Disclaimer: The following is no investment advice. The author may own, buy and sell securities mentioned in this post. Please always do your own due diligence! Some companies are micro-caps. Keep in mind that even a small investment from your side can move the share price due to the low liquidity of shares. It's not easy to liquidate if you want to get out.

Welcome,

In this Earnings Update, I will have a closer look at the recently published results of Shelly Group.

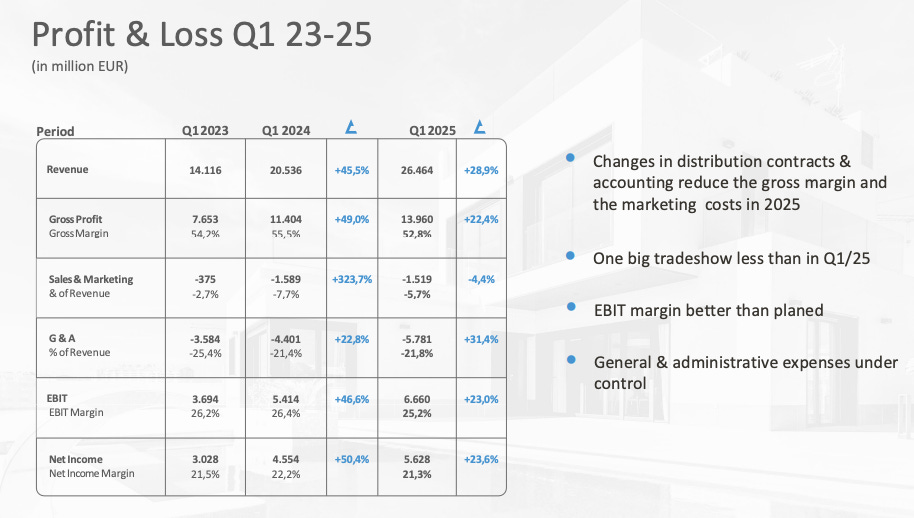

Revenues of EUR 26.5 million (+29 %)

Gross Profit of EUR 14 million (+22.4 %)

GP margin of 52.8 % (vs. 55.5 %)

EBIT of EUR 6.7 million (+23 %)

EBIT margin of 25.2 % (vs. 26.4 %)

Net income of EUR 5.6 million (+23.6 %)

Net income margin of 21.3 % (vs. 22.2 %)

Operating Cashflow of EUR 4 million (vs. 0.2 million)

First of all, everything was in line or even better than expected by the management. The “slower” growth in revenues of 29 % is better than the managements forecast of 25 % and the management already explained at the beginning of the year, that growth is expected to accelerate during the year with new products and regions, but we will have a closer look at this later. Also the lower gross profit margin is nothing to worry about and something that the management already explained earlier. This is related to a switch in accounting as previously some advantages given to distributors were classified as marketing costs and now they are included in costs of goods sold. So just a reclassification with no effect on the overall margin profile of the company.

Shelly continues to gain momentum in the smart home market. They sold over 23 million devices, of which 9 million in the last 12 months alone. They are installed in over 4.5 million households where they have added 1.5 million in the last 12 months and the cloud users have reached more than 2 million, with 700k added in the last 12 months.

Before we have a closer look at the product highlights let’s first start with a closer look at the regional share and growth of the revenues.

Keep reading with a 7-day free trial

Subscribe to Under-Followed-Stocks to keep reading this post and get 7 days of free access to the full post archives.