Welcome,

in this new “Investment Strategy” series of Under-Followed-Stocks, I will write a bit about my generally used investment process. How do I find new investment ideas? How do I select the best ideas? How do I attempt to avoid “FOMO” and how do I get the latest information about the companies I already own? Over time I developed a more or less standardized process. As always when I write in the “Investment Strategy” section of this substack, it is a more personal write-up. So keep in mind that the process is not perfect, it just currently works for me. I’m constantly learning and thus my process also evolves over time.

I decided to split this topic into multiple parts as I realized that the “idea generation” part already became quite long.

If you aren’t a subscriber yet and enjoy the content I share, feel free to subscribe so that you won’t miss any new content.

Let’s go!

1. Idea generation

Finding new investment ideas off the beaten path is something I really enjoy. Below I will present you some tools, sites and other examples I frequently use to find new ideas.

1.1 Social Media (Twitter, Commonstock, etc.)

There is a lot of noise on social media and you will find a lot of bad ideas and scammy people over there. But if you use it right, it can be a powerful tool. I was able to connect with so many great investors via Twitter or Commonstock which helped me become a better investor and also to find new investment ideas. So it’s important to find trustworthy people to follow. Accounts that mainly focus on selling you something or trying to push you into a stock are not among them. In my experience, the best accounts are not the ones with the most followers. There are many experts that focus on their niche or just a few stocks that do not even have a hundred followers. But they sometimes follow a stock or industry already for many years and are often happy to share their thoughts. So how to find these accounts?

What was most useful for me, was starting to write about the stocks I like by myself. The “experts” are following their stocks closely, so they will recognize it when someone writes about a stock they own. They will like your posts, or comment when they agree or disagree with your view. Searching for the ticker of the stocks you like and then checking out which accounts are also posting about them is another option.

Give them a follow or send a DM once you believe it is a reliable account, and then just keep an eye on the stocks they are also writing about. It is likely that their other ideas are also interesting for you. When I publish a new stock idea here at

, I also post a summary on Twitter and below the tweet I recommend some great people to follow where you can get interesting stock ideas, take a look at them :) I also started a list on Twitter with some high-quality small-cap investors with great ideas.

From time to time it is also important to muck out your followings so that your feed does not get too noisy. Focus on the best people you can find. While you probably can also find some valuable information on platforms like Instagram, Youtube or TikTok, I personally stick to Twitter and Commonstock as both allow you to search for a stock ticker and both are text-based, which I prefer as it is better searchable.

1.2 Substack / Blogs

As I like text-based formats & also more detailed stock pitches, other Substacks or personal investment Blogs are of course also important idea generators for me.

is doing a great job in rolling out new very useful functions, like the search that allows you to search across the whole platform for stocks or terms, the Chat where you can ask the writers additional questions or the recommendations where you can see what other substacks your favorite author also likes. In my opinion, Substack is less noisy compared to pure social media platforms as you only get posts into your inbox from the newsletter you actually subscribed to and not all the recommended content from the platform, where clicks and tweet impressions play a big role. It will be interesting to see how the new Substack Notes feature develops. I hope that the recommendation engine will not be purely optimized to generate impressions and clicks, but more on what is really interesting for the user. Some Substacks I can highly recommend to subscribe to when you are searching for interesting ideas: , , , , , , or just to name a few. There are many more out there!Besides substacks conventional investment Blogs of course also still exist. And I must admit that the quality of some of these completely free Blogs is incredible. The Value and Opportunity Blog is the role model for my little newsletter. You can trace the thoughts and ideas of the author back to 2010 and his skill to reflect on past situations and adapt to new ones is amazing. In addition, you get great stock ideas off the beaten path. Especially his series where he shortly covers all stocks of a country (currently Norway) are interesting when you are searching for new stock ideas. In my opinion, this blog is a must-read for everyone who wants to become a better investor. Another high-quality investment Blog is the somewhat newer Trident Opportunities Blog, where you can find deeply researched special situations and deep value ideas. For my German subscribers or everyone who is able to use the google translate extension, I can also recommend taking a look at the Abilitato Blog, here you can learn a lot about investing and find write-ups about various stocks.

1.3 Investment Communities / Stock Forums / Other Websites

In Investment communities like Good Investing, the Micro Cap Club or the Value Investors Club you can exchange with other top investors and as you often have to apply for membership (e.g. with a good stock pitch) the quality of the content is often high.

Stock Forums exist in nearly every country. Especially when you own small caps in foreign countries it is always interesting to me what the locals think about the company. So every time I invest in a new country, I actively search for a stock forum in that country. I often come across new ideas in these forums while reading something about a stock I’m actually researching. Of course, for these forums the same applies as for social media: You have to find the good contributors. Scammy people already existed before social media was a thing.

I also frequently look at some other websites where you can find interesting stock ideas. For example the European Small and Mid-Cap Awards where every year, interesting European Small and Mid-Caps are presented like Dino Polska in 2018 or Alfen in 2019. If you are searching for stock ideas that cover a special trend or are operating in an industry that you think is interesting, you can take a look at Trendlink. Especially in the small / micro cap segments, you will also find many smaller niche sites that cover the local stocks like Börsengeflüster or Nebenwert-Magazin in Germany where you can find interviews or articles about German Small Caps. It is not easy to find these small sites in foreign countries. So if you know such a site or stock forums in your country, please leave a comment for me :)

1.4 Analysts / Funds

Some analysts are publishing their research on the companies they cover. Redeye for example covers growth companies in the Nordics and publishes their research. Nordea is another research house from the Nordics that publishes its commissioned research. But please take these analyses just as an idea generator and not as investment advice. You must always do your own due diligence. Another idea to discover new ideas is looking at funds that are investing in companies you like. In my case for example the Alpha Star Europe Fund that invests in European Small Caps with high ROI. On their website, you can also see their current Live Depot which is really interesting. For other interesting funds, you often have to wait for the next investor letter or other documents to see their current positions.

1.5 Stock Screener / A-Z

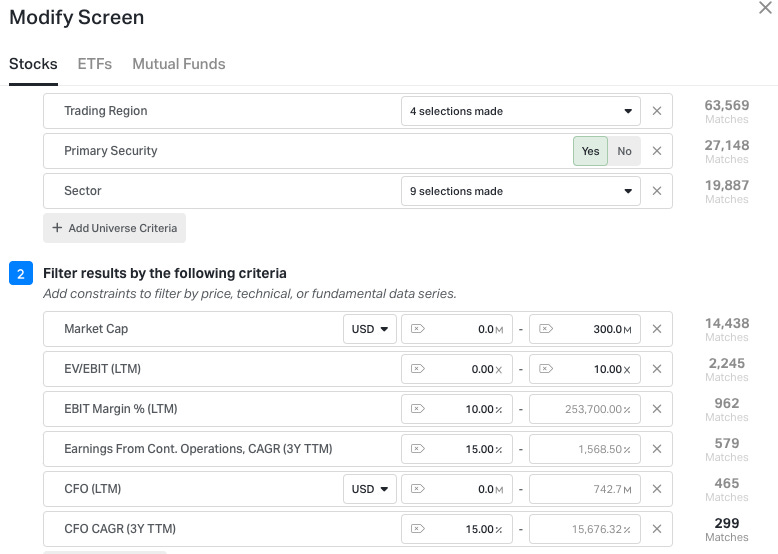

Stock screeners are a useful tool. You can eliminate industries you want to avoid & add multiple key performance indicators to select only that kind of companies you want to invest in. For example, you can search for all companies below a market cap of $300 million, EV/EBIT < 10, EBIT-Margin > 10%, 3Y Earnings growth CAGR > 15% and a positive operating Cashflow that grew by 15 % in the last 3 years (CAGR), excluding companies from Asia and that are operating in the finance or real estate sector. Applying these filters, only 299 companies are left from over 99.000 using the Koyfin stock screener (by using this affiliate Link you can get a 10 % discount on the Koyfin premium subscription).

Another method where stock screeners are also useful is the A-Z research of the stock market in a certain country. You simply look at every company that is listed in this country. For the US this is of course useless, but for small countries like Hungary for example, this is an interesting method. You can check the list of all issuers of the Budapest Stock Exchange on a lazy Sunday as it consists of only about 60 stocks.

1.6 Keep your eyes open / Talk to others

Finding investment ideas is not just about sitting in front of your computer. Go out and keep your eyes open. What are the people wearing? What are they using? What are they talking about? Your friends are currently building a house? Ask them what insulation material they use and why? Is the company listed? Believe me, these first-hand experiences are often more useful to find new trends than the newest article about how AI will disrupt our everyday life.

1.7 Meet other investors

You can go to the annual shareholder meetings of the companies you own or attend investor conferences. You will meet many other investors and most of them are happy to talk about their investments. Even when you don’t share the same investment approach and don’t like their other invests, you will always learn a lot by listening to other investors.

This was Part 1 of “The Journey from idea generation to an invest”. With all the idea generation methods I presented above the number of ideas I get is too high. In the next part, I will describe how I filter all the ideas using a so-called quick list and then manage the leftovers on my watchlist. Also, I will describe how I try to avoid “FOMO”.

Lust but not least I want to know the methods or tools you mostly use to generate new investment ideas! Especially examples of great local sites for small caps in your country would be interesting. Leave a comment here, write me in the Substack Chat or on my socials :)

Excellent post. There's a few blogs there I've never heard of before so thanks for mentioning them. Don't forget Capital Employed for idea generation too, that's our raison d'etre ;)

Great article Leon with so many useful sources for idea generation.

We are also glad that we were mentioned among other great newsletters. Thank you. 🙏