Disclaimer: The following write-up is no investment advice. The author may own, buy and sell securities mentioned in this post. Please always do your own due diligence! This company is a micro-cap. Keep in mind that even a small investment from your side can move the share price due to the low liquidity of shares. It's not easy to liquidate if you want to get out.

Welcome,

in this issue of Under-Followed-Stocks, I will present you Powersoft SpA ($PWS). ,

Investment Summary:

high-quality hidden champion with a market-leading position in its niche

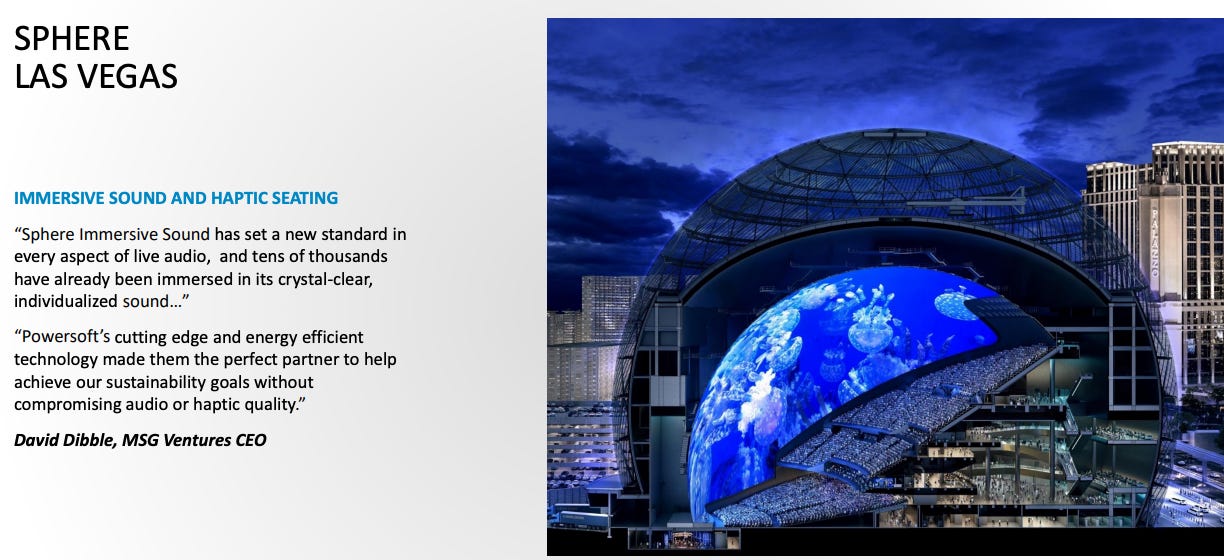

patented technology that creates superior immersive experiences e.g. in the “Las Vegas Sphere”

the biggest venues and most famous artists are among their customers like Taylor Swift, Lady Gaga, Coachella, Tomorrowland or the Wembley Stadium and Ferrari chose them for a partnership

long history of sustainable organic growth as a result of continuous innovation

a clean balance sheet with net cash and no long-term debt

founders still own 75 % of the company

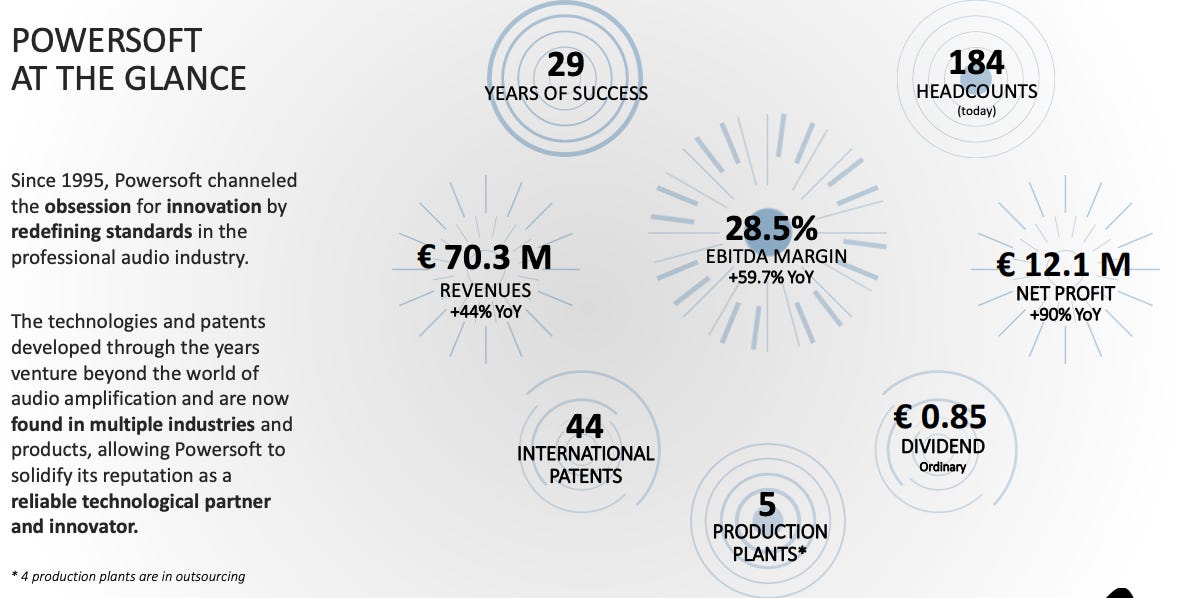

Revenue growth of 44 % & EBIT growth of 68 % in 2023

EV/EBIT of 9.3x & P/E of 13.8x

If you aren’t a subscriber yet and enjoy the content I share, feel free to subscribe so that you won’t miss any new content. The company write-ups I share are free. But if you want to keep up-to-date about the companies in my portfolio, you can voluntarily choose the paid option :)

Let’s go!

1. Introduction

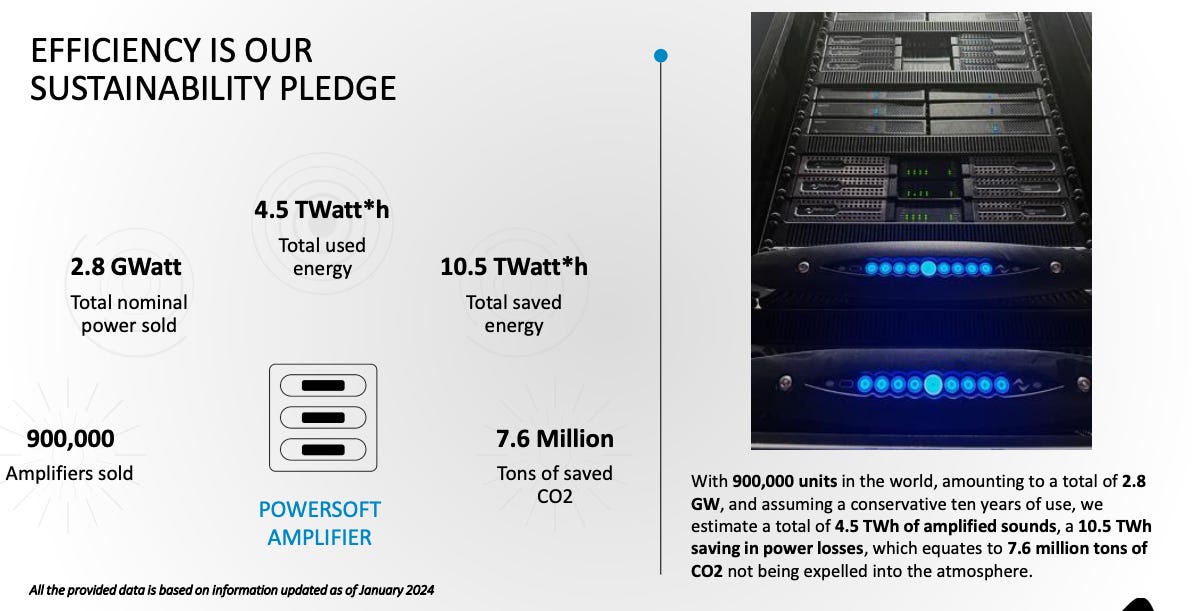

Powersoft is a global leader in the design and manufacturing of professional audio amplification technologies, advanced signal processing, unique transducer systems and software for the professional audio sector. Their products are used in fixed audio systems of venues like the Las Vegas Sphere or the Wembley Stadium and also in transportable audio systems for the most famous artists and festivals like Taylor Swift or Coachella. Powersoft is the creator of the world’s finest audio technology.

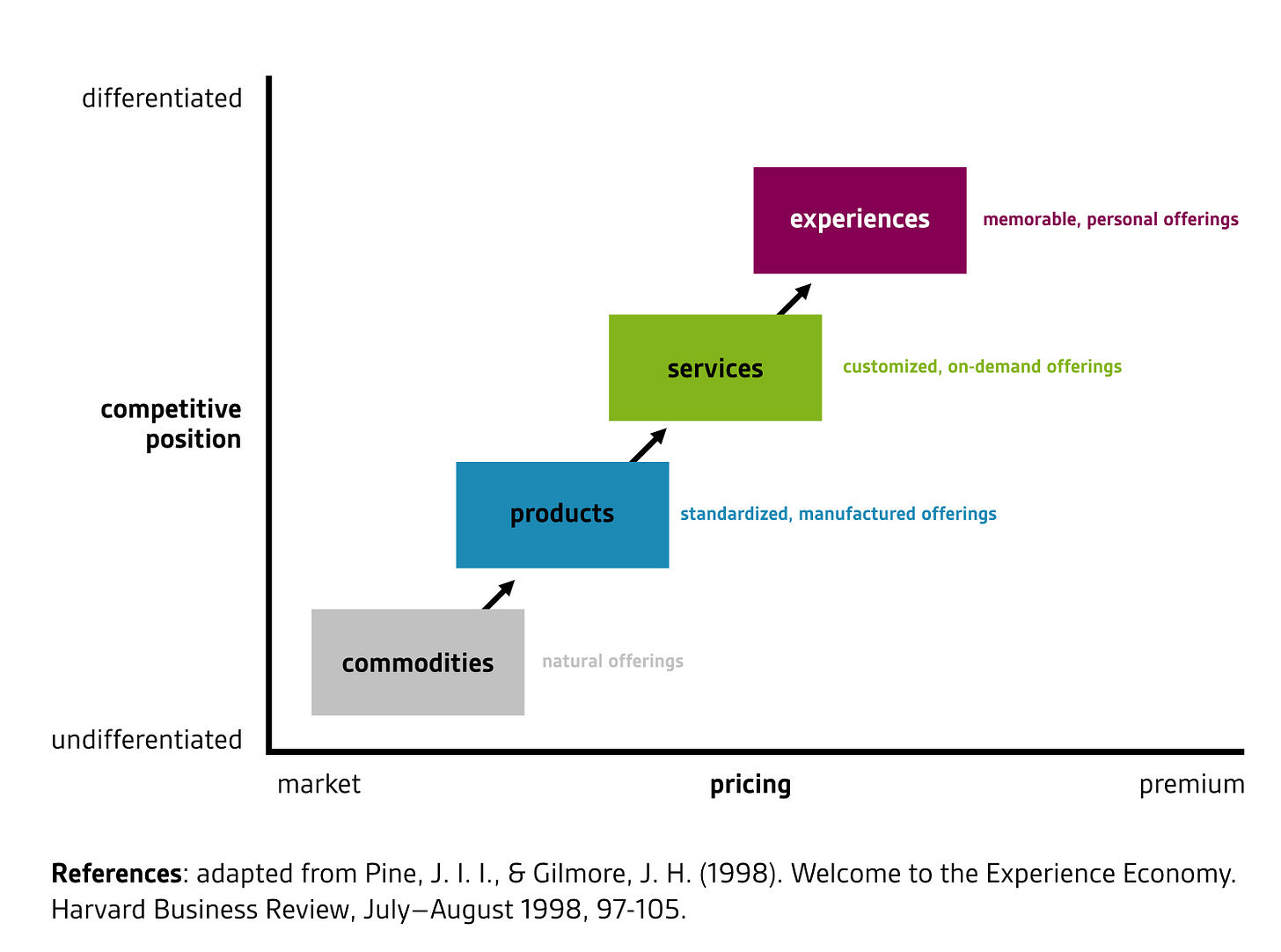

In recent years, the company has transitioned from a product company to a solution provider, expanding into vertical markets segment within the install sector and increasing its portfolio of offerings. This change allowed the company to grow fast and expand its margins. The company’s mission is to make inspiring, reliable and innovative products that shape audio frontiers while helping customers succeed.

Powersoft is listed on the Euronext Growth Exchange in Milan since 2018 under the ticker $PWS.MI. The current market cap is EUR 164 million (USD 181 million).

2. The Company

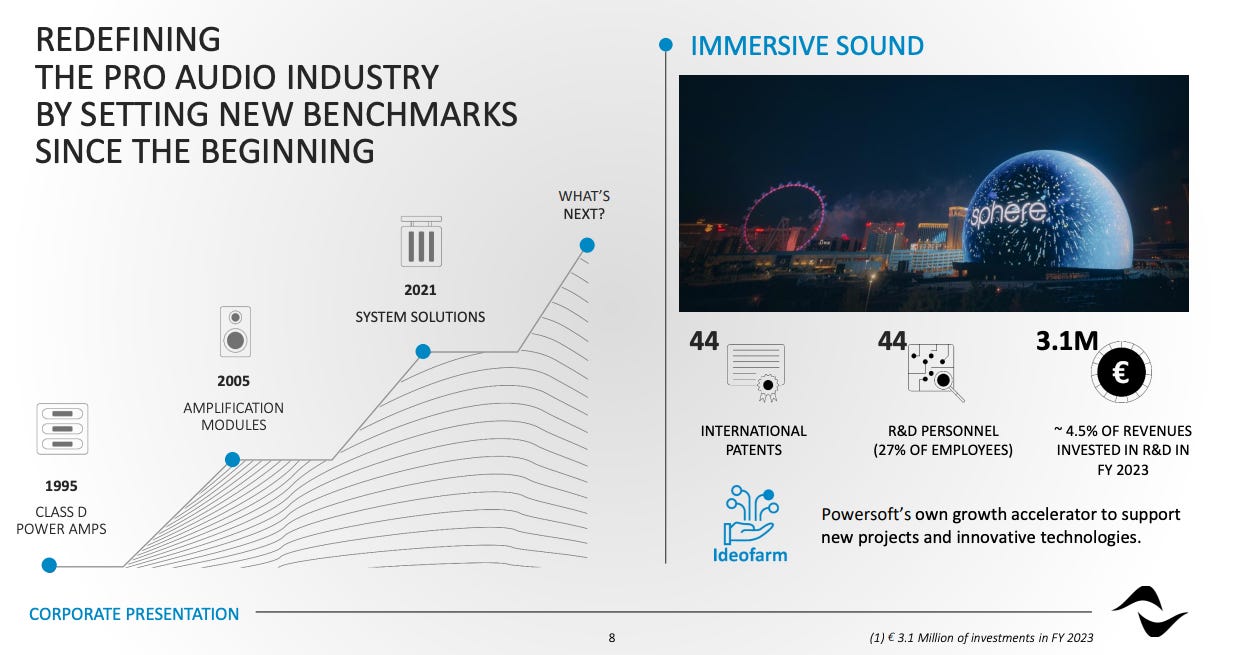

Powersoft was founded in 1995 by Luca Lastrucci, Claudio Lastrucci, and Antonio Peruch in a small garage in Florence, Italy - and since then the company hasn’t stopped innovating.

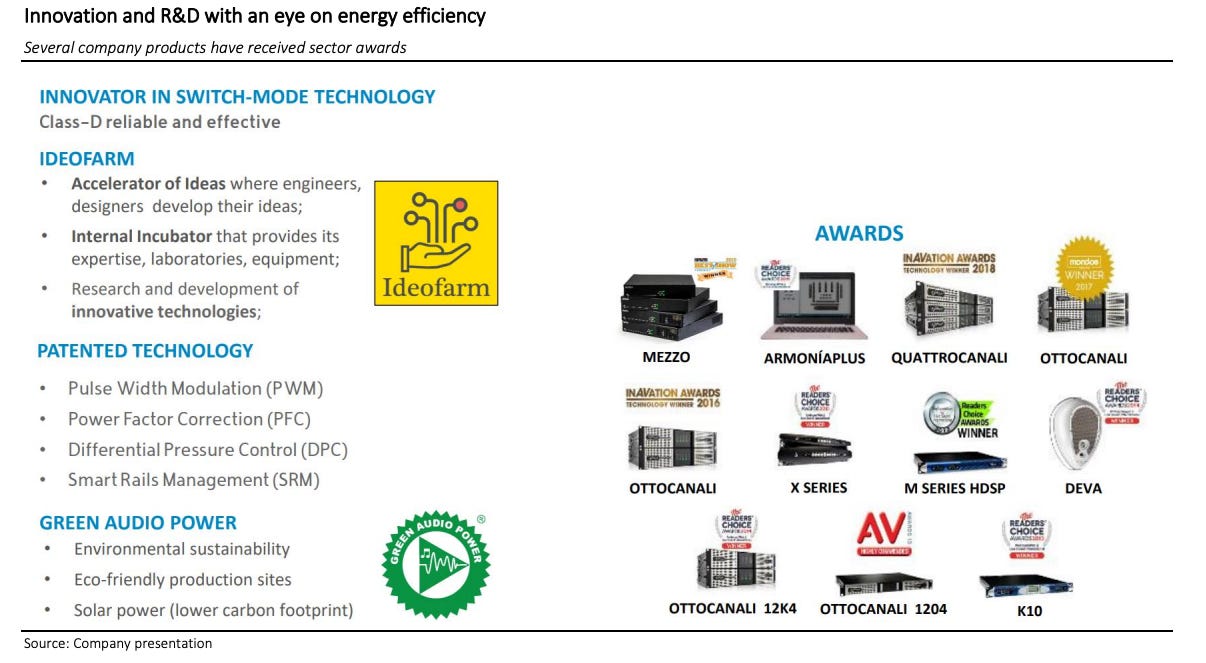

Powersoft is a pioneer in switched-mode technology. They mastered the design and development of a new Class-D amplifier that was able to deliver consistently reliable high power levels – something that had never been achieved before. The development of fixed frequency switching mode technology for professional amplifiers delivered many benefits to its professional products, including unprecedented low noise leakage, low crosstalk, and performance suitable for any power levels. This helped correct the overall industry perception that switched-mode power supplies were unreliable. Now, the technology is considered an industry standard. Using its own-patented technologies, Powersoft’s switching mode power supplies were also able to greatly reduce heat dissipation, and deliver back EMF (active recycling of the reactive energy from the loudspeakers), while easily handling heavy impedance loads.

As these examples demonstrate, Powersoft is constantly breaking new ground in terms of what is possible: it holds 44 patents, has meaningful manufacturing partners around the world, and also holds the keys to what will be possible in the next generation of audio.

Powersoft operates globally, with over 90 % of its sales originating in markets outside Italy. It maintains a direct and indirect presence in 110 countries across the globe.

Production activities are primarily conducted at company-owned plants in Scandicci, which employ approximately 140 resources. Additionally, partnerships with leading industry players in Bologna, Cortona, Gorizia, Modena, and Vicenza involve over 100 resources. The products are “Made in Italy”. The main activities involving R&D, technical support, marketing, sales, logistics, warehouse and corporate are all carried out in Italy.

Advertisement:

You are searching for one tool where you can find the financial data of up to ten years of 30,000 listed companies, call transcripts of over 9,000 companies, the ability to create your own watchlist and find new investment opportunities with a stock screener? Try MartkeScreener, the No. 1 in stock market advice in the USA.

Use this link to save up to 40 % discount on all subscriptions.

3. Products

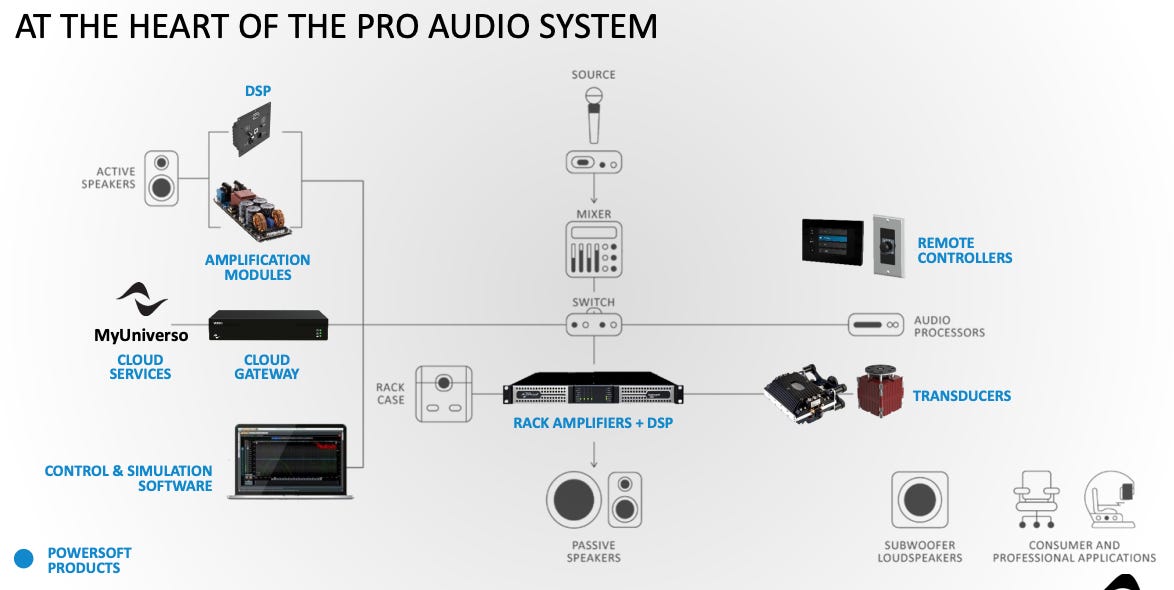

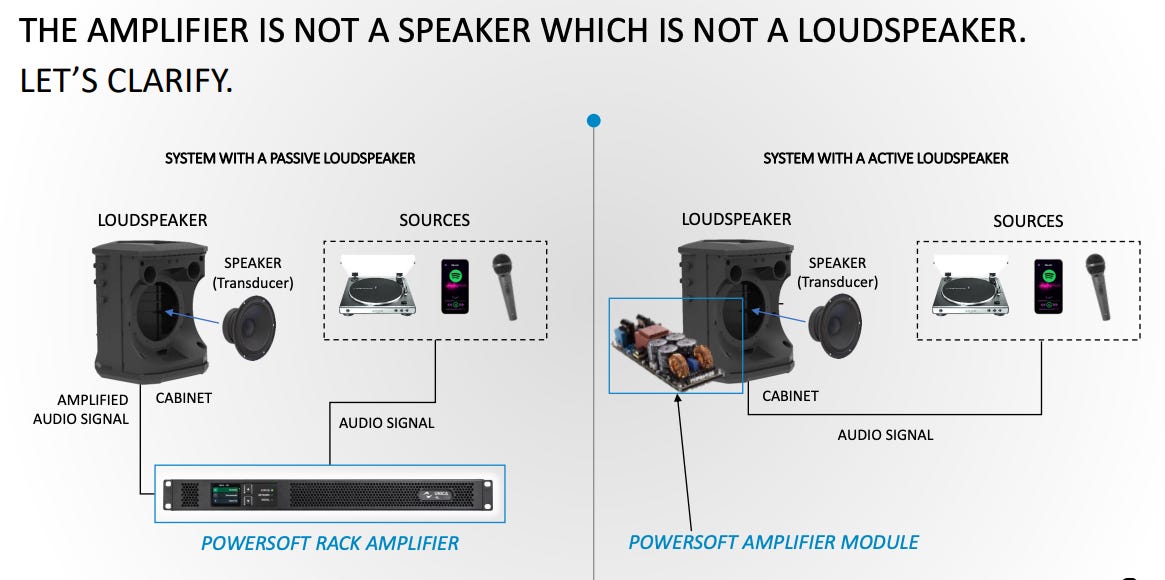

Powersoft’s core products are amplifiers. As probably not everyone knows what an amplifier is and why it is necessary in a professional audio system, let’s first clarify this.

An audio system processes (transports, changes and/or stores) audio signals coming from a sound source (human voice, musical instrument or any phenomenon that generates an audio signal) and sends the output to human ears. The amplifier is at the heart of a professional audio system. It is needed to increase an audio signal voltage to a higher level at a low impedance to drive energy into loudspeakers.

A professional audio system differs from a home (consumer) system in many ways. A professional audio system is composed of different basic components:

Microphone: It converts the acoustic signal coming from an acoustic source into electric analogue signals

Head amp (HA): It is a microphone pre-amplifier, which amplifies signals generated by microphones before entering further electronic circuits

A/D converter: It converts electrical (analogue) signals to digital data for further processing in digital audio systems

LAN (Distribution Network): It is a collection of components used to transfer data from and to all physical locations in the audio system

DSP (Digital Signal Processors): They are used to perform real-time change and mixing of different audio signals

D/A converter: It converts digital audio data to electrical (analogue) signals to be sent to power amplifiers

Amplifier: It increases an audio signal voltage to a higher level at a low impedance to drive energy into loudspeakers. Modern power amplifiers use high-frequency switching output stages to directly drive loudspeakers (class-D). Some power amplifiers have distribution interfaces, DSP (for speaker processing) and D/A converters built-in. There are two main types of amplifiers: rack and module. Rack amplifiers are stand-alone and usually mounted on a rack. Module amplifiers are integrated with loudspeakers in one product

Loudspeaker: It converts electric signals into acoustic signals. High-quality loudspeaker systems use multiple transducers to generate a combined acoustic output, each delivering a separate frequency range. Loudspeakers integrated with module amplifiers in one product are called active speakers and differ from passive (non-integrated) speakers

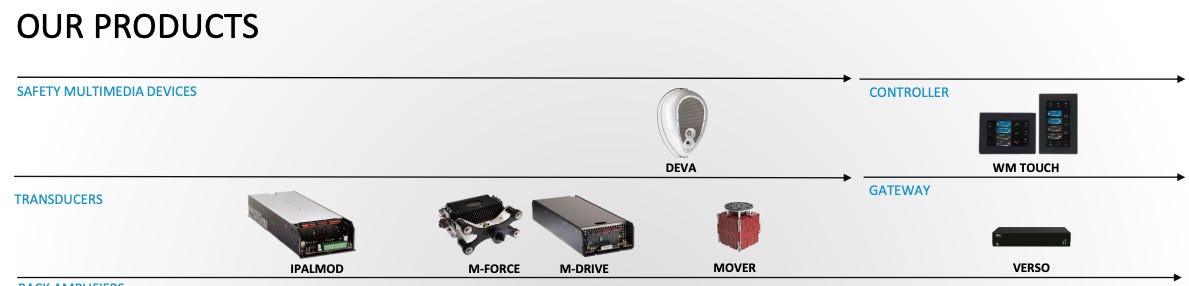

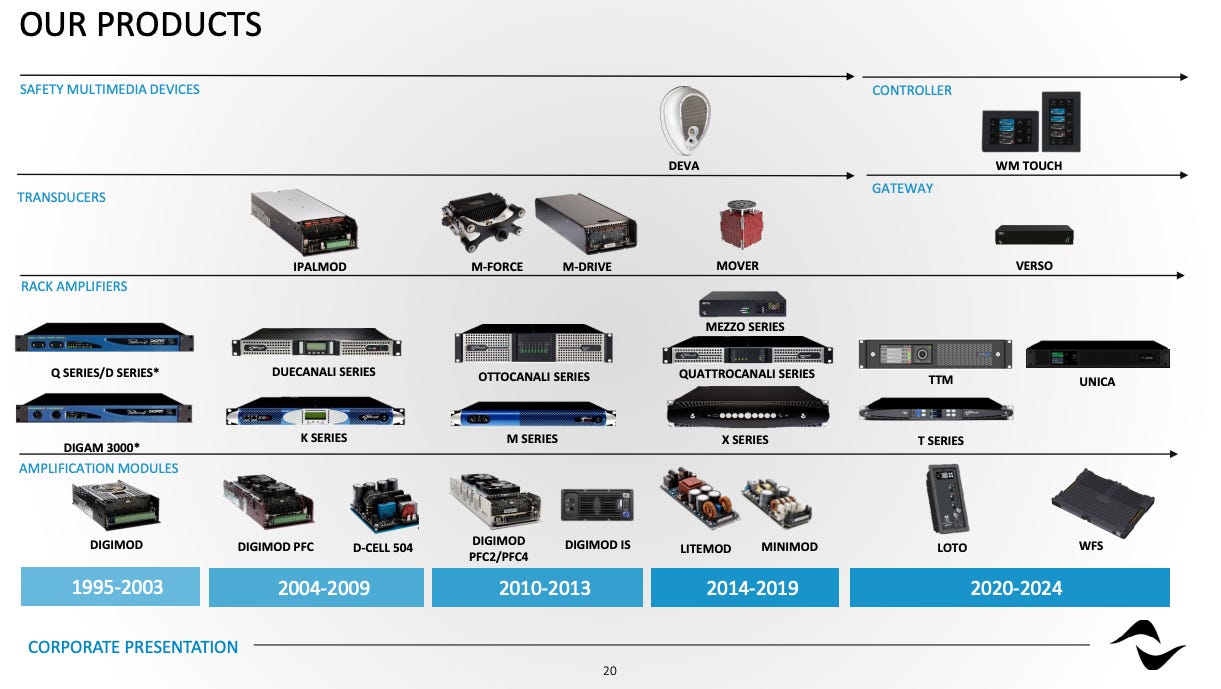

Powersoft offers a broad range of different amplifier modules for active loudspeakers and rack amplifiers for passive loudspeakers. Over the years, Powersoft’s engineers have added multiple new innovative features to the products.

Their latest development is the cloud-based amplifier platform Unica. Unica represents the next-generation amplifier platform designed to deliver unmatched performance and flexibility. It combines high-quality amplification with advanced DSP capabilities, providing users with exceptional sound reproduction and control. The cloud-native connectivity allows remote monitoring of the amplifier status from any device, anywhere in the world, via Powersoft’s Cloud Platform MyUniverso.

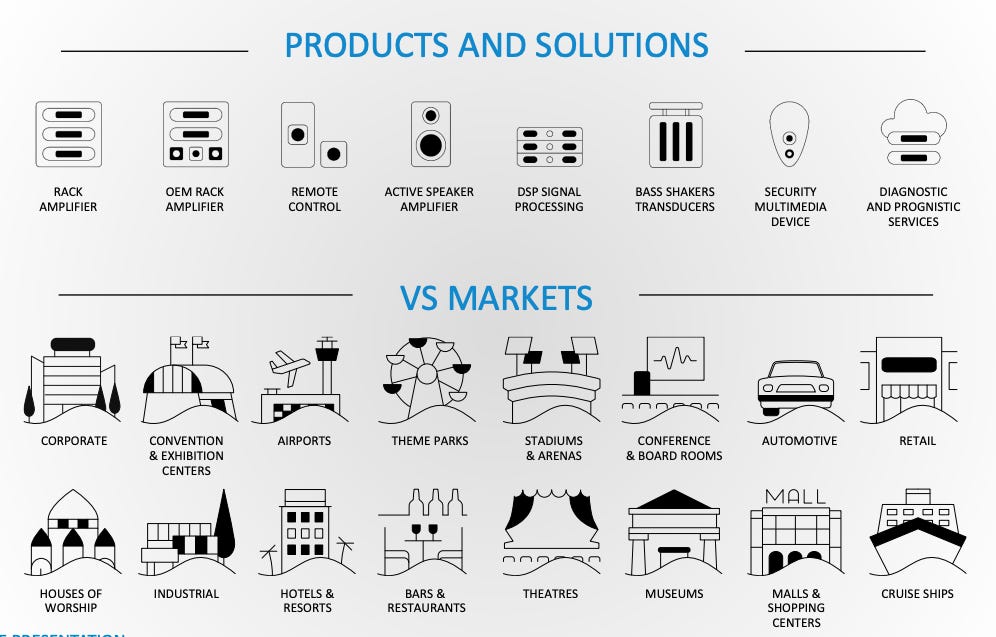

Besides the different amplifiers, the company also offers different controllers for the amplifiers, a gateway, a safety multimedia device (a high-powered speaker with a camera and multiple sensors) and transducers.

Especially the new “Mover” Transducer is a highly interesting product. The Mover is a patented low-frequency direct-drive/tactile transducer designed to kick the listener’s butt. Mover lets audiences feel the sound through haptic perception by vibrating the surrounding environment, which the human body picks up and, through bone conduction, stimulates the inner ear, translating the vibrations into perceivable frequencies.

A key component of The Las Vegas Sphere Experience that makes audiences feel like they’ve been transported to another world are Sphere’s 10,000 haptic seats that are integrated with Powersoft’s Mover technology. Powersoft’s patented moving-magnet technology is more durable, accurate, and efficient, relying on an audio signal with ultra-low-frequency reproduction to make the chairs vibrate and shake as desired for each performance. These immersive experiences are currently getting traction, but more on this topic in the “Growth Driver” section of this write-up.

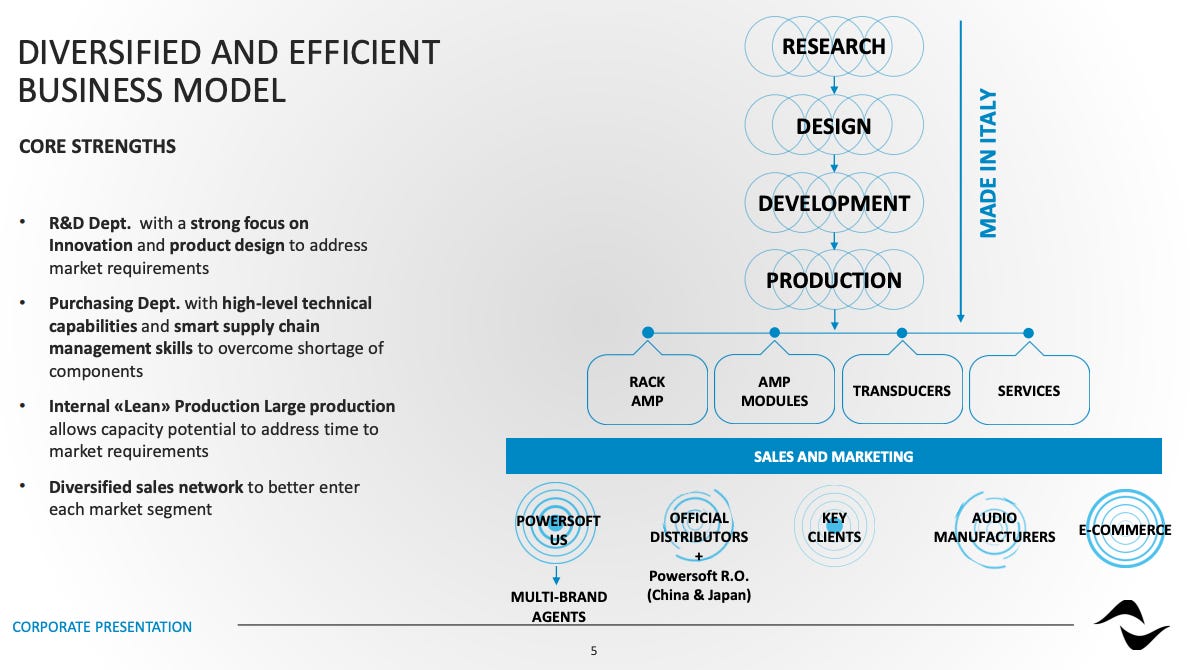

4. Business Model

Powersoft has a flexible business model that mixes internalized and outsourced manufacturing. All the research, design and development is done in-house.

The group's internal production activity consists of the assembly of components and semi-finished products at its factory located in Scandicci (Florence) following the “lean” methodology. Once the assembly phase is completed, the products go through quality control. It consists of testing the finished product carried out by qualified operators, through the use of measuring equipment designed by the Group. The production process is managed internally by the Group for higher-added value products to protect the company know-how.

In parallel, the Group makes use of strategic partners for the production of both semi-finished and finished products, which allows mitigation of the production risk, as well as the possibility to adjust the overall production volume according to the market needs. In particular, for the production of components and for the production of finished products, modules and multimedia units, the group makes use of partners specialized in EMS (Electronic Manufacturing Services). Roughly 60% of finished products are assembled by themselves, while the remaining 40% is assembled by specialized partners.1

Most of the revenues are generated via direct sales. This includes sales generated by the 100% owned distribution company in the US, by key accounts (large clients served with Powersoft’s branded products) and by OEM’s (mainly related to white label module amplifiers sold to active loudspeaker makers) and also via E-Commerce. In addition, the group makes use of an articulated network, coordinated by area managers, of authorized distributors, to sell its branded products in a specific geographical area.

5. Market, Customers & Competition

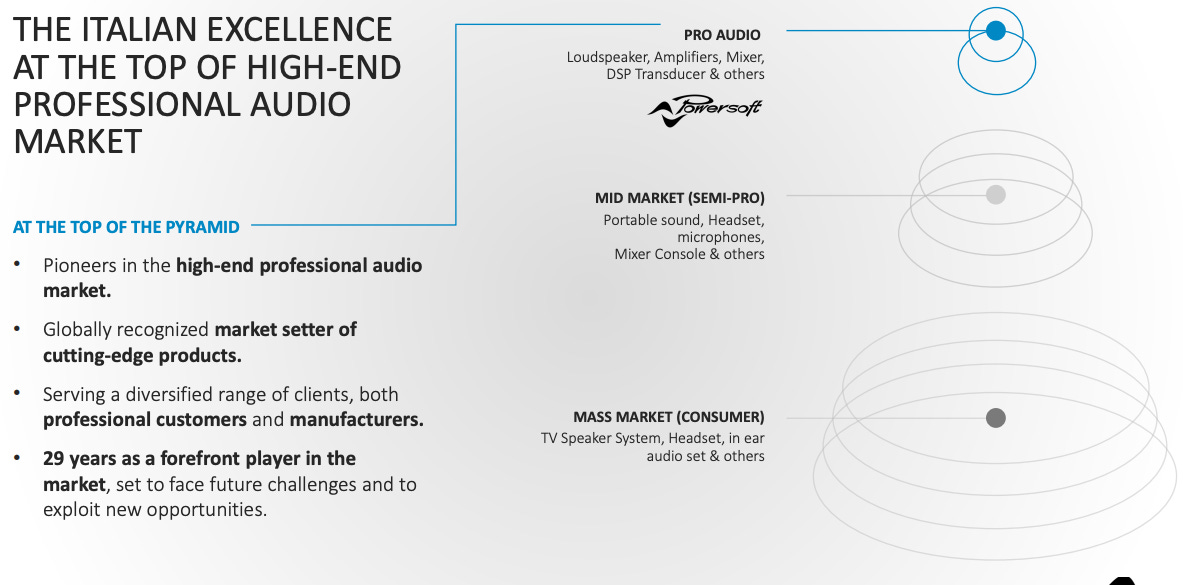

Powersoft is active in the high-end professional audio market. In this niche, they are globally recognized as a market setter of cutting-edge products.

With these high-quality solutions, Powersoft is targeting a variety of end markets like stadiums & arenas, theme parks, hotels & resorts, malls, cruise ships, houses of worship, cinemas and many more.

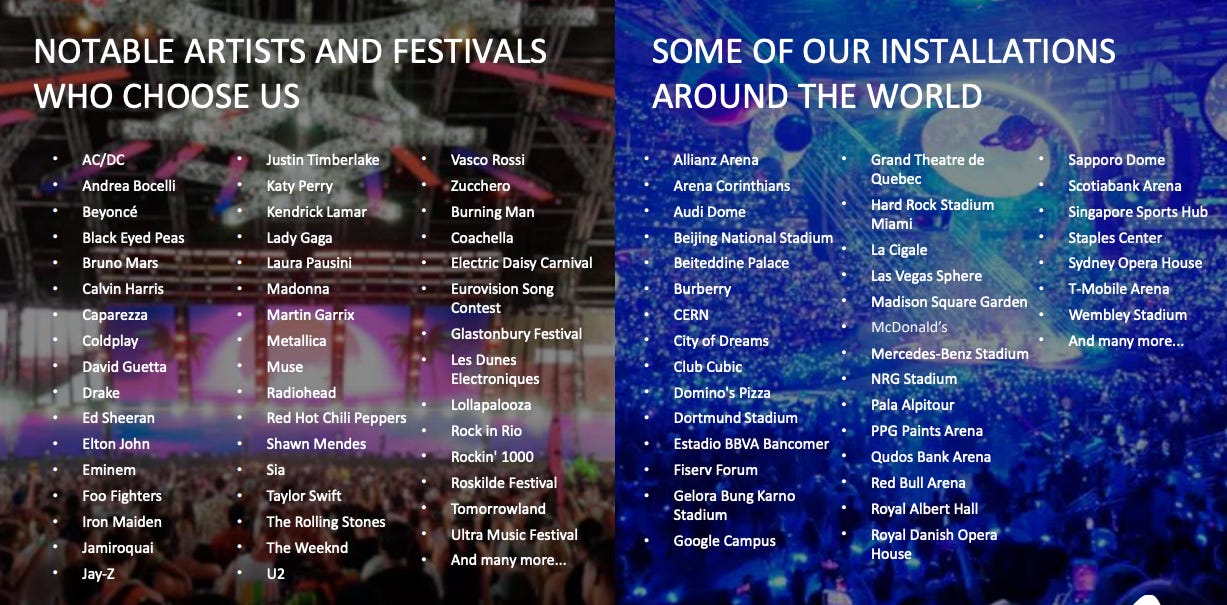

Looking at the list of customers, we can see that Powersoft already serves the “who is who” of the audio industry. We have artists like AC/DC, Beyoncé, David Guetta, Ed, Sheeran, Drake, Elton John, Eminem, Jay-Z and Taylor Swift. We also have the biggest festivals in the world like Tomorrowland, Burning Man, Coachella, Eurovision Song Contest, and Lollapalooza. But also in the fixed installations segment, the biggest venues & companies are their customers like McDonald’s, Burberry, The Sphere, Allianz Arena, Staples Center, Wembley Stadium, Google Campus, Dortmund Stadium or Domino’s Pizza. And that's just the tip of the iceberg.

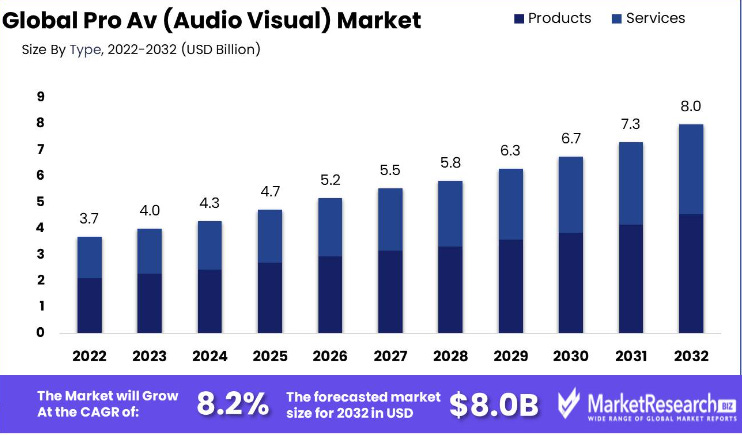

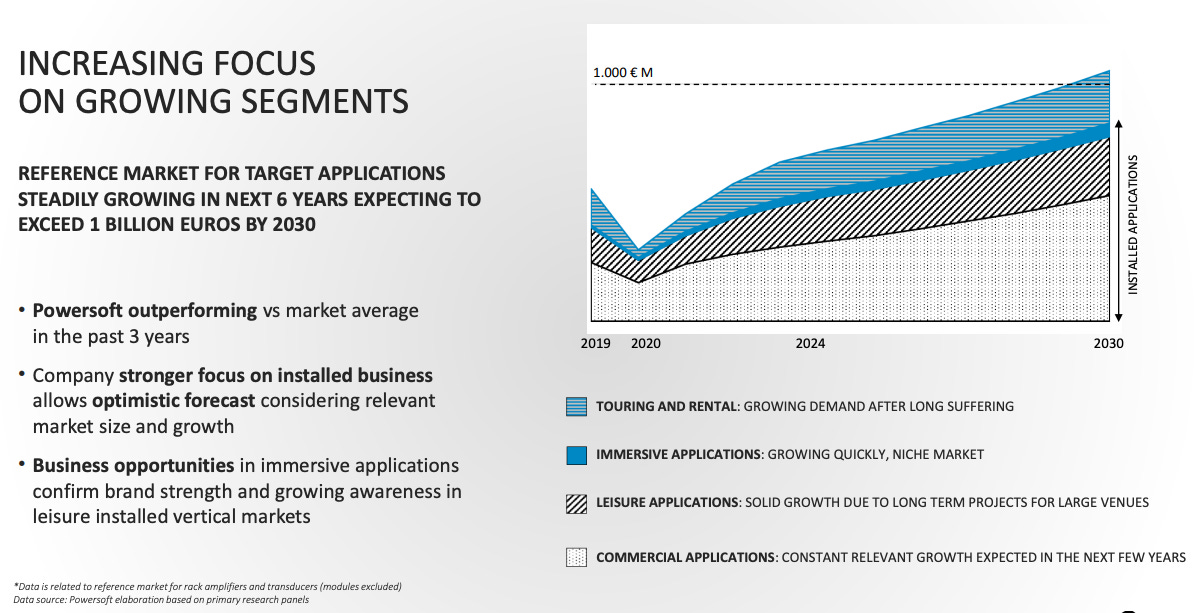

The overall global professional AV (Audio Visual) Market is expected to reach a market size of 8 billion USD by 2032, growing with a CAGR of 8.2 % between 2022 and 2032.2

This of course includes segments where Powersoft is not active. The company expects that their targeted end-markets for installed applications will reach 1 billion Euro by 2030.

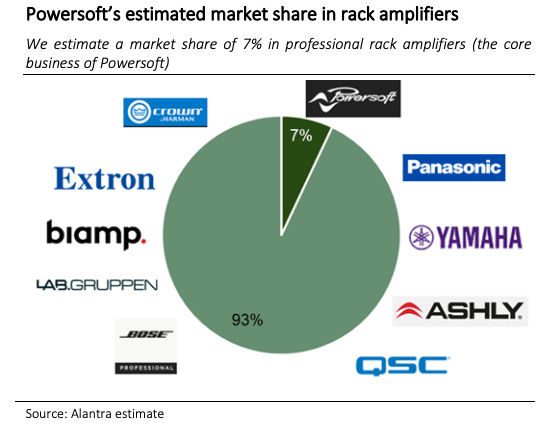

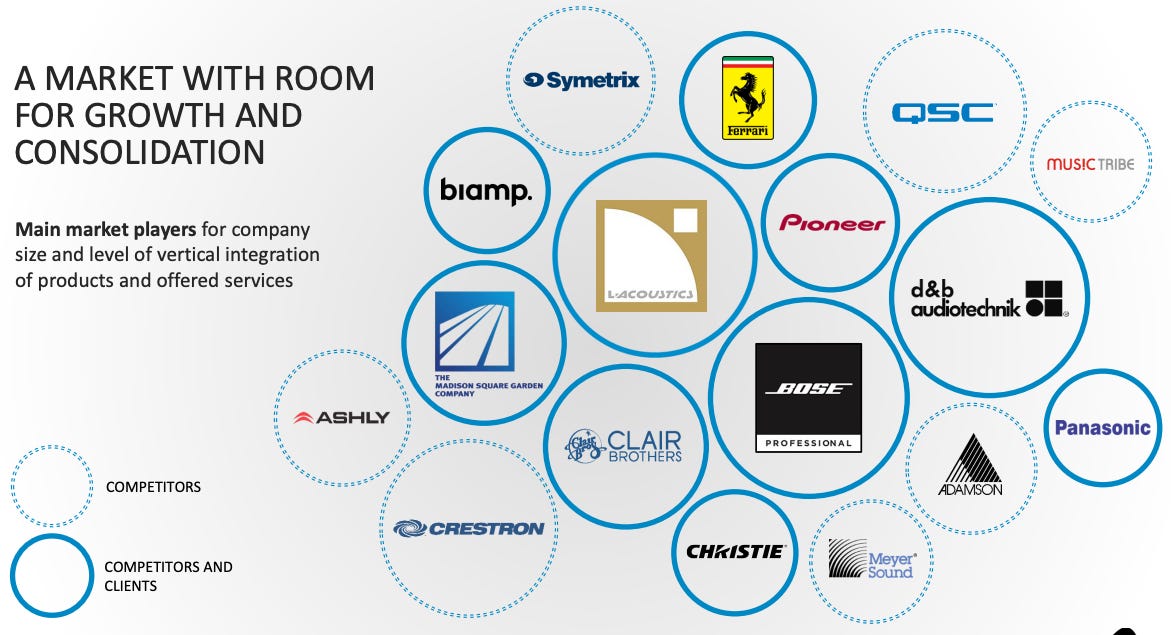

Powersoft is active in a highly fragmented industry. With an estimated market share of 7 % in their core market of rack amplifiers, they are one of the market leaders.

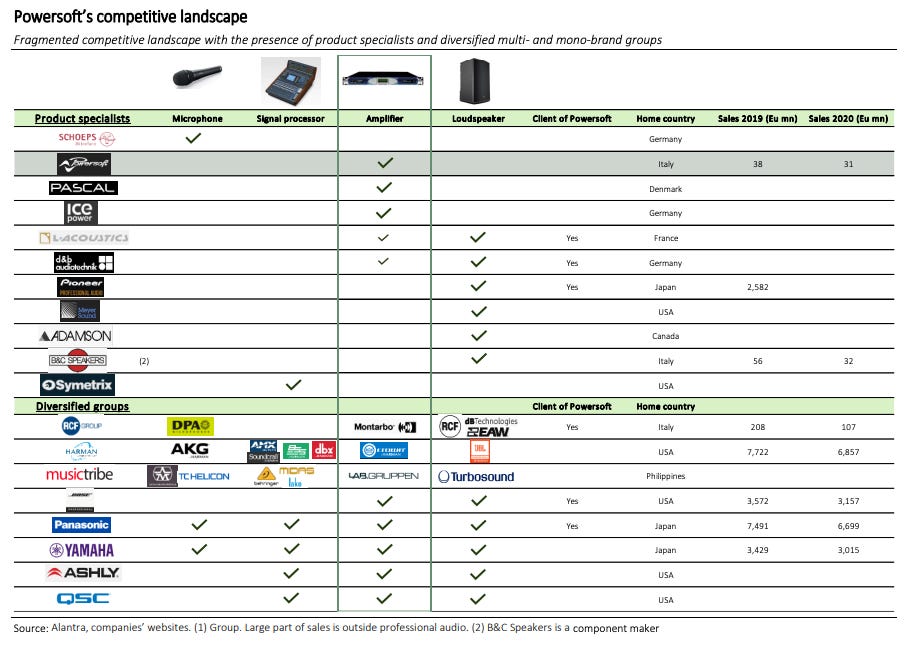

The German IcePower group and Danish player Pascal are mainly producers of professional module amplifiers. Other competitive brands are part of larger multi-brand conglomerates, including the Swedish Lab.Gruppen (acquired in 2015 by the Philippian group Music Tribe) and Crown (part of the US group Harman, acquired by Samsung in 2016). Other competitors are large mono-brand integrated groups, including Bose Professional, Panasonic, Yamaha, Ashly and QSC. Below you can see a summary of the competitive landscape:

Some of the market companions are competitors and clients of Powersoft at the same time, which is often an indicator that a company has a unique positioning in the market. Recently, Powersoft has for example signed a partnership with Bose Professional to develop the new Bose Professional PowerShareX series of amplifiers.

In February, Powersoft has signed another very interesting partnership with Ferrari, bringing together Italian excellence in acoustic innovation and automotive engineering. The partnership aims to develop solutions enhancing the Ferrari brand's audio experience while minimizing energy consumption and offering benefits in efficiency, reliability, and sound quality. That such a well-known and high-quality brand like Ferrari has chosen Powersoft is another sign for their unique & qualitative products & innovations. One of the reasons why Ferrari has chosen Powersoft is that their technologies stand out for their significant reduction of heat dissipation, recycling of reactive energy from speakers, and installation flexibility, thanks to the remarkable weight/power ratio. Powersoft products will likely be implemented in the new fully electric Ferrari models, which will have an “authentic sound” according to Ferrari executives. This is why they created an intricate system of auditory feedback devices that use the genuine sounds of the vehicle's motors and aero to create its roar. Powersoft’s expertise certainly plays an important role in the development process of this unique system.

6. Growth Driver

International Expansion: Although Powersoft is already a global company, they still see huge opportunities in geographical expansion, especially in the US, China, Japan and Middle East. China and US are expected to account to over 40 % of the professional rack amplifier market by 2025.

In January 2023, Powersoft has strengthened its US organization by appointing Thomas Howie as a new Business Development Manager who is a highly regarded professional, and brings over 15 years of experience in developing and managing vertical markets within the large sports installation and theme park industry for top-tier brands.

In July 2023, Powersoft opened a representative office in Tokyo to accelerate business penetration in Japan.

In August 2023, Powersoft announced the reinforcement of its team in China by appointing Miao Wang as Solution Engineer and relocating to the new offices in Beijing. Moving the representative office from Shenzhen to Beijing confirms the Group's strategic decision to strengthen its presence in the People's Republic of China, offering a more extensive and timely response to market needs.

In August 2024, Powersoft strengthened its global presence with 2 new business development managers for the Chinese and Southeast Asia markets and 3 solution engineers for the Chinese, UK & US market.

We can see that Powersoft is currently working on improving its international presence. This geographical expansion is strategically tailored to encompass markets experiencing rapid growth in the demand for advanced technology solutions.

New technologies: Powersoft became a global leader in professional audio amplification thanks to strong R&D and continuous innovation. Since the three founders started with their first innovation in a small garage in 1995, they continuously added new technologies and products. They haven’t stopped at amplifiers, they also developed completely new products like the “DEVA” multimedia device or transducers and their own software (Armonia Plus) and cloud solution (MyUniverso).

The R&D Director Claudio Lastrucci has international recognition as winner of the Innovation Awards in the Industry Influencer category. Several company products have received sector awards. Powersoft also launched its own growth incubator/accelerator Ideofarm dedicated to supporting new creative projects, and future development of innovative technologies. With Powersoft’s focus on developing extremely energy-efficient products, they also meet current expectations of more eco-friendly companies.

Now that Powersoft has transformed from a product company to a solution provider, they are more directly in exchange with their partners & customers. They will know even faster what their customers need to create even better (audio) experiences. So after nearly 20 years of continuous innovation, one can expect Powersoft to continue to innovate the industry.

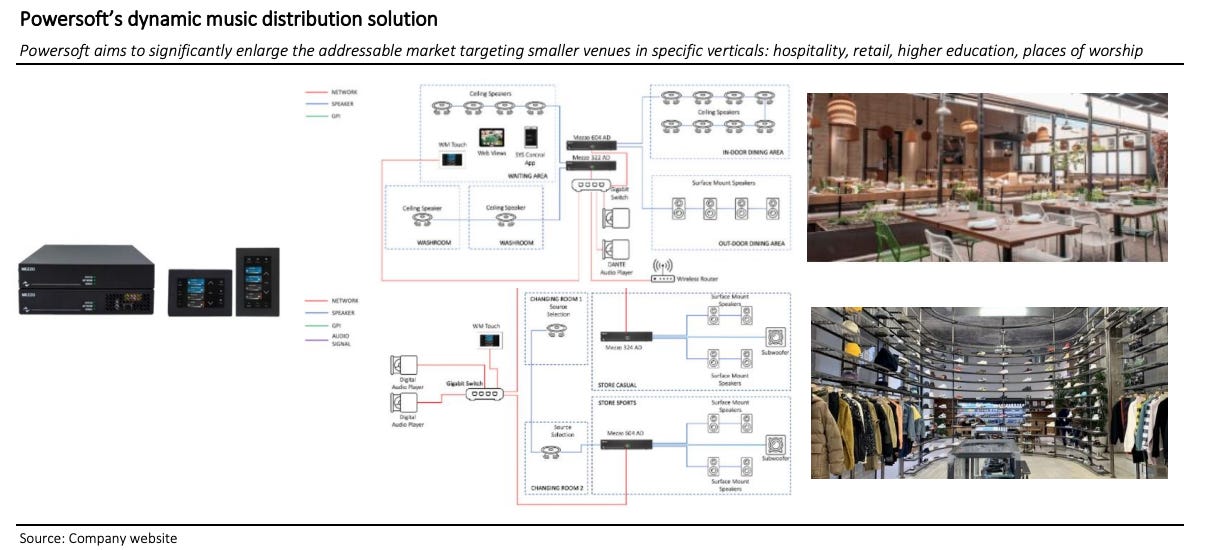

New verticals/partnerships: Powersoft hasn’t just changed from a product company to a solution provider, they also expanded their addressable market from large installation to small(er) commercial installations. The company launched Dynamic Music Distribution, a suite of hardware (“Mezzo” series amplifiers), software (Armonia Plus, mobile app for remote control) and additional tools (internally developed wall mounted remote touch controls) designed to offer system integrators and installers an integrated solution for smaller venues in 4 identified verticals (hospitality, retail, higher education, places of worship) and other corporates verticals. This platform offers system integrators key advantages like (i) reduced installation time, (ii) reduced cable runs, (iii) less equipment, (iv) simple setup and less time to learn and configure the system. Powersoft can leverage on its current distribution network to push the new solution.

Since introducing this solution in 2021, Powersoft has already been able to sign contracts within a variety of verticals and they continue to find new ones where they can implement their products. For example, the partnership with Ferarri opens the automotive sector as a new vertical for Powersoft, which they hadn’t even thought about when they introduced this series. Another example is the agreement they signed with Vega Global, a leading name in Digital Workplace solutions in audiovisual, video conferencing, and collaboration technologies, to supply professional amplifiers to expand and strengthen the audio solutions it offers to end customers. Every location where people hear music via loudspeakers is a potential vertical for Powersoft.

More Software & Cloud services: Powersoft has already developed proprietary software solutions like Armonia Plus, Pro Manager Plus, and the Sys Control App for audio engineers to easily design and configure their audio system. With the MyUniverso Cloud solution, the audio engineer can upload their audio projects into the cloud, allowing Powersoft to carry predictive maintenance and remote diagnostics activities. This is key to have more visibility on the installed base of amplifiers, to develop potential direct to customer upselling and cross-selling activities, and for the development of aftersales and warranty extension business. Powersoft plans to increase their offering of cloud-native IOT products and software-based services in the future.

(Immersive) Experience Economy: Millenials are more interested in experiences rather than goods. According to an Eventbride Study, 78 % of (US) millennials would choose to spend money on a desirable experience or event over buying something desirable, and 55% of millennials say they’re spending more on events and live experiences than ever before. Nearly 7 in 10 (69%) millennials experience FOMO. In a world where life experiences are broadcasted across social media, the fear of missing out drives millennials to show up, share and engage.

And this Forbes article suggests, that the GenZ will continue with this trend:

Of the people surveyed, 93% plan to visit attractions at the same or greater level in 2024 when compared to 2023. Of note is that 50% of Gen Z and affluent visitors plan to go to even more attractions than they did this past year, making them the two groups with the most positive sentiment heading into next year.

The gigantic hype around Taylor Swifts “Eras Tour” is another indication. And the audio experience is a crucial part of any experience, so Powersoft will probably benefit from this trend.

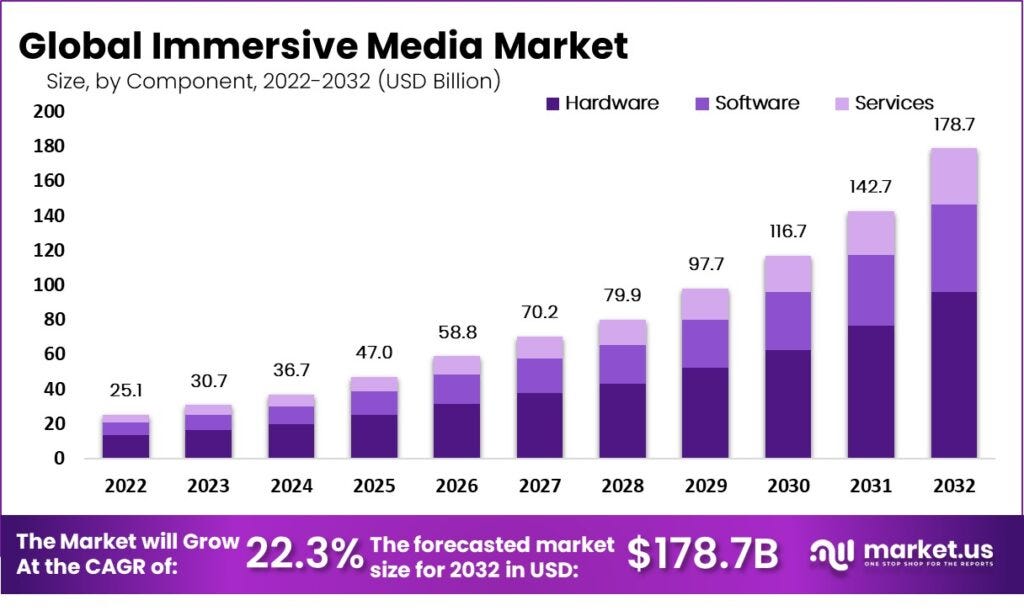

The immersive entertainment markets is a submarket of the experience economy market, but it is one of the fastest growing. According to this study the market is expected to grow with a CAGR of 22.3 % from 2022 - 2032.

The market is still in its infancy. But with examples like “The Sphere” where people can now actually feel what real immersive entertainment is, it has the potential to emerge from its current niche market status. MSG is already in talks for other Sphere venues around the world and they will probably not be the only one. Below you can see an interesting video with Erik Hockman, the Mastermind and acoustic engineer of “The Sphere”. There he talks about the unique experience when you can actually feel the sound via bone conduction and why immersive sound and haptic seating is the next generation of entertainment. He also explains that they chose the Powersoft “Mover” over other solutions as it allows very very low frequencies which others can’t. This makes it possible, for example, to feel the swaying of a boat very well. On the other hand, very high frequencies are also possible, so that the spectrum is very large.

For true virtual realities, the user must be fully immersed in the new world. Ultimately, this will only be possible if they can actually feel what they are experiencing on their bodies. Immersive sounds bring the fourth dimension to this experience. For now this only an application for large venues and theme parks. But with a wider adoption of virtual reality glasses, this could become more and more relevant for the masses.

M&A: The sector of professional audio equipment is quite active in terms of M&A, with deals finalised by PE and industrial players. Below you can see selected M&A deals in the professional AV sector since 2010.

One of the reasons for the IPO of Powersoft was to use the proceeds for potential M&A targets. But since then the company hasn’t finalized any significant M&A deal. When large industrial conglomerates and PE funds are also bidding for potential targets, valuations are often not a steal. In addition, large acquisitions are often not that easy to integrate and often don’t have the synergies initially expected. The Powersoft management is long enough in this industry to know when they found a target that fits to them and can be acquired at a fair price. They are continuously scanning the market and acquisitions to gain market share or to diversify their product range is still an option.

On the other hand, Powersoft could also become a target of a large multi-brand conglomerate. However, as the founders still own over 75 % of the company, this would only be possible with their consent.

7. Management & Shareholders

Carlo Lastrucci is the Chairman of the Board of Directors. He has over forty years of experience as a top manager in the telecommunications industry. In 1998, persuaded by his sons to join the newly founded startup Powersoft, he embraced the challenge of becoming its President. Focusing on foreign business development, he immediately brought his vast experience and strategic vision, significantly contributing to Powersoft’s growth and international expansion.

The three founders of Powersoft are still active in the company. Luca Lastrucci is the CEO. With a degree in Electronic Engineering, a PhD in Artificial Intelligence applied to voice recognition and an MBA, Luca Lastrucci began his career as a researcher at Berkeley. As a co-founder of Powersoft in 1995, he led the software development until 2001, and then took on the role of CEO in 2011, focusing on the company’s expansion and organization.

Claudio Lastrucci is the R&D Director. He has been the Director of the R&D department from the start, showcasing his ingenuity in the fields of power electronics, audio amplification, signal processing, acoustics, and transducer design. His work propelled the evolution of the entire audio industry, his extensive patent activity underscores his constant dedication to research and development, and numerous international awards and recognitions attest to his broad impact in the professional audio industry, reinforcing Powersoft’s reputation as a high-value brand and hotbed for technological development.

Antonio Peruch is the Cost Assessment & Production Engineering Director. He has applied his skills in hardware design and the development of switching power supplies, significantly contributing to the engineering of the first Class-D amplifiers. His vision, integrating engineering innovation with economic acumen, reflects a commitment to efficiency and sustainability that enhances Powersoft’s competitiveness by producing technically superior and financially accessible audio solutions.

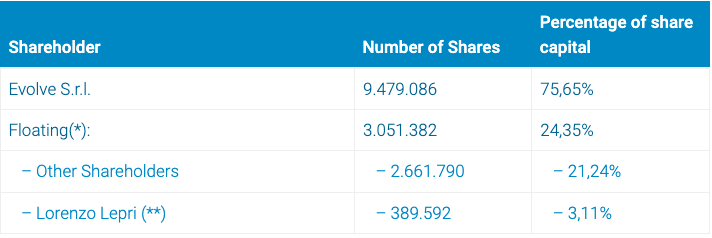

The major shareholder is Evolve S.r.L. with 75.65 %. Evolve S.r.L. is is controlled by the three founders Claudio Lastrucci (45%), Luca Lastrucci (45%) and Antonio Peruch (10%). So Powersoft is still founder-led and has management with high skin in the game. In Addition, Lorenzo Lepri, a non-executive director owns 3.11 %, leaving a free float of 21.24 %.

8. Financials

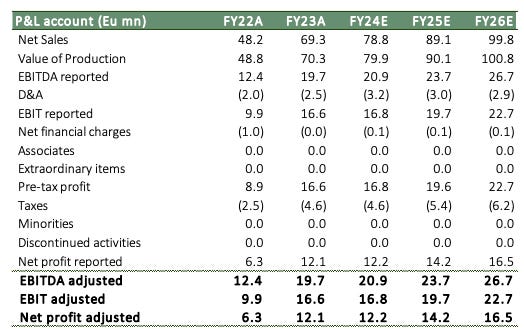

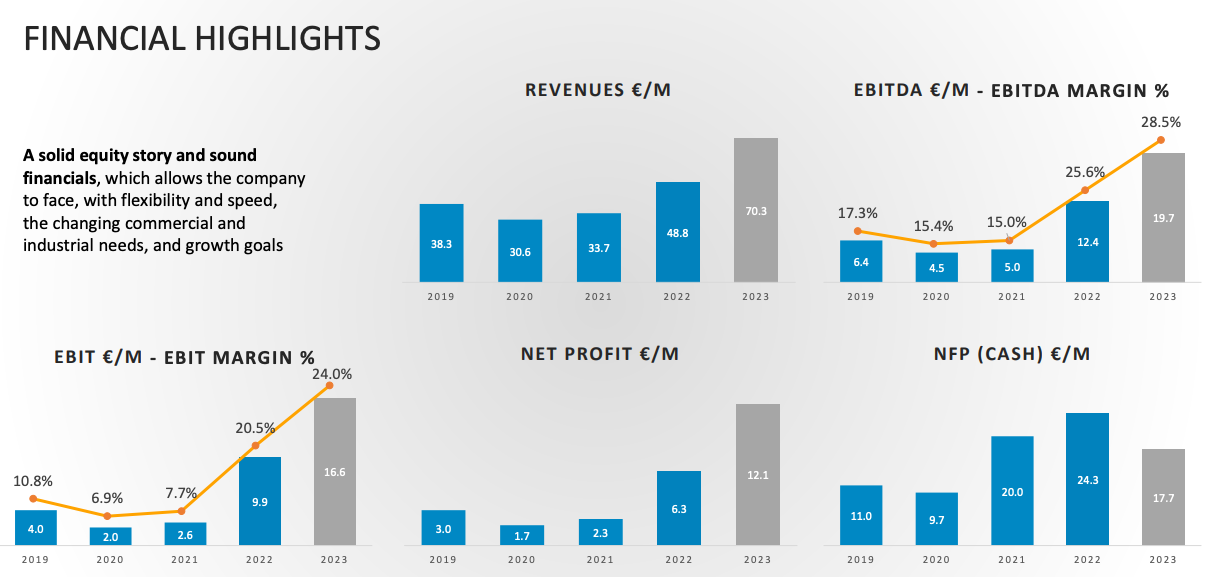

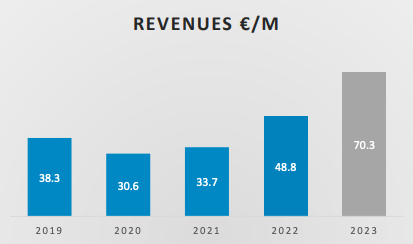

Between 2017 and 2023, Powersoft grew its top line with a CAGR of 13.7 % and its EBITDA with a CAGR of 26.5 %. Due to operational leverage, the EBITDA margin nearly doubled from 14.7 % to 28 %.

The most recent financial numbers available are the numbers for FY 2023:

Total revenue +44.2 % (EUR 70.3 million)

EBITDA +59.7 % (EUR 19.7 million)

EBITDA-Margin of 28.5 % (vs. 25.6 %)

EBIT +68.1 % (EUR 16.6 million)

EBIT-Margin of 24 % (vs. 20.5 %)

Net Profit +90 % (EUR 12.1 million)

Net Profit-Margin of 17.2 % (vs. 12.9 %)

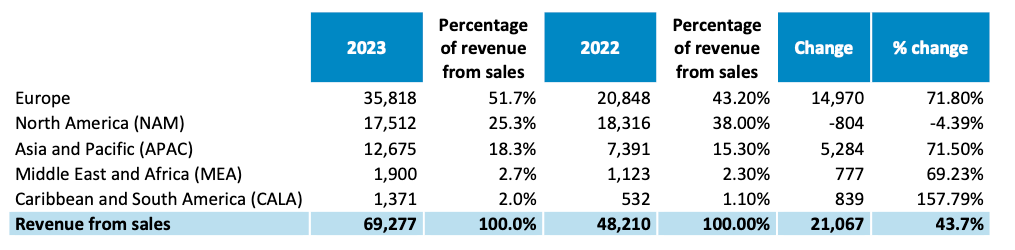

As you can see below, over 50 % of revenues in 2023 were made in Europe as Powersoft was able to grow by over 70 % there. With 25 %, the North American market (NAM) is the second largest. In 2023, revenues decreased by 4 %. I could imagine, that the North American revenues have been influenced by the construction of the Las Vegas Sphere, which is probably one of the biggest venues equipped with Powersoft equipment. The Sphere has been completed in 2023. I could imagine that most of the deliveries of the audio equipment were already made in 2022 which would explain the consolidation in 2023 on a high level. The North American region is expected to grow again in 2024. With 18 %, Asia and Pacific (APAC) is also an important market for Powersoft, which grew strongly by over 70 % in 2023. The Middle East and Africa market (MEA) and the Caribbean and South American market (CALA) are significantly smaller with a share of 2.7 % and 2 % respectively, but both are growing fast with 70 % and 158 %.

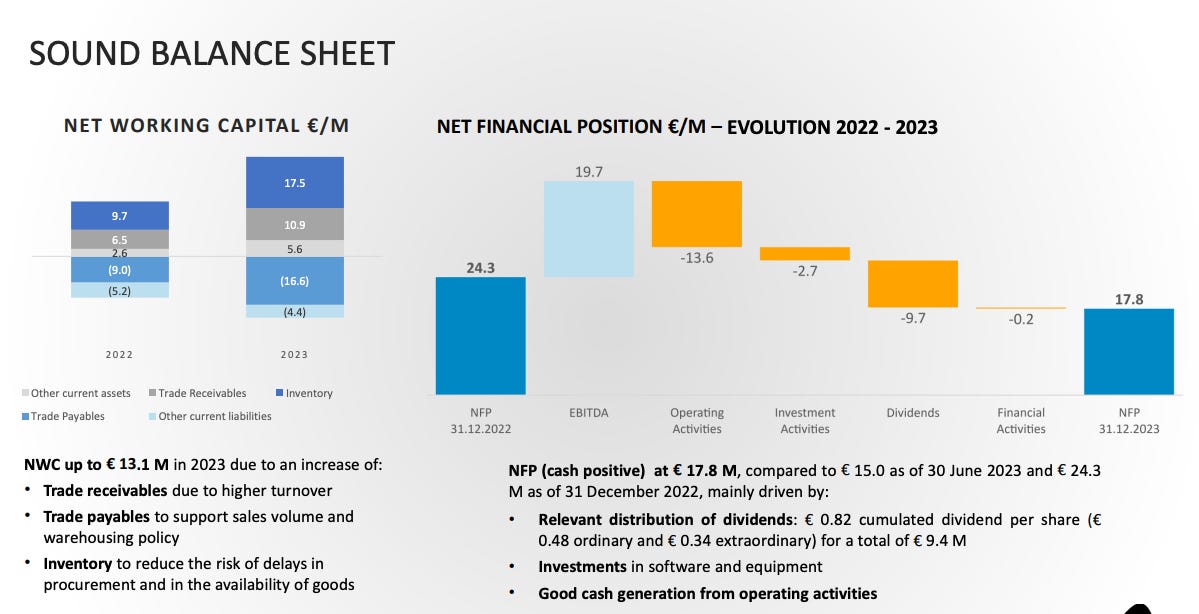

In 2023, the operating cash flow decreased by 22.7 % from EUR 8.2 million to 6.3 million, mainly as a result of higher working capital needs due to the high growth. Powersoft has relatively low Capex needs, resulting in a good free cash flow conversion. There is no need for external capital fo fund further growth. Powersoft has a sound balance sheet with a net cash position of EUR 17.8 million and no long-term debt. In addition, the company is paying a dividend. In 2023, they paid EUR 0.82 per share, resulting in a dividend yield of around 6 %.

Advertisement:

You are currently looking for a new financial service or broker? Feel free to use one of my discount codes to save some money :)

Quartr Core 20 % Discount: MAVIX20

Koyfin Premium 10 % Discount: Use this link

Marketscreener up to 40 % Discount: Use this link

DeGiro Broker 100 € free transaction fee: Use this link

9. Valuation

For 2024, it is expected that the company will grow its sales by 13 % while the EBIT is expected to stay nearly flat due to an expected additional personnel expansion to support higher expected business volume. For 2025, sales are expected to continue to grow by 13 % and EBIT will return to grow by around 16 %.

Powersoft’s management doesn’t publish specific guidance for 2024. In the annual report it is only noted, that the year 2024 began on a positive note, marked by the prestigious partnership with Ferrari and the launch of the new “Verso” gateway device. On September 25, Powersoft will publish its H1 2024 results an we can see how the company performed so far this year.

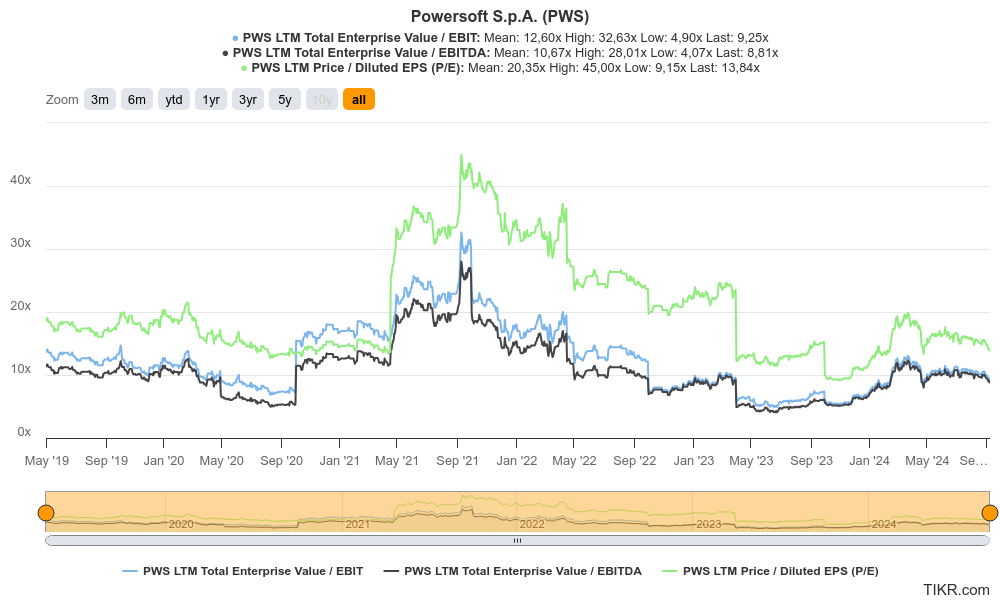

Based on the results for FY 2023, Powersoft is currently valued at the following multiples:3

EV/EBITDA of 8.8 x

EV/EBIT of 9.3x

P/E of 13.8x

This is below the mean valuation of 12.6x EV/EBIT and 20.4x P/E since the IPO, but it is also far away from its low.

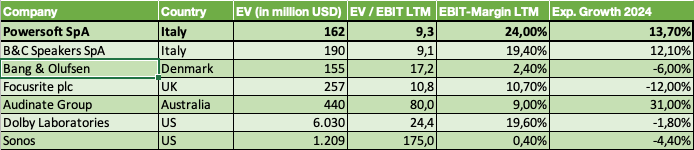

As already outlined in the “Competition” section, Powersoft has no direct peers that are publicly listed. Other companies active in the professional amplifier market, are part of large conglomerates or private companies. This makes a peer comparison more difficult, but below you can see some companies that are also active in the professional audio sector. Although these groups are not involved in the same products as Powersoft, they are exposed to similar end markets.

I think the most comparable company is B&C Speakers. B&C is also a pure player in the professional audio market (but more with transducers instead of amplifiers), has a similar size and is also listed in Italy. Powersoft and B&C are valued at a similar level and both are expected to grow at a similar pace in 2024, but Powersoft (currently) has a slightly better margin profile. Moreover, Powersoft has attained its entire historical expansion by organic means, whereas the growth of B&C was also driven by acquisitions. Powersoft’s management has already successfully shown that they can expand in new verticals and product categories. B&C is more dependent on the touring market, while Powersoft is also successful in the fixed installations market. The valuations of both companies are currently not demanding with a single-digit EV/EBIT multiple, but I think Powersoft offers better optionality for future growth.

Looking outside of Italy, the valuations are significantly higher, margins are lower and except for Audinate, the companies are not expected to grow this year.

Assuming that Powersoft can grow by 12-13 % in 2024 & 2025 and that it can maintain an EBIT-Margin of around 20 %, the company can reach around EUR 20 million in EBIT in 2025, resulting in an EV/EBIT multiple of ~7.5x. Putting this multiple into the context of a high-quality business with a market-leading position, showing consistent double-digit organic growth for a long time, the valuation seems to be attractive.

10. Risks

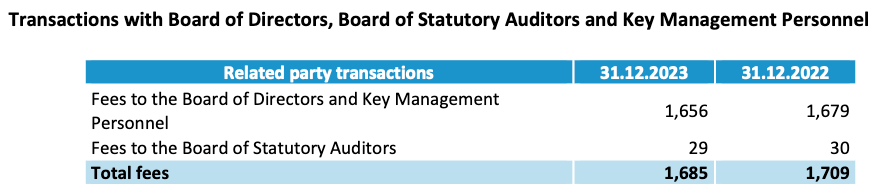

Related party transactions: As seen in the “Shareholder” section of this write-up, Powersoft is controlled by its founders via their investment vehicle Evolve S.r.L who still own over 75 % of the company and who are still actively engaged in the company. While it is generally a positive sign when the managers/founders have a lot of skin in the game, they can also take advantage of their majority ownership. They can agree on excessive salaries or make other agreements to the detriment of minority shareholders. As you can see below, the salaries for the key management don’t seem to be exaggerated.

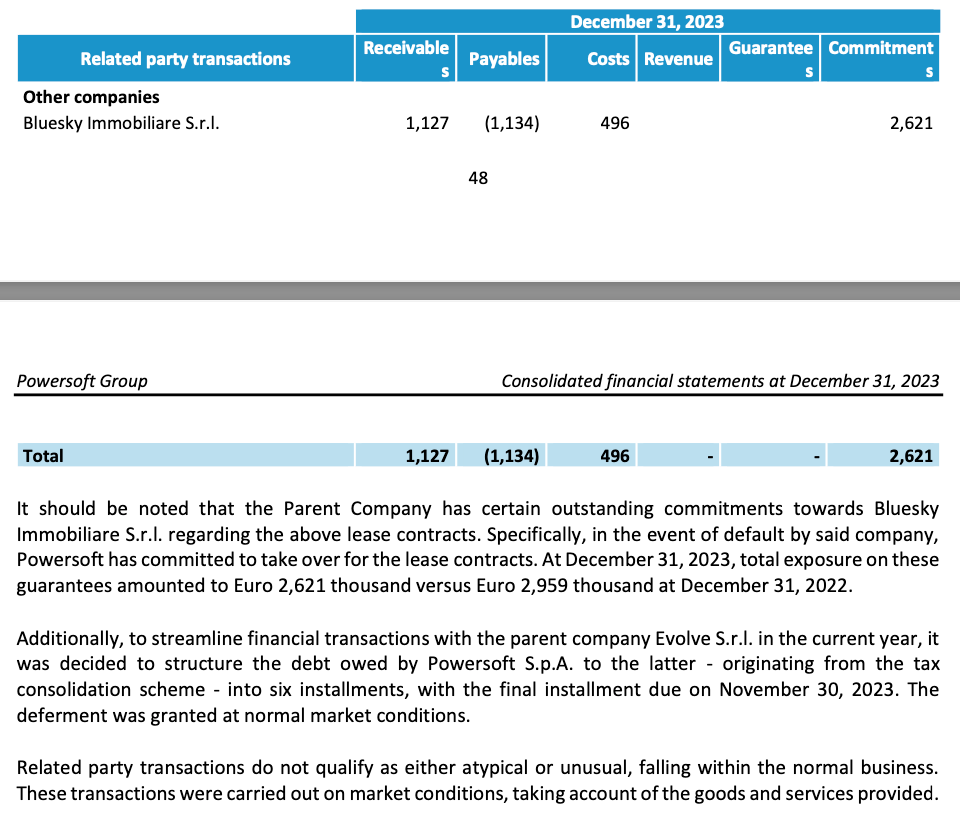

But that’s not all. Powersoft is leasing business property from Bluesky Immobiliare S.r.l and Bluesky is owned by Evolve S.r.l. To put it more simply, Powersoft leases buildings from its founders. There is still nothing wrong with this as long as these transactions are carried out at normal market conditions. In the annual report it is noted that all business dealings with Bluesky are concluded at normal market conditions and looking at the reported related party transactions, the numbers don’t seem to be exaggerated.

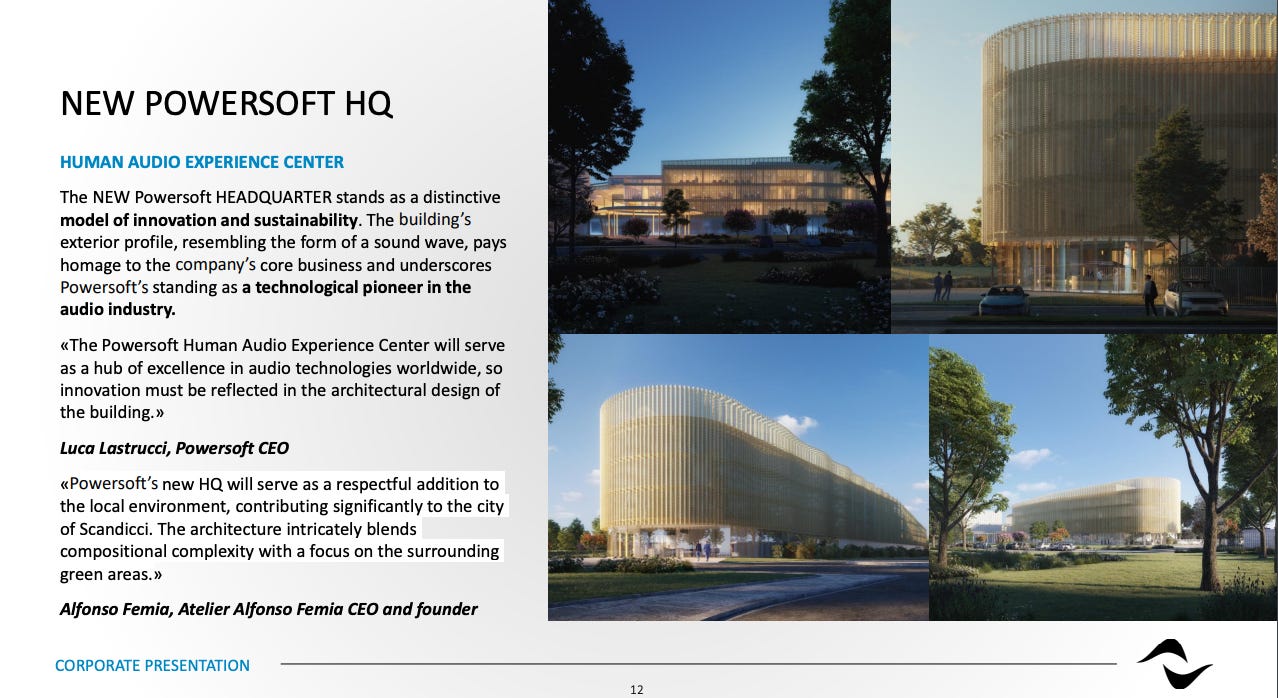

In March 2024, Powersoft announced plans for a new headquarters, the “Human Audio Experience Center”. The new headquarters, covering more than 9,200m² across four floors, is purpose-built to accommodate a projected increase in the size of the company’s workforce, as outlined in its development plan for the coming years. By centralising all corporate functions, enhancing departmental potential, improving cross-team collaboration, and delivering significant operational cost savings while boosting energy efficiency. Construction is anticipated to conclude in the latter part of 2026, after which production lines and all company departments will relocate from the existing premises to the new HQ.

This new headquarters will also be owned by Bluesky Immobiliare (or the founders of Powersoft) and then leased by Powersoft. As you can see in the picture below, the new building is much bigger and was planned by an internationally acclaimed architectural firm. The leasing costs will be much higher here and they could possibly be structured abusively and to the disadvantage of minority shareholders. But Powersoft has already released a 26-page information document regarding the preliminary lease agreement with Bluesky where they openly explain how they calculated the leasing rate and other potential costs. In addition, the Board of Directors of Powersoft has appointed KROLL Advisory SpA, an independent expert firm to determine the market rent for the New Complex. The annual rent for the building will be EUR 1.75 million.

I think with this detailed information document and the appointment of an independent advisory firm, the major shareholders have shown that they are not trying to hide something or betray the minority shareholders. Nevertheless, the related party transactions will be something to have a close look at in the coming years.

Economic cycle: Many industries were severely impacted by the COVID-19 measurements. However, the travel and (live) entertainment/event industries have arguably been impacted the hardest. This is of course also reflected in the numbers of Powersoft, as it is (at least partially) dependent on the live entertainment industry. Revenues in 2020 and 2021 have been 15-20 % lower than 2019.

After months in their homes, people wanted to catch up on everything they had missed during Covid. In the travel industry, they were talking about “revenge traveling”. A similar effect has happened in the live entertainment industry. Festivals and concerts were what people longing for, no matter what it cost. After two years of being closed, all the arenas, stadiums & venues may had to renovate their acoustic installations. At least the revenues of Powersoft more than doubled since the end of COVID-19 and partially this could be explained by a similar “revenge partying” effect which Powersoft benefited from.

Any industry that benefited during COVID-19, has been hit hard once the restrictions were lifted. And a similar effect likely happens to the industries that strongly benefited from the end of COVID-19. You can already find many articles that the end of revenge travel has arrived. At least one can assume that the growth rate of the live entertainment market will not continue to be in a similar range as it was in 2022 & 2023. This is underpinned by the market expectations for music events. The growth rate will substantially decrease in the coming years.

So one should not expect that Powersoft can continue to grow by over 40 % like 2022 & 2023. This growth was at least partially due to the effect described above. It is possible that Powersoft is currently overearning. But historically, Powersoft was able to grow with low double digits for many years and with the different “Growth Driver” described before, they should be able to continue to return to such growth rates in the coming years.

Dependence on key individuals / Selling shareholders: The three founders of Powersoft have played, and continue to play, instrumental roles in the company's success. If these key individuals were to leave the Group Management, there is no assurance that the Group could swiftly find equally capable and fitting replacements, at least in the short run.

After the IPO in 2018, the controlling shareholders owned 87 % of the company. That means they have already sold around 12 % since then. They may continue to sell their shares which would of course have an impact on the share price.

Competitors with deeper pockets: As already described, there are a lot of M&A activities in the professional AV market. Many large conglomerates emerged and also big PE funds invested. These competitors often have deeper pockets than a small company like Powersoft. They can invest much more money in R&D and Powersoft would definitely lose a price war against them. Powersoft has found a niche as an independent product specialist where even competitors are customers of them. But Powersoft enters more and more verticals and launches new product categories. Eventually, the rivals may consider this as a threat and launch an offensive instead of cooperating.

11. Summary

While looking at Powersoft's list of customers and partnerships, you wonder who in the professional audio sector is not one of their customers. This is no coincidence. Thanks to continuous innovation, Powersoft has built up an excellent reputation in its niche over the years. Powersoft is constantly expanding its addressable market thanks to the introduction of new innovative products like the patented “Mover” technology for the fast-growing immersive experience market. It remains to be seen if the company was over-earning in the last two years. However, the three founders are still passionate about the future opportunities of the company like the successful international expansion. Even if 2024 would be a year of “consolidation, the current valuation for such a high-quality company, with a clean balance sheet & net cash is not really demanding. If they can continue to profit from the various growth drivers described and return to sustainable double-digit growth, the valuation is even more attractive right now.

https://www.powersoft.com/wp-content/uploads/2021/09/Powersoft-Alantra-research.pdf

https://marketresearch.biz/report/pro-av-audio-visual-market/

Date: 15.09.2024

Really comprehensive write up!

Thank you for the write up. One question if I may.

Margins historically (pre covid) were substantially below current levels: why do you believe they will be able to retain higher margins for longer? in other words why are current margins sustainable as opposed as being a result of increased demand / cycle? B&C margins were higher historically, and have declined during covid, but now have returned to their longer term averages. Powersoft's operating margins were around 10% in 2017-2018-2019 and 12.4% in 2016. After the covid bounce they're now at 20%+. Why is this the new normal?

thank you