#1 HeadHunter Group

The leading online recruitment platform in Russia and CIS

Welcome,

this is the first issue of Under-Followed-Stocks. Today i will present you the HeadHunter Group ($HHR).

Investment summary:

#1 online recruitment platform in Russia with a leading position in other CIS countries

Underpenetrated and fast-growing market

Robust business model generating growing revenue streams from loyal and diversified customer base

Strong technology foundation and scalable infrastructure

Revenue growth of 103 % at 60 % EBITDA-Margins valued at NTM P/E of 24

If you aren’t a subscriber yet and enjoy the content I share, feel free to subscribe that you won’t miss any new content.

Disclaimer: The following write-up is no investment advice. The author may own, buy and sell securities mentioned in this post. Please always do your own due dilligence!

Let’s go!

1. Introduction

The HeadHunter Group (“HH”), founded in 2000, is the leading online recruitment platform in Russia and the Commonwealth of Independent States (“CIS”) with over 351.000 paying customers on their platform. The company has 3x more unique-monthly-visitors (UMVs) than their closes competitor in this region and was ranked #4 among the leading jobs websites globally by traffic behind Indeed, jooble & glassdoor.

2. The market

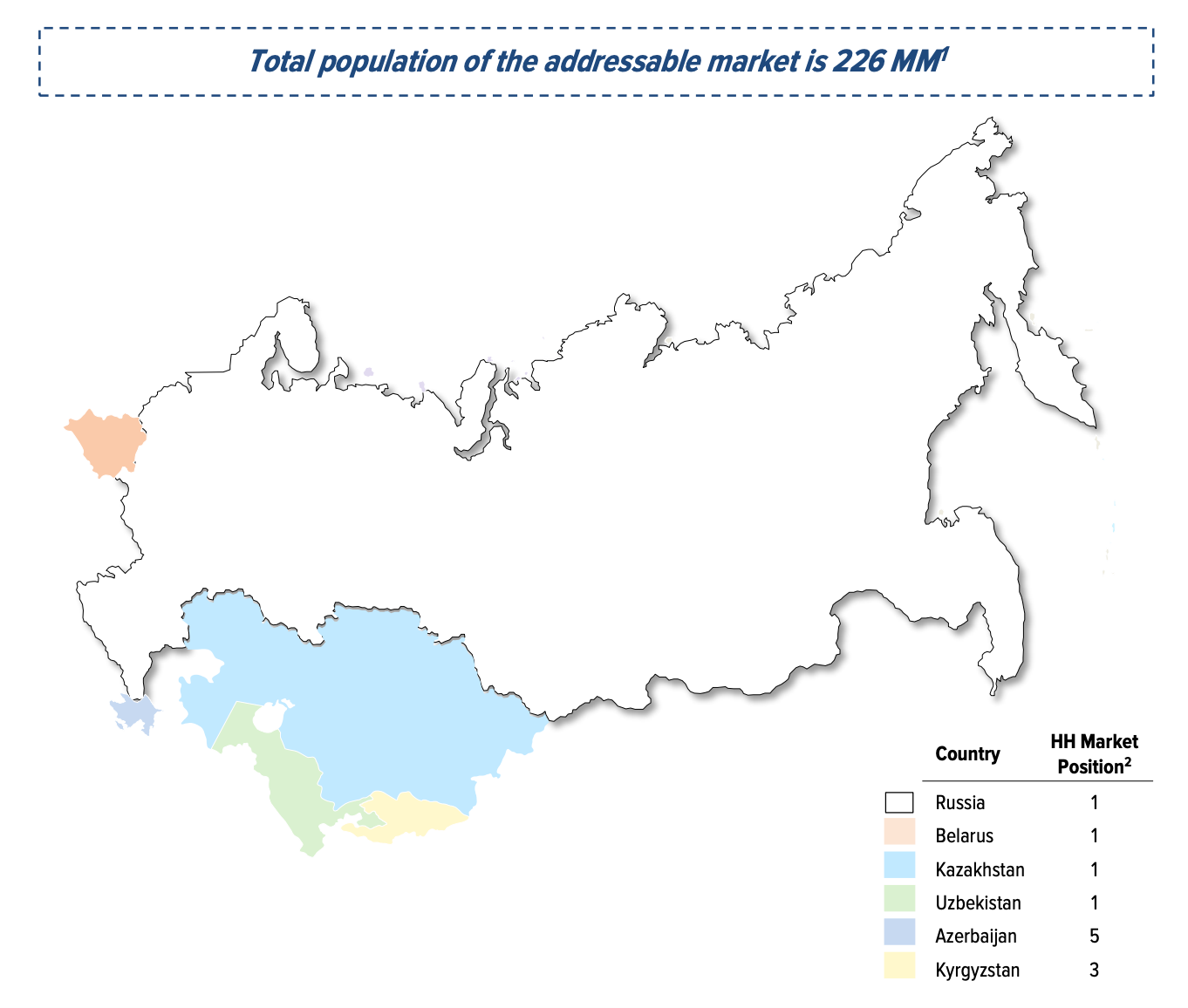

HH currently operates in Russia, Belarus, Kazakhstan, Uzbekistan, Azerbaijan and Kyrgyzistan. The total population of these countries is 226mm. HH already established as the market leader in 4 of these countries (Russia, Belarus, Kazakhstan, Usbekistan), is #3 in Kyrgyzstan and #5 in Azerbaijan. The main market is of course Russia.

The online recruitment market has significant growth potential in Russia and the CIS region, driven by intensifying competition for human capital, the ongoing shift of jobs marketing spend online and increasing maturity of the HR functions in Russia. The Russian labor market is characterized by a shrinking labor force (-2 million from 2016 to 2020), high turnover of employees (28.7 % in 2020) a growth of salaries (wage growth has always been higher than Russian GDP growth in the last years) and a low unemployment rate (5.8 % in 2020) leading to strong competition for highly skilled and talented employees. High internet penetration and ubiquitous usage of internet by businesses and consumers is creating a favorable backdrop for the rapid shift of recruitment services and spending on job advertising to online platforms from offline media.

Competition

HH is by far the largest online-recruitment-player in Russia in terms of CVs and job postings, CV database, traffic, and brand recognition. They face competition mainly from Russian online job portals, online classifieds platforms with presence in the jobs vertical and offline media. The key competitors are probably Superjob.ru and Rabota.ru which has been acquired by Russia’s largest commercial bank “Sberbank”. But as you can see in the graphic below, none of these has a similar size in terms of operations metrics or product variety:

3. Business Model

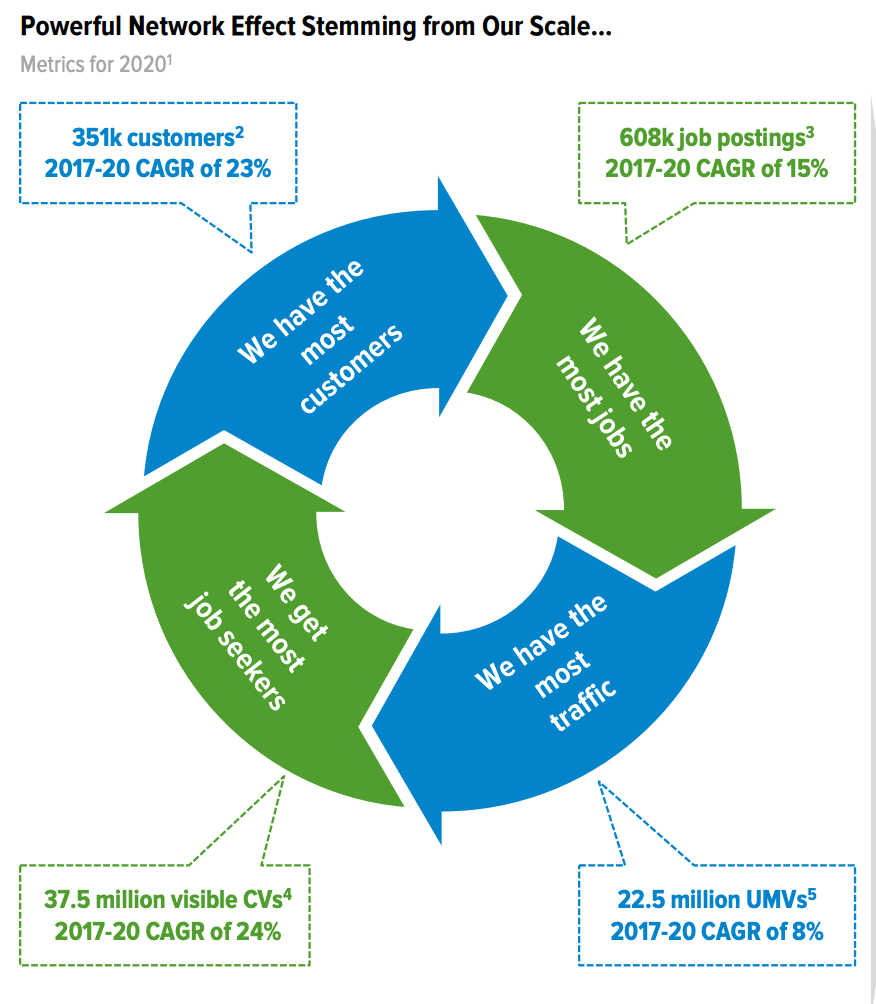

Headhunter derives revenue primarily from providing access to their CV database and posting job advertisements on their platform. I think i don’t have to explain to you how powerful the network effect is for a leading platform, so here is just a quick reminder how it works:

So having 3x the traffic, 3x the candidate base and 2x of 30-day job postings compared to their closest competitor is a big competitive advantage for HH and makes it almost an impossible task for competitors to catch up. Headhuner’s high brand awareness of 55 % in Russia (#2 has 19 %) ensures that 80 % of their customer acquisition sources is completely free and only 20 % is paid.

CV database (21 % of revenue)

The access to the CV database of more than 48.2 million CVs (Dec. 2020) is a subscription-based service. Job seekers submit their CVs to be uploaded to Headhunters database, and employers pay a subscription fee to access and search the database for a period of time. HH evaluates and approves the CVs submitted before they are uploaded to ensure that the customers are viewing complete and high-quality CVs. Approximately 70 % of the CVs were already approved by Headhunters AI and heuristic systems without the need for further human moderation at the end of 2020.

Since August 1, 2020, each type of new or renewed access to the database contains a limited number of job seekers contacts to view (for example, there are 120 contacts provided for the one-day access and 9,000 contacts are provided for annual access to the whole of Russia). After reaching the limit, in order to view more job seekers contact details, customers would need to purchase additional packs of contacts.

Job postings (44 % of revenue)

Customers can also post their job advertisements for up to 30 days on the platform for a one-off fee, depending on the volume of postings. Job seekers can browse the platform and apply for the positions they select. In 2020 Headhunter contained a daily average of approximately 608.000 job postings.

Bundled Subscriptions (25 % of revenue)

Recurring bundled subscriptions of access to the CV database + job postings. For example, a customer may purchase a subscription to access the CV database for one month with a specified number of job postings over the same period included in a contract for a flat fee.

Human Resource Value Added Services (11 % of revenue)

In addition to the primary online recruitment services, HH offers additional VAS that are aimed at enhancing effectiveness and increasing efficiency throughout the recruitment process like an Applicant Tracking System (ATS), benchmarking tools like online labor market & salary analytics, employer branding consulting and recruitment process automation tools.

Headhunter has a highly diversified customer base. The Top 10 customers represented 1.7 % of total revenue in 2020.

4. Growth drivers

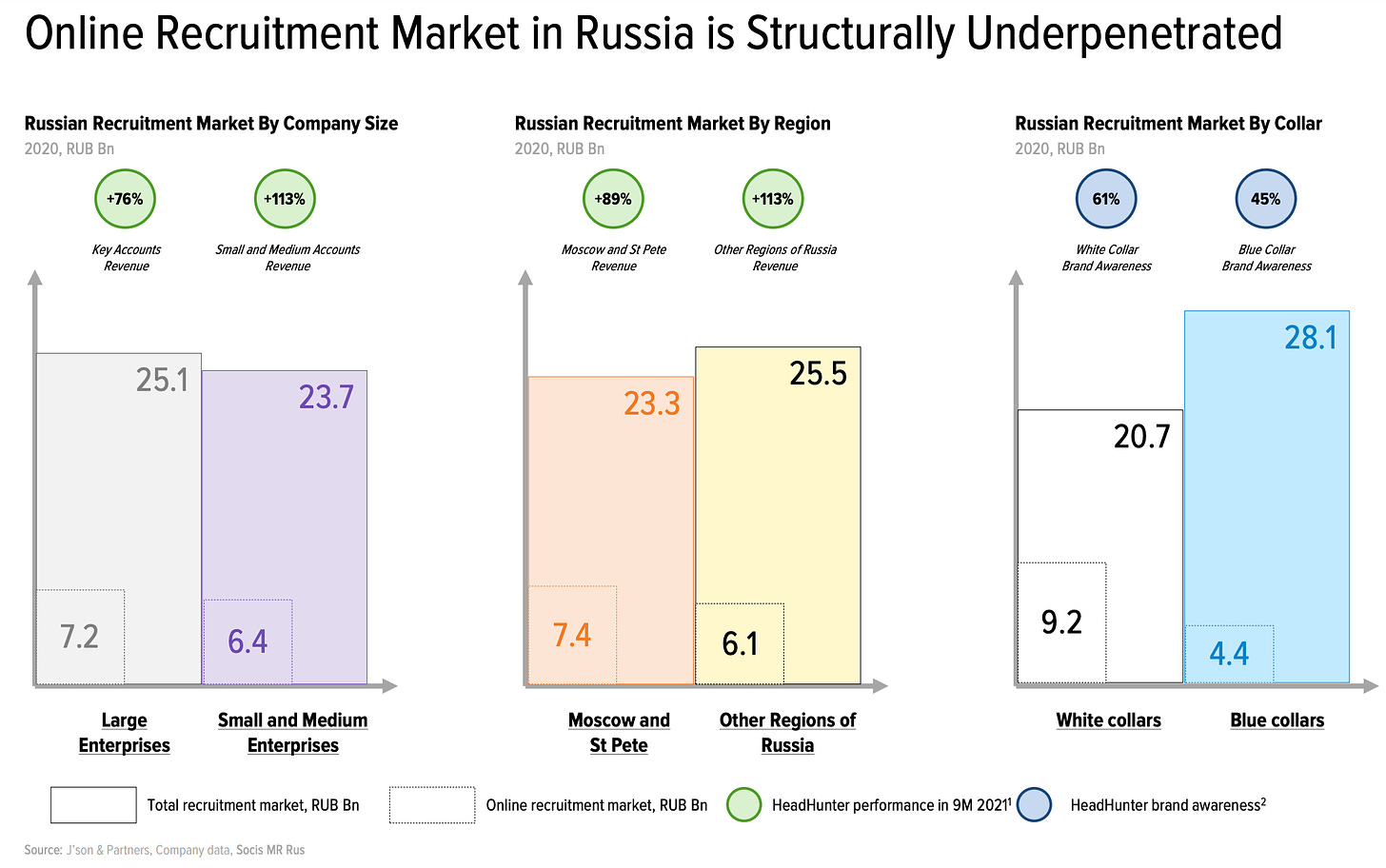

Online recruitment penetration growth

As already highlighted under point 2 (“The market”) the online recruitment market in Russia is structurally underpenetrated and the shift from offline to online is still in the early innings, especially in rural areas and for blue collars. Currently the majority of Headhunters customers are located in the Moscow and St. Petersberg regions. This provides a substantial growth opportunity due to the growing numbers of emerging businesses, increasing internet penetration and online recruitment services adoption in Russia.

In December 2020 HH acquired 100 % of “Zarplata.ru” which has a strong footprint in certain Russian regions such as Siberia and Ural and increases the outreach to blue collars & Small and Medium Accounts.

Enhancement of Monetization

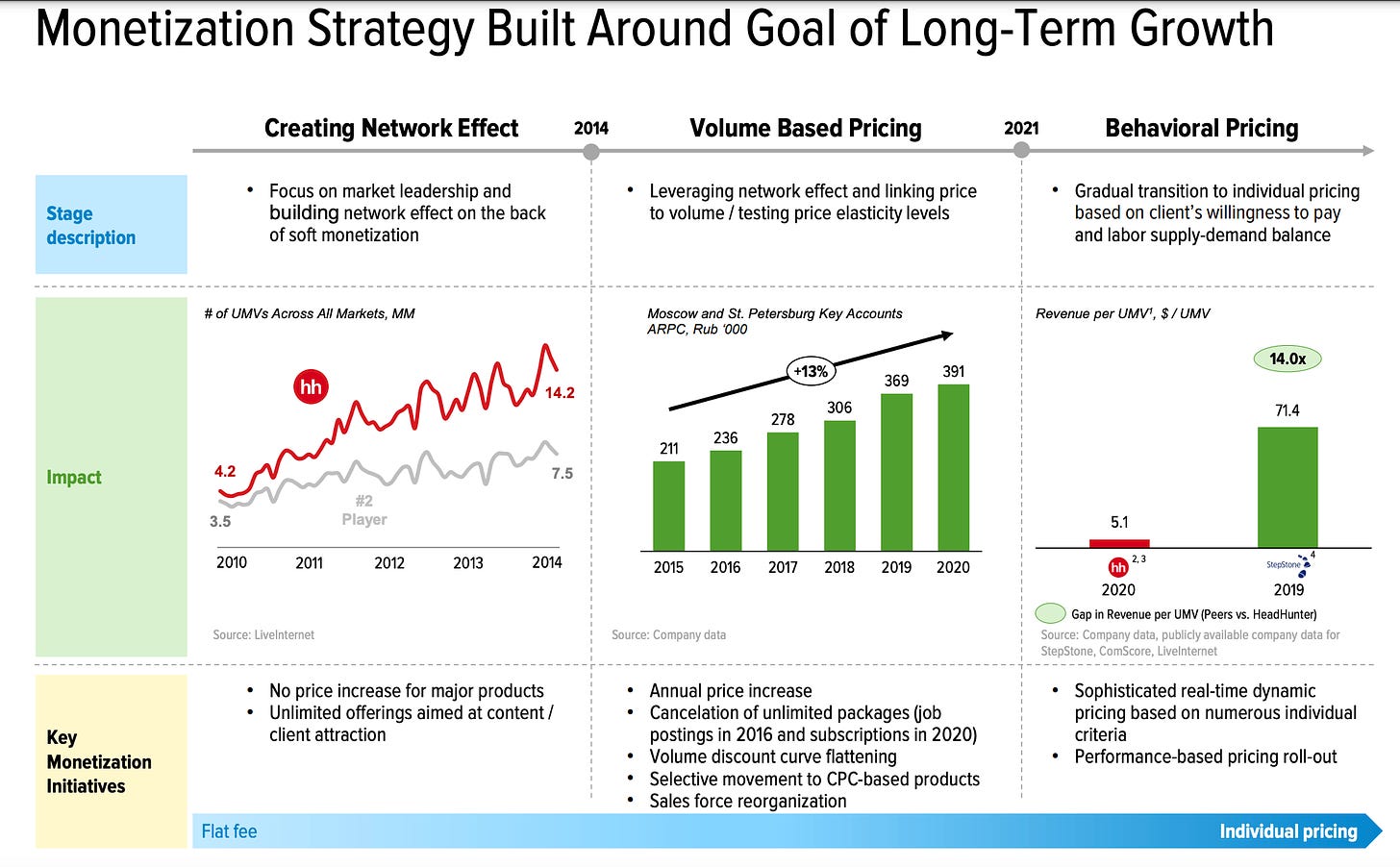

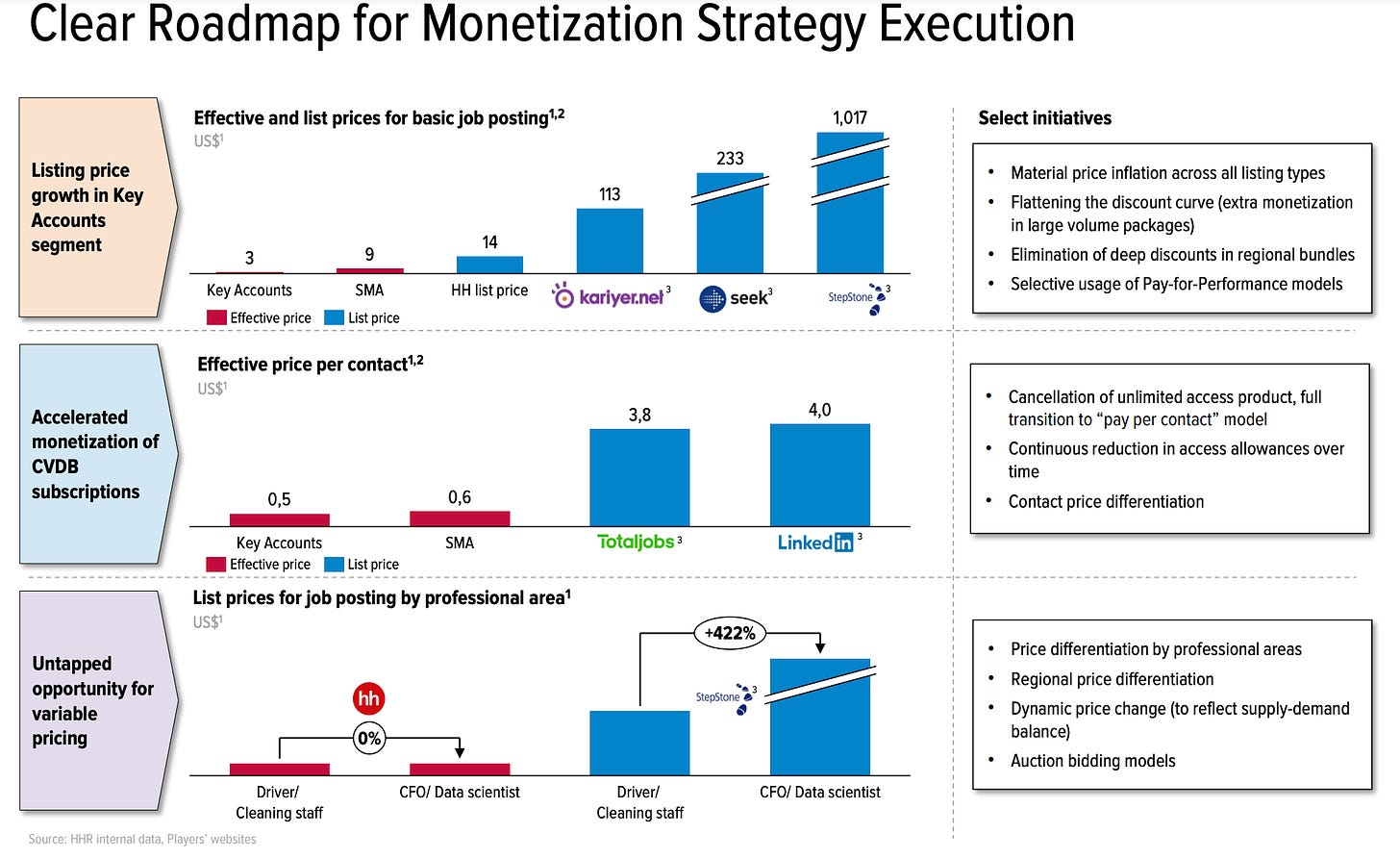

Until 2014 Headhunters focus was on market leadership and building network effect on the back of soft monetization. They increased no prices for major products with unlimited access.

In 2014 they started volume based pricing by linking price to volume and testing the price elasticity levels. They also started to increase prices annualy, cancelled unlimited packages or started flattening the curve of volume discounts.

The next step in their monetization strategy is the gradual transition to individual pricing based on clients willingness to pay and labor supply-demand balance. Currently there is for example no price differentiation by professional areas, so a customer is paying the same for a job posting no matter if he searches cleaner staff or a data scientist. At stepstone a posting for a Data scientist would be 422 % higher than for cleaning staff. Other initiatives are regional price differentiations, dynamic price change (to reflect supply-demand balance) or auction bidding models.

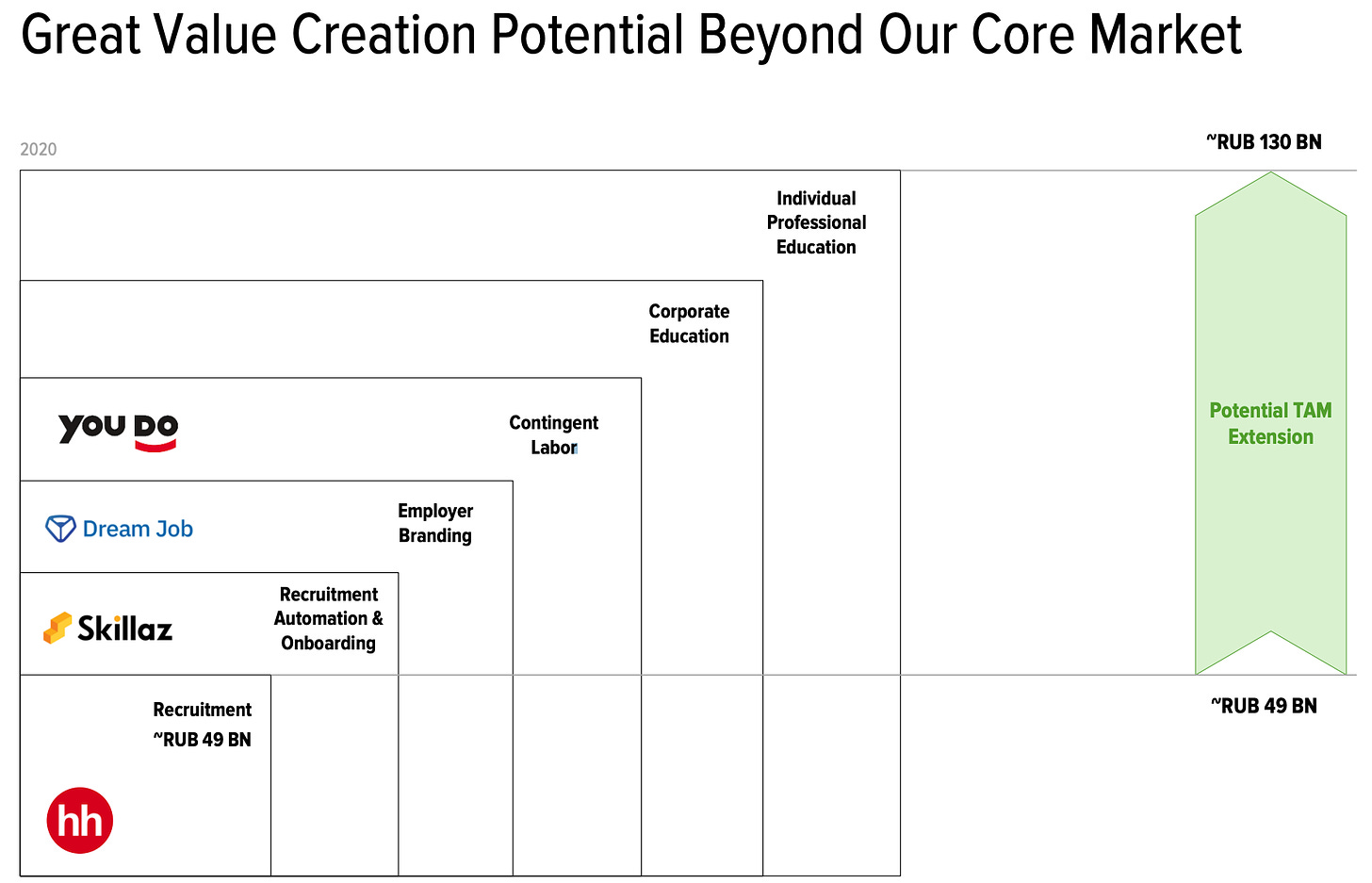

Expansion beyond the core market

Currently Headhunter mainly operates in the core Recruitment market that had a TAM of 49 billion russian ruble in 2020 according to J’son & Partners. Beyond this core market HH identified a potential TAM extension to 130 billion ruble.

Since June 2021 HH owns 74.99 % of Skillaz, a russian HR technology company which automates routine recruiting processes by implementing complex built-to-suit integration projects. Skillaz’s product offering complements HH’s own ATS solution as it targets larger, high-end market customers who have a sophisticated recruitment function. With this acquisition HH finally entered the Recruitment Automation & Onboarding market.

In addition to that HH announced in May 2021 that it supported an investment round of the dreamjob.ru project at an early stage and received 25 % of the company. With this investment HH sets a first step into the Employer Branding market. On the dreamjob website users leave feedback about working in companies where they were employees, like “Glassdoor”. The database of dreamjob contained reviews of more than 300.000 employers in May & the portal audience exceeded 450.000 visitors per month.

In October 2021 HH acquired a minority stake in “YouDo”, one of the largest Russian horizontal online service marketplaces matching freelance labor demand and supply in C2C and B2B segment (like “Fiverr”), to also be part of the contingent labor market and take advantage of the rising Gig-economy in Russia. Until a legislation change in 2018 most of the Gig-economy market was operating in a grey-market. After the change the russian labor market saw a huge intake of self-employed. The management expects that this number increases by 10x in the next 3 to 5 years.

The corporate Education & Individual Professional Education market are also potential markets for HH in the future, but they have not started to enter yet.

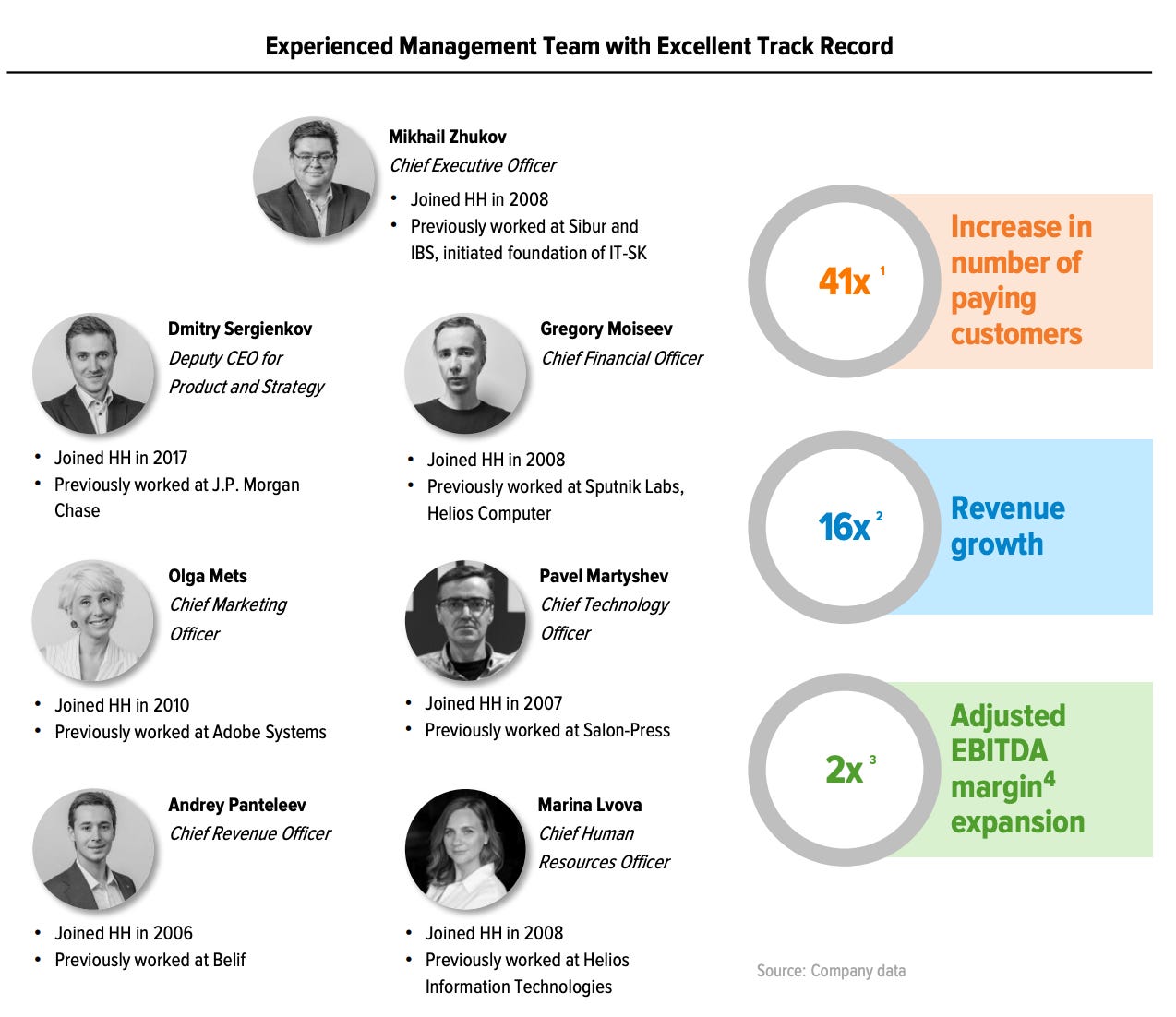

5. Management & Shareholders

The management team is highly experienced in the recruitment market. Most of the members of the management board are part of the company since more than 10 years. The CEO Mikhail Zhukov & CFO Gregory Moiseev joined HH in 2008, the CTO Pavel Martyshev in 2007. Since 2009 this management achieved to increase the number of paying customers of HH by 41x, to grow revenue by 16x and to expand the adj. EBITDA-Margin by 2x.

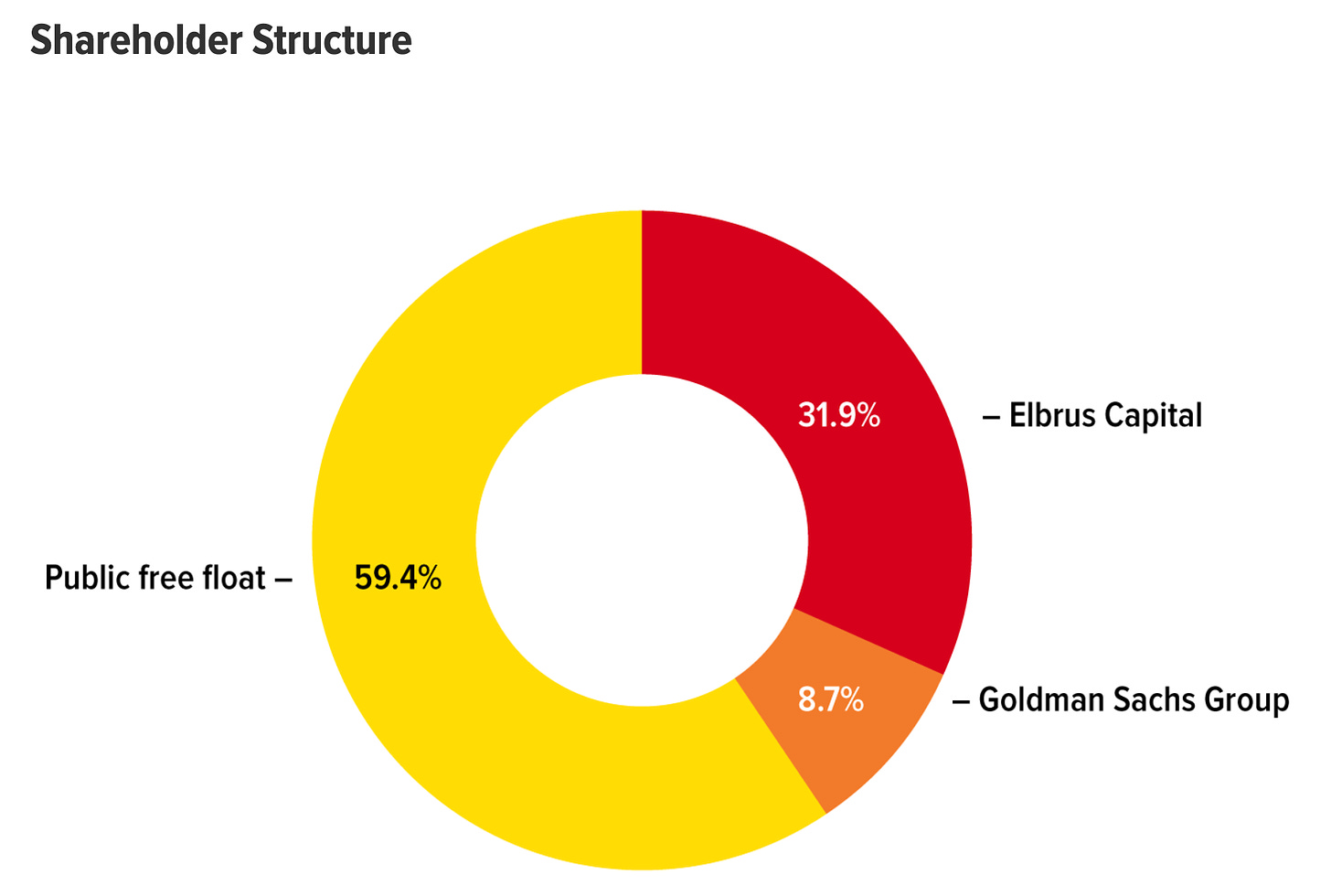

Elbrus Capital, a leading Russian and CIS-focused private equity business owns 31.9 % of HH. Elbrus Capital has currently $1.5 billion assets under management.

Another 8.7 % of HH are owned by Goldman Sachs and the remainder of 59.4 % is free float.

6. Financials

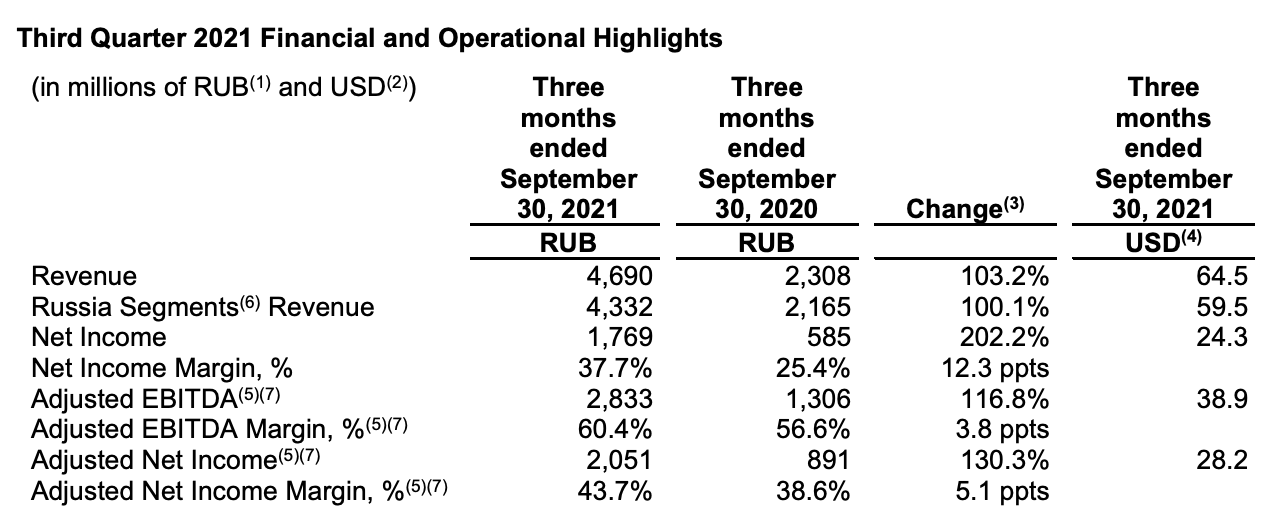

In Q3 2021 the revenue of Headhunter grew by 103 %. The growth came from all types of customers (Key Accounts +97 %, SMA’s +106 % & Other +109 %), across all geographies (Moscow & St. Petersburg +98 %, Other regions of Russia +110 % & Other +109 %) and all product types (Bundled Subscriptions +89 %, CV Database Access + 94 %, Job postings +110 % and other VAS +136 %).

Of course this high growth is not completely organic growth as HH acquired “zarplata.ru” and “Skillaz” in 2021 and also a low base effect for 2020 as a comp as revenue has been affected by lockdowns. According to the management the growth can be divided as follow:

Total revenue growth of 103 %

15 % low base effect

15 % inorganic growth (acquisitions)

70 % organic

The organic growth is a result of the following aspects:

40 % monetization (new subscription model & the pay-per-contact products performed very well)

35 % client-based-expansion (predominantly SMAs and rural regions)

25 % consumption growth (impact of market situation and labor force shortage)

The management increased their revenue growth outlook for 2021 from 63%-68% to 81%-84% with the presentation of the Q3 results.

The business of Headhunter is highly profitable and scalable. The adj. EBITDA increased by 116.8 % and reached a margin of 60.4 %. The net income increased by 202 % and reached a net-income-margin of 37.7 %. But Q3 is typically the best quarter with the highest margins. In the last 2 years the margins in Q4 has been 4-10 percent points lower.

The operating cashflow in the first 9 months of 2021 increased by 209 % and the net debt decreased by 52.5 % reaching a Net Debt to Adj. EBITDA-Ratio of 0.3x. The high cashflow allows it HH to distribute a dividend to it’s shareholders. For 2022 it is expected that they will distribute ~$1,40 per share resulting in a dividend yield of nearly 4 % based on the current price. In addition to the dividends, the company announced a share buyback program of RUB 3 billion.

7. Valuation

Market Cap: $2.16bn

Enterprise Value: $2.2bn

P/E (TTM) : 35.9x

P/E (NTM) : 21.7x

P/FCF (NTM) : 20x

EV/EBIT (NTM): 18.8x

The Forward estimates are based on the current estimates by analysts. They expect revenue growth of 27.6 % in 2022. I personally think that this is a very conservative assumption. The organic growth accelerated from 60 % in Q2 2021 to 70 % in Q3 2021. The management expects 20 % revenue growth in 2022 alone from the new monetization strategies. In addition to that comes growth from client-based expansion and consumption growth that accounted for 60 % of the organic growth in Q3 2021.

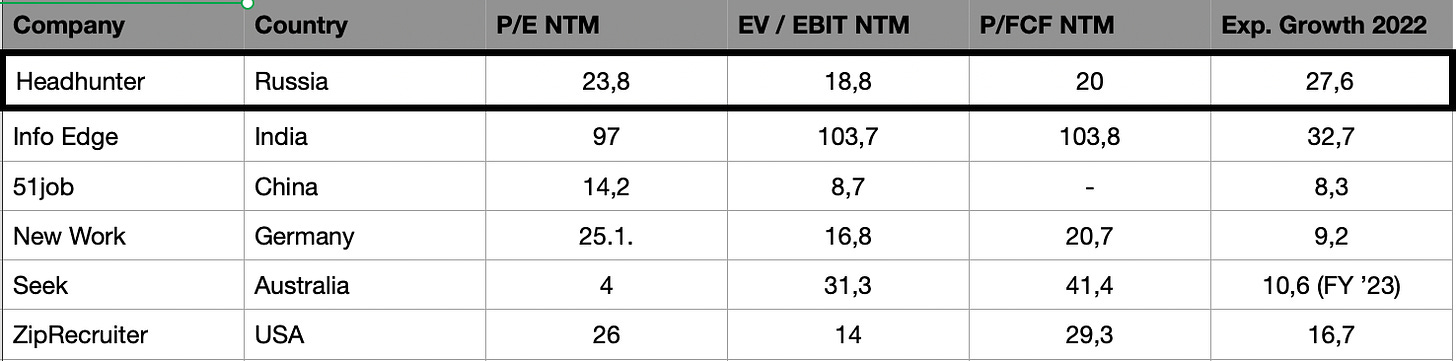

Below you can see how Headhunter is valued compared to their Peer Group:

8. Risks

Political Risks

Headhunter is a Russian company. The main risk is of course the political risk related to Russia. Every time Wladimir Putin provokes the rest of the world or does anything dumb (like invading the Ukraine), the stock of Headhunter will react negatively. Even during the recent incidents in Kazakhstan the stock fell more than 10 %. Political risks, especially in non-democratic countries are unpredictable. So this is not a stock for a highly concentrated portfolio, if you take the risk you should reflect it in your position size.

Regulation

In December 2019 the “Federal Antimonopoly Service (FAS)” in Russia determined that HH, together with SuperJob and RDV-Soft, are currently occupying a collective dominant position in the market of internet-based-services related to ensuring information coordination between employees , employers and staffing agencies in Russia after an complaint filed by “Stafori LLC”. Headhunter was found to have violated Russian antitrust legislation by abusing its collective dominant market position. HH had to pay a final fine of RUB 737.500 ($9.500).

The conclusion by the FAS could limit future acquisitions. But the fact, that the the FAS approved the “Zarplata.ru” acquisition in November 2020 and that the amount of the fine is quite low is an indication for me that this is not a big risk for HH in the medium-term.

Goodwill & Intangible assets

Goodwill and other intangible assets, which are comprised primarily of the brand name, CV database and non-contractual customer relationships, collectively amounted to 66 % of the total consolidated assets as of Sep. 2021. An impairment of these assets would have a material effect on the profitability and the earnings, although the recording of such impairments would not have a direct cash impact.

9. Summary

The decrease of the most active population groups in Russia will increase the competition on the labor market & the increasing adoption of online services are strong secular tailwinds that Headhunter will benefit from as the clear market leader in the online recruitment market.

In the past the stock has been valued higher, the risks (especially the political) has probably not been reflected appropriately. But due to the tech sell-off in the last weeks and increased provocations by Russia the stock came back to a more reasonable price and offers now a much better risk/reward ratio. If the the situation in the Ukraine continues to intensify the stock of course has still more room for a downside. But people are forgettable. Sadly, the most people are not talking about incidents like it happened in Kazakhstan anymore a few weeks later. So maybe such incidents are good opportunities to slowly start a position in companies that have a high quality and are not directly affected. But as always, the risks should be reflected in your position size.

Data is from tikr.com (Date: 29.01.2022)

Great post! Really liked the analysis. How are you defining a stock as being under-followed and what is your method for finding them?

Great first post! Keep them coming and all the best