Disclaimer: The following write-up is no investment advice. The author may own, buy and sell securities mentioned in this post. Please always do your own due diligence! This company is a micro-cap. Keep in mind that even a small investment from your side can move the share price due to the low liquidity of shares. It's not easy to liquidate if you want to get out.

Welcome,

in this issue of Under-Followed-Stocks I will present you Lindbergh SpA ($LDB.MI).

Investment summary:

Lindbergh’s services bring significant benefits to their customers’ productivity and reduce their environmental impact

Unique positioning in the in-night in-boot delivery service thanks to the proprietary technology platform that allows offering complementary services to increase the productivity of technicians

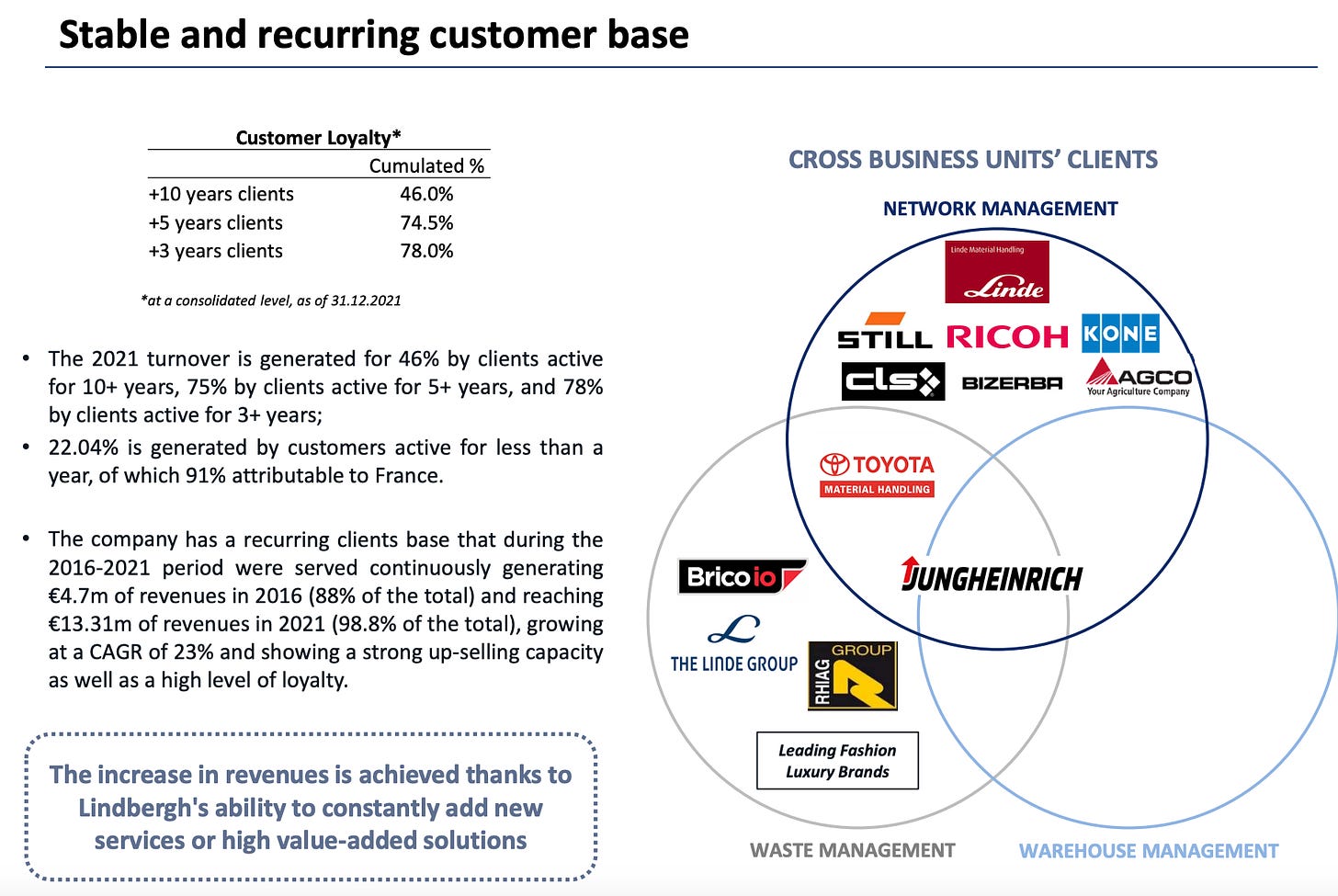

High standing and loyal client portfolio of multinational customers like Jungheinrich, Kion, Linde, Toyota, Kone, RICOH and Still

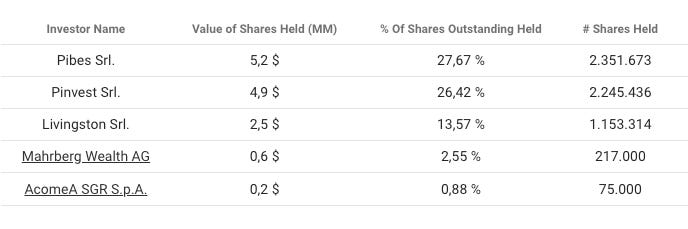

illiquid micro-cap with high insider ownership of 67 %

Revenues in H1 ‘23 +19.5 %, EBIT +39.4%, Net Profit +40%

successful (and faster than expected) turnaround of the French subsidiary should further increase the overall margins in the coming years

EV/EBIT ‘23 of 10.3x, P/E of 11.6x

If you aren’t a subscriber yet and enjoy the content I share, feel free to subscribe so that you won’t miss any new content. The content I share is free. But if you want to support me, you can voluntarily choose the paid option :)

Let’s go!

1. Introduction

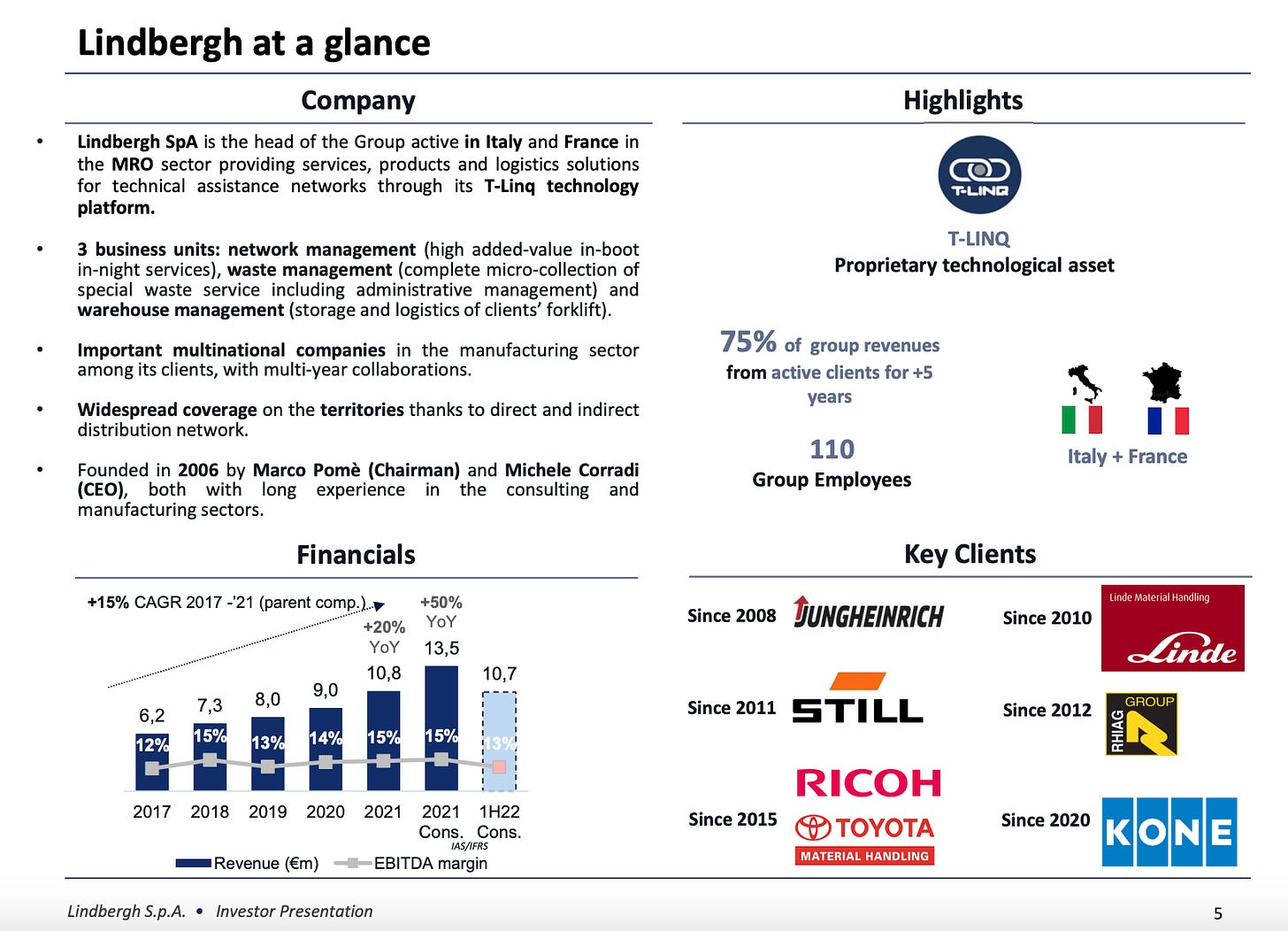

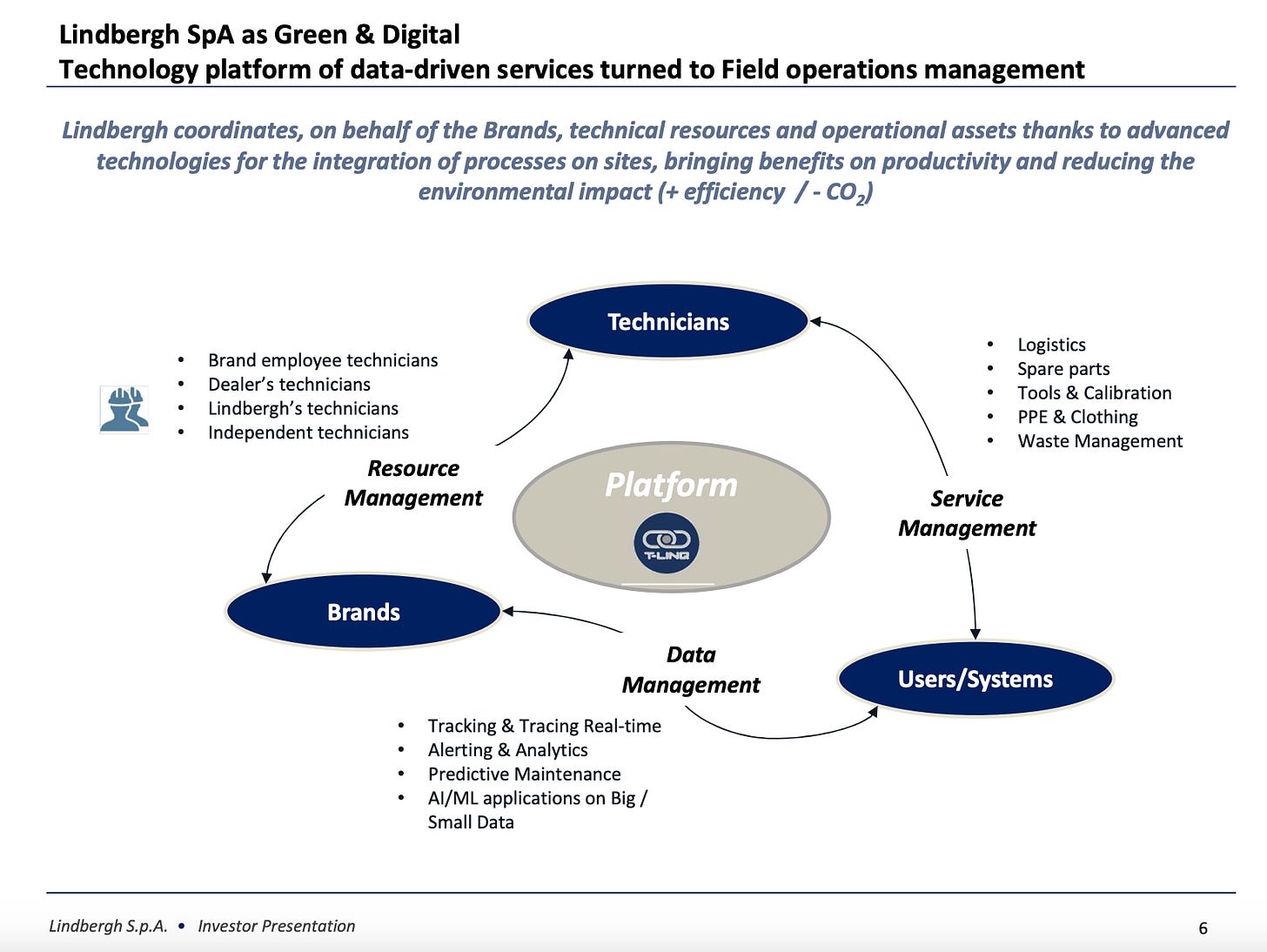

Lindbergh offers a range of value-added services in the MRO (Maintenance, Repair and Operations) sector for technical assistance networks through its proprietary T-Linq technology platform. It coordinates the technical resources and operational assets of its customers, leveraging advanced technologies for the integration of their processes, making significant improvements to their productivity and reducing environmental impacts.

The company operates through three Business Units (Network Management, Waste Management & Warehouse Management) and is active in Italy and France. Lindbergh has recently managed to turn the French subsidiary into profitability through several reorganization measures. That offers a chance that the company's overall margins will increase in the coming years. Improved margins combined with revenue growth by adding more value-added services and customers. At the current valuation, it seems that Lindbergh could be an interesting idea.

The current market cap is EUR 17.8 million (USD 18.7 million). So again, this is a really illiquid micro cap. Never buy such stocks without doing your own research. I’m not an expert in the market Lindbergh is active in so you can’t rely on my assumptions. If you decide to buy after doing your own research always use a limit order.

Advertisement:

Tikr.com is always the first place I visit when I come across an interesting stock. Here I have all the information I need to quickly decide if this stock is worth a deeper look. You have the latest news, financial statements, estimates, valuation, filings and even transcripts in one place. If you ever thought about making an account there, you can use my link to support me. Thanks!

2. The company

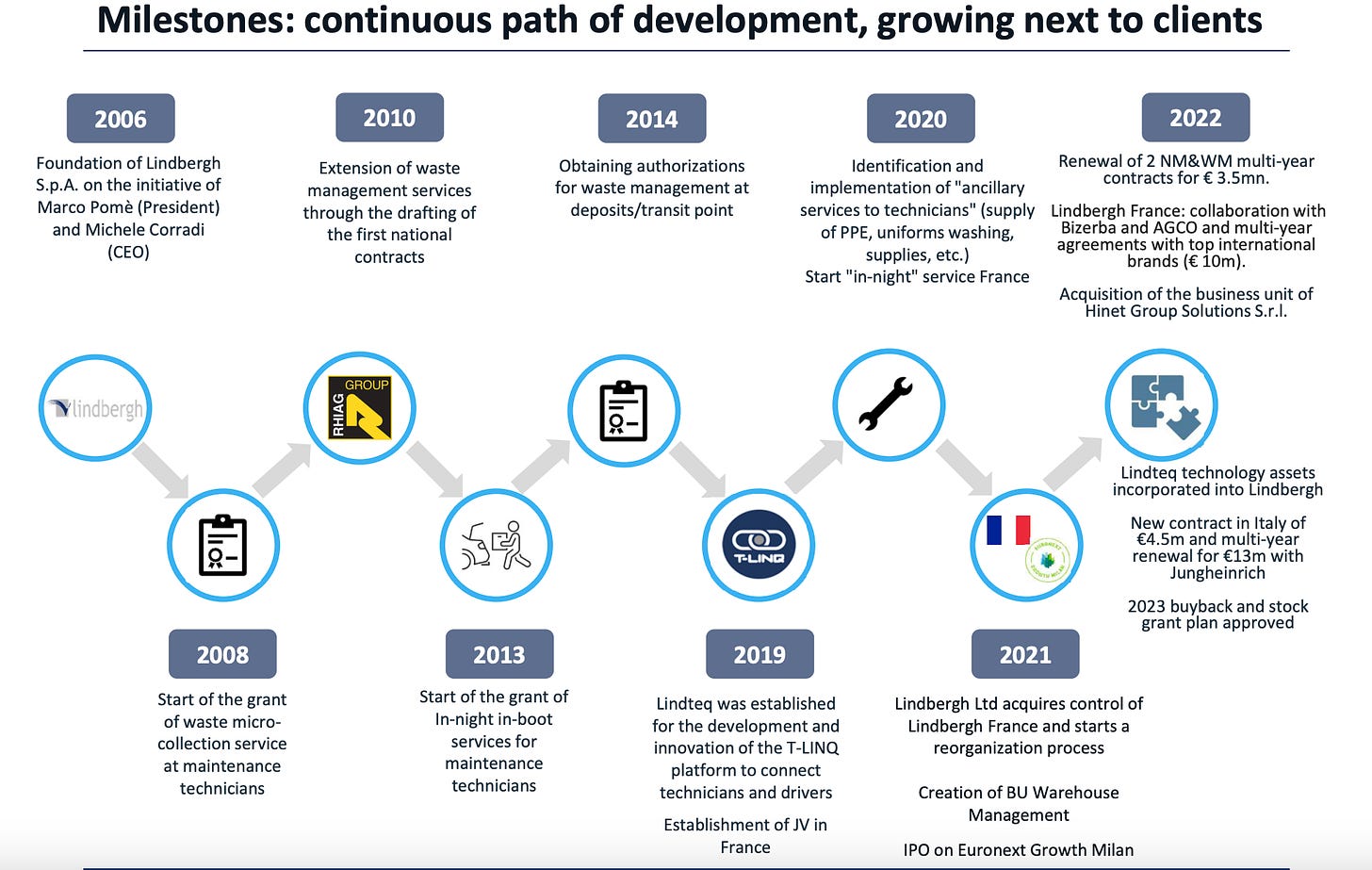

Lindbergh was founded in 2006 by Marco Pomè (current Chairman of the Board) & Michele Corradi (current CEO) and is based in Pescarolo ed Uniti, Italy. In 2008, the company established the Waste Business Unit to provide miro-waste collection services to maintenance technicians. In 2013 the provision of in-night- in-boot services for technicians began. Lindteq, a company aimed at the development and innovation of the proprietary T-LINQ platform was founded in 2019.

Expansion to France: In collaboration with Globe Express, a French logistics operator, Lindbergh started a Joint Venture in 2019 in France called Temex but without the majority ownership. After some acquisitions in 2020 and 2021, Lindbergh gained control of the JV and started some reorganization measures and changed the name to Lindbergh France. The management knew that the company was in financial difficulty and with significant past losses. From April 2020 to August 2021 the company recorded operating losses of EUR 2.6 million on a turnover of around EUR 8 million. But the management saw potential in the company and the French market, which in terms of size and type of customers is larger than the Italian one. The reorganization included the appointment of Marco Pomè as CEO and Michele Corradi as CFO of Lindbergh France. In addition, they started some operational reorganizations like the definition of a new, more effective transport plan, the implementation of Lindbergh’s proprietary platform T-Linq, and the insourcing of customer and operations management to Lindbergh. These measurements by the Lindbergh management have made it possible to reach profitability of the French subsidiary faster than expected. Lindbergh currently owns 79 % of Lindbergh France.

In 2021 Lindbergh IPO’ed on the Euronext Milan to further fund the scale-up in France, to optimize the IT platform and to fund possible M&A transactions related to the internationalization and their own technical assistance network.

Thanks to a highly developed distribution network (direct & indirect), Lindbergh is able to guarantee widespread coverage (99 % punctuality of deliveries) with 8 operational units in Italy and 1 in France. Thanks to its proprietary cloud-based technology platform T-Linq, Lindbergh is able to create a direct connection between suppliers, drivers, maintenance technicians and customers, bringing productivity benefits and reducing environmental impact. The iOS and Android compatible & customizable application allows the maintenance engineers to solve every problem in the simplest way:

order a spare part and get real-time updates on delivery status

book a collection slot for a return

schedule use of electronic equipment on a shared calendar that is accessible to the rest of the team of the company

report a problem at work

send special customized reports

upload photos and videos of the maintenance they’re working on

book the Lindbergh laundry service

buy the PPE (personal protective equipment) they need

book special accessories and tools from a catalog

With T-Linq, the parent company can control the frequency with which work clothing is replaced and how much PPE is actually requested by each maintenance engineer to prevent waste and improve everyone’s efficiency.

The company has a stable and recurring customer base of multinational customers like Jungheinrich, Kion, Linde, Toyota, Kone, RICOH and Still to name just a few. 46% of the turnover in 2021 has been generated by clients active for 10+ years. Lindbergh has a recurring client base that during the 2016-2021 period was served continuously generating €4.7m of revenues in 2016 (88% of the total) and reaching €13.31m of revenues in 2021 (98.8% of the total), growing at a CAGR of 23% and showing a strong up-selling capacity as well as a high level of loyalty.

3. Business Units

Lindbergh operates through 3 Business Units:

Network management (84.7 % of revenue)

Waste Management (11.7 % of revenue)

Warehouse Management (3.6 % of revenue)

Network management: Lindbergh is no ordinary courier. They are specialized in night-time deliveries for maintenance engineers and technicians in industry and manufacturing. The technicians order for example spare parts and Lindbergh delivers them in record time (national deliveries are guaranteed by 7.00 a.m.) directly into the van of the technician while he is sleeping (“in-night” & “in-boot”). Lindbergh also picks up the returns to be repaired or disposed and delivers them directly to the specialized centers. All this takes place without the need for the maintenance engineer to be present for the delivery. This job can not be done by ordinary national or international couriers.

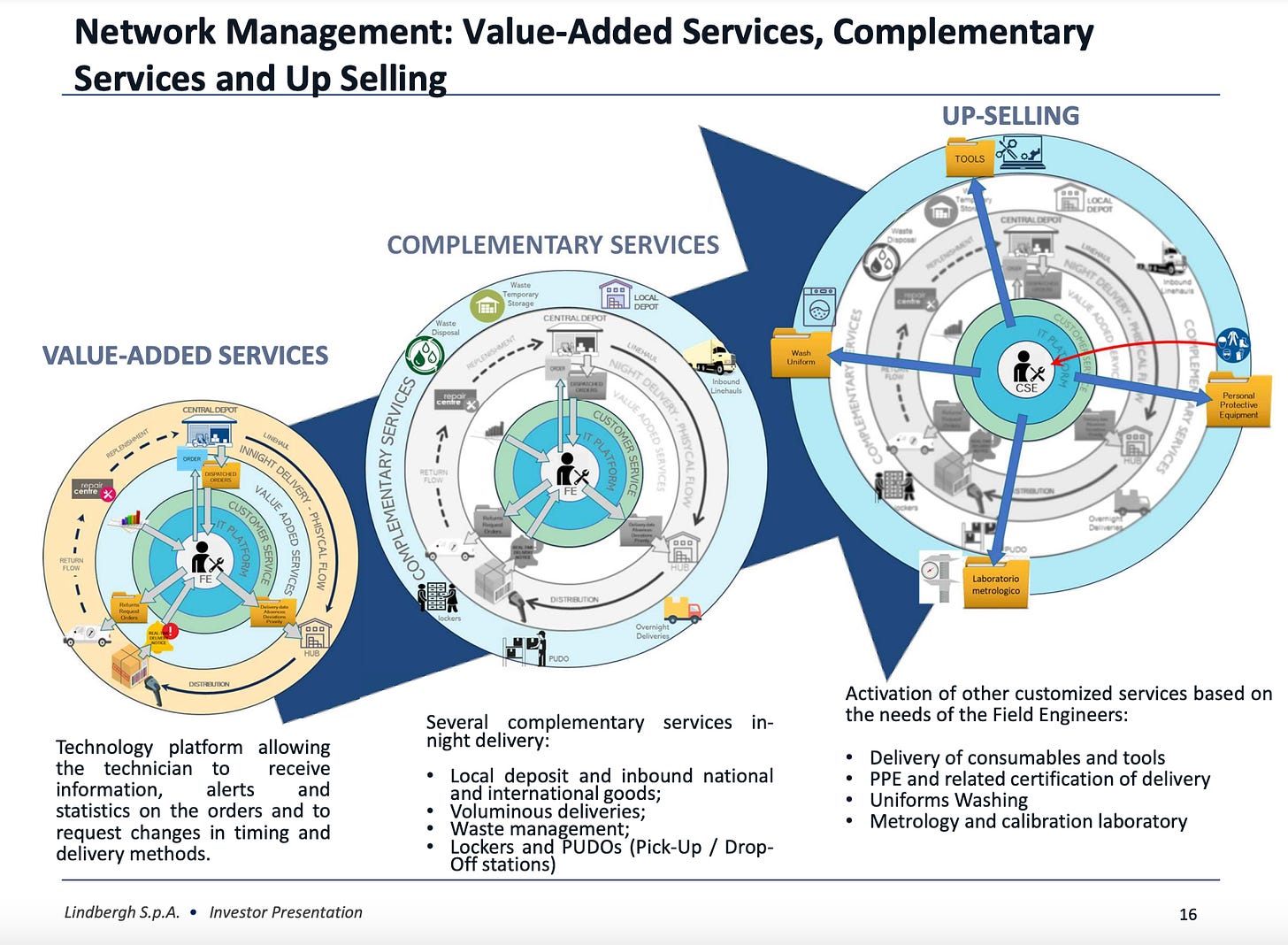

It first started with the delivery of spare parts, but over time the customers asked for additional services like:

management and repair of returns

the returns are collected from the engineers’ van and immediately delivered to the warehouse or repair center

PPE (personal protective equipment) supply

every hour that an engineer spends looking for gloves, overalls, work shoes, equipment and accessories in PPE warehouses is an additional cost for the company, which translates into reduced productivity and efficiency

the technicians can order the PPE they need directly from a catalog in the T-Linq app

Lindbergh delivers the order overnight directly into the van of the technician

washing of work clothing

laundry, sanitizing and repair service for overalls, uniforms and other workwear

the technician can order the service via app and the fresh overall will be delivered into his van within the time established

tool testing

tools such as digital multimeters, torque wrenches, measuring gauges, pressure gauges, scales and Megger testers require periodic but constant testing and checks, which are necessary to keep them perfectly efficient and compulsory to meet the quality certification requirements

managing these testing and reconditioning activities promptly and accurately takes not only time but also a structured organization and properly trained personnel

with Lindbergh, there is no need to deliver the equipment to a specialist center as Lindbergh has its own metrology laboratory where they offer the first on-demand service for calibration and operation testing

customized / on-demand services

all supplies can be agreed upon according to the needs of the company and its maintenance engineers

Lindbergh will set up a customized service, stocking everything the engineers need so it is ready for a last-minute delivery

All these services have one goal: To save the valuable time of the technician so that he has more time for his main task and is not wasted on various sideline activities. Especially in the current time of shortage of skilled workers, this creates real value for the technicians and ultimately the customers of Lindbergh.

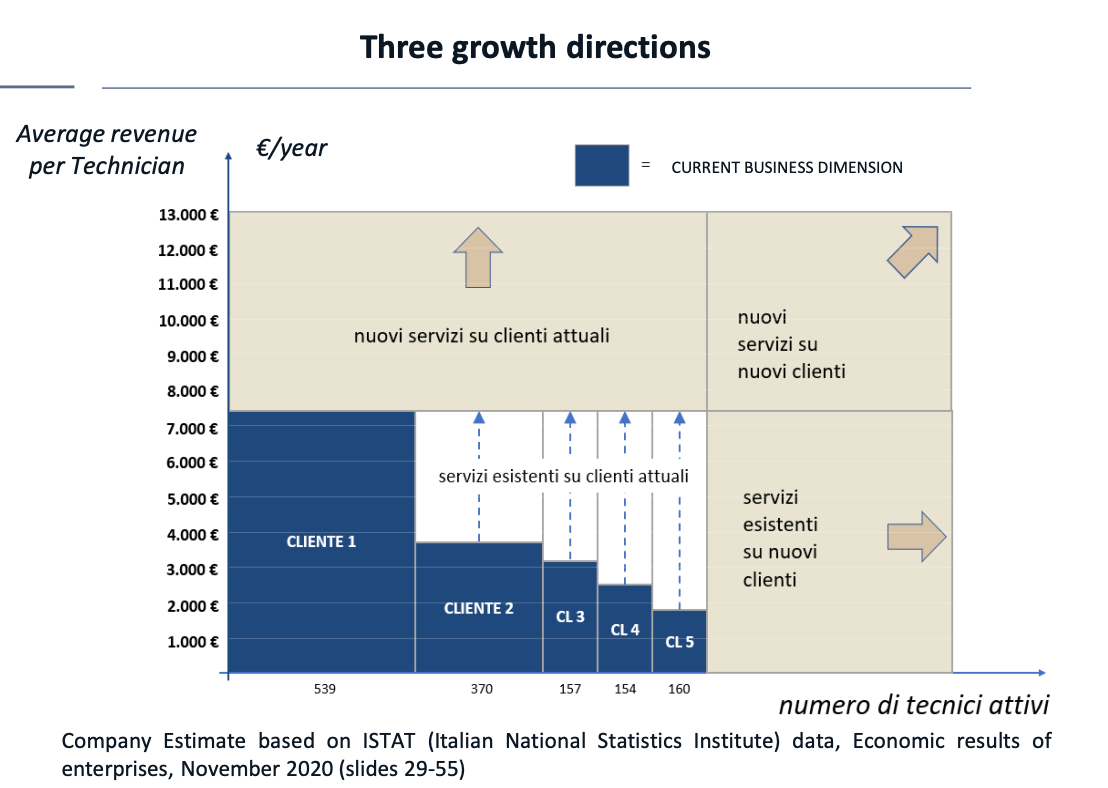

These value-adding services have substantial up-selling potential. In the past, Lindbergh was able to constantly increase the revenue per technician. Since the main costs (delivery costs to the technician’s van) are covered by the core delivery, every additional service increases the margin & profit for the whole delivery. The focus on the technician and his needs and not solely on the pure delivery is what makes Lindbergh unique. While traditional logistic companies focus on the number of deliveries, Lindbergh focuses on the number of technicians they serve.

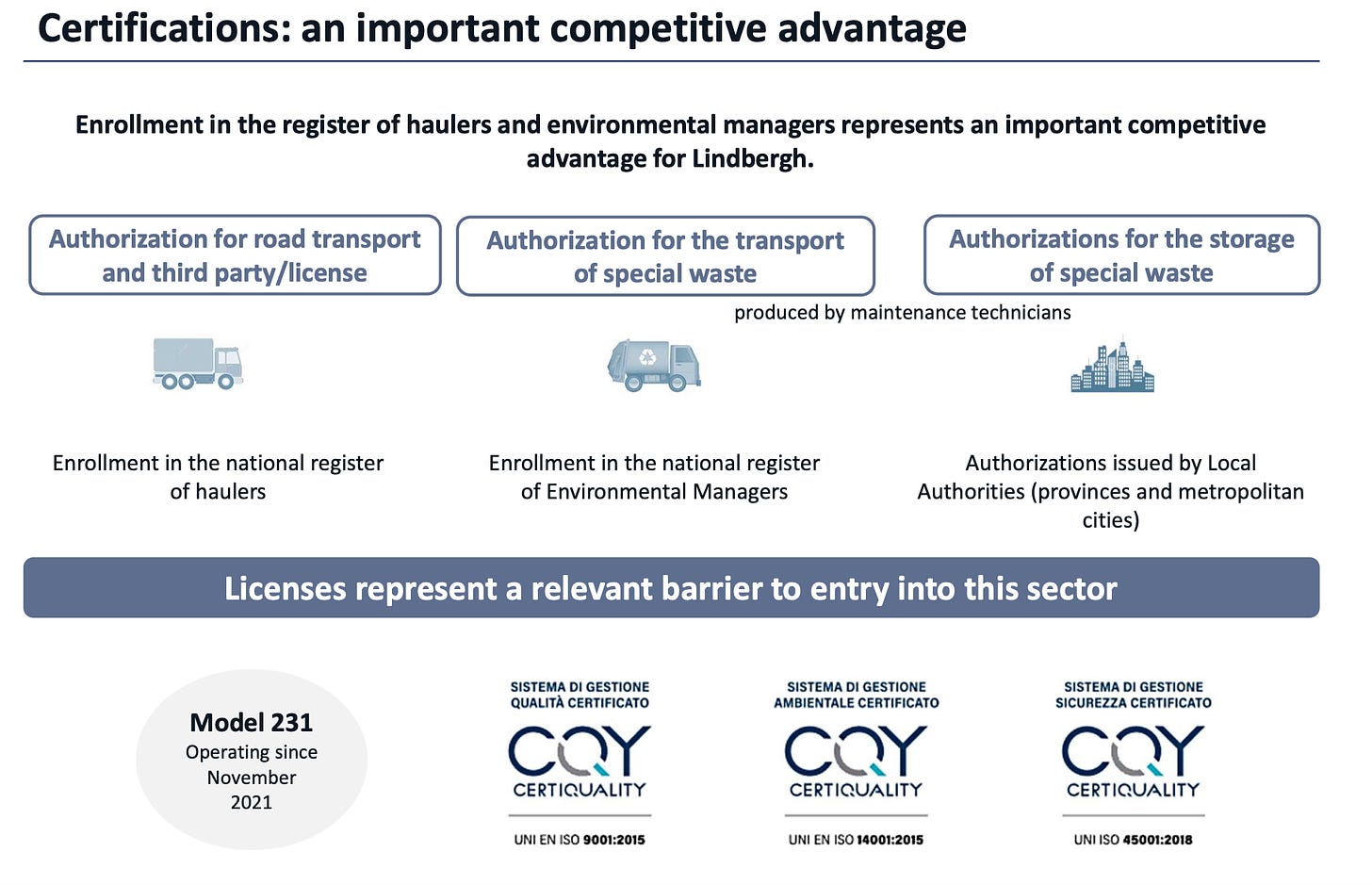

Waste Management: Lindbergh offers consultancy for each type of waste produced by the engineers like spray cans, waste oil, batteries, chemicals and other polluting materials. Lindbergh collects this special waste and disposes it thanks to a widespread network of certified operators throughout the country. Each package is tracked and noted in the electronic waste register, available via its platform. Lindbergh takes over the management of all administrative obligations and archiving of documents for its customers.

Warehouse Management: In 2021, Lindbergh introduced the new Warehouse Management unit, which currently has only one customer. Jungheinrich, Lindbergh’s biggest and longest customer asked them to manage an 8.000 qm warehouse for them. Lindbergh now deals with the management service of Jungheinrichs forklift fleet (storage, delivery and assembly of forklifts; verification of their functionality; washing painting and maintenance of used trolleys).

4. The Market

The company operates in the Field Service Management market within the Maintenance, Repair and Operations (MRO) market. The European MRO market is expected to grow with a CAGR of 2.05 % from 2023-2028, so no significant growth for the overall MRO market.

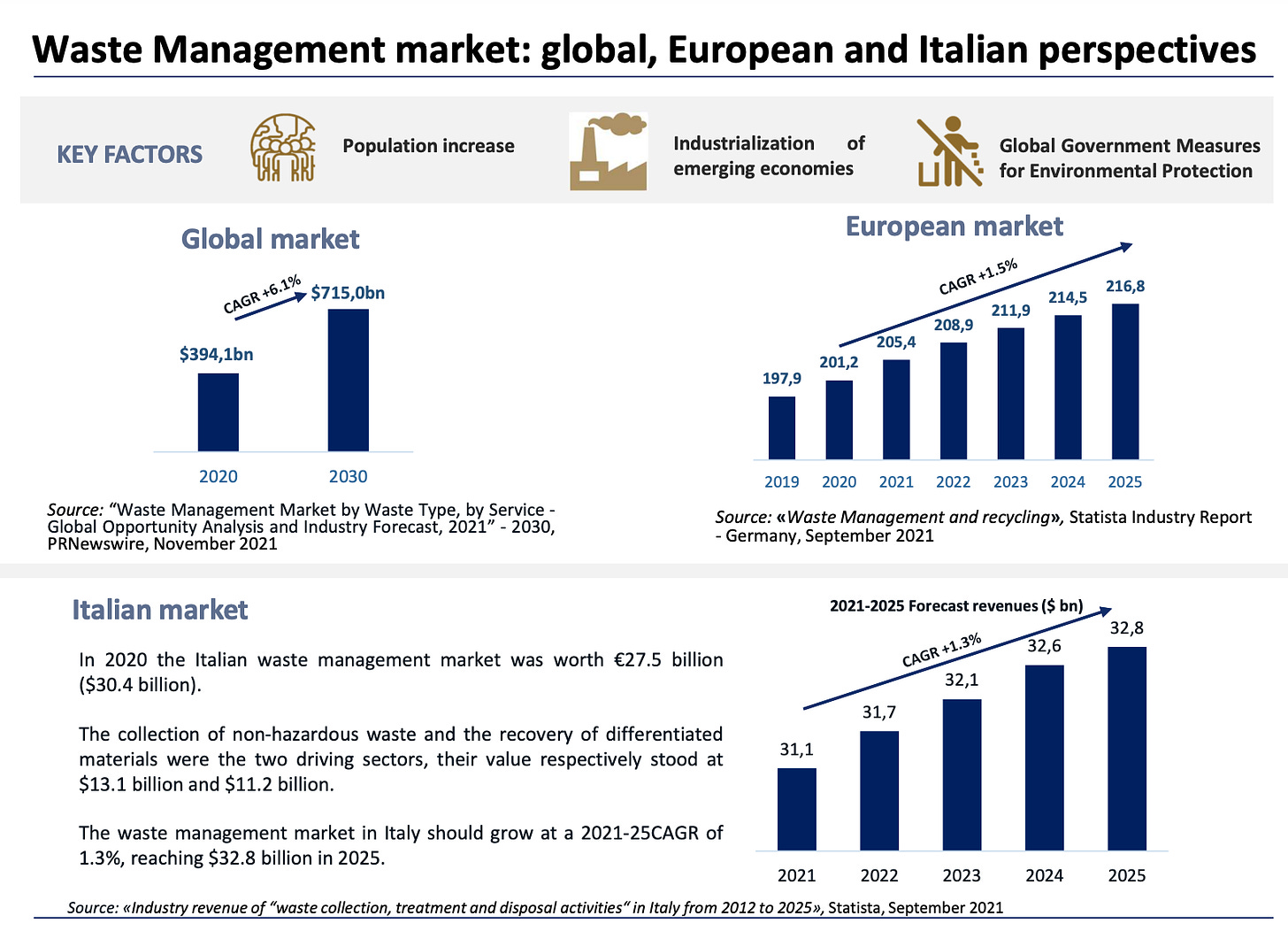

The European Waste Management Market is expected to grow with a CAGR of 1.5 % from 2019 - 2025 & the Italian market with a CAGR of 1.3 % from 2021 - 2025.

5. Growth Driver

So the markets in which Lindbergh is active are growing, but the growth rate is not high. In the past, they were able to outgrow these markets significantly and they are planning to continue to do so with the help of the following growth drivers:

Lindbergh France: The management has achieved the turnaround to profitability in France, but there is still a lot of unused potential to increase the turnover and profitability further. Despite several disruptions for their customers during the reorganization process, Lindbergh was able to renew contracts that included tariff increases (sometimes significant). Simultaneously, Lindbergh started working to increase the number of customers and to increase the volume of existing customers. They were able to add new brands, but also brands that already knew their value-adding service from Italy. Most of Lindbergh’s customers are multinational companies. So there is a high potential that they consider expanding their contracts to France when they are satisfied with their services in Italy. In H1 2023 for example they were able to add 120 new technicians in France.

In 2022 Lindbergh France generated 97 % of its revenues from transport services and only 3 % from other value-adding services. In Italy, in contrast, already 33 % of the revenues are generated by value-adding services. The average revenue per technician per year in Italy was 4.096 € in 2022, while in France only 2.307 €. So the other services are not only value-adding for the customer, they are also highly revenue-adding for Lindbergh. Considering that Lindbergh supplies more than twice as many technicians in France as in Italy, you can see how high the sales potential still is there. In March 2023, Lindbergh appointed a new general manager of Lindbergh France with the aim of implementing the waste management service. In Italy, waste management has made the company unique and contributed decisively to increase margins. So Lindbergh is working on replicating their Italian success story. If successful, Lindbergh France offers great possibilities to increase the top line and especially the bottom line.

Own technical assistance network: Lindbergh has started a process of vertical integration by offering technical assistance by themselves with the plan to become a national player in the thermohydraulic sector in Italy by aggregating small local players. In Italy, the technical assistance market is very fragmented. There are a lot of small companies with a few technicians who manage a little part of the territory. They have chosen the thermohydraulic sector precisely because there is no competition with their current client base. Lindbergh's target is to aggregate 100 technicians by 2025 organically and via M&A:

In February 2023 they acquired 52 % of Smit Srl (€400.000 turnover and €23.000 EBITDA in 2021) for €72.806 (6x EBITDA-Multiple of average EBITDA in 21 & 22). In July 2023 they increased their stake to 77.5 % for €30.2012. The remaining 22.5 % will remain with historic shareholders/founders who will stay at the company.

In March 2023 they acquired Hinet Group (€750.000 turnover and €50.000 EBITDA in 2021) for 250.000 € (5x EBITDA-Mutiple).

In August 2023 they acquired Gatti Ermanno (€700.000 turnover and €100.000 EBITDA in 2022) through their subsidiary Smit Srl. They will pay €350.000, but only for the branch dedicated to the assistance of thermo-hydraulic systems which will be spun out from the real estate activities of Gatti Ermanno.

In September 2023 they acquired 55 % of Climan Srl (€689.000 turnover and €42.000 EBITDA in 2022 and €70.000 EBITDA on average in the last 3 years) and 55 % of Idro Calor SrL (€808.000 turnover and €93.007 EBITDA in 2022 and €80.000 EBITDA on average in the last 3 years). Both companies are acquired through their subsidiary Smit Srl for a total of €192.500 (3x EBITDA-Multiple) with the option to acquire a further 25 % of Climan for €43.750 and 35 % of Calor for €61.250 until 2025.

Currently, Lindbergh directly controls around 30 technicians. The technicians will be using the same IT platform to plan and manage their maintenance activities and they will directly start to optimize all the warehouses, managing spare parts stocks centrally to achieve significant economic and operational advantages. Furthermore, Lindbergh will provide its own value-adding services to recover operational efficiency and effectiveness to improve the margins of the acquired businesses.

More Technicians, more Services, more Sustainability: Technicians are increasingly a scarce resource and therefore difficult to find on the market. This trend will be intensified in the future by the demographic change in many European countries. So companies have to find ways to increase the productivity of the technicians they have and that’s where Lindbergh comes in. They can save the valuable time of the technician by taking over his annoying side tasks.

The regulations in many areas are becoming more & more and with them often the tasks of the technicians. In the past, often the technicians/customers came to Lindbergh and asked for additional services they could take over. Lindbergh aims to further increase their service offering and especially the share of value-adding services in relation to the basic transport services.

The sensitivity of companies towards sustainability issues and circular economy projects increases. That’s why Lindbergh is planning and implementing services that must have a positive impact in terms of sustainability for themselves and for their customers. Recently they have for example closed an agreement with KION Group which provides for the complete replacement of cardboard packaging for the transport of spare parts with fully tracked and traceable multipurpose boxes. The boxes will be Lindbergh’s property and the customer will pay for this turnkey service.

Below you can see the different growth opportunities for Lindbergh. They can

increase the average revenue per technician of their existing customers by offering additional (existing) services

add new services

add new customers (technicians)

add new services to new customers

International expansion: In the past, the management often mentioned that Germany is also an interesting market for them as it’s a big market and many of their customers are also active there. But until now there has been no move in that direction. I think the management will currently concentrate on their efforts in France and their own technician network as this will probably already tie up a lot of management time. But once the French business has fully recovered, Germany could be the next step in their international expansion plan.

6. Management & Shareholders

The founders of Lindbergh are still active in the company. Marco Pomè is the Chairman of the Board. He has 30+ years of experience in logistics thanks to roles held at HP or DHL. The other Co-Founder, Michele Corradi, is the CEO and CFO of the company. He also has 20+ years of experience in logistics. Other key people are Marco Rodini (IT Director), Andrea Allegrini (Sales and Customer Service Director) and Matteo Vaccaraci (Operations Director).

The management of Lindbergh has a lot of skin in the game. Pibes Srl. is with 27.76% the largest shareholder. Pibes is 50% owned by Michele Corradi (Co-Founder of Lindbergh) and 50 % by Davide Dacco. The second largest shareholder is Pinvest Srl. with 26.42 % and the sole shareholder of Pinvest is Marco Pomè (Co-Founder of Lindbergh). Livingston Srl. owns 13.57 % of the outstanding shares. Livingston Srl. is a holding company owned by Marco Rodini (IT Director), Matteo Vaccari (Operations Director) and Andrea Allegrini (Sales & Customer Service Director). So companies related to the management of Lindbergh own 67.66 % of it, leaving only a free-float of 32.34 % which makes it even more illiquid.

The two founders received a remuneration of €95.000 in 2022 and there haven’t been additional related party transactions between the company and their founders (or their companies that own the shares) so I don’t see a conflict here.

7. Financials

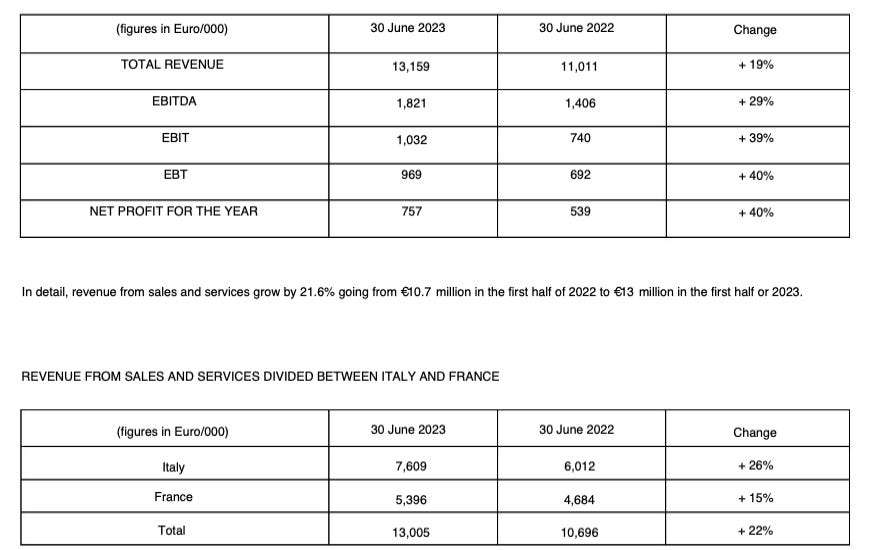

For H1 2023, Lindbergh presented the following results:

Total revenue +19 %

Italy +26 %

France +15 %

EBITDA +29 %

EBITDA-Margin of 14 % (vs. 12.8 %)

EBIT +39 %

EBIT-Margin of 7.8% (vs. 6.7 %)

Net income +40 %

Net income margin of 5.8 % (vs. 4.9 %)

Operating Cashflow +29.5 %

Below you can see the P&L development since 2019. It is striking that the margins, after reaching a top in 2020, began to decrease again in 2021 and 2022. There are two main reasons for this. The obvious reason of course is, that since September 2021, the French subsidiary has been fully consolidated and these losses reduced the overall margins of the company. Looking at the margins only for Italy in 2021, one can see that the “core” business of Lindbergh was even able to further increase its margins. But while the margins for the French subsidiary started to increase in 2022 due to the reorganization measurements, the margins of the core business decreased. This is mostly related to higher costs due to inflation. Lindbergh has long-term contracts (typically 2-3 years) with its customers and they are defined to guarantee a gross margin of around 30 % in Network Management and 35 % in Waste Management. These contracts have automatic adjustments with respect to fuel prices, but they were only triggered every six months and with higher prices every month for much more than only fuel, the inflation was eating up the margins of Lindbergh. The management immediately started to talk to its customers to adjust all those contract clauses that were no longer sustainable and they found a solution. I think this is another good indicator for a very good and sustainable relationship between Lindbergh and its customers as they could have also decided to insist on the contracts as the margins of the customers were probably also deteriorating at that time. But as the services of Lindbergh seemed to be valuable for them, they decided to help them instead. Furthermore, the net income in 2021 benefited from a tax discount of EUR 100k while the net income in 2022 was reduced by EUR 55k due to a devaluation of the value of investment funds (by applying the IAS principles). So on an adjusted basis, the drop in the net income margin would have been lower and as we can see in H1 2023, the net income margin is already back at a level above 2021.

One has to keep in mind, that Lindbergh France and other subsidiaries where Lindbergh has the majority ownership are fully consolidated but they don't own 100% of the companies and thus they are not entitled to 100% of the profits either. In H1 2023 only €11.500 or 1.5 % of the net income was attributable to minority interests. However with the expected increasing profits of the French subsidiary and the multiple acquisitions in Italy with minority interests left, one has to follow this number more closely in the coming years.

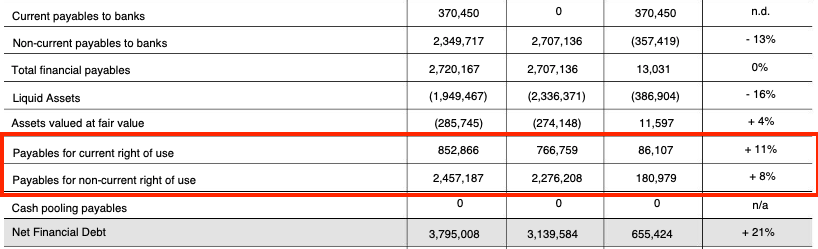

As of June 2023, the company had a net debt of €3.79 million (1.04x annualized EBITDA). This number includes €3.31 million for lease liabilities (IFRS 16). Debt related to Banking loans are €2.72 million.

With the IPO in 2021, the company issued 2.499.000 new shares at €1.70 per share and received €4.3 million. In addition, they issued 2.528.000 Warrants with the right to convert them to a maximum of 1.264.000 new shares in Lindbergh at a strike price of €2.21 until 2025. So if fully exercised, the current shareholders will be diluted by ~15% and the company will receive €2.8 million

8. Valuation

The management expects the growth rate of the revenue for the second half of 2023 to be in line with the trend shown in the first half. This would result in revenues of €26.5 million in 2023. I expect that Lindbergh will be able to continue to grow by (at least) 15 % in the following year (to €30.5 million), which is the CAGR of the Italian business from 2019-2022. Taking into account the new technical assistance companies and that there are still huge opportunities in up-selling in France, I think this is conservative. In my conservative scenario, I also calculate with the margins achieved in H1 2023 and don’t expect further margin improvements. These assumptions result in the following multiples.

After achieving a faster than expected turnaround of the French business and the introduction of Waste Management services there, I could imagine that the margins of the subsidiary will continue to improve in 2024. If the margins in Italy can even be kept stable, this would already lead to an improvement in the consolidated margins. I think an increase of the EBIT margin from 7.9 % in 2023 to 9 % in 2024 and earnings margin from 5.8 % to 7 % in 2024 is achievable. These assumptions result in the following multiples.

Considering that the company already achieved net income margins of above 10 %, we can see that there is still a lot of room for further margin improvements in the mid-term. The multiple growth drivers (see point 5) offer also the possibility that the company will be able to continue to grow the revenues by double-digits in the mid-term.

So you can get a company with double-digit revenue growth, margin expansion, a proven business model with long-term & recurring customers and excellent management with skin in the game for a low double-digit earnings multiple.

9. Risks

Customer concentration: The biggest customer of Lindbergh has a share of around 30% of the group’s revenues and the top 15 customers of 85 %. So losing one of these bigger customers would have a significant impact on the financial situation of the company. But Lindbergh has decade-long relationships with their most important customers and is integrated with their T-Linq system in their workflows.

Own technician network: While the plan to become a national player for technical assistance services can be a huge growth driver, it is also a risk. While the expansion in France was in a field they already had a lot of experience in, it is completely new for the company to carry out service work with their own technicians. It can be expected that Lindbergh will further acquire small companies in this sector. The integration of multiple companies at the same time, in a sector where the management has no experience, is not an easy task. For example, the management admitted that they underestimated the linguistic problems in France, a new market for them. I think this is the main reason why most of the acquired companies were bought through their Smit Srl subsidiary, where Lindbergh only owns 77.5 %, but where an experienced management owns the remaining 22.5 % that will stay on board and where the Lindbergh management can profit from their sector knowledge

HR management: It is not easy for Lindbergh to find suitable employees to carry out their activities in the field. In 2022 the service level (albeit at a high level according to management) declined. Lindbergh has started a Stock Grant plan for employees and corporate welfare initiatives (shopping vouchers of up to €1.200 per year & vouchers of €500 for every employee who will have a child in 2023) to maintain and attract qualified staff.

Lindbergh France: As already mentioned, France is a different market than Italy and the management had to learn that they could not that easily copy & paste their model. They first had to learn French to have acceptable working relationships. Additionally, in France, Lindbergh relies more on partners for their delivery network. So it’s more difficult to have control of the quality of their services. It is unsure if Lindbergh France will ever be able to achieve similar margins like the Italian business.

10. Summary

The founders of Lindbergh have established a company that creates real value for its customers. The long-term relationships with its multinational large clients underline this. By listening to the needs of workers in the field they were able to expand the business from a simple delivery service to a single point of contact for technicians. The management has demonstrated that they can improve by being willing to acknowledge their mistakes and learn from them. The goal of becoming a leading national player in technical assistance is a huge growth opportunity and risk at the same time. In this regard, shareholders must have trust in management to make sound decisions. If this is the case, Lindbergh is an interesting high-quality company that can grow its revenues by double-digits for multiple years and earnings even faster that you can currently buy for a low double-digit earnings multiple.

Thanks for the great write-up. Would like to get your thoughts on the valuation - for a micro cap of this growth profile, would you think the 9-10x EBIT multiple not offer sufficient margin of safety?

Great write-up, really liked reading it.

I was wondering if you have any insight into competitors and what makes this company really unique. I.e. what is their competitive advantage?