Welcome,

in this issue of Under-Followed-Stocks i will present you Leatt Corporation ($LEAT).

Investment summary:

designer and developer of award winning protection gear

cutting edge development with 98 patents granted or in process

global industry leader in neck brace market

Management with skin in the game

3Y Revenue CAGR of 37 % and net income CAGR of 108 %

LTM EV/EBIT of 6.2 and P/E of 8.8

If you aren’t a subscriber yet and enjoy the content I share, feel free to subscribe that you won’t miss any new content.

Disclaimer: The following write-up is no investment advice. The author may own, buy and sell securities mentioned in this post. Please always do your own due dilligence!

Let’s go!

1. Introduction

Leatt designs, develops, markets and distributes personal protective equipment for participants in all forms of motor sports and leisure activities, including riders of motorcycles, bicycles, snowmobiles and ATVs. The Company sells its products to customers worldwide through a global network of distributors and retailers.

The Company's flagship products are based on the Leatt-Brace® system, a patented & revolutionary injection molded neck protection system, designed to prevent potentially devastating injuries to the cervical spine and neck. In the past years Leatt developed from a “one-product-company” to a company with a head-to-toe offering with the ambition to become a global consumer brand.

2. History

In 2001 the founder of Leatt, Dr. Christopher Leatt, was at a motorcycling event and his son, who was 4 years old at the time, was with him. They watched a race and a fellow motorcycle rider fell off and broke his neck. The paramedic asked Leatt to come and assist. They tried to resuscitate but unfortunately it wasn’t successful. Leatt came to the realization that his son, who started motorcycling two weeks ago, was also at risk of breaking his neck.

Dr. Leatt who has a background in medicine (specialized in neurosurgery) and also has a passion for motorcycling, began to research & develop a device almost immediately, as he couldn’t find any neck protection on the market. Driven by a passion to protect not only his son, but all riders from the effects of catastrophic neck injuries. His first patents were filed in 2003. The revolutionary Leatt-Brace® was developed in Cape Town, South Africa and tested by BMW engineers at their facility in Munich, Germany, with first production units sold in late 2006.

3. The market

The current focus of Leatt is the protective and also clothing market for MTB and off-road motorcycle market with the ambition to protect more athletes in a wide range of sports with multiple product lines. Leatt established a market leading position within the neck-brace segment. The younger product categories like helmets, shoes and boots, apparel and armor have still plenty of room to grow in terms of market share.

According to this study, the global MTB equipment market is set to grow with a CAGR of 4.6 % from 2021 to 2026 in a fragmented market and 40 % of the growth will originate from North America. According to Grand View Research the motorbike riding gear market is expected to grow even faster with a CAGR of 6.4 % from 2019 - 2025.

4. Business Model

Leatt has an asset light model. In their Headquarter in Cape Town, South Africa, they focus on research, development and design of their products. The manufacturing process is outsourced to third-party companies mostly in China, but Leatt has already started to establish additional production capacity in Thailand and Bangladesh. The company uses outside consultants and its own employees to ensure the quality of its products through regular on-site product inspections.

The Company's products are sold worldwide to a global network of distributors and dealers, and directly to consumers when there are no dealers or distributors in their geographic area or where consumers choose to purchase directly via the Company's e-commerce website. In 2007 Leatt established “Two Eleven Distribution” a wholly owned subsidiary to directly distribute Leatt products to dealers in the US. The company recently opened a new warehouse in Reno, Nevada to deliver more products more efficiently across the US.

5. Products

As already mentioned Leatt developed from a single product company to a head-to-toe offering. Besides their market leading neck-braces they offer further protection gear like helmets, body protection, chest protection, knee braces, boots, goggles and elbow guards, riding apparel like jackets, jerseys, gloves, pants and socks and also accessories like beanies, caps, hoodies, shirts, sunglasses or hydration backpacks.

Chris Leatt regarding new products:

„Looking at the need in the market for example goggles or a helmet or gloves or any product category and say ok we know that those products exist, how do we make the best one.“

The company has won dozens of awards for their innovative products:

Leatt splits their products in 4 categories: neck braces, helmets, body armor and other products, parts and accessories. In the graphic below you can see the change of their product mix. In 2014 over 50 % of revenue accounted for the Neck braces. By releasing more and more products and entering new categories like helmets in 2016, this share has decreased to only 12 % in 2021.

5.1 Neck Braces (12 % of Revenue)

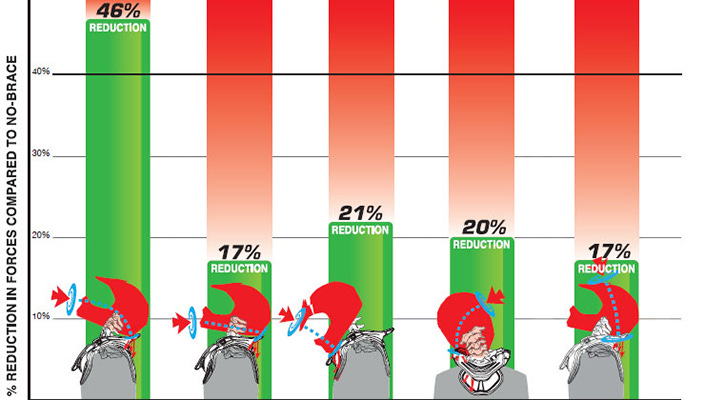

The Leatt-Brace® is a prophylactic neck bracing system composed of various combinations of carbon fiber, glass fiber, polycarbonate or Glass Filled Nylon, which was designed to help prevent potentially devastating sports injuries to the cervical spine (neck). It works as an alternative load path technology (ALPT) injury. In other words, some of the force transmitted to the neck in a fall onto your head is redirected safely to other body structures. The neck brace reduces the risk for a serious neck injury by up to 46 %.

The Leatt-Brace® has been designed in such a way as to offer neck protection to all who utilize a crash helmet as a form of protection, including soldiers, law enforcement officers and other professionals whose activities could result in cervical spine injury.

5.2 Helmets (12 % of Revenue)

In 2015 the company launched its helmet range and commenced shipment with a limited helmet range. The Company currently sells various models of helmet products which the Company believes redefines head and brain protection with its groundbreaking 360-degree Turbine technology for concussion and brain rotation safety. These helmets offer superior head and brain protection in a shell that is smaller, very lightweight, and super-ventilated, even at low speeds.

„Our vision within Leatt in terms of all our products, but specifically helmets, is not only to produce a product that works well in terms of mitigating injuries but it’s also lightweight and aesthetically pleasing. You can have the best product on the market in terms of preventing injuries, but if it’s not lightweight or comfortable to wear, nobody’s gonna use it.“

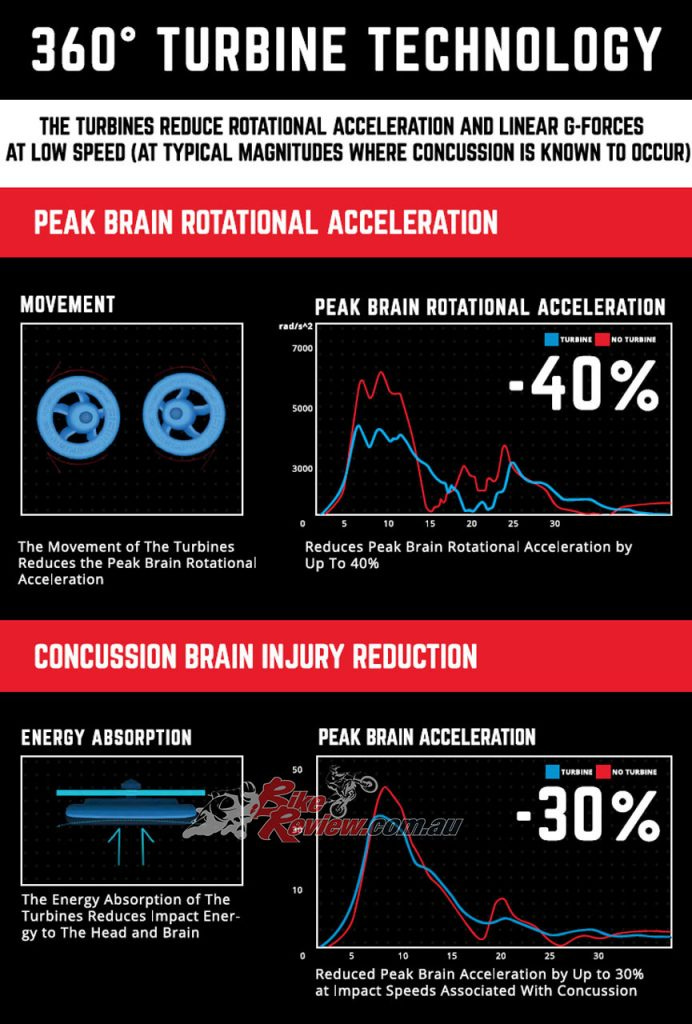

What is the 360-degree Turbine technology?

Previously it was thought that brains were injured by just linear deceleration, but it’s actually rotational acceleration where the head impacts an object on the ground and starts rotating relative to the torso. That rotational velocity is actually more damaging to the brain than just linear deceleration.

This is not something that Leatt found out. A technology that addresses this phenomenon has been developed by the Swedish company MIPS AB ($MIPS). They invented the Multi-directional Impact Protection System already in 2001. MIPS is licensing their technology to a lot of helmet manufacturer all over the world and is the clear market leader who reached a market cap of USD 1.700 million generating over USD 600 million in revenues. But instead of licensing, Leatt decided to invent their own technology - the 360-degree Turbine technology.

The movement of the turbines (little blue discs that are mounted into the EPS layer within the helmet) reduces the peak brain rotational acceleration and the energy absorption of the turbines reduces impact energy to the head and brain. If you want to learn more about the technology i can recommend to read their whitepaper.

Regarding the differences between the MIPS and the 360-degree Turbine technology Chris Leatt said:

They essentially do the same thing in terms of protecting against rotation. They’re surfaces that slide or move in a tangential direction. The advantage of the turbine over MIPS is that MIPS is only for rotation whereas the turbines works for low speed linear damping as well as rotation.

5.3 Body Armor (57 % of Revenue)

In 2010 Leatt launched their body armor range, starting with a hard-shell chest protector and then continuously expanded their offering with body vests, full body protectors , back protectors, knee guards, elbow guards and so on.

The Leatt team is committed to consistently update and refine these products based on consumer feedback and demand on an annual basis. The Company offers various versions, sizes and colors of these products to appeal to different clients in different disciplines and to address different price points. All products have achieved CE certification when necessary.

„One of our rules we live by is that we won’t put something on the market we won’t put on our own children“ - Chris Leatt

5.4 Other Products, Parts and Accessories (19 % of Revenue)

In 2019 Leatt launched their Goggle range, developed with WideVision anti-glare, anti-fog technology and bullet proof tested to military ballistic standards for durability.

The Leatt Apparel Range is the fastest growing product category. They started in 2015 with gloves and have since added a variety of apparel products for off-road motorcycle riders and bicycle riders but also Casual Clothings and Accessories.

Leatt also offers Spare Parts for their products as certain components of their gear can collapse and fail in a controlled mode to help prevent further bodily injury.

6. Management & Shareholders

Dr. Chris Leatt is the Founder, Chairman of the board and Head of R&D. While watching interviews like that one below you really get to know that Dr. Leatt’s core passion is to save lives of athletes. That’s also why he is currently doing a Ph.D. on brain injuries to learn more about how brains react to accidents although he already has a Dr. in medicine. Dr Leatt still owns currently over 34 % of the company.

Sean Macdonald is the CEO, President of the Company and also the CFO. He served as a director of Leatt since 2010 he is a Chartered Accountant with over 15 years experience in the financial and operational aspects of running sports oriented companies. Mr. MacDonald currently owns 3.43 % of the company.

Further 6.98 % of the company are held by Jean-Pierre De Villiers, and individual investor.

7. Financials

As you can see in the graphic below, Leatt was able to grow in all operating metrics in the past years. Especially in 2020 and 2021 the growth accelerated. In 2021 Leatt was able to grow its revenues with 88 %, the operating income with 175 % and the net income with 184 %.

The scalability of the asset light model and also a very good cost control regarding the operating expenses led to a much faster growth of the income vs. revenues. In addition Leatt has a clean balance sheet with no long-term debt and enough cash on hand to meet the working capital needs.

A common thought was that Leatt was a Covid-19 beneficiary as outdoor sports became more relevant in this time. But while many Covid-19 beneficiaries had problems to present good results in Q1 2022, the results of Leatt are not indicating any problems.

Revenues +88 % (body armor +69 %, helmets +269 %, others +122 %, neck braces -21 %)

Operating income +104 % (Margin of 23.2 % vs 21.3 %)

Net income +105 % (Margin of 17.4 % vs. 16 %)

CEO MacDonald also commented on customer demand in the call:

Demand is still looking strong globally, domestically in the U.S. We certainly have not seen any drop-off in demand. And in Europe, it's the same. And in the rest of the world, Australia. We still have significant demand.

It’s always astonishing to me how efficient the marketing of Leatt is. They achieved 88% revenue growth in Q1 while the marketing expenses only grew by 18.6 %. And that’s only 2.5 % of the revenue. For me, this is a clear indication how strong the brand “Leatt” is.

„We’re at heart an innovation company, but I think we’ve now also a cool brand.“ - Dr. Chris Leatt

8. Valuation

Market Cap: USD 122.78 million

Enterprise Value: USD 120.69 million

P/E (LTM): 8.78 Ø P/E (18-21): 11,35

EV/EBIT (LTM): 6.19 Ø EV/EBIT (18-21): 9,391

As you can see, Leatt is currently trading below their historical multiples. This does not necessarily mean, that it’s a cheap stock, but i think with a P/E of < 9 Leatt is currently valued like a company that will have nearly no growth in the future. Of course Leatt was a beneficiary of the pandemic and the outdoor trends that emerged in this time and Leatt will definitely not continue to grow with the speed of the last two years. But in my personal opinion, Leatt is more than a pure Covid-winner. Most of the Leatt gear is for more advanced riders and i don’t think that a rider that just started during the pandemic directly started with full professional protection gear. Probably the growth rate will come back to lower growth like 15-20 % per year. Leatt is still a small player in their market. Only within the neck-brace segment they have a significant market share. In the other categories, that are the reason for the past growth, Leatt has still much more room for further growth. And remember: Leatt has yet not even really started with marketing.

9. Risks

Conflict of interest with founder & selling pressure

The patent for the Leatt-Brace® system is owned by Xceed Holding. Dr. Leatt owns and controlls the Xceed Holding and is licensing the rights to manufacture and distribute the neck braces to Leatt since 2006. Leatt has to pay 4 % of all revenues billed and received from the Leatt-Brace® to Xceed Holdings. So there could be a conflict of interest for Dr. Leatt who directly owns Xceed and is also the major shareholder of Leatt.

In addition Dr. Leatt filed a 10b5-a plan for the sale of up to 200.000 shares over a 12-month period on November 17, 2021. This is a sale of <10 % of his stake in Leatt and after it he will still own >30 % of the company and has still much skin in the game. In interviews with Dr. Leatt you will see that he has still a vision for Leatt and is not done yet with this company. For me it is fine when a founder is taking some chips from the table after he dedicated a long time of his life for a company, as long as he has still so much skin in the game.

Outsourced manufacturing

The products of Leatt are predominantly manufactured in China. This is a risk for many reasons. First, the trade with China is subject of many restrictions/sanctions. An escalation of the “trade-war” of the "Western world” with China could massively effect the production of Leatt products. That’s why Leatt is already working on establishing manufacturing capacity in other countries. Secondly, Covid-19 especially in China is still a big problem and has effects on the global supply chain. But in 2020 and 2021 Leatt has already shown that they were able to manage these problems as they had no supply problems. Thirdly, the intellectual property of the Leatt products is not really safe when you outsource the manufacturing.

Gross-Profit Margins

While Leatt was able to increase the Net-Income-Margin from 4.9 % to 17.3 % in the last 4 years, the Gross-Profit-Margin decreased from 47.4 % to 43.4 %. One reason for that is the decreasing total revenue share of the neck-braces, which have a higher GP-Margin than apparel for example. Also the share of international sales, where Leatt is working with distributors have a lower margin profile compared to US sales, where they have their own distribution. And then, Leatt is also facing the increased costs, especially for shipping.

But there are also some aspects that could have a positive effect in the future on Leatt’s margin profile:

sale of products via a direct-to consumer-model on Leatt.com. Something Leatt is already working on

possibility to license the 360-degree-turbine technology to other manufacturer like MIPS is doing it

establish own distribution center in Europe for example

10. Summary

While researching this company, especially watching interviews with the founder or reading the call transcripts with the CEO, i got really impressed by the passion they have developing new products that saves lives of athletes while simultaneously building a “cool” brand. For long term growth, a high quality management is the most important aspect and Leatt’s management has proven that they can transform a company from a one trick pony to a head-to-toe brand and expanding into other markets. Leatt has still many opportunities for further growth and i don’t see why the management should stop now with executing.

The growth will slow down and i think the current concentration of manufacturing in China is a bigger risk. But given the current valuation i think at least the declining growth is already priced in. If Leatt is able to continue to grow double digit the current valuation could be a good opportunity to start a position, especially once the selling pressure has ended.

Data is from tikr.com (Date: 19.06.2022)

Ok thanks for your thoughts

Did you analyse the capital efficiency like Return on capital, return on equity and so on?