#2 VOW ASA

Turning waste into gas - the solution for europe's gas problem?

Welcome,

in this issue of Under-Followed-Stocks i will present you VOW ASA ($VOW.OL)

Investment summary:

clean-tech company with world leading technologies to eliminate pollution, enhance circular economy and mitigate climate change

patented unique solutions that turn waste & biomass into CO2 neutral energy like synthetic gas

#1 market leader within cruise waste handling systems

beneficiary of decarbonization & “revenge travelling” trends

Management with skin in the game

Revenues expected to nearly double in 2022 & NTM EV/EBIT of 23x

If you aren’t a subscriber yet and enjoy the content I share, feel free to subscribe that you won’t miss any new content.

Disclaimer: The following write-up is no investment advice. The author may own, buy and sell securities mentioned in this post. Please always do your own due dilligence!

Let’s go!

1. Introduction

Vow ASA develops and delivers world leading technology and solutions that bring and end to waste and that are required in a truly sustainable circular economy.

With advanced technologies Vow solutions turn waste, biomass, plastics and polymers into recycled advanced carbon materials, low carbon fuels, chemicals, and climate neutral gas for industries, making it possible for them to reduce their dependence on fossil energy and petroleum products. Vow solutions are scalable, standardised, patented and the companies delivery model is well proven.

The Vow groups key markets for waste valorisation, prevention of pollution and decarbonisation include cruise, biogas, minerals, metallurgical, plastic to energy, end-of-life tires, power to heat, waste management, agricultural, aquaculture and food processing.

2. History

Vow came to light in 2020 when the company Scanship Holding ASA decided to change name to Vow ASA.

Scanship was founded in 1993 and soon became a preferred provider of wastewater treatment solutions for the cruise industry. In 2020 the company had undergone a remarkable and significant transformation, most notably by the acquisition of the French engineering company Etia Technologies.

Founded in 1989, Etia is a European technology leader to valorise biomass residues and waste into renewable products, chemicals and fossil free energy through pyrolysis solutions.

3. Business Model

Vow is organised in three operating segments:

Projects Cruise

Aftersales

Landbased

I will first cover the “traditional” businesses (Cruise & Aftersales) shortly and then the Landbased segment in a bit more detail as i think that this is the more interesting part in the moment given the current situation that European countries need an alternative to the Russian Gas.

3.1 Projects Cruise

The segment Projects Cruise includes sales of systems to shipyards and the aquaculture industry for newbuild constructions or to ships in operations as retrofits under the brand Scanship. Cruise ships on every ocean have Scanship’s clean ship systems onboard, which processes waste and purifies wastewater. Fish farmers are adopting similar solutions, and public utilities and industries use their solutions for sludge processing, waste and plastic management.

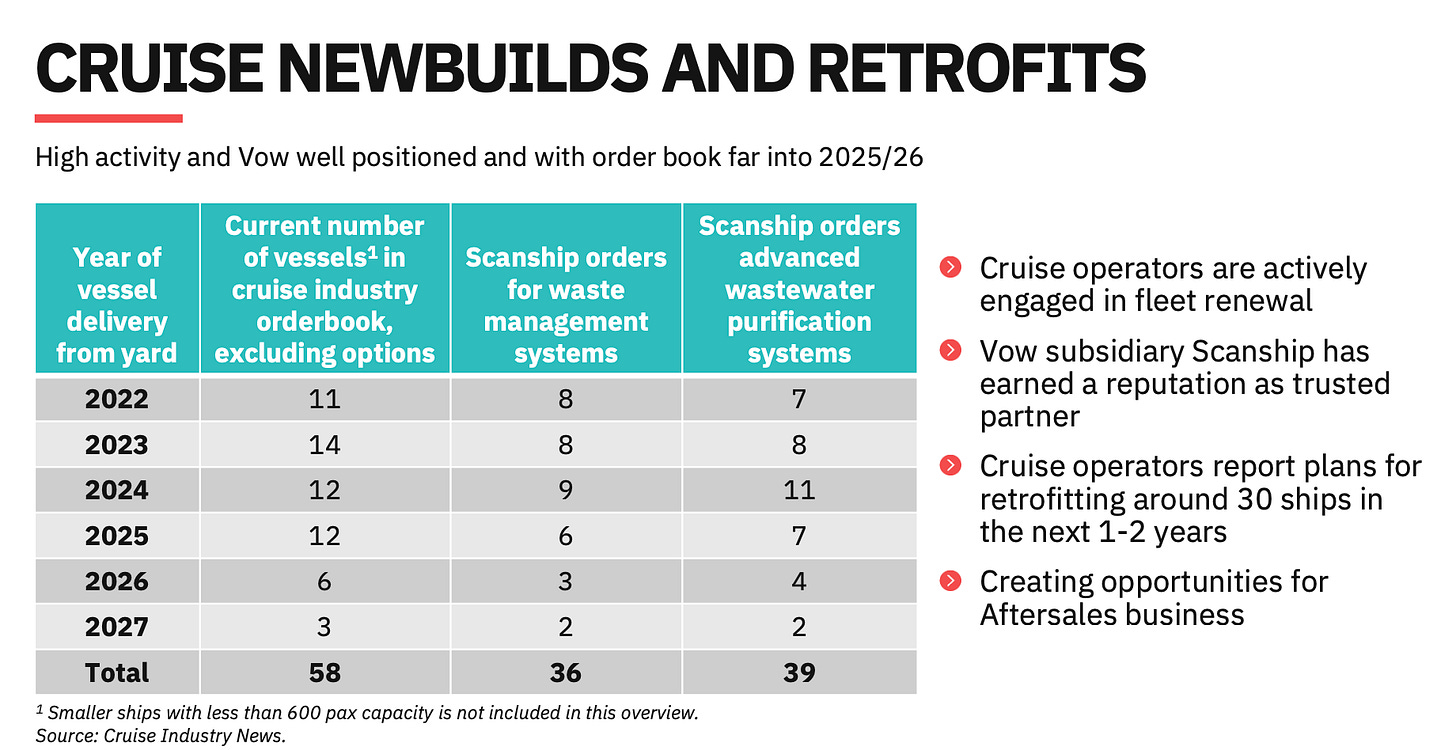

Scanship is the #1 market leader within cruise waste handling systems. Historically they had a market share of 1/3. But looking at the current backlog, it seems that Scanship was able to expand their market leadership immensely during Covid. According to the management there are currently 58 cruise ships under construction at European yards for more than 600 passengers to hit the water from 2022 until 2027. 36 of these 58 ships will be equipped with Scanship technology, so we are now talking about a market share of more than 60 %.

The international focus on discharging wastewater in coastal waters is increasing. New standards for discharge and various regulations are driving the maritime industries to process all wastewater onboard. To meet the demands, not only new ships need the latest waste handlings systems, but also the cruise ships that already hit the water. That’s why Scanship is also getting more and more “retrofit” contracts. Cruise operators reported plans for retrofitting around 30 ships in the next 1-2 years.

Customers of Scanship are all tier 1 cruise companies, yards and acquaculture operators like Carnival, Royal Caribbean cruises, TUI, Hapag-Lloyd, Meyer Werft, Leroy or Mowi.

3.2 Aftersales

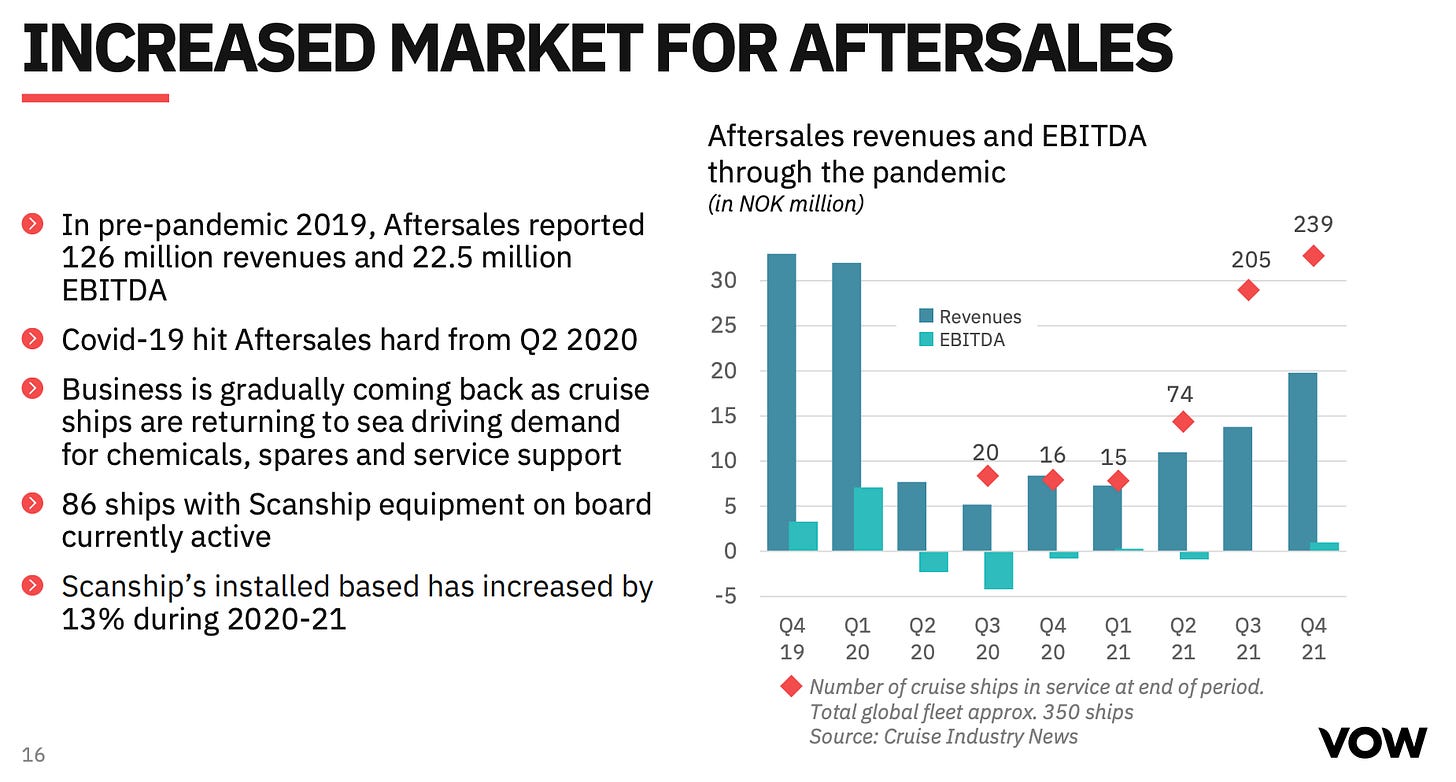

The Aftersales segment is directly connected to the Cruise segment as it relates to sale of spares and consumables, as well as service on the delivered systems by the cruise segment. These aftersales are a great source of recurring revenue for Vow if the cruise ships are actually in operation.

As you can imagine the aftersales segment has been hit hard by Covid as especially the cruises were not possible, but throughout 2021 travel restrictions have been eased and cruise ships have gradually resumed operations. At year-end 2021 approximately 60 % of the world’s cruise fleet was back in normal operations. Scanship was even able to increase the install base by 13 % during the pandemic. So as soon as the cruise ships are all back on operation, the aftersales should be even higher than pre-pandemic. Traditionally the aftersales has been 1/3 of total revenue.

Summary and chances of the “traditional business”

The traditional business was affected by Covid during the last 2 years. Nevertheless Vow was able to stay profitable during these times. Hopefully the pandemic is now ending and the people can travel again. I think the traditional business can benefit from several trends in the future:

higher regulations for wastewater treatment

more retrofit contracts as older ships are no longer allowed to enter some harbours

“revenge travel” after Covid (but could be negatively affected by the high inflation)

higher awareness for waste management to meet certain ESG criteria

Aftersales will contribute to margins as soon as more cruise ships are operating again

3.3 Landbased

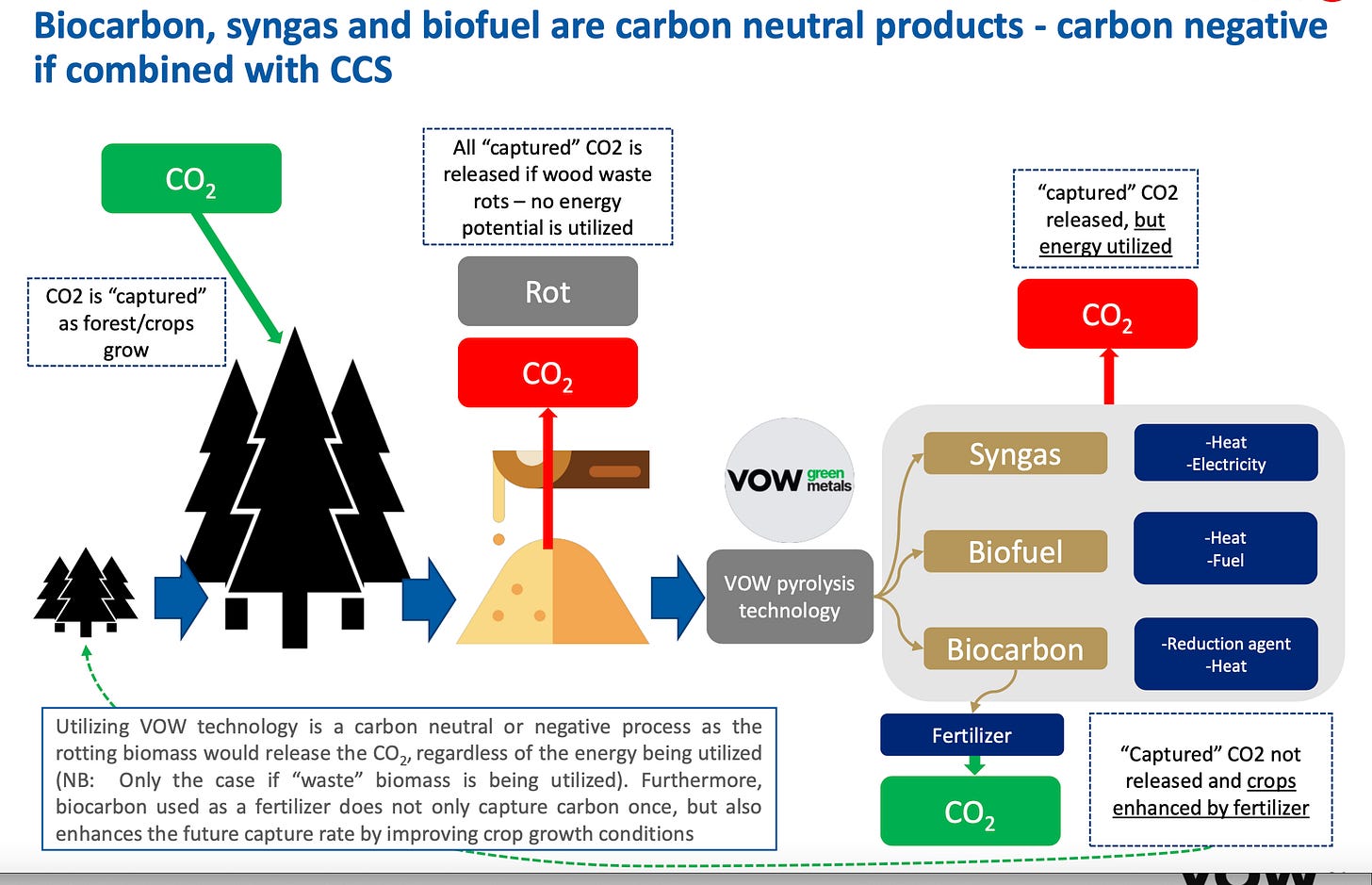

The landbased segment was established since the acquisition of ETIA in 2019. ETIA designs and provides plants for processing biomass, food products, plastics and polymers into recycled advanced carbon materials, low carbon fuels, chemicals and climate neutral gas for industries, making it possible for them to reduce their dependence on fossil energy and petroleum products. To achieve this, ETIA uses a technology called Pyrolysis.

Pyrolysis

Pyrolysis is a thermochemical treatment which can be applied to any organic (carbon-based) product. In this treatment, material is exposed to high temperature and in the absence of oxygen goes through chemical and physical seperation into differrent molecules. Thermal decomposition leads to the formation of new molecules. This allows to receive products with a different, often more superior character than original residue.

In easy words: With Pyrolysis you can turn waste into gas! (for example)

ETIA developed Biogreen, one of the leading pyrolysis processes in Europe, protected by international patents. Biogreen is an extremely versatile system that offers a wide range of possibilities for thermochemical conversion of biomass and waste into high value materials and energy. Biogreen provides a compact and local scale answer to the demand of industry , producing the energy and valuable resources just at the place they are needed.

The whole production of the Biocarbon, Syngas and Biofuel is carbon neutral, if combined with carbon capture and storage it’s even carbon negative as you can see in the example below:

The Biogreen pyrolysis technology is proven in industrial operation for over 14 years. As this technology already exists for so many years without having a big breakthrough we have to ask:

Why now?

I think the reason is obvious: The Russian war against Ukraine. Russia is the biggest supplier of natural gas for Europe and also other fossils and a large part of the European industry depends on it. And finally the European countries are realizing that this dependency is fatal. So the industry, especially the energy-intensive needs an alternative and that really fast.

The industry already knew that they would need alternatives before the war. The costs of CO2 emissions, the price for metallurgical coking coal and for natural gas was already rising before and national and international law maker and governments are pushing for new legislation and regulation, i.e. EU Green Deal. But they always thought they would have more time.

Vow already announced some major partners they are currently working with on different projects and plants:

Arcelor Mittal: Arcelor Mittal and Vow announced in January 2021 to work together to build the first dedicated biogas plant for the steel industry that will reduce CO2 emissions produced during the steelmaking process using ETIAs Biogreen solution. Arcelor Mittal committed to reduce CO2 emissions by 30 % by 2030.

Repsol: In December 2021 Vow received an order to deliver a pilot plant using the Biogreen system to generate fuels and materials with low carbon footprint from alternative feedstock. Repsol has the goal to become a net zero emissions company by 2050.

Global Non-Ferrous Metal Producer: In February 2022 Vow signed a Letter of Intent with a yet undisclosed customer with the possibility for technology supply to a 50.000 tonnes per year biocarbon plant. This project has a potential volume of EUR 85-100 million, but it would replace EUR 37 million of fossil coke and produce 300 GWh CO2 neutral syngas replacing the equivalent of EUR 32 million in fossil natural gas (at current prices probably even more).

GRTgaz: Europe’s second largest gas distributor marked production start of a demo plant in February 2022, built to confirm that CO2 neutral pyrolysis gas can replace fossil gas in the European gas grid. This cooperation is a significant step for Vow’s technology as it expands the potential applications for potential industrial customers.

A recent study in France made by GRTgaz and GRDF, both major gas transportation and distribution companies in Europe shows a 320 TWh realistic potential of renewable methane production from biomass to cover 100 % of methane need in 2050. This paper shows that pyrolysis and gasification technologies could cover 90 TWh which corresponds to 28 % of the total forecasted production of renewable methane in 2050.

Accelerating the green shift

As already said, a lot of energy intensive industries knew that they will need alternatives in the future, but fossil energy was still affordable and a fast change to greener alternatives would result in higher costs in the short term. So they started buying some test plants from Vow but not in a big industrial dimension they would need for a complete shift to a greener production, because they thought there will be more time.

Vow saw the need to accelerate the green transition and launched Vow Green Metals.

3.3.1 Vow Green Metals

In February 2021 Vow announced their plan to spin off Vow Green Metals to their shareholders as a new and separate entity and to list it in the Euronext Growth segment in Oslo.

Vow Green Metal (VGM) was established to build, own and operate BioCarbon production plants at an industrial scale. VGM will recycle waste to produce BioCarbon for metal production and climate neutral gas for energy intensive industries.

The first plant is currently built in Follum, Norway and is already fully financed with 150 MNOK in equity raise (injected by Vow through private placement) and in addition an ENOVA (Ministry of Climate & Environment in Norway) grant of up to 80.7 MNOK. After the spin off Vow still owns 30.5 % of VGM.

Vow Asa signed a 215 MNOK contract with VGM for delivery of the pyrolysis technology and project execution capabilities. The process equipment is expected to be delivered in Q2 & Q3 2022. The plant is expected to produce 10.000 tonnes of BioCarbon annually. Strategic partners are already in place. VGM has secured wood waste from feedstock partner Lindum and signed a LOI with Elkem and Vardar for supply of BioCarbon and CO2 neutral gas. Elkem has a target of 500.000 tonnes of biocarbon by 2030.

3.3.2 Acquisition of C.H. Evensen & new pyrolysis reactor

In March 2022 Vow announced the acquisition of C.H. Evensen as a response to the rapidly changing and growing demand from current and potential customers.

"We are making three significant steps forward. We will have more and complementary technologies in our toolbox, we will significantly increase our capacity and ability to service a growing market and customer base, and we will gain access to new customers in new industry verticals and markets," said Henrik Badin, CEO of Vow ASA.

C.H. Evensen has an installed base of more than 4.200 systems worldwide and a large customer base with renowned names such as Elkem, BMW, Thyssen or Aludyne. Vow paid NOK 50 million. C.H. Evensen reported NOK 57mm in sales in 2021 and an adj. EBITDA-Margin of 10.4 %.

Only 2 weeks after the announcement of the acquisition Vow announced that C.H. Evensen will build a large scale pyrolysis reactor that can produce yearly up to 100 GWh of syngas and 10.000 tonnes of BioCarbon in an application based on forestry residues. This amount of biocarbon enables a possibility to capture up to 30.000 tons of CO2 which otherwise would have been released to the atmosphere. The reactor will be built and delivered by the end of 2022 but it is build on spec. So Vow is taking a big risk to accelerate the green shift. But just to put the demand for BioCarbon into context: If the EU was to substitute 40 % of 2021 coking coal demand with BioCarbon they would need 22.5 million tonnes while the current BioCarbon production in Europe is around 20.000 tonnes.

“We are building the reactor on spec, but we are confident that we will have found a buyer by the time it is delivered,” Badin said.

With the addition of this Evensen reactor, Vow is now able to offer three complementary pyrolysis technologies:

Evensen reactor for processing large volumes of biomass and to produce clean energy and biochar

Biogreen solution that can be finely tuned to produce the most sophisticated and advanced biocarbon, needed for instance by the metallurgical and advanced materials industries

Scanship MAP (microwave assisted pyrolysis) technology to process organic waste and produce clean energy on board of a cruise ship. The first such system is being installed on a cruise ship this spring by Scanship

Summary and chances of the “landbased business”

In the past the pyrolysis solutions from Vow has not been more than pilot projects in the industry. Now the situation changed dramatically. The green shift has to happen much faster in Europe. The supply with fossil energy is not longer guaranteed. Vow has a proven technology to substitute coking coal and natural gas. The increasing costs for fossil energy & CO2 emissions makes Vow’s solutions also economically more and more interesting. Vow has seen their opportunity early and started investing to be ready for the increasing demand.

4. Management & Shareholders

Management

Henrik Badin is the CEO of Vow and has 20 years of experience related to environmental engineering onshore and in the maritime industries. He joined Scanship in 2001 and was appointed as CEO in 2008. In 2020 he was selected as “Norways foremost growth creator” by EY Norway from 3.900 candidates. Mr Badin owns ~8.64 % of Vow and is the fourth largest shareholder.

The CFO is Erik Magelssen who joined Scanship in 2017. He has more than 15 years of experience as CFO in companies like VIA Travel Group and Kongsberg Automotive and owns 73.334 shares in Vow (0.06 %).

CCO is Bjorn Abraham Bache who joined Scanship in 2018 and has more than 25 years of experience from international business serving in leading positions in companies like Elkem, Unitor/Wilhelmsen or Mettler-Toledo. He owns 25.217 shares in Vow.

Shareholders

Reiten & Co became the largest shareholder in 2017 and currently owns ~27 %. Reiten & Co. is one of Norways most experienced investment companies and invests in medium-sized Nordic companies with an international potential. Narve Reiten, the founder of Reiten & Co. is also the Chairman of the Board of Vow.

The second larges shareholder is the CDO of Scanship Asgeir Wien who owns through his company Daler Inn Limited ~8.79 %.

The third largest shareholder is the COO of Scanship, Jonny Hansen who owns ~8.69% through his company Exproco Limited.

The management has skin in the game. Together with the CEO Henrik Badin, these three top managers own over 26 % of Vow.

5. Financials

Despite the headwinds due to the Covid-pandemic Vow was able to increase their revenues compared to Pre-Pandemic and to stay profitable, showing a significant improvement in the second half of the year 2021 especially in the Aftersales segment as the Covid restrictions were eased. In addition the order backlog leaped to a record high.

Segment breakdown

Cruise

The cruise segment accounted for 65 % of the total revenue in 2021. The revenues came in slightly below 2020 while the EBITDA-margin was slightly better. In H2 2021 newbuild and retrofit contracts worth EUR 246 million were awarded, confirming cruise operators confidence and commitments to invest in new climate friendly and sustainable operations.

Aftersales

Aftersales accounted for 11 % in 2021. With cruise operations resuming in H2, revenues were up 84 % compared to H1 2021 but still at around half of pre-covid level. EBITDA returned to positive in H2, driven by the higher revenue. With more newbuilds coming into service, market for Aftersales is expected to grow and likely surpass previous levels, since Vow’s installed base has increased. Pre-Covid the Aftersales segment already reached EBITDA-Margins of > 20 %.

Landbased

Landbased revenues more than doubled from H1 2021 to H2 2021 to NOK 74 million, accounting for 24 % of total revenues. EBITDA-margin was slightly positive for the first time. The backlog at the end of the year reached NOK 279 million whereof a big part is the NOK 215 million contract with Vow Green Metals.

Outlook

Activity was picking up in all parts of Vow in the 2nd half and 4th quarter of 2021 and the record high order backlog provides a good visibility for 2022. The cruise segment is expected to bounce back as cruise operators continue to renew and upgrade their fleets, and demand for Aftersales continues to increase. As a response to the growing demand for sustainable and advanced carbon products and especially climate neutral energy independent from Russia, ongoing investments into alternative solutions are expected. That’s why management expects to nearly double the revenues in 2022 (acquisition of C.H. Evensen not included). While in 2021 only the cruise segment contributed to the positive margins, in 2022 it is expected that all three segments will contribute, resulting in higher overall margins.

6. Valuation

Market Cap: NOK 2.431 mm ($ 279 mm)

Enterprise Value: NOK 2.444 mm ($ 280 mm)

NTM EV/EBITDA: 19.4x

NTM EV/EBIT: 23x

NTM P/E: 33x1

SpareBank 1 recently released an interesting updated study covering Vow with a price target of 50 NOK/share. While i personally don’t really care about analysts price targets i think their SOTP Valuation is interesting regarding what is possible if everything goes right for Vow. They assume that the Landbased segment will be the major growth driver representing over 70 % of Vow’s total value by 2025. The valuation is based on the assumption that Vow would be able to deliver 10 of their bigger industrial pyrolysis solutions for an average sales price of NOK 150 mm per annum at an EBITDA-Margin of 20 %.

7. Risks

Operational risks

With the Spin Off of VGM and the pre-production of the Evensen reactor without having final end-customers Vow is taking a big operational risk. If they fail to sign a final contract with Elkem (currently just a LOI) and/or find an end-customer for the Evensen reactor this could have substantial impact on the financial situation of Vow. Also this would probably mean that the large-scale pyrolysis solution is not that interesting for the industry which is a big part of the future valuation of Vow.

Covid-19

Currently, it looks like the pandemic is mostly over. But i think what we have learned in the past two years is that we can never be sure. A new mutation could again trigger new restrictions for the cruise industry and it is not sure if they could survive another crisis which could have material impact on the Aftersales and also the Cruise segment of Vow.

Recession / Inflation

If the economy drives into a recession and / or the inflation continues to increase it is unlikely that there will something like “revenge travelling” happen as the people are just not able to afford expensive cruise vacations.

8. Summary

As a provider of world leading technologies that can eliminate pollution, enhance circular economy and mitigate climate change, and a proven ability to deliver reliable technology at a competitive price, Vow is well positioned to meet the global trends of replacing fossil carbon and turning waste into valuable resources.

Given the current situation of the urgent need for the replacement of fossil carbon the prospects for Vow’s solutions, especially in the landbased segment look promsing. Nevertheless one can not predict which technology or solution the industry will finally chose for this effort. Vow has some high valuable partnerships and also signed interesting LOI’s but it is necessary to turn these LOI’s into definite contracts to prove that their solutions are also highly valuable for their customers in a large scale. So assumptions like the Sparebank made are interesting, but no one knows currently what way the industry will go.

On the other side, Vow is already an established market leader with their waste management systems and wastewater purification solutions. And Vow showed that they were able to stay profitable even when the cruise industry was in a crisis and the Aftersales segment generates recurring revenues as long as cruise ships are operating.

To sum up, with Vow you get a clean tech company with a potentially huge upside in their landbased segment while the downside is at least partially protected by a currently strongly recovering seabased segment where Vow was able to increase their market leadership in the past.

Data is from tikr.com (Date: 10.04.2022)

Good write-up. I have been interested in this company for a while but believe that the valuation is still too high and multiple contraction imposes a significant risk in my view.