Disclaimer: The following write-up is no investment advice. The author may own, buy and sell securities mentioned in this post. Please always do your own due diligence! This company is a micro-cap. Keep in mind that even a small investment from your side can move the share price due to the low liquidity of shares. It's not easy to liquidate if you want to get out.

Welcome,

in this issue of Under-Followed-Stocks I will present you Toyokumo Inc. ($4058).

Investment Summary:

sticky Software-as-a-Service business with churn rates < 1 %

Revenue CAGR of 38 % and EBIT CAGR of 45 % from 2018 - 2023

Revenue growth of 25 %, EBIT growth of 37 % with an EBIT-Margin of 36 % in 2023 & ROIC of 37 %

a clean balance sheet with net cash and no long-term debt

CEO owns 49 % of the company

LTM EV/EBIT of 15.8x & NTM EV/EBIT of 13.8x

If you aren’t a subscriber yet and enjoy the content I share, feel free to subscribe so that you won’t miss any new content. The company write-ups I share are free. But if you want to keep up-to-date about the companies in my portfolio, you can voluntarily choose the paid option :)

Let’s go!

1. Introduction

Toyokumo is a SaaS company that provides cloud services like a safety confirmation service & cloud services that are linked to the low / no-code platform “kintone” as well as a group scheduler that makes it easy to adjust daily schedules.

The company’s mission is “Freeing all people from inefficient work”. By keeping ahead of the constantly changing times, it intends to anticipate products and services that customers will wish for and prepare them in advance. With an unprecedented focus on service, ease of operation, simple functions, and self-explanatory user interfaces, Toyokumo hopes to provide services that those new to the world of IT, who do not use PCs and smartphones on a day-to-day basis, can use with confidence, assisting business in their first steps toward computerization.

Toyokumo is listed on the Tokyo Stock Exchange Growth Market (TSE) since 2020 under the code $4058. The current market cap is 16.483 ¥ million (USD 106 million).

2. The company

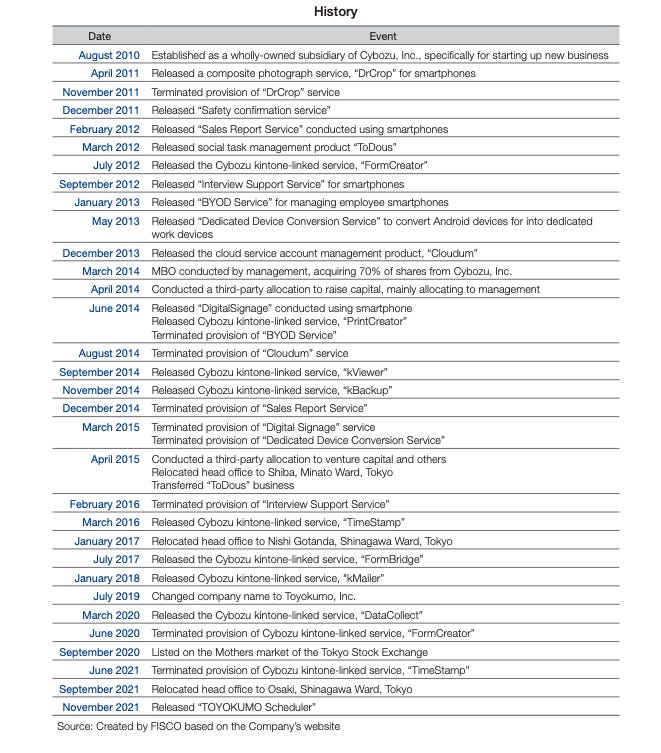

The company was established as Cybozu StartUps Inc. in August 2010 as a wholly-owned subsidiary of Cybozu Inc., to develop new cloud services. Cybozu is Japan’s leading groupware provider. Its products like Cybozu Office or Kintone are used by over 115,000 companies worldwide including SoftBank, Nissan, Ricoh, Volvo, Gojek or WholeFoods.

In 2014 it was judged that shifting the company to an independent management structure would be beneficial for both companies and a management buyout (MBO) was agreed upon. Yuji Yamamoto (the current CEO & president director of the company before the MBO) acquired 70 % of Cybozu StartUps. Afterwards he conducted a third-party allocation to raise capital which was mainly allocated to the management.

In July 2019, to clarify the independence of Cybozu, the company changed its name to Toyokumo. The origin of the company name expresses the companies desire to spread cloud computing all over the world, just as the Japanese god Toyokumononokami is said to have created clouds and brought rain to the land at the time of creation, thereby enabling agriculture.

In September 2020, the company was listed on the mothers market of the Tokyo Stock Exchange.

Toyokumo’s aim is the “popularization of IT”. They have a corporate philosophy of contributing to the development of affluent social life around the world through information services. To realize this corporate philosophy, they are actively working with the following in mind:

Toyokumo’s services are available to try free of charge for 30 days before entering into a contract. During this short period, they strive to ensure that users become familiar with how the service works, and experience operational improvements through the service operations and settings. To secure high profitability, they are highly focused on working efficiently by keeping their per-contract acquisition costs low. They do not send out sales personnel to visit prospective clients and propose services for them. Instead, they employ inside sales via e-mail and telephone, and use marketing automation tools to automate some parts of the process. This waste-free operational approach is how they ensure high profitability.

Talented people are essential to maintain efficiency and continue to ensure high profitability in an ever-changing environment. To encourage talented people to choose Toyokumo over the competition, they are focused on affording individual employees a high degree of freedom so that they can fulfill their potential, and paying them generous salaries commensurate with the results they produce. Paying a generous salary is not just corporate babble. Between 2018 to 2023 the average annual salary at Toyokumo has increased by 57.3 %. Despite being a small company, the salaries at Toyokumo are at the 58th rank of the “Top 500 companies in Japan”. Recently, they have introduced a completely new personnel system which aims to create an environment where employees can demonstrate their performance through an in-house system that allows for fair evaluation of each other's achievements. They set two goals for each person: long-term goals to achieve future growth (growth goals) and guidelines for working towards the goals (achievement goals). Toyokumo believes that this will lead to continuous growth and improvement, making it easier for employees to plan their own careers. They have also established a stock ownership plan where employees can buy shares of Toyokumo with a 50 % discount for up to 10% of their salary. To maintain high profitability while increasing salaries, Toyokumo must grow its revenues and profits accordingly. We will see in the Financials section if they achieved this in the past and in the Growth Driver section if they can continue to do so.

Advertisement:

Quartr is the most comfortable way to listen, read or search across thousands of call transcripts. In the past, this information was reserved for professional analysts, but with Quartr there is now a simple and inexpensive way for retail investors to access it too. Get a 20% discount for Quartr Core by clicking the button below.

3. Products & Business segments

Toyokumo is reporting in two business segments, the safety confirmation service and kintone-related services that contain multiple products. Both segments have been growing consistently for many years.

Safety confirmation service (34 % of revenues)

In Japan, companies are required to provide countermeasures to minimize confusion in the event of a natural disaster like earthquakes or tsunamis. As Japan is situated in an area where several tectonic plates meet, it is vulnerable to natural disasters. Therefore, the Japanese government invests in disaster prevention systems such as earthquake alert systems. Furthermore, participation in natural disaster drills is common in Japan.

In 2011, Toyokumo released its safety confirmation service, a cloud service for confirming the safety of employees and others when disasters occur. In the event of a disaster within Japan, automatic safety confirmation notifications are sent to cell phones, smartphones, and PCs to help organizations accurately assess any damage, confirm that their employees and their families are safe, and communicate with suppliers. The countermeasure instruction function for example enables users to engage in three different communication functions:

a message function for discussing countermeasures with the most suitable team member

a message board function for notifying transitional processes

a bulk notification function for communicating the results

Toyokumo uses data centers of Amazon Web Services (AWS) for its safety confirmation service. The data centers are mainly located in Singapore as there have been no earthquakes or damages by Tsunamis observed in Singapore in the last 100 years, it has a stable electricity situation and is close to Japan. Other internationally distributed data centers are also available. The server capacity can be expanded flexibly and the system can respond automatically to an increase in access during disasters. For instance, based on early reports of earthquakes by the Japan Meteorological Agency, the function can automatically expand servers before opening access to users to ensure that the system can operate stable even when access to the service increases rapidly. On the other hand, there is little need for use during normal times. Toyokumo enters therefore server contracts according to the status of access that allows them to be always able to operate with an appropriate cost burden, enabling them to provide the service at a competitive price.

Every year, Toyokumo conducts a nationwide simultaneous training for all its current contract users. In this training, they place a load on the system that is close to or even larger than an actual disaster, allowing customers to see for themselves whether the system will actually be able to operate in the event of a disaster. In addition, participating companies will be provided with a free training report, summarizing for example the average response time for the entire training, which can also be used to raise disaster prevention awareness.

Over 3,500 companies have implemented the service, which has been ranked No. 1 in customer satisfaction for six consecutive years by ITreview, one of Japan’s largest IT product and SaaS review sites.

The churn rate for the safety confirmation service is around 0.2 %, which makes it a very sticky, profitable & growing SaaS business.

Kintone-related services (66 % of revenues)

Before going into detail about what services Toyokumo offers in this segment, let’s have a closer look at what kintone actually is. Kintone is a customizable workplace platform that organizes your data, workflows and conversations in one centralized place for a more streamlined work experience. The no-code drag-and-drop interface allows you to create your own custom database application whether it’s sales leads, customer quotes or inventory management.

Kintone is a fast-growing solution that is used by over 30,000 companies across multiple industries like Volvo, SoftBank, Whole Foods, Ricoh or Japan Airlines.

A comparable, but bigger company with a larger offering in the US is Appian. Appian for example is mentioned as a “leader” in the Gartner Magic Quadrant for Enterprise Low-Code Application Platforms, while Kintone is mentioned as a “niche player”. Kintone is owned by Cybozu, the company that spun out Toyokumo and that still owns about 7.3 % of Toykumo.

Kintone’s sometimes limited capabilities can be expanded by a wide variety of extensions and third-party API integrations. These let you build out your kintone environment the way you want without waiting on traditional software development methods or IT support.

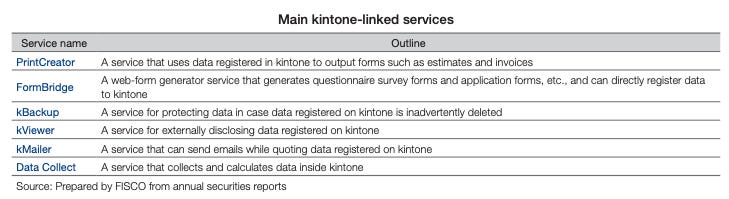

Toyokumo is offering such extensions in its Kintone-linked services segment like FormBridge, kViewer, kMailer, PrintCreator, DataCollect, kBackup or the Toyokumo Scheduler.

After a 30-day free trial, the customer is billed a monthly fee that is determined by usage. For instance, the monthly expenses for the FormBridge extension are displayed below.

Currently, there are 267 different extensions available in the kintone extensions store, so there is a lot of competition for Toyokumo. To find the best extensions more easily, Cybozu has developed a partner evaluation standard that ranks all available extensions (from 1 star to 3 stars). In the latest Cybozu Partner Network Report (CyPN Report), Toyokumo has received the highest ranking for 3 of its products (Foam bridge, kViewer, Print Creator), 2 stars for kMailer & Data Collection and 1 star for kBackup. Toyokumo is the only company that received a star rating for 6 products. In addition, Toyokumo has won the “Extensions Category Award” for the second consecutive year at the Cybozu Awards 2024.

These recognitions are helping Toyokumo to be more visible with its products. When searching for an extension on kintone, the preset order is the “Evaluation order”. With this order, the user will see four Toyokumo products among the first 9 extensions.

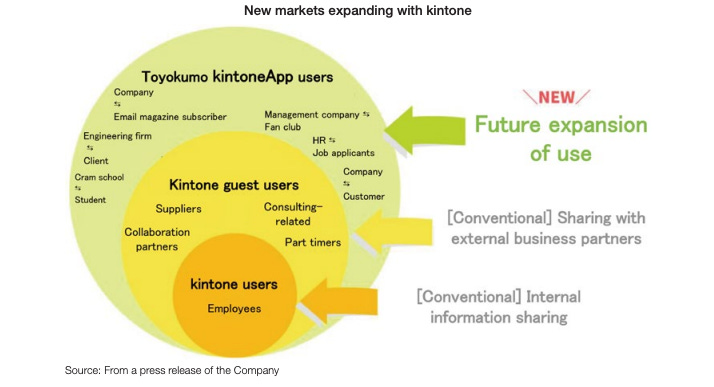

From my impression, Toykumos FormBridge and kViewer extensions are the most successful. With FormBridge, the user can create web forms where even people who don’t have kintone (like customers) can enter data that automatically will be saved in kintone. kViewer on the other side, allows you to publish information from kintone to people who don’t have a kintone account. So Toyokumos service works here as a bridge between kintone users and non-kintone users.

One reason for the huge success of FormBridge and kViewer is that Toykumo added a new user management function called “Toyokumo kintoneApp Authentication” to these two services in February 2022. Previously in kintone user management, employees with accounts conducted operations as kintone users and suppliers and collaboration partners conducted operations as guest users. When using Toyokumo kintoneApp Authentication, it is possible to easily share information with others who could not be communicated with online previously. Toyokumo kintoneApp Authentication is expected to enable the evolution of kintone into an external information-sharing platform.

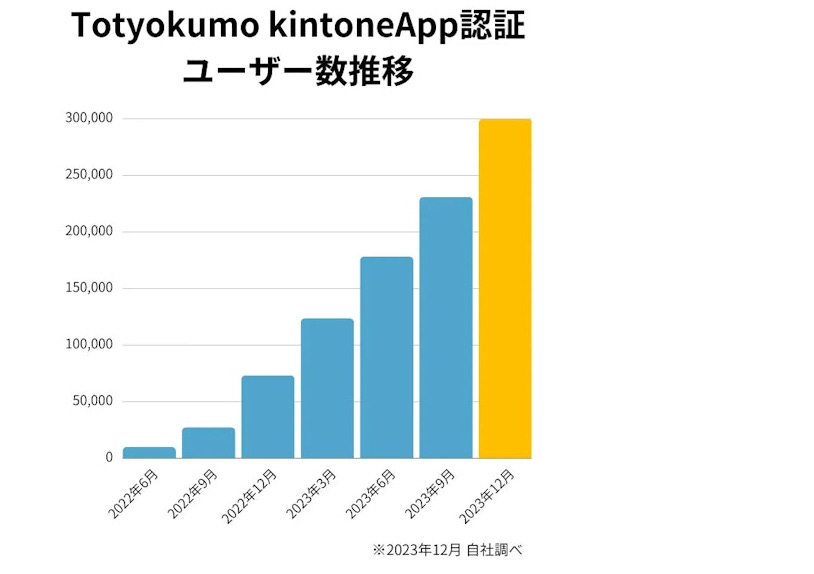

Recently, Toyokumo kintone App Authentication exceeded 400,000 users, showing rapid growth since its introduction. The graphic below is from the end of 2023 when the kintone App Authentication reached 300,000 users. Just 5 months later, they have added 100,000 additional users. It took them nearly a year to reach their first 100,000 users.

The services of Toyokumo are mainly used by SMBs, but also increasingly by local governments and larger enterprises as you can see below.

In November 2021, the company also released the Toyokumo Scheduler. The scheduler has a new concept of enabling schedule arrangements with people outside the company. It can be used by companies of any industry or scale, offering a wide range of user base. Additionally, the company has earmarked this service for overseas expansion.

4. Growth Driver

Toyokumo Cloud Connect: In November 2023, Toyokumo & Cybozu have established a new company that is called “Toyokumo Cloud Connect”. Toyokumo owns 85 % of the company, while Cybozu owns 15 %. The new company will provide packaged solutions made up of multiple cloud services (primarily the companies own services) and then release them as one service. While typically Toyokumo is aiming at SME’s with its products, these packaged solutions target larger companies and especially local governments. Over 400 local governments are already using solutions by Toyokumo, including Osaka Prefecture, Kobe City, Kanagawa Prefecture, Kakogawa City, Ichikawa City, Aichi Prefecture, Takayama City, and Gifu City. Toyokumo products are used by local governments because they are easy to use when communicating with residents which has been very helpful. Especially during the coronavirus, when many local governments searched for solutions to easily communicate with residents. Once employees were accustomed to the ease of use of kintone, the services continued to be used after the pandemic and their usage options were expanded. One of Kintone’s strengths is that it can be created by people in the field who know the business and don’t have to be IT professionals. On the other hand, there are also dangers involved, as these people are not as aware of potential IT security risks. Especially when several different cloud services are used, this risk can increase, which can be a major problem for sensitive information from local governments. Additionally, when used in large-scale projects, the limits of the Kintone product are becoming apparent.

Toyokumo Cloud Connect was established to solve these issues. They offer for example packaged services that can handle personal information of citizens or support services that are expected to be accessed on a large scale.

The new company will still be in its start-up phase in 2024. But management already aims to achieve sales of 100 million Yen in 2024.

Increasing Lifetime Value (LTV): LTV is a measure of how much revenue a customer can bring to the company after entering into a contract through to the termination of the contract. To generate profits, Toyokumo is focusing on the quality of sales. They do not force sales growth but rather invest in products that will ensure profits. That’s why the LTV is an important indicator for the company and they are continuously working on improving the LVT. By encouraging users to upgrade to a higher-end service (upselling) and to sign up for another service (cross-selling) the company was able to increase the LTV in the past.

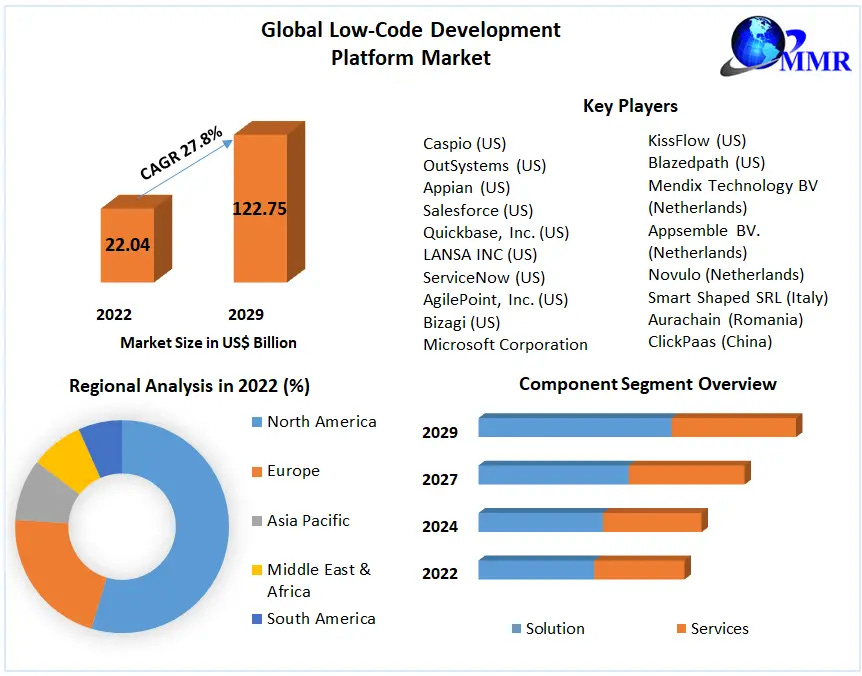

Growing end markets: The expansion from cloud service solutions is expected to grow in Japan, especially compared to traditional on-premise solutions.

In addition, the worldwide low-code development platform market (including complementing services) is expected to grow even faster in the coming years.

The prevention-related information systems and services market in Japan is expected to grow from 105 billion Yen in 2021 to 153.3 billion Yen in 2027, an annual growth rate of 6.5 %.

5. Management & Shareholders

Yuji Yamamoto is the CEO and main shareholder of the company. He currently owns about 49 % of the company (personally and via his asset management firm KK Nano Bank). He served as the president of the company since 2010 (when it was still Cybozu Startup) and then organized the management buyout in 2014.

The second largest shareholder is still Cybozu with 7.25 % of the company, followed by Tomohiko Tasato with 5.57 % who is a Board Member of Toyokumo.

6. Financials

From 2018, the company has increased its sales from 482 million Yen to 2,434 million in 2023, resulting in a CAGR of over 38 %. At the same time, EBIT increased from 137 million Yen to 875 million, implying a CAGR of 44.9 % and the net profit increased from 91 million Yen to 631 million (CAGR of 47 %). So highly impressive historical results.

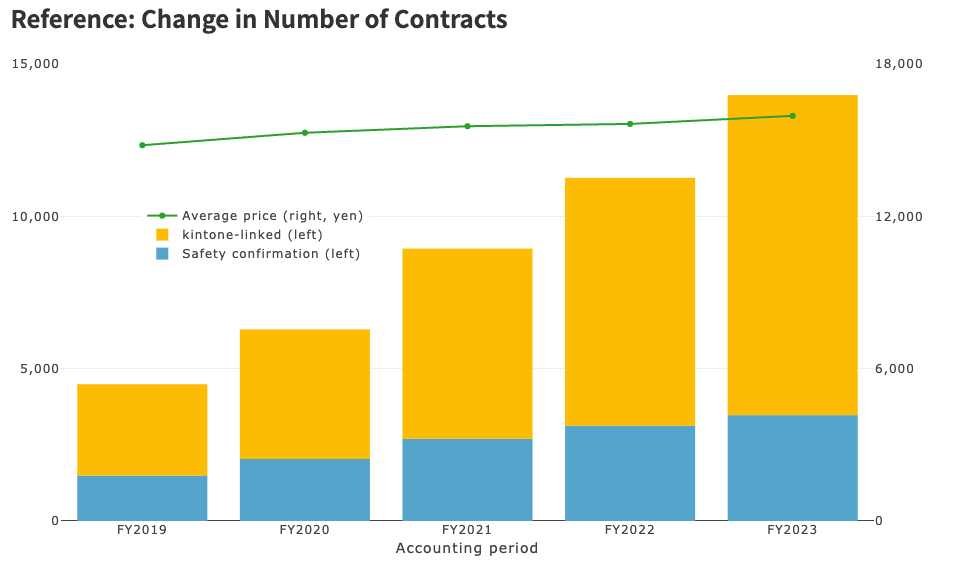

This consistent growth can be achieved by a growing number of paid contracts with recurring SaaS revenues, combined with a low churn rate. As you can see below, the number of contracts for both segments have increased rapidly since 2019 while prices have remained relatively stable.

At the same time, the company was able to keep the churn rate at a level that is rarely seen in SaaS businesses. In 2023 the churn rate for the safety confirmation service hs been at 0.2 % and for the kintone-related services at 1 %, resulting in a combined churn rate of 0.68 % which indicates that the Toyokumo services are very sticky.

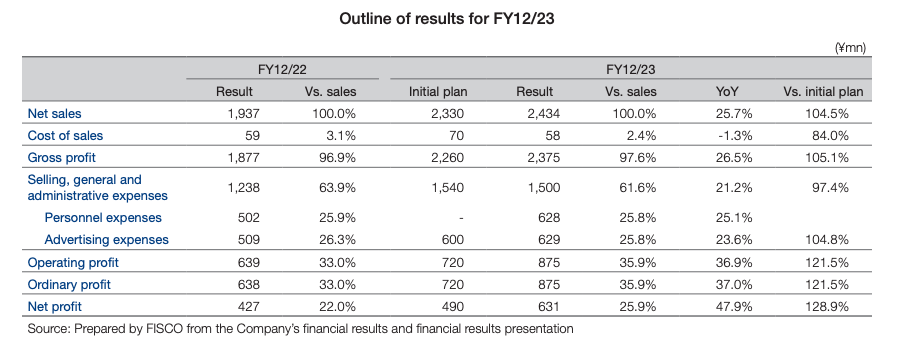

Let’s have a look at the 2023 results:

Revenues +25.7 %

EBIT +37 %

EBIT-Margin of 35.9 % (vs. 32.9 %)

Net Profit +47.9 %

Net Profit-Margin of 25.9 % (vs. 22 %)

Return of invested Capital (ROIC) of 37 %

You can see that the only costs that Toyokumo has are personnel & advertising expenses. Especially the advertising costs can fluctuate strongly during a year that can have a bigger impact on quarterly earnings. For example in Q1 2024 there has been a bigger eartquake in Japan. Toyokumo has increased is advertising spend significantly afterwards for its safety confirmation service (compared to previous year) with the result that EBIT decreased in Q1 ‘24 by 3 % yoy while revenues increased by 26 %. This is not unusual and in the end, Toyokumo has often exceeded its guidances for the fiscal year. More on Toyokumo’s guidance for 2024 in the valuation segment.

Toyokumo has a solid balance sheet with an equity ratio of 67 %, no long-term debt and net cash of 3,086 million Yen (vs. market cap of 16,757 million Yen).

They also pay a dividend since 2021 which they continuously increased (14 yen per share expected for 2024: +40 % yoy).

The company is also releasing monthly sales data. Based on the recent monthly sales trends of ~25 % growth in April 2024, the company is already on a good way to achieve its targets for 2024. You can also see that the growth rate accelerated slightly in April 2024, which hasn’t been the case for some time.

In the grafic below you can see the monthly increasing recurring revenues. I think this steady growth in recurring revenues speaks for the great quality of the company.

If you want to reveice monthly updates about Toyokumo and all the other stocks in my portfolio, you can upgrade your free subsciption to paid to support my work.

7. Valuation

For 2024, the company is expecting sales growth of 23.2 %, EBIT growth of 14.3 % and Net Profit growth of 9.3 %. The lower growth in profit is mainly a result of higher expected personnel expenses as the company plans to increase the number of employees from 57 in 2023 to 72 in 2024. The company is targeting an EBIT-Margin of (at least) 30 % in the medium-term while maintaining high sales growth by investments in personnel and advertisement.

The management of Toyokumo is known to be conservative in its guidance. In the last two years, they had to announce upward revisions of their guidance at the time of its Q3 earnings announcements. Based on the current guidance for 2024, Toykumo is currently valued at the following mutiples:

EV/EBIT of 13.8x

EV/E of 20x

Considering the quality of revenue Toyokumo generates (recurring, low churn rate, highly profitable) and the long history of profitable growth, I don't think this valuation is expensive.

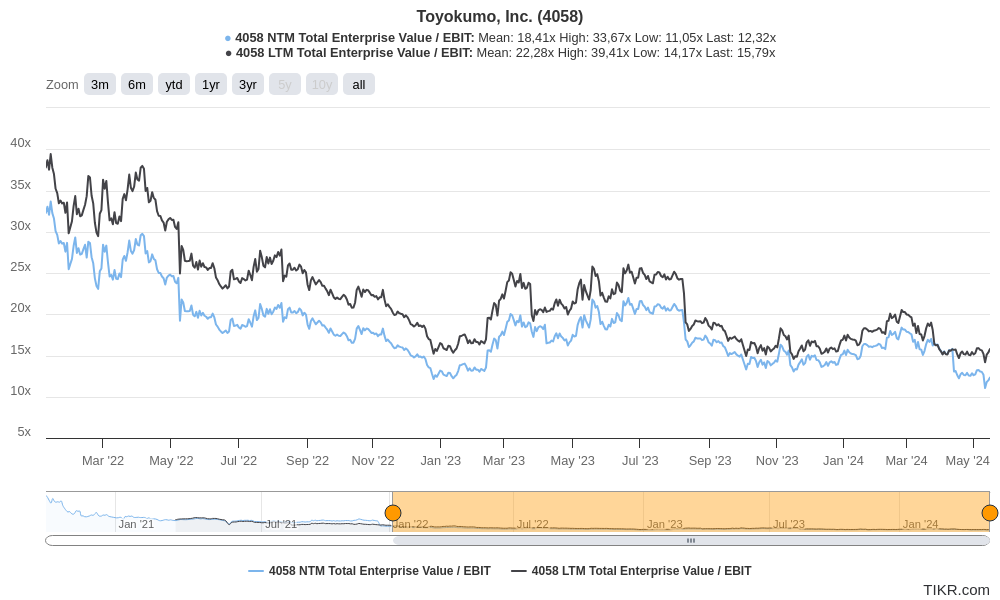

The company was listed in Sepemtber 2020 at an insane EV/EBIT multiple of over 200x. No wonder that the share price has decreased by over 65 % since. Maybe this share price development is one reason why the stock hasn’t reveiveid a lot of love from investors since then, although the business itself delivered continued revenue and profit growth since its listing.

Leaving the insane valuation multiples of 2020 & 2021 aside, the company was valued at a NTM EV/EBIT of 18.4x in the mean since January 2022. So currently it is valued well below its mean, but also not at its lowest valuation of 11x.

Everbridge EVBG 0.00%↑, a US company that also offers some kind of safety confirmation services like Toyokumo recently announced that it will be acquired by Thoma Bravo, a leading software investment firm. Everbridge will be valued at approximately USD 1.8 billion which equals to a EV/EBIT multiple of 24. But of course Everbridge is a significantly bigger company that offers more services than just a confirmation service and it is a US company. So comparing this multiple with Toyokumo is probably not that meaningful.

The only listed company from Japan I found that offers a safety confirmation service like Toyokumo is Secom ($9735). Secom trades at a NTM EV/EBIT of 12, but the safety confirmation service is just a very small part of Secom. Secom is not a pure software company like Toyokumo, which is also reflected in substantially lower margins and it is also expected to grow by only 3 % in 2024.

For the kintone-related segment it is even more difficult to find comparable companies. One of the closest competitors here is probably R3 institute, that also offers mutiple extensions for kintone and that also receive high ratings. Unfortunately this is not a listed company and other companies in this segment are even smaller and also not listed. I came to the conclusion that a comparison to Cybozu itself could also be ineteresting. Cybozu currently trades at a NTM EV/EBIT of 19, but its also has significantly lower margins (13 %) and is expected to grow by 14 % in 2024.

8. Risks

Dependence on kintone (Cybozu): Although Toyokumo was separated from Cybozu in 2014, there is still a high dependence on the services that Cybozu offers. 66 % of Toyokumo’s sales are based on kintone, a product that Toyokumo has no influence on. Every failure in the kintone product can have a big impact on Toyokumo’s sales. Additionally, Cybozu could decide to implement extensions that Toyokumo offers, itself in its kintone product. Although Cybozu still owns a part of Toyokumo and they have recently established a Joint Venture, the odds are not zero.

Product failure: Especially in the safety confirmation segment, a product failure would have dramatic effects. When a natural disaster occurs, and the products of Toyokumo are not working as they are expected to do, the churn rate of these products would increase dramatically.

Ability to continue to grow: For a long time, Toyokumo was able to grow its monthly sales by over 40 %. But since February 2022 the sales growth rates declined to “only” about 25 % in 2023 and for 2024 it is expected to continue to decline to only 23 %.

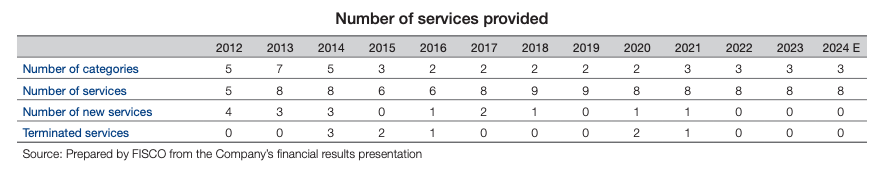

Looking at the product development, one can also see that the company hasn’t released a new service since 2022.

Questionable is, if Toyokumo is able to continue to grow in the future without developing new services. Although one could argue that with the offering of Toyokumo Cloud Connect, they essentially started new services in 2024. But it remains to be seen whether they will actually be successful.

9. Summary

Toyokumo ticks a lot of boxes when you are searching for a high-quality investment. First of all the highly predictable, recurring & sticky revenues. But also the high profitability, high insider ownership, history of rapid growth, high equity ratio & high returns on the invested capital. Despite this high quality, an investment in Toyokumo shares was not particularly successful, with a loss of 65% since the IPO. This is mainly due to the exaggerated valuation at the time of the IPO. But now the valuation has come down to a more than reasonable level for such a quality company. If Toyokumo is able to expand its reach in its growing end markets while keeping the churn rate as low as it has been the chances are good that the future will be much better than the past as a shareholder of Toyokumo.

Thank you for this excellent and detailed analysis.