Disclaimer: The following write-up is no investment advice. The author may own, buy and sell securities mentioned in this post. Please always do your own due diligence! This company is a micro-cap. Keep in mind that even a small investment from your side can move the share price due to the low liquidity of shares. It's not easy to liquidate if you want to get out.

Welcome,

in this issue of Under-Followed-Stocks I will present you Transense Technologies plc ($TRT.L).

Investment summary:

turnaround after years of losses with the help of a highly profitable license deal by new management

a substantial part of the current market cap is backed by future cashflows of this license deal that will be used to maximize shareholder value via buybacks and investments in a controlled manner in highly promising & patented SAW technology

high profile customers like Bridgestone, Continental, Goodyear, GE, McLaren Applied, Pirelli

Fiscal Year 2023 revenues increased by 35 % and net profit by 310 %

EV/PBT ‘24 of 7.7x & EV/FCF ‘24 of 6.8x

net cash, buybacks, insider buys & corporation tax losses that are available for offset against future profits

If you aren’t a subscriber yet and enjoy the content I share, feel free to subscribe so that you won’t miss any new content. I have no intention of making this a paid substack in the foreseeable future. The content I share is free. But if you want to support me, you can voluntarily choose the paid option :)

Let’s go!

1. Introduction

Transense Technologies is a leader in the development and supply of specialised sensor technology and measurement solutions for use in demanding, high growth markets. Some of the best known, global companies rely on Transense technology for their demanding mission critical applications. The company owns over 35 international patents that protect the use of SAW sensors, the interrogation electronics, firmware and antenna for non-contact torque, temperature and pressure measurement.

Transense was founded in 1991, listed on the AIM market (AIM:TRT) in 1999 and has a long history of unprofitability. At least until Nigel Rogers became the CEO in 2020 and changed the strategy. The new CEO licensed the Transense iTrack system to Bridgestone under a ten-year deal expiring in 2030 that turned the company from a notoriously unprofitable company into a highly profitable one.

The current market cap is GBP 14 million (USD 17.8 million). So again, this is a really illiquid micro cap. Never buy such stocks without doing your own research. I’m not an expert in the torque sensor market so you can’t rely on my assumptions. If you decide to buy after doing your own research always use a limit order.

2. The company

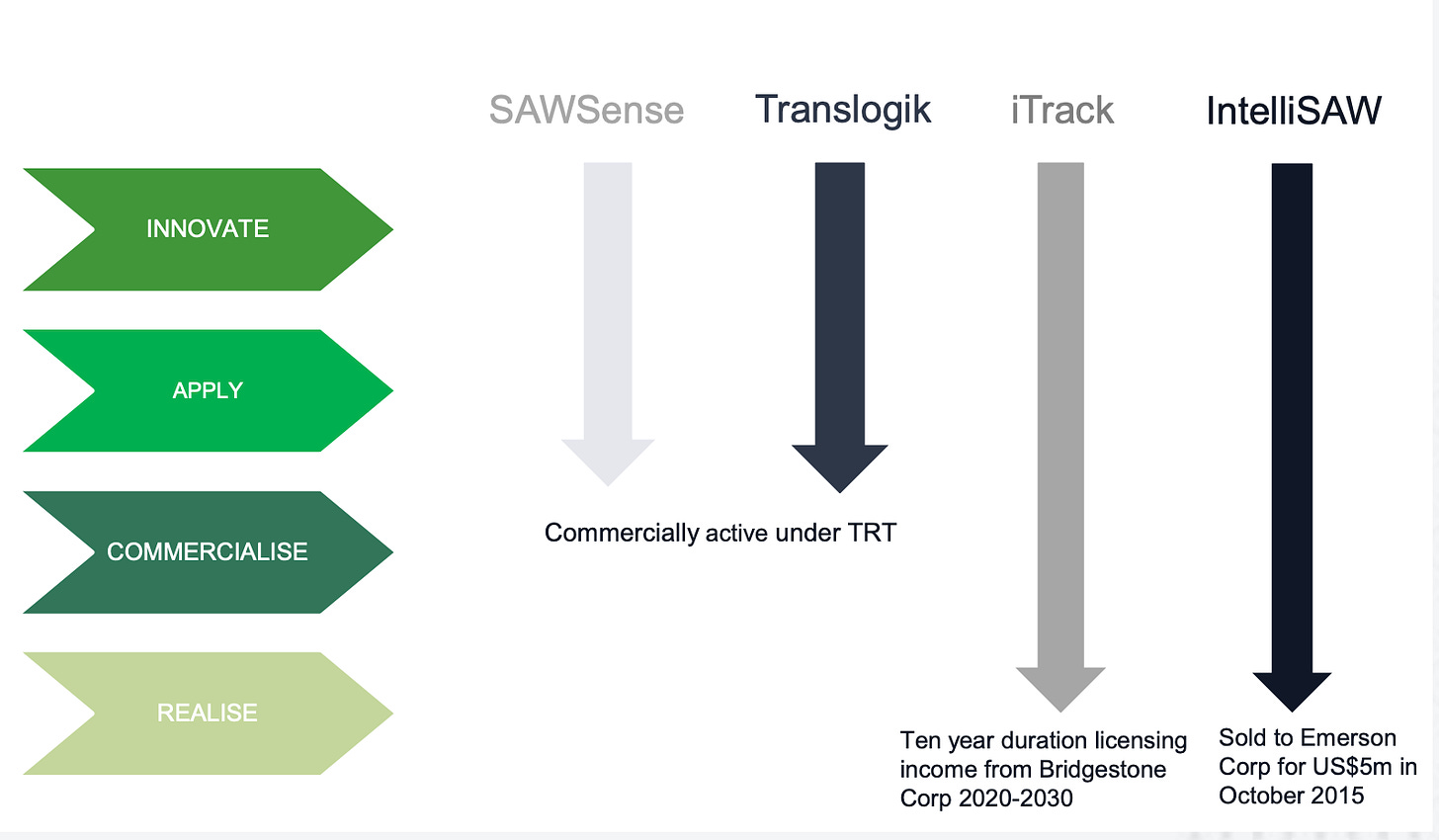

The company has developed 4 different products for different applications that are at varying stages of monetisation.

IntelliSAW: Provides advanced monitoring solutions for critical electric power transmission and distribution assets. It has been sold to Emerson Corp for USD 5 million in October 2015.

iTrack: Tyre pressure monitoring system (TPMS) that was exclusively licenced to a Bridgestone subsidiary (ATMS) in 2020 for a 10-year royalty stream.

Translogik: Tyre inspection and data capture tools that can be used to reduce operating costs and improve safety within tyre management systems.

SAW: Surface Acoustic Wave (SAW) sensor technology and solutions, used in demanding applications to accurately and reliably measure torque, temperature, force and pressure to improve performance, efficiency and safety.

3. Business Units

Transense currently has 3 business units and revenue streams that are all growing.

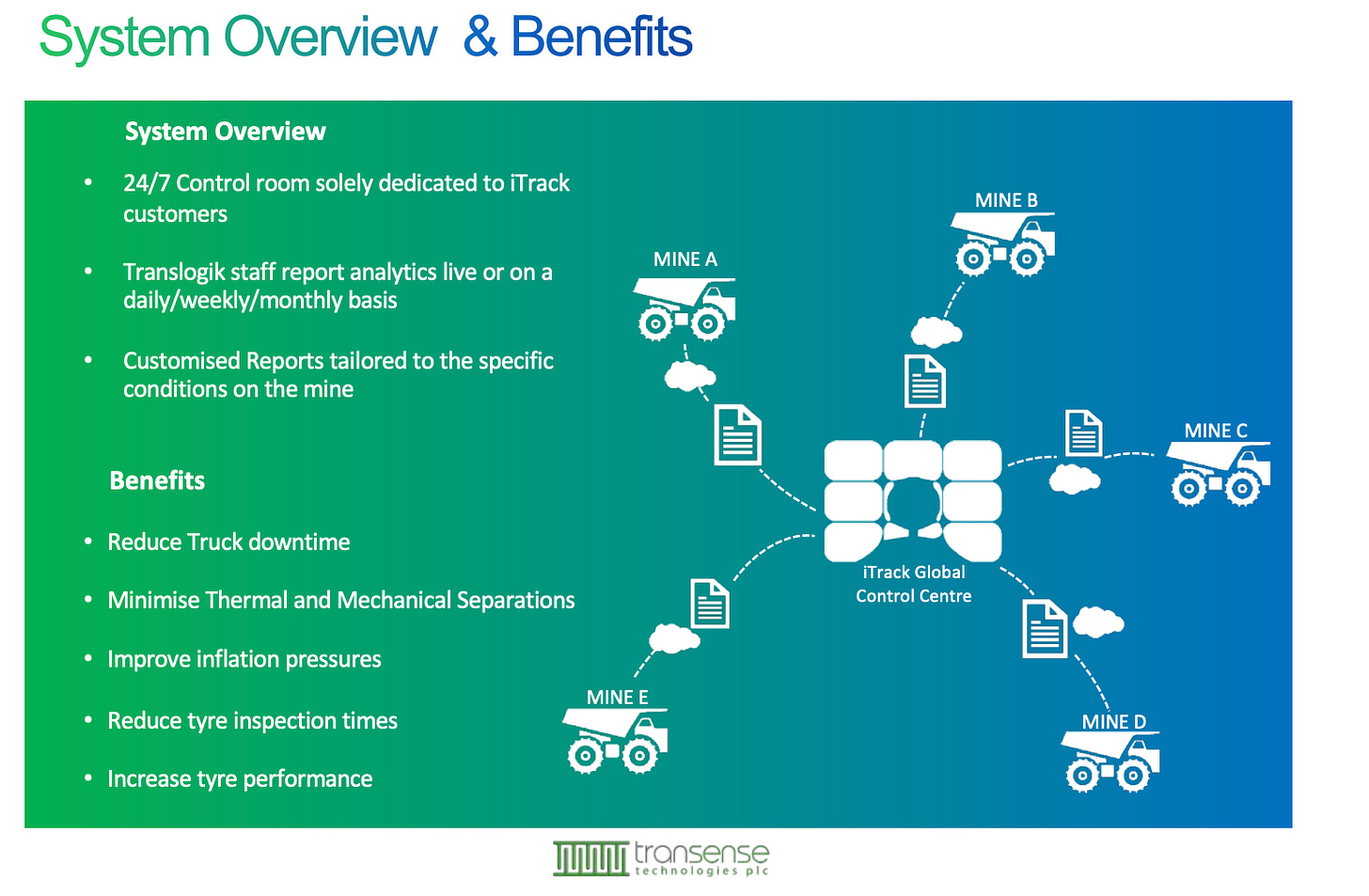

iTrack (60 % of revenue): As already said, this is the business segment that was sold in 2020 to Bridgestone under a 10-year license agreement and the option to acquire the technology for a nominal cash sum at the end of the 10-year period. Under the license, Bridgestone will offer its customers worldwide tyre monitoring systems for all off-the-road (OTR) vehicles (mainly mining trucks) based upon iTrack technology. Transense receives quarterly royalty payments based on the number and classification of vehicles upon which the iTrack technology is deployed.

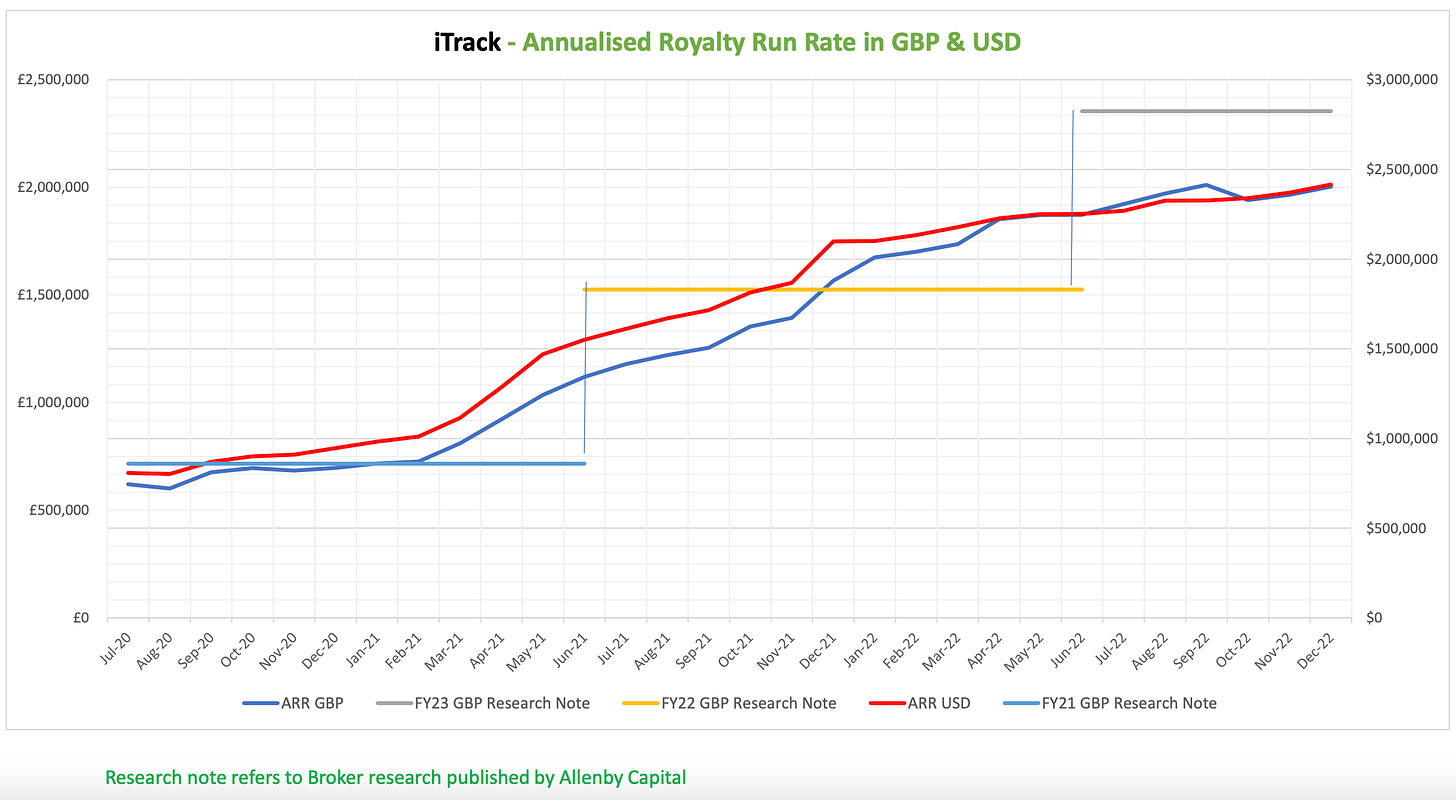

The initial quarterly royalty was estimated to be approximately £ 0.15 million. The royalty income grew with a CAGR of about 50 % since then reaching £ 0.6 million for Q4 of FY 23 at an annual run rate of £ 2.3 million with a profit margin of about 96 % (excluding the costs for central overhead).

The frequency of iTrack installations is non-linear. Periods of lower growth where new customers trial the system will be followed by sharp increases as mines actively convert their vehicles. The sales focus of Bridgestone has now moved from North America to Latin America and Australia (which are both bigger markets for mining trucks than North America) and Bridgestone was able to win already 2 major customers at the end of 2022 and also made an acquisition in Australia where the iTrack technology will also be implemented. The Transense Management has good visibility on the deployment of iTrack as Nigel Rogers, the CEO of Transense became a Non-Executive Director at ATMS (the Bridgestone subsidiary responsible for the global deployment of iTrack) after the deal.

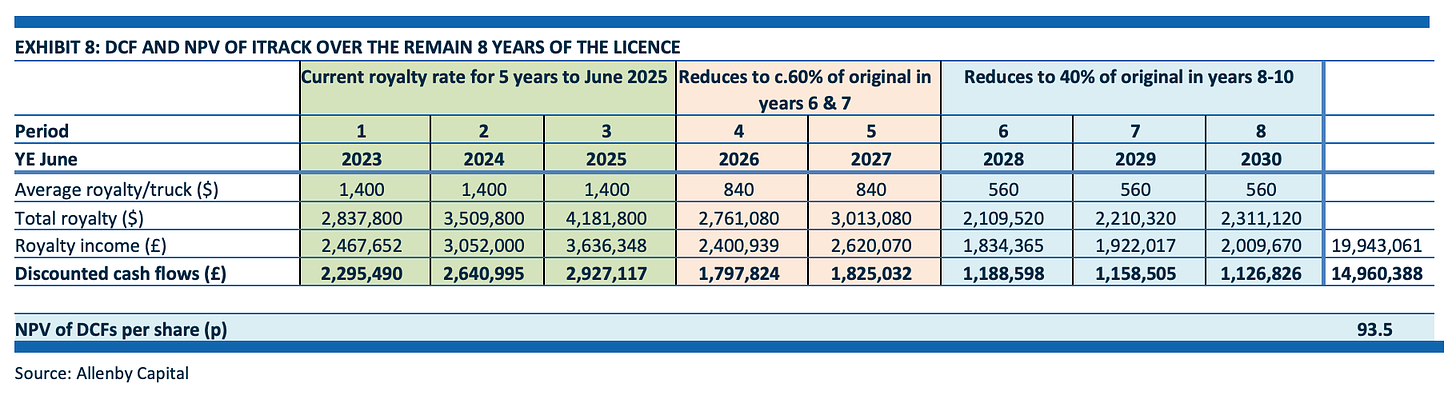

The analysts of Allenby Capital made the following assumptions to estimate the discounted cash flows and net present value of the royalty payments:

The rate of iTrack installations continues to grow at a rate similar to that of the first two years, to June 2025.

The rate of installations then diminishes by round one third to June 2027.

The rate of installations diminishes further to around one third of the historic rate until the end of the licence period (June 2030) as the market becomes saturated. The market share at this stage would be equivalent to around 36% of the available ultra-size truck market.

No additional growth from the installation of iTrack into smaller mining trucks even though it seems that such installations have already been achieved

£/$ exchange rate at 1.15

Given the relatively low risk profile, they discounted future cash flows at a rate of 7.5% to arrive at a net present value (NPV).

On the above assumptions, the analysts are calculating the NPV of the future discounted cashflows from iTrack installations with £ 15 million or 93.5p per share which is more than the current share price.

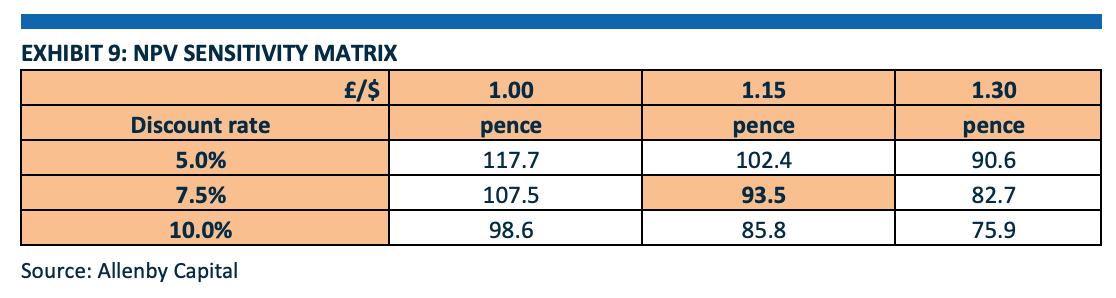

The inputs are of course highly subjective and even small changes can have a strong impact on the result like the exchange rate that is currently at 1.27 for example. Below you can see the sensitivity analysis. In the valuation section, I will further elaborate on my thoughts about these calculations. For now, you should just keep in mind that a substantial part of the current market cap is probably covered by the iTrack royalty streams.

Translogik (31 % of revenue): In the Translogik segment they offer tyre tread depth probes that provide extremely accurate and reliable tyre data instantly and is aimed towards fleet management companies in conjunction with the major global tyre manufacturers such as Bridgestone, Goodyear, Continental or Pirelli who are all customers of Transense. Additionally, the business has expanded beyond its traditional tyre manufacturing client base to fleet management companies and software providers. The technology has been shown to deliver reduced costs and improved collection of data which helps commercial vehicle fleets comply with safety inspection regulations and manage the significant costs of their tyres more effectively.

The modular Translogik TLGX range, which was launched in 2020, is now the principal system among its customer base. You can see the differences between the 4 products in the video below.

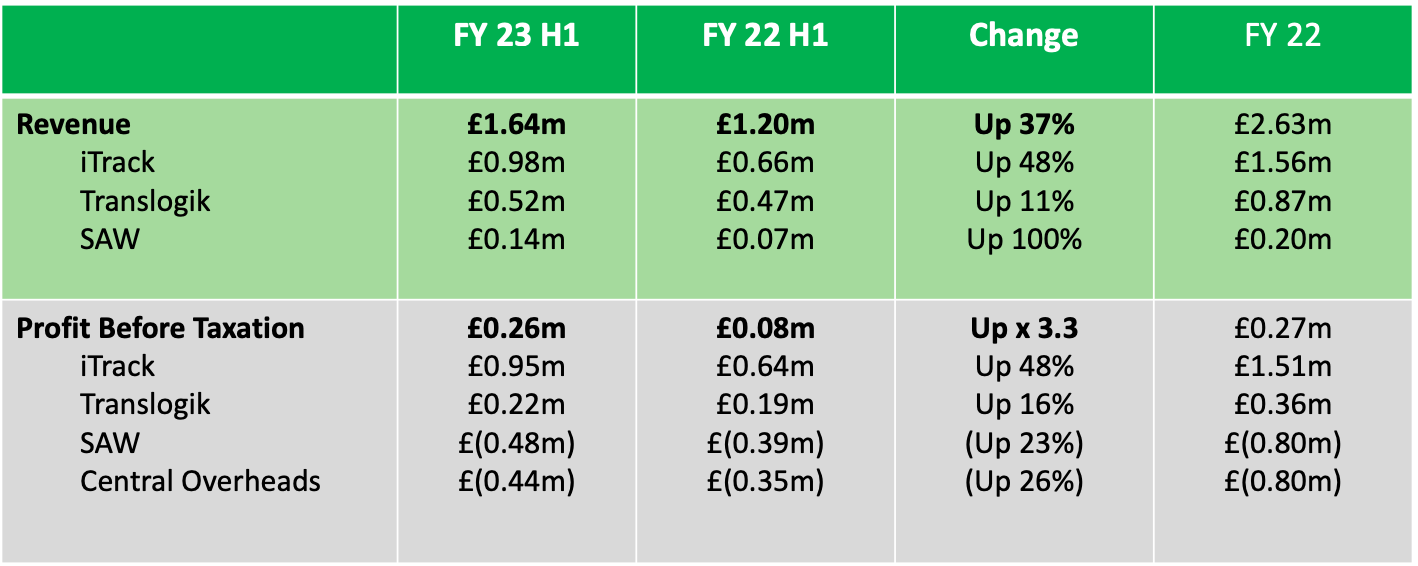

In H1 FY 23 revenues grew by 11 % and PBT by 16 %. Third-party manufacturing of the devices allows a low cost base and profit margins of 42 % (excluding the costs for central overhead). A healthy pipeline indicates good prospects for 2023 and beyond, underlined by accelerating revenue growth of 20 % in H2 FY 23.

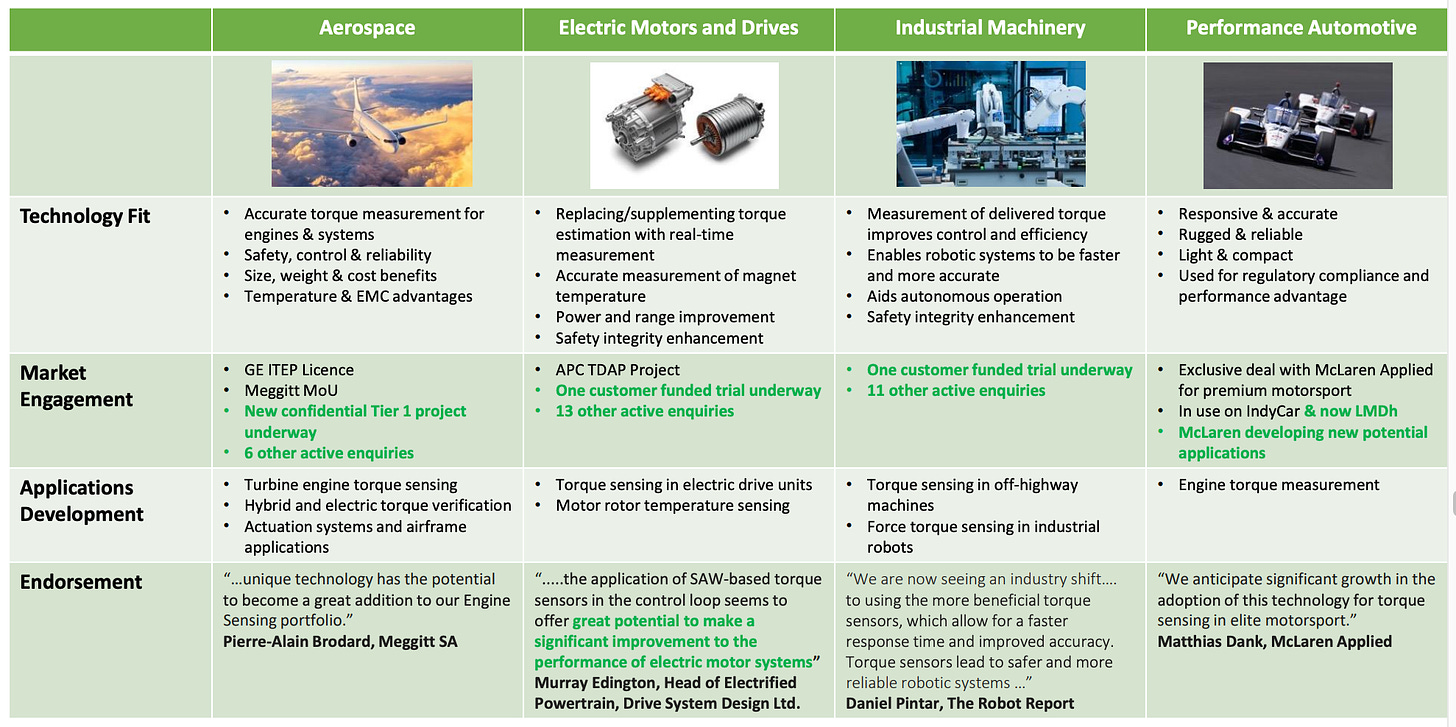

SAW - Surface Acoustic Wave Technology (9 % of revenue): The patent protected SAW sensor technology provides real time measurement of torque, temperature, pressure and strain, and is used to improve efficiency, performance, safety and sustainability of propulsion systems and machinery without the need for bakeries. This means that SAW can be used in applications that traditional sensors cannot, such as on rotating shafts or in environments where access to the sensors is difficult or potentially hazardous. The torque sensor market is expected to grow from $6.8 billion to $9 billion between 2021 & 2026. The business is focusing on four sectors:

Aerospace & Defence

Electric Motors & Drives (EMD)

Industrial Machinery (IM)

Performance Automotive (PA)

In the video below you can see a comparison of the different torque sensor technologies and their advantages and disadvantages.

The commercialization of the technology is still in its infancy, but some of the cashflows coming in from the license deal can now be used to accelerate the process.

Transense already signed a licence agreement for their SAW technology with GE for the use of SAW sensors in its future military jet engine (ITEP / GE T901 Turbine) that will replace the GE T700 engine on all US Army Apache & Black Hawk helicopters (about 6.000) from 2024 on and that will also be used in the new “Future Attack Reconnaissance Aircraft (FARA)” of the US Army. The SAW technology has been selected due to improved torque measurement accuracy and the elimination of sensor maintenance which enables the engine control system to deliver better fuel consumption, handling, data collection & component protection. Recently, the license has been expanded to be also used in the hybrid electric (HEAT) project of GE & NASA and also the RISE program.

In addition Transense has also signed a 5-year agreement with McLaren Applied to develop non-contact torque products for specific motorsport applications. The technology is currently used in the IndyCar and LeMans Daytona hybrid (LMDH) series and has recently been approved for use on Formula 1 cars.

In September 2022 Transense signed a Memorandum of Understanding (MoU) with Parker Hannifin, an international leader in the aerospace market, to evaluate potential market opportunities for the future deployment of SAW technology in the aerospace sector with the shared intention of a licence agreement covering relevant fields of use to Parker Hannifin at the conclusion of the MoU on or before 31 December 2023. The MoU offers a potential route to market and would probably have a significant impact and Transense figures (Parker Hannifin had revenues of USD 19 billion in FY ‘23).

In May 2023 Transense secured a new development project with a tier one automotive electric propulsion systems business to investigate the application of the Transense SAW sensor technology in electric motor drive or Drive systems for torque measurement. The development work will be funded by the customer which shows that there is a real interest by the customer. Especially power and range improvements that the technology can provide (has been externally verified) are very important for new electric motor designs. Whilst the initial scope of work under this development project is not financially material to Transense, if successful these projects could lead to SAW technology being built into series production eDrive systems, which would be a significant new application of the Company's technology.

In the Industrial Machinery sector, Transense was also able to acquire one customer funded trial and has 11 other active inquiries.

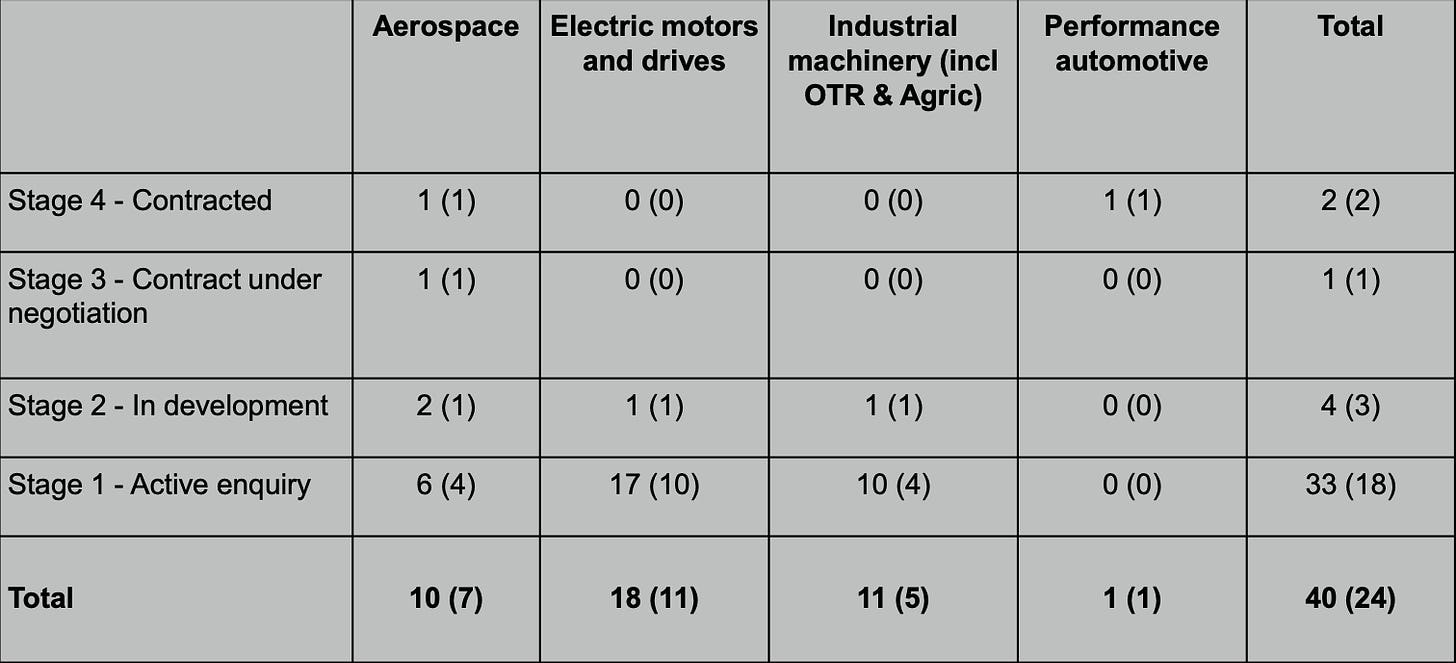

All in all, one can say that the planned acceleration of commercialization of the SAW technology is on track. The Company is now actively engaged with a combined total of 10 aerospace OEM and T1s, 18 in the EMD space and 11 with industrial machinery manufacturers which brings the total number of potential customers engaged from 24 in September 2022 to 40 in February 2023, representing a big pipeline of opportunities in their key market sectors.

The SAW revenues increased in H1 FY 23 by 100 %, albeit from a low base and at a negative PBT of £ 0.48 million (up 23 %). The revenue growth for the full FY 23 accelerated to 150 % YoY.

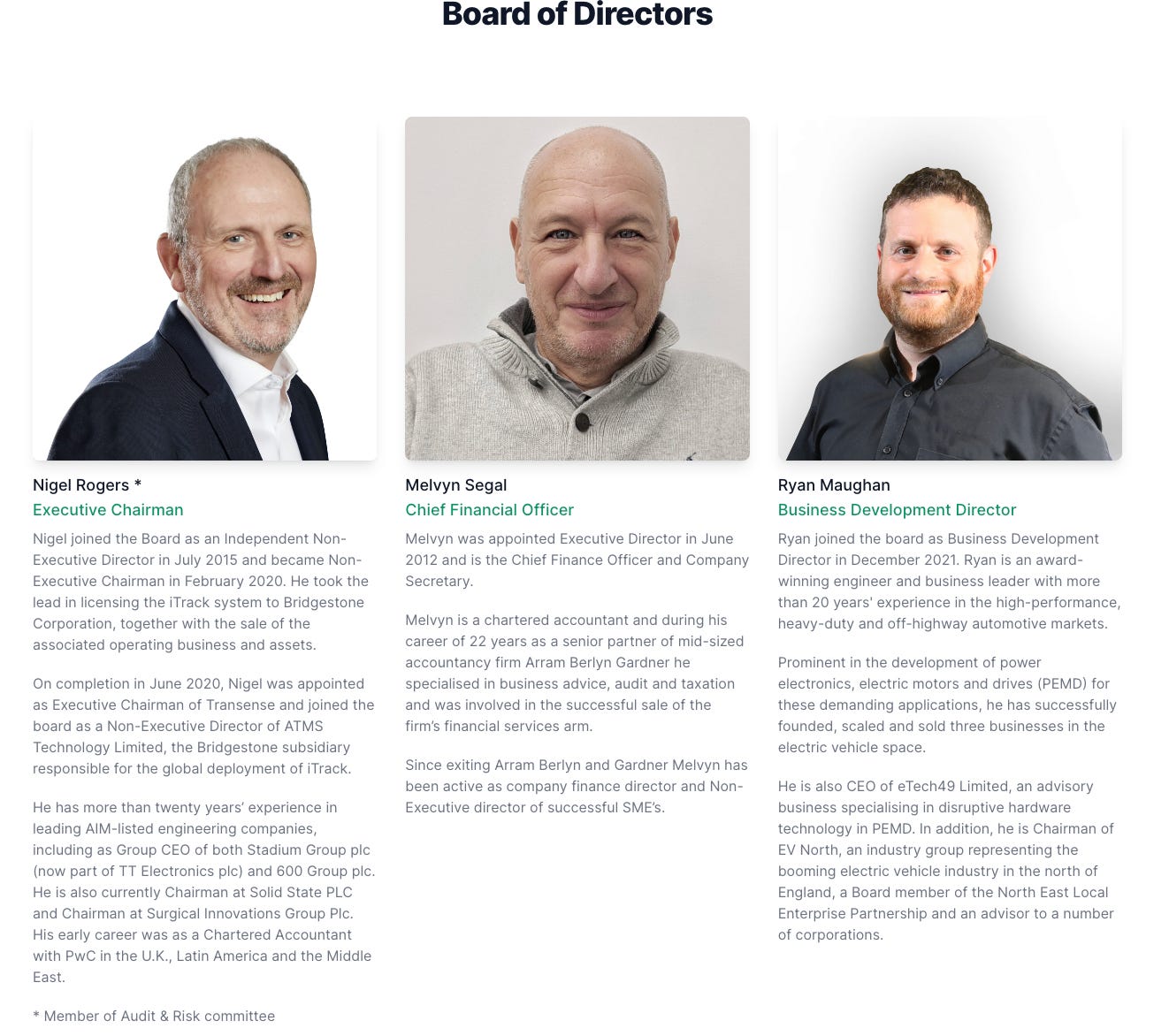

4. Management & Shareholders

Nigel Rogers joined the Board of Transense as an Independent Non-Executive Director in July 2015 and became Non-Executive Chairman in February 2020. He took the lead in licensing the iTrack system to Bridgestone. On completion in June 2020, he was appointed as Executive Chairman of Transense. Since then he put the focus more on the commercialization of Transense’ technologies by repositioning the cost base toward customer-facing engineering and project management specialists instead of additional R&D. He also joined the board of ATMS (the Bridgestone subsidiary responsible for the global deployment of iTrack). Since his appointment as CEO of Transense, he has bought 173.000 shares of the company. Nigel Rogers has more than 20 years of experience in leading AIM-listed companies, including as Group CEO of Stadium Group (now part of TT Electronics) and 600 Group.

Melvyn Segal is the CFO since June 2012. He is a chartered accountant and was a senior partner of mid-sized accountancy firm Arram Berlyn Gardner.

Ryan Maughan joined the board as Business Development Director in December 2021. He is an award-winning engineer and business leader with more than 20 years experience in the high-performance, heavy-duty and off-highway automotive markets.

It appears that the management and other insiders are optimistic about the future of the business as they have bought over 248.000 shares since June 20 at an average price of 72 GBX. The Board owns about 4 % of the company and also has 1.462.500 unexercised share options (about 9 % dilution). 2/3 of these options will be granted when the share price reaches 150 GBX and 1/3 when it reaches 200 GBX.

The largest shareholder is Criseren Investments with 10.36 %, a family-controlled small-cap investment group. Second largest is Seneca Partners with 8,04 %, an award-winning SME specialized investor. Below you can see a list of the additional shareholders.

5. Financials

Transense published a trading update in July 2023 for their Fiscal Year 2023 (ends in June) with the following unaudited information:

Total revenue +35 % to £ 3.5 million

iTrack +30 % to £ 2 million

annual run-rate of £ 2.3 million (+ 23 %)

Q4 royalties of £ 0.6 million (invoiced in Q1 FY ‘24) indicates acceleration of growth rate

Translogik +17 % to £ 1 million

SAW +150 % to £ 0.5 million

Adj. EBITDA +133 % to £ 1.4 million

Profit after tax may exceed expectations but mainly due to extending the recognition of deferred tax assets arising from prior year losses (more on that later)

Cash balance maintained at £ 1 million despite outgoings of £ 0.4 million (£ 0.3 million in ‘22) on share buybacks and non-recurring reorganisation costs of £ 0.2 million (for the already mentioned repositioning to focus on commercialization)

The overall numbers has been in line with expectations. The iTrack revenue came in a bit lower than expected as the majority of the royalties came in at the end of the year, but has been compensated by better than expected results in the other segments. The management is also confident to meet market expectations for FY ‘24 (more on that in the valuation section). Final results for FY ‘23 will be published in September.

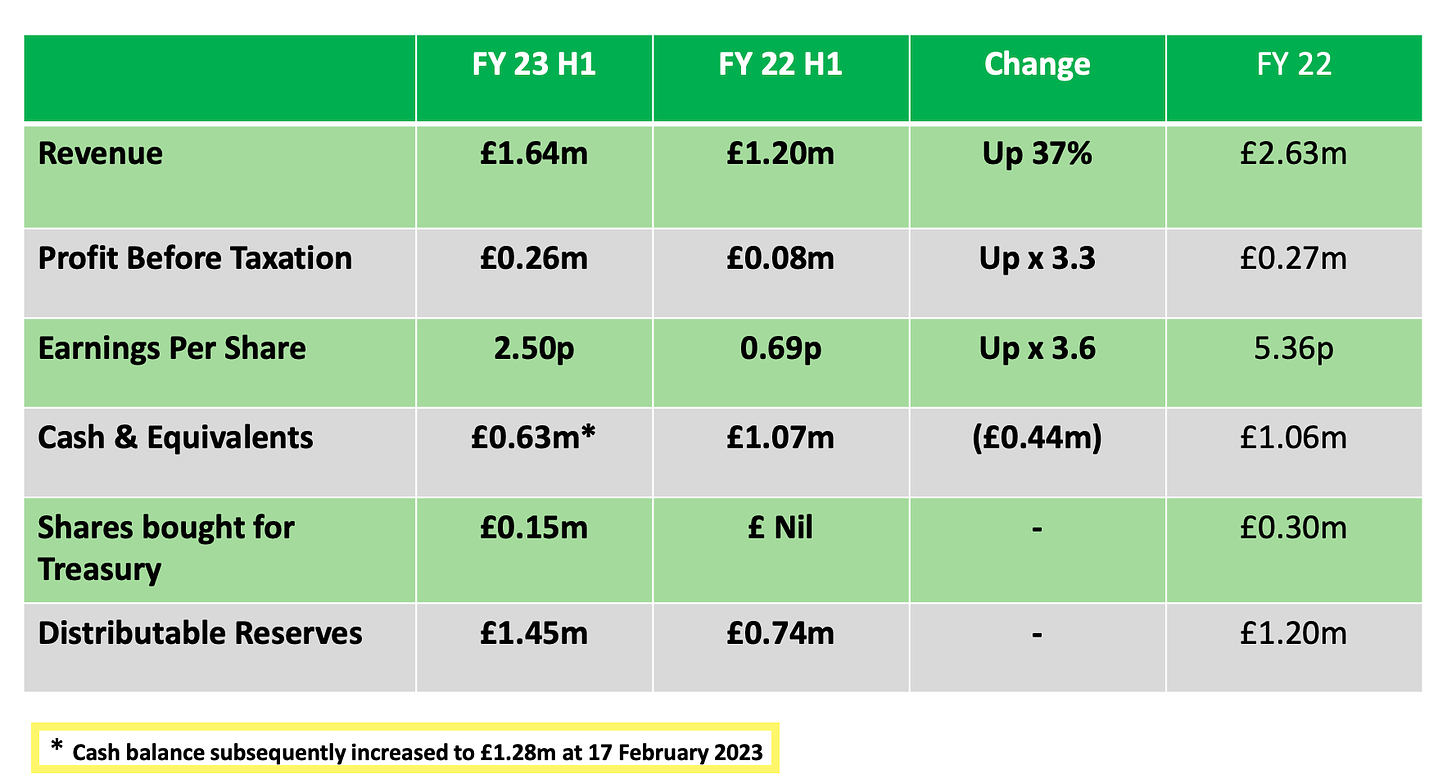

As the numbers mentioned above are not audited, here are also the last audited results for H1 FY ‘23. In the first 6 months of FY 23, Transense was able to achieve a profit margin of 15.9 %. With continued growth in the highly profitable iTrack segment and expected break-even in the SAW segment, the profit margin is expected to more than double until the end of FY ‘24.

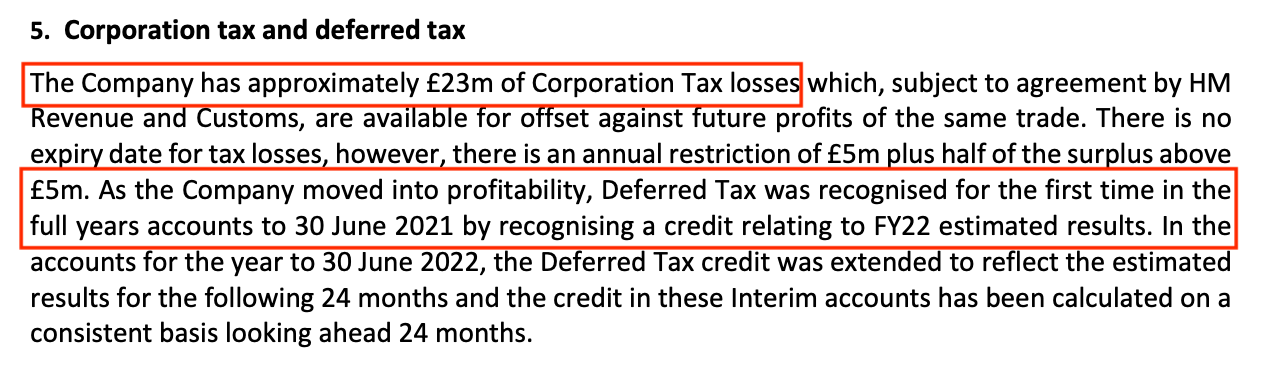

As mentioned, the company has approximately £ 23 million of Corporation Tax losses available to offset against future profits. So Transense does not have to pay corporation taxes in the foreseeable future. This benefit is recognized as a positive credit in the P&L resulting in a higher profit after taxation (PAT) than profit before taxation (PBT). I will use the (lower) PBT in the valuation section or the cashflow (where the tax credit is eliminated) appropriately because these credits are unrelated to the operational business and I want to value the company based on their present operations.

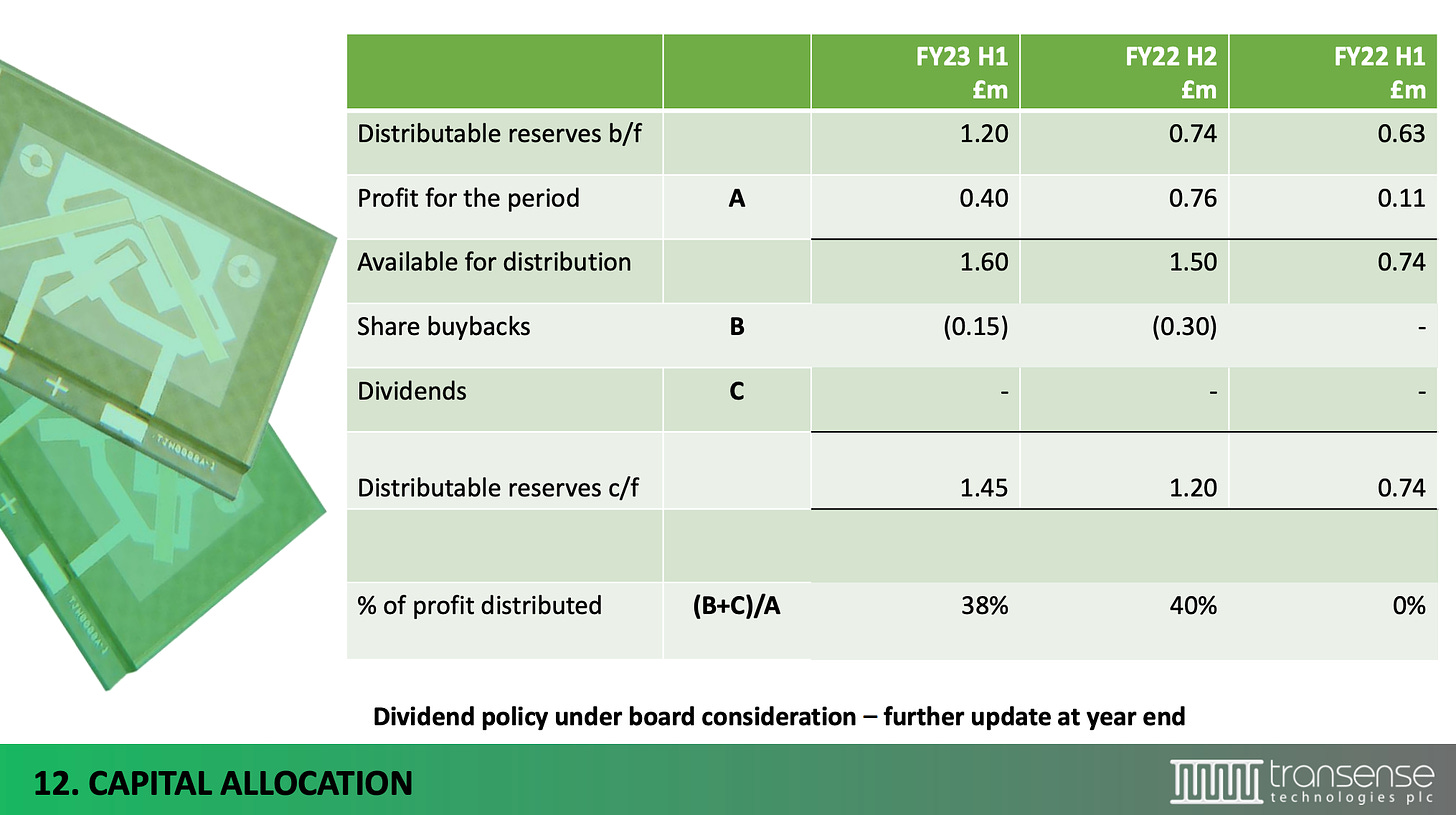

The management is commited to use the excess cash to create shareholder value via share buybacks. In the last 2 years, the company has used about 40 % of profits to buy back shares. Under the current buyback program, the company can still buy about 300.000 shares. In addition, the board considers paying a dividend in the future. The board will update their dividend policy when they present their FY ‘23 results in September.

6. Valuation

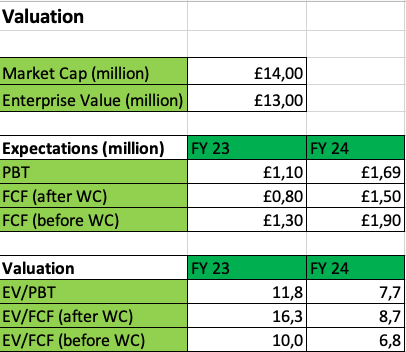

It is expected that Transense can achieve a PBT of £ 1.1 million (+310 % you) in FY ‘23 and £ 1.69 million in FY ‘24 (+53 % vs. FY ‘23). The FCF (after Working Capital) is expected to reach £ 0.8 million in FY ‘23 and £1.5 million in FY ‘24. The FCF (before WC) is expected to reach £1.3 million in FY 23 and £1.9 million in FY 24. As the working capital is mainly receivables and payables, I think the FCF before WC is a more appropriate number to value the business.

These assumptions would result in the following valuation:

Remember, that a substantial part of the current market cap is backed by the future cashflows of the royalties. Although I wouldn’t calculate with the 95 GBX per share calculated by Allenby Capital as the various inputs are highly sensitive. Given the fact that the royalty income came in a bit lower than expected (though mostly due to timing as Q4 was a big part of installments) and changing currency rate (but management hedges fx risks). With a cautious approach, I would only calculate with 70 GBX per share. This still corresponds to over 75 % of the current market cap. Adding now the already highly profitable & growing Translogik business (calculating with £ 0.4 million cashflow per year for the next 5 years, no growth and a WACC of 8 %) we can increase the number by another 10 GBX per share.

So the downside is rather limited while the upside potential is huge if the SAW business takes off. I think only one of the following trigger would be enough to achieve a sharp increase in share price.

Final licence agreement with Parker Hannifin until end of the year (+++)

Successful development project with the Tier 1 automotive company and announcement of future series production in eDrive systems (+++)

Production start of the GE turbines that will replace older engines in US military helicopters (about 6.000) and positive development of the other programs with GE & NASA (++)

Any other positive news regarding the SAW pipeline (+)

Better than expected development of iTrack or Translogic business (+)

In 2021, Transense made £ 90.000 in SAW revenue only with the implementation of SAW sensors in the IndyCar series. The series has 40 cars. Assuming that only 1 sensor is used in a car and that every team has a replacement car, one sensor costs about £ 1.125. So imagine when a world-leading aerospace distribution network or a Tier 1 automotive company would implement the sensors in series production, I think that this would have an material impact on Transense’ earnings and share price (+++).

The implementation of the sensor in 6.000 turbines could lead to highly profitable licence revenues of about half of the current market cap, but spread over several years. I think the market would then realize the real potential of the technology. But as the agreement with GE is already known for a while, the impact on the share price would probably be lower than the announcement of a new agreement (++).

I think one of the other trigger (+) would further increase the opportunities of the technology or further minimizes the downside. Thus I would still expect a positive impact on the share price, but lower than the trigger mentioned before.

7. Risks

Slowdown in implementation of iTrack systems: While better than expected implementation of iTrack would have a positive effect, a slowdown of course would have a negative one. Despite having a seat on the board of the Bridgestone subsidiary, Transense has no control over the implementation of the iTrack systems. Theoretically Bridgestone could decide to stop implement iTrack and use another TPMS system. Although the probability is quite low as Bridgestone has just replaced its own system with iTrack.

Continued losses of the SAW segment: Low / no conversion of the inquiries / MoU’s into contracts would result in continued losses in the SAW segment instead of a near-term break-even. It is also possible that the management will not increase the investments in a “controlled” manner so that the losses would instead increase.

Currency risks: The royalty fees are paid in USD by Bridgestone. As Transense is reporting in GBP, a change in the currency rate could have a negative effect. Management started to hedge these risks.

IP / Patents: Transense has over 35 patents that are securing its know-how. Nevertheless there is always a risk that other companies are developing similar or better technologies.

8. Summary

I think Transense offers an interesting risk / reward ratio. While the downside seems to be rather limited as the company will probably continue to generate high cashflows thanks to the iTrack licence deal and the Translogik business, an additional licence deal for the SAW technology is like a lottery ticket. However, I believe that the agreements with certain well-known clients, such as GE, McLaren, or Parker Hannifin, are an indicator that the odds of Transense's stockholders winning the lottery are improving. Especially the MoU with Parker Hannifin with a fixed conclusion date (end of ‘23) seems to be interesting. With continued double-digit growth from iTrack and Translogik at a single digit FCF valuation, this is a period I am willing to wait for. The fact that management is also purchasing shares underlines my point of view.

Interesting company for sure. How much longer is their tech patented for?

what a great post, it got me interested in the company, even sold some shares to buy Transense, just to find out they don't trade on Interactive Brokers. Can you tell me what platforms could be used in order to buy the stock?