Disclaimer: The following is no investment advice. The author may own, buy and sell securities mentioned in this post. Please always do your own due diligence! Some companies are micro-caps. Keep in mind that even a small investment from your side can move the share price due to the low liquidity of shares. It's not easy to liquidate if you want to get out.

Welcome,

In this Earnings Update, I will have a closer look at the recently published results of Shelly.

On February 24, Shelly published its FY 2024 results:

Revenues of EUR 106.7 million (+42.4 %)

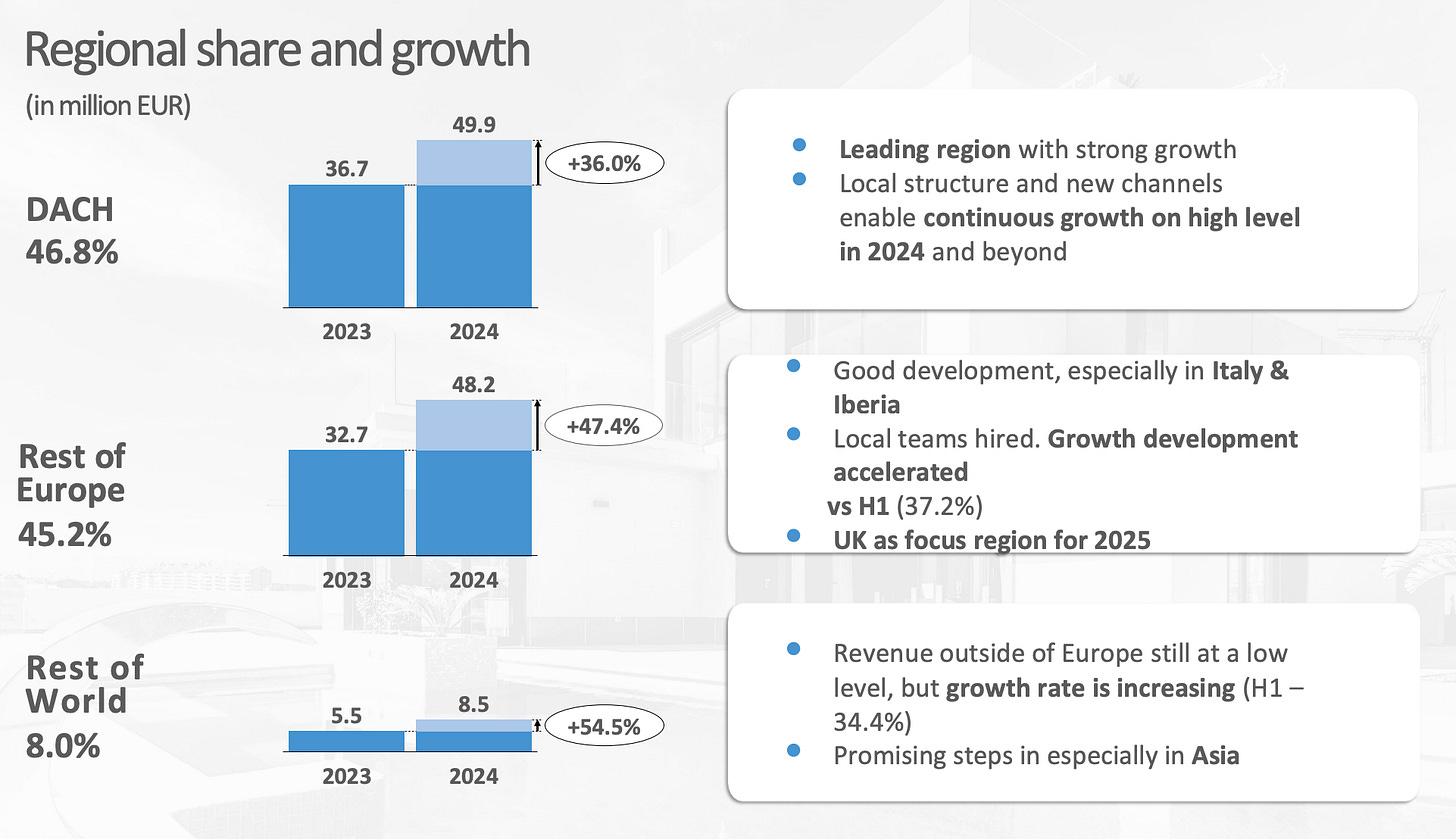

DACH +36 %

Rest of Europe +47.4 %

Rest of World +54.5 %

EBIT of EUR 25.7 million (+34.4 %)

EBIT margin of 24.1 % (vs. 25.5 %)

Net income of EUR 23.1 million (+37 %)

Net income margin of 21.6 % (vs. 22.5 %)

Cash on hand of EUR 14 million (-11.1 %)

The revenues with EUR 106.7 million came in a little bit higher than the guidance of EUR 105 million. Shelly also changed some contracts with distributors that had an effect on revenues at the end of 2024. These changes are related to how distributors can spend some of the marketing budget (given from Shelly for distribution purposes). Before the changes, this was reflected as marketing costs & now this is reflected as a deduction of the revenues. So at the bottom line, the effect is neutral, but Shelly management now has more control on how the distributors spend the money. Without this change, revenues would have been EUR 109 million, so even a bit higher above the guidance. EBIT came in at EUR 25.7 million, while the management guided for EUR 26 million, so a very small amount below the guidance, but that’s hardly worth mentioning. So all in all, Shelly delivered on what they promised.

From a regional perspective, the DACH region remains the largest market with 46.8 % of total revenues, growing by 36 %. This is a bit underproportional compared to the total revenue growth of 42 %, but Shelly is still outperforming the market by around 4x.

On the other side, Rest of Europe is growing overproportionally by 47.4 % and with 45.2 % of total revenues, the Rest of Europe is now nearly on par with the DACH region. Especially in Italy & Iberia, Shelly is seeing a very good development and Shelly is repeating the playbook from the DACH region. With the installment of local teams in the regions, Shelly was able to significantly increase their growth rate in the DACH region in the previous years. Now Shelly is doing the same, step by step, in the other European countries and we can already see fir successes in some countries. The growth rate in H2 already accelerated from “only” 37.2 % in H1. UK will be a focus region for Shelly in 2025. The UK market is nearly as big as the German market, so there is huge untapped potential. The management is expecting to have a fully equipped local sales team in the UK in the second half of 2025.

The Rest of the World is growing by 54.5 %, but its still on a low level, as it only stands for 8.5% of total revenues. But similar to Rest of Europe, the growth rate accelerated compared to H1, when this region grew “only” by 34.4 %. Especially the Asian market is growing fast according to the management, and it is interesting that even in China, Shelly products are well received. This is interesting because there are Chinese competitors that offer hardware similar to Shelly at a cheaper price. So it seems like Shelly is more than just a hardware company. Their multi-protocol and open system is a key differentiator to cheaper Chinese products, as well as to more expensive western products.

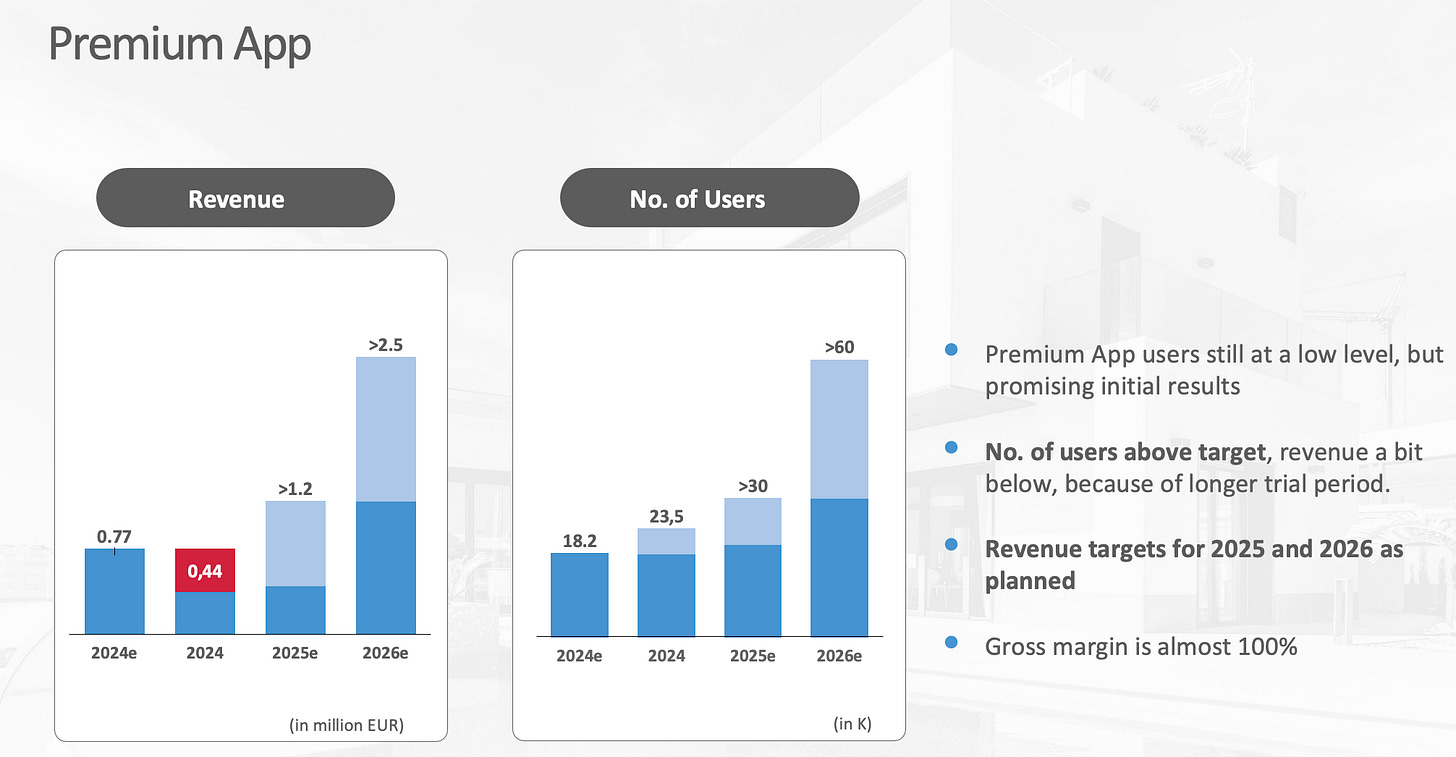

Since 2024, Shelly is also offering a premium version of its app. Shelly management has published targets regarding the revenue of this premium subscription and the number of users. In 2024, Shelly only generated EUR 0.44 million in subscription revenues, compared EUR to 0.77 million they initially expected. This is well below the target, but this is mainly due to the long trial period of 3 months that the users have. Regarding the number of users of the premium service, Shelly is well above its target of 18.2 million users, with 23.5 million users reached. With these existing users at the end of 2024, Shelly would already nearly reach its target of EUR 1.2 million in subscription revenues for 2025 although there will probably also be some churn. This subscription revenue stream remains the cherry on the cake for Shelly. These revenues are nearly 100 % gross margin and almost already pay all the cloud costs for Shelly.

The operating cash flow decreased from EUR 7.5 million to EUR 2.8 million. This is mainly due to the significantly higher working capital, which is needed to fund the growth. During the Capital Markets Day and the last calls, the management already explained that they are actively working on improving the working capital needs by more restrictive customer payment terms and the start of negotiations of payment terms with suppliers. In 2025, Shelly will also start reducing its inventory levels from 5-6 months to at least 4-5 months which should also be helpful for the working capital, especially in the 2nd half of 2025. Despite these high working capital needs, investments in R&D and a dividend payment, the cash level is still at a healthy level of EUR 14 million at the end of 2024, compared to EUR 15.7 million at the end of 2023.

Quarterly, Shelly’s revenues grew by 35.6 % in Q4 2024 and EBIT grew by 42.9 %. This is particularly worth mentioning, as Shelly already grew by 70.3 % in revenues and EBIT by 114.7 % in Q4 2023.

After a small reduction of the EBIT margin in Q3 2024 (20%), the margin rebounded nicely to 24.8 % in Q4 as promised by the management.

At the end of 2024, Shelly has sold more than 21 million devices in over 100 countries. They have sold 9 million devices in the last 12 months alone. They are now reaching more than 4 million households, adding 1 million in the last 12 months and have 1.85 million cloud users, adding 0.6 million in the last 12 months. We can see that the Shelly platform is growing rapidly.

So, Shelly again delivered fantastic numbers for the past year. Let’s now have a closer look at the financial guidance for 2025 and what’s even more interesting, the product roadmap for the current year and some info regarding the first Shelly X / powered by Shelly products.

Keep reading with a 7-day free trial

Subscribe to Under-Followed-Stocks to keep reading this post and get 7 days of free access to the full post archives.