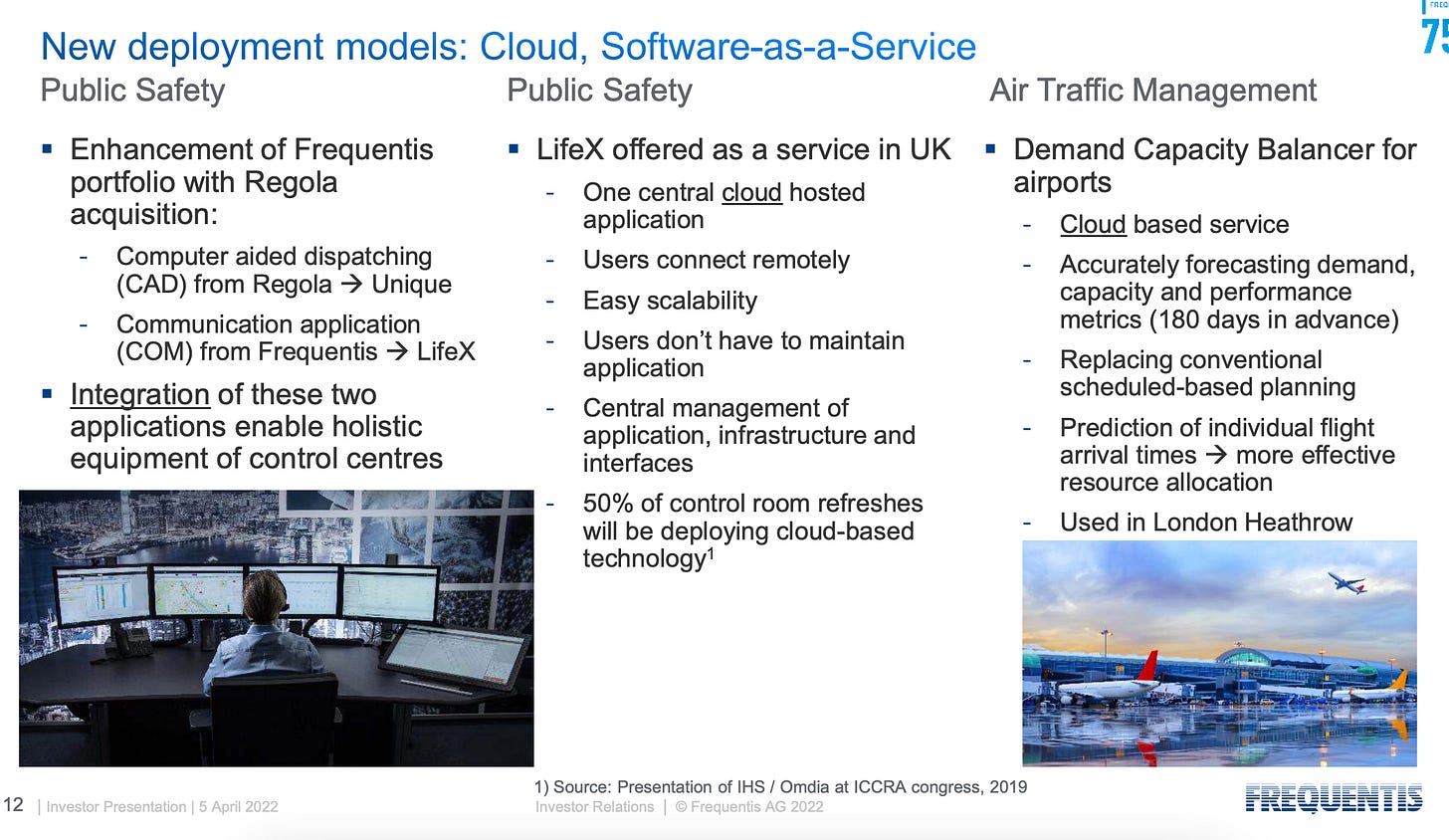

7 years ago, Frequentis started a journey, to transform its hardware-centric business model into a software-centric business model. They started to develop software solutions that would ultimately substitute their hardware solutions as they anticipated that their customers will go more and more into software environments. At the moment, 70 % of the portfolio is already pure software, which allows Frequentis to go more into a licensed model and also into SaaS models. In the Public Safety segment, most of the customers are already working in safety-critical data centers. So Frequentis can deploy their products as a Cloud solution. But the Governmental customers in the ATM segment & especially in the Defence segment, are always late to the party when it comes to new trends. So while SaaS is already the standard in the business sector, the trend is only arriving with a big delay at governmental agencies. But the management is recognizing a change. In the UK for example, Frequentis is already offering their control center solution as-a-service out of the cloud. 30 % - 35 % of Frequentis revenue is already recurring, but mostly from software maintenance contracts and not pure SaaS contracts.

5. Growth Driver

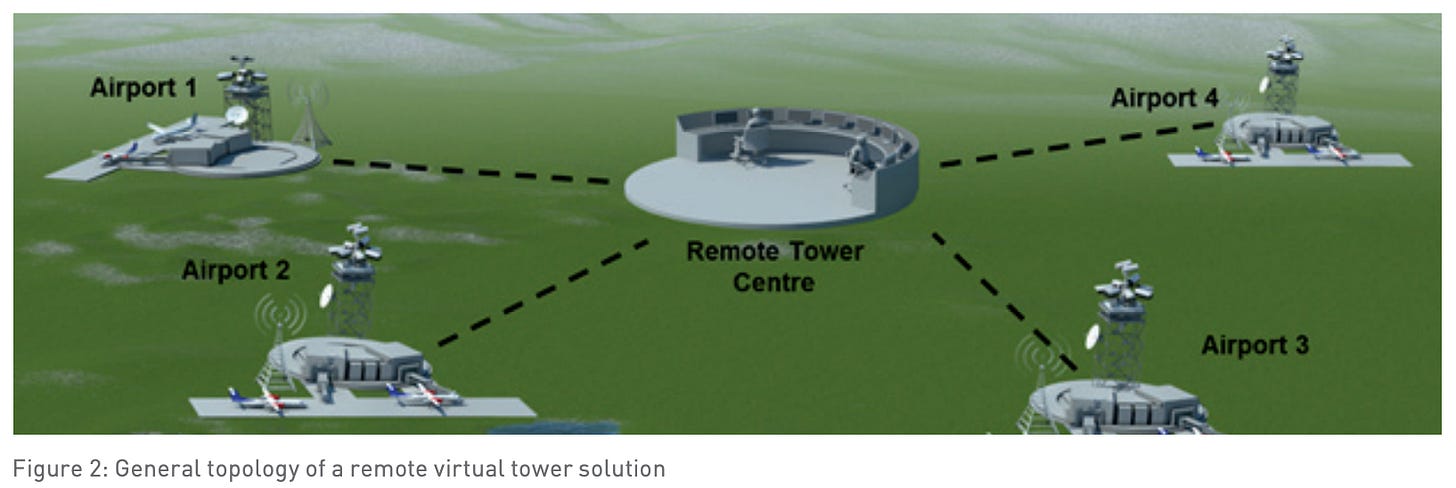

Remote Digital Tower: A fully equipped and operational tower at a small airport servicing only a handful of take-offs and landings per day can be an economic burden, which may overstretch the financial capabilities of low-traffic airports. Frequentis innovative Tower technology allows to manage air traffic on airports from remote locations which opens a wide range of synergies.

The benefits of remote tower operations include:

Safety: digitally augmented vision enhances situational awareness

Cost-efficiency: greater flexibility and better planning for staffing.

Contingency and/or resilience: remote tower operations can provide flexible backup ATC services.

In the video below you can see such a Remote Tower in action:

Frequentis needed 7 years to get approval from the german authority (DFS) for their solution. But Since 2018 the airport Saarbrücken is controlled from a remote tower 500 km away and Frequentis is currently rolling out the solution to additional airports. Besides Germany, Frequentis also already sold this solution internationally to customers in Argentina, Brazil, UK, New Zealand and Australia. In addition, the US DoD (Department of Defense) bought this technology for military use cases.

Drone Management: Drones have arrived, and they are here to stay. As their numbers rise, the importance of finding a way for them to safely coexist with manned aircraft is growing increasingly urgent. For aviation authorities across the world, the priority must be the full and safe integration of drone operations into existing aviation systems. Frequentis is a recognized pioneer in envisaging a harmonized framework for both air traffic management (ATM) and unmanned traffic management (UTM). They already sold their newly developed unmanned traffic management software to 4 aviation service providers in Europe.

On the other side, drones pose key hazards to critical infrastructure (including airports), law enforcement and defence organizations – risks such as collisions, espionage, smuggling or even attacks. Thats why Frequentis has developed a robust drone detection solution based on mature solutions already in use operationally in various industries. The solution, which helps users to integrate detection, management and handling of unwanted drones into their everyday operations, has been tested and verified in trials with customer and research programs.

In the video below you can see a successful interception of illegally flying drones at Hamburg Airport, using the Frequentis system.

5G/LTE in control centres: Thanks to social media, broadband communication networks are a well-established part of our daily lives. But in safety-critical environments, the stakes are much higher and every change must be managed carefully. Highly available public broadband networks could change the paradigm for the operation of mission-critical services.

MissionX is an integrated, end-to-end solution based on Mission Critical Services, which reliably ensures safety-critical multimedia communication over public, dedicated and hybrid standardized 4G/5G mobile networks provided by various network operators. The Frequentis-led BroadPort consortium has been selected for the final phase of pan-European critical broadband communication “BroadWay” with the goal of establishing a Europe-wide interoperable mobile broadband communication network for police, rescue, firefighters, and other blue-light organizations.

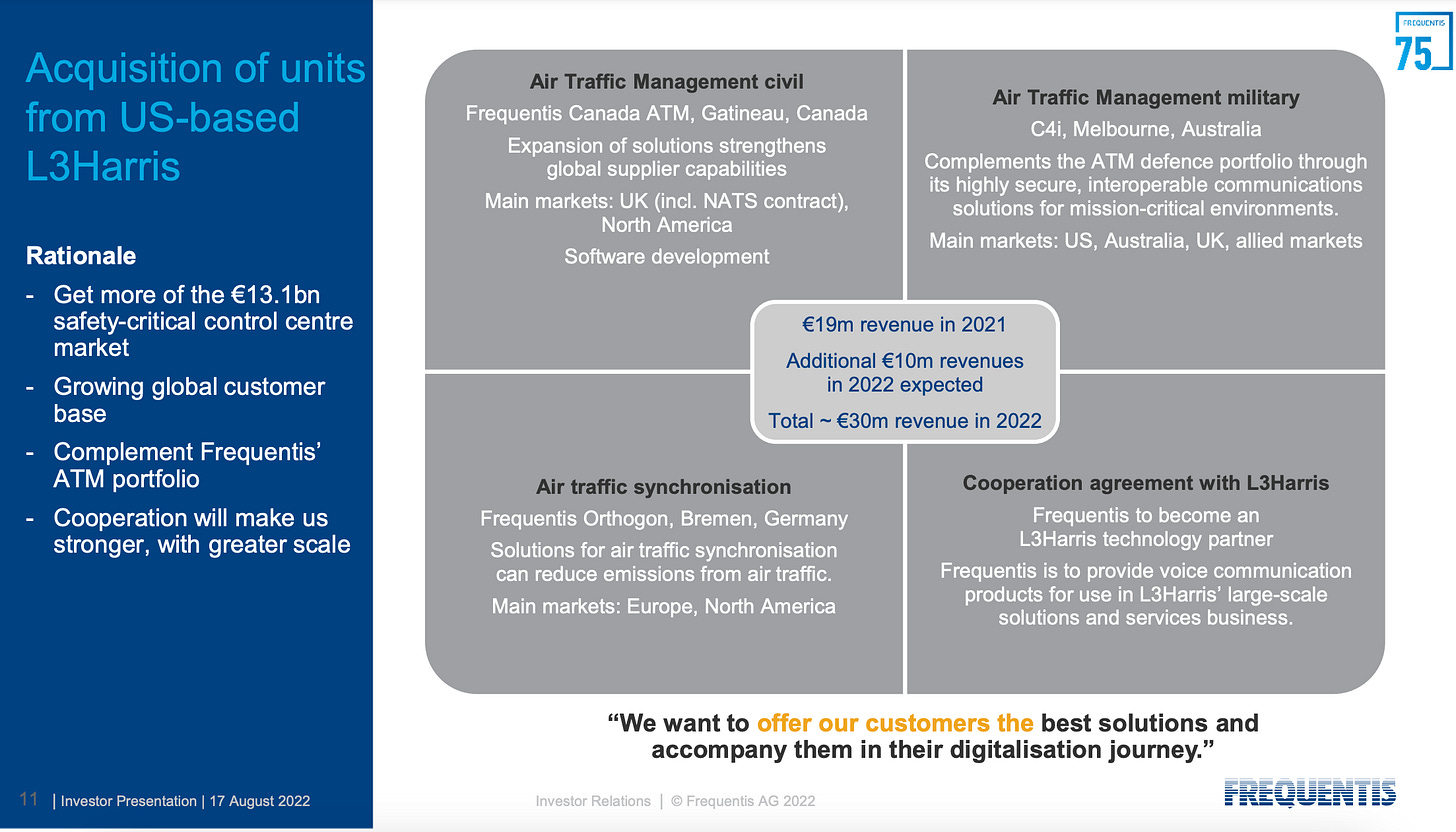

Mergers & Acquisitions: With over 500 customers in 150 countries, Frequentis already has great customer access. So by extending its product portfolio, Frequentis can make more of the EUR 13.1bn TAM addressable for them by selling more and more applications to its big customer base. That’s why part of Frequentis’ strategy is to proactively search for attractive M&A opportunities to extend its product portfolio. Since the IPO in 2019, Frequentis has made six acquisitions. According to the management, Frequentis is typically paying 7-9x EBIT for its acquisitions. In February 2021 they acquired, for example, parts of the ATM product segment from L3Harris and also signed a cooperation agreement with them to provide voice communication products for use in L3Harris’ large-scale solutions and services business.

6. Management & Shareholders

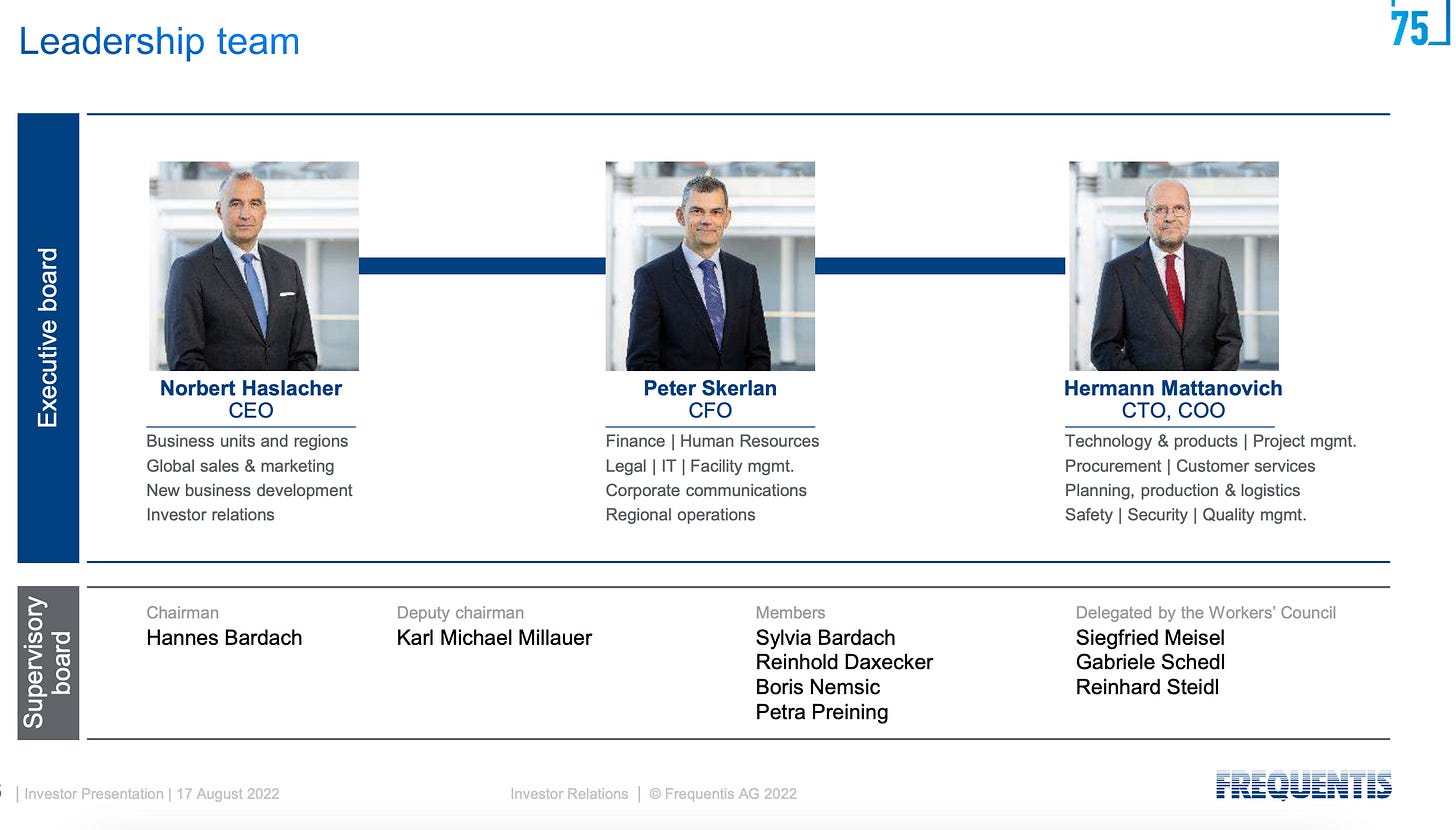

The CEO of Frequentis is Norbert Haslacher. He has been appointed in April 2018 after joining the Executive Board in 2015. He studied business economics at St. Gallen Business School and has more than two decades of experience. Before Frequentis, he was responsible for Austria and Eastern Europe at the US IT company CSC.

Peter Skerlan is the CFO since 2021. He studied corporate management at Vienna University and business administration and accounting at the University of London. He joined Frequentis in 1999.

Hermann Mattanovich has been CTO of Frequentis AG since January 2009. He studied electrical engineering at Vienna University of Technology and started his career as a technical consultant for companies such as Philips, Elin, VOEST, and Frequentis.

Frequentis’ core shareholder is Hannes Bardach. He holds around 68% of the shares (about 8% directly and about 60% indirectly through Frequentis Group Holding GmbH). In 1986 Mr. Bardach bought all shares of Frequentis via a Management Buy-out. Back then, the company had only 45 employees and revenues of EUR 2.9 million. In 2018, after 35 years, he stepped down as the CEO of Frequentis and joined the Supervisory board as the chairman.

B&C Holding Österreich GmbH, an Austrian investment company, holds more than 10% of the shares.

The free float is approximately 22%, mainly investors from Germany, Austria, and other European countries.

7. Financials

As you can see in the graphic below, Frequentis was able to consistently grow its revenue in the past 30 years.

Frequentis is not growing that fast, but slowly and steadily. In 2021 revenue grew by 11.4 % and in H1 ‘22 by 15. 7 % (4.3 % organic). Frequentis is not reporting quarterly, so the H1 figures are the latest. They are expecting to grow the top line with a CAGR of 8 % in the next 10 years (organically & via acquisitions). I personally think that this is a conservative assumption. The orders on hand increased by 10 %.

The ATM segment accounted for 67 % of the total revenues and the PST segment for 33 %. 65 % of revenues came from Europe, 17 % Americas, 11 % Asia, 5 % Australia/Pacific and 2 % ROW.

Not only are the revenues growing consistently, but also the profits. In 2021 EBIT grew by 8. 7 %.

Only in 2020 the net income was negative. This was due to an impairment loss of EUR 30.9 million on financial assets for Frequentis bank balances at the Commerzialbank Mattersburg. The bank had to file for insolvency due to an accounting scandal in Austria and Frequentis has lost its deposits.

The EBIT shows typically a seasonality pattern. In the business with governments, the order intake and project acceptance are generally highest at year-end. That’s why the half-year results are typically negative. Only H1 2021 was an exception due to faster project acceptance in Covid-times.

The EBIT-Margin of 8.7 % in 2021 does not look that sexy at first glance. But one has to consider that Frequentis is accounting very conservative. The R&D expenses (EUR 15 million in 2021) for example were fully expensed and not capitalized. In addition, the transformation of the portfolio completely into software and also some synergy effects from the acquisitions will further increase the margins in the future. In the long term, management is expecting margins between 10 % and 12 %.

Frequentis has a clean balance sheet with net cash of EUR 45.25 million (22. 5% of market cap) and an equity ratio of 40.7 %. Frequentis is paying out 20 % - 30 % of the net profit as a dividend.

8. Valuation

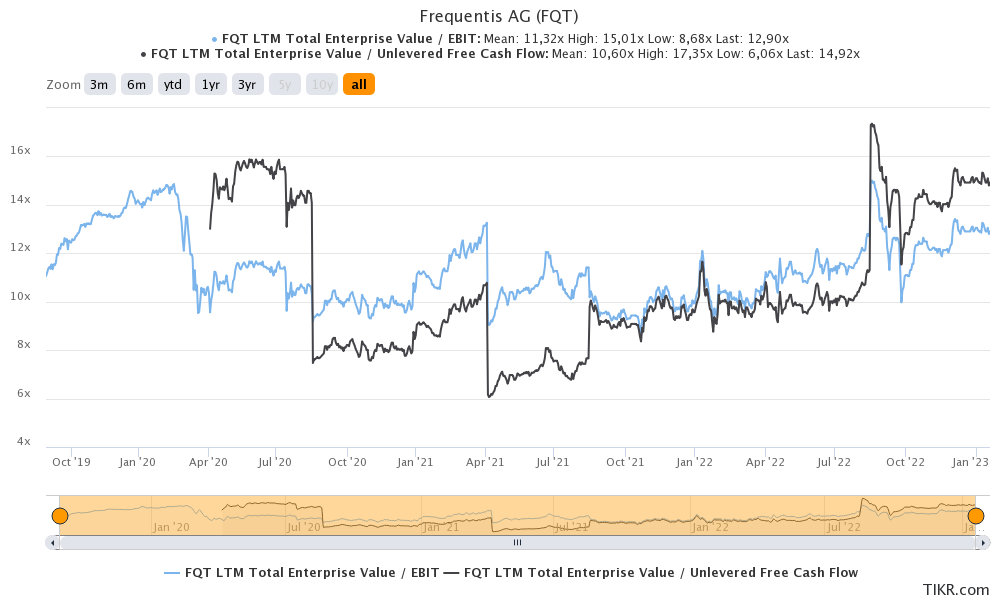

Frequentis currently has an Enterprise Value of EUR 333 million and is valued at an EV/EBIT of 12.9x, EV/FCF of 14.9x and P/E of 23x.1 According to the estimates from Tikr.com, Frequentis is expected to grow by 5.6 % in 2023. This probably only reflects organic growth, as management expects to grow by 8 % in the coming years, but that includes acquisitions. Historically, the mean valuation for Frequentis (since their IPO in 2019) was at an EV/EBIT of 11.3x and EV/FCF of 10.6x. So Frequentis is currently valued above the historical mean.

Below you can see the valuation of some peers. These are similar companies, but as Frequentis is operating in a niche and is probably the only publicly listed company that is solely focusing on this niche, these companies are not totally comparable. Indra Sistemas for example also offers ATM solutions like Frequentis, but in their other segment, they offer IT Services & Solutions that are not really comparable.

To give you a rough idea of what growth is already priced in at the current share price, I made a very simplistic reverse DCF Model. But please note that even a small change in the inputs can lead to a completely different result. In this case, I used the following inputs:

Historical FCF-Margin (10 Years): 6.8 %

Terminal Value (after 10 years): 1 %

Discount Factor: 10 %

With these inputs, the current share price of EUR 28.30 implies a revenue CAGR of 7.3 % in the next 10 years. But keep in mind that only a small change, like reducing the Discount Factor by 1 % would change this CAGR to 5.5 %. So just take this as another indication to get the full picture.

9. Risks

Political risks: public and semi-public organizations dominate Frequentis’ customer structure. Such customers may, for various reasons, prefer suppliers from certain countries over Frequentis. Increasing tensions between countries could also have the effect that Frequentis is for example not allowed to deliver certain products to China anymore (China accounts for 3 % of total revenue).

Management risks: The integration of multiple acquisitions has to be managed well. Also, the loss of a substantial part of Frequenits cash in 2020 was at least partially a management mistake. It’s the task of the CFO to check the integrity of the bank where a substantial part of the cash is parked. But the CFO changed in 2021 and now the majority of the cash is split among 11 system-relevant major banks.

Inflation: The tender process is often long. So it is difficult for Frequentis to estimate the costs for a specific project in the future. Changes in costs and production in projects based on fixed-price contracts might influence the financial result of the relevant project.

Competition: Frequentis is active in highly competitive markets where a few large international companies compete against a number of smaller businesses. Some of Frequentis’ competitors have higher market capitalization and greater financial power, so they are in a better position to adapt to changes in the market, finance new technologies, and bypass financial bottlenecks.

10. Summary

In my opinion, Frequentis is a small, high-quality hidden champion with a long history of successful and profitable growth, even during recessions or crises. Particularly during leaner economic times, these factors are in high demand. This quality has its price, especially in times when investors are searching for safety. As you can see in the valuation sector, Frequentis is currently not cheap. The expected growth for many years is already priced in and it trades above the historical multiples.

So why did I publish this write-up when I think that it is not that interesting at the current price? Well, this is a small cap with just a small free float. These stocks are often highly volatile and go up or down without any news. Like last year, when the stock fell from its high at EUR 33.40 in August to EUR 22.60 € in September without any significant news. These are the chances for small retail investors, but you will only be able to grab this chance when you already know the company very well. In September I was only brave enough to buy a small starter position in Frequentis as I did not know the company well enough to assess if there was a specific reason for the drawdown or if it was mispricing. So now after having a deeper look into the company, I’m sure that I would be well prepared for the next drawdown and to seize the opportunity.

Data from Tikr.com (Date: 19.01.2023)

very interesting biz! thanks for writing about it

Hi Mavix, great piece, do you know what the software mix would have to become (@ 30% today according to your piece) to reach the 10-12% margin? Is there any upside potential to the 10-12% margin suggested by the management (seems relatively low for a mission critical SaaS that theoretically shouldn't be price sensitive)?

Is there also upside to the 7% long term revenue CAGR? I'm looking at it from the angle of drone applications (delivery, surveilance, military, defense, etc.), eVTOL (I like $BLDE), and emerging countries like India's infrastructure rollout.