Disclaimer: The following is no investment advice. The author may own, buy and sell securities mentioned in this post. Please always do your own due diligence! Some companies are micro-caps. Keep in mind that even a small investment from your side can move the share price due to the low liquidity of shares. It's not easy to liquidate if you want to get out.

Welcome,

In this Earnings Update, I will have a closer look at the recently published results of Frequentis.

On April 8, Frequentis released its FY 2024 results:

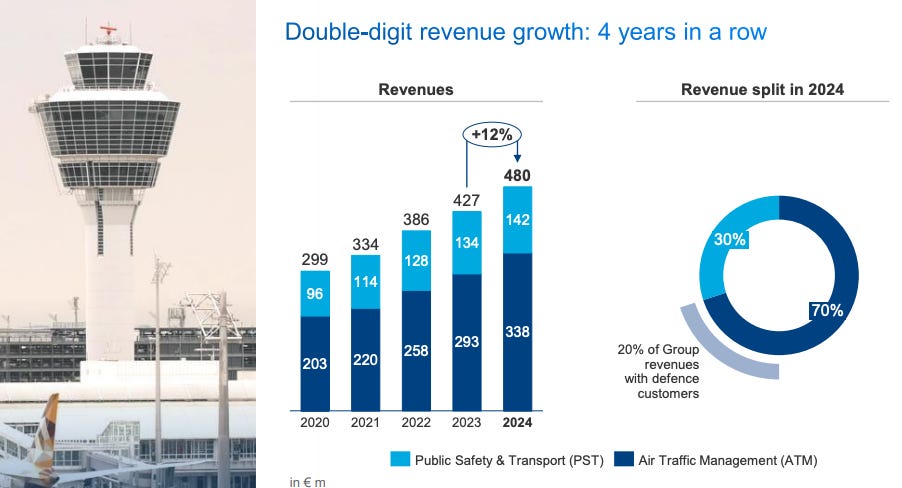

Revenues of EUR 480.3 million (+12.4 %)

Air Traffic Management / ATM of EUR 338.2 million (+15.3 %)

Public Safety & Transport / PST of EUR 142 million (+6.1 %)

EBITDA of EUR 54.1 million (+22.5 %)

EBITDA margin of 11.3 % (vs. 10.3 %)

EBIT of EUR 32.1 million (+20.5 %)

EBIT margin of 6.7 % (vs. 6.2 %)

Profit of EUR 23.5 million (+17.8 %)

EPS o EUR 1.66 (+19.3 %)

Order intake of EUR 583.8 million (+15.7 %)

Air Traffic Management of EUR 397.8 million (+15.2 %)

Public Safety & Transport of EUR 186 million (+16.8 %)

Orders on hand of EUR 724 million (+21.8 %)

Dividend of EUR 0.27 per share (+12.5 %)

Outlook for 2025:

Increasing revenues by about 10%

Increasing order intake

EBIT margin of around 6.5 % - 7%

Frequentis has more than 90 % governmental customers, spread all over the world. 62% of revenues are generated in Europe, 18% in Americas, 12% in Asia, 6 % in Asia/Pacific and 1% in Africa. As Frequentis has won some large tenders in the US, one can question whether the tariffs might be a risk for the company. Frequentis commented on this potential threat in their report:

“In the first quarter of 2025, some countries announced new customs tariffs and protectionist measures, some of which have already been implemented. The resulting distortion of both imports and exports has a significant effect on international trade and could have major economic consequences. Frequentis considers that it is well-positioned in this respect as it has many years of experience with the impact of national and other official regulations, customs tariffs, and other measures. In addition, in countries such as the USA and Australia local value-added accounts for a high proportion of local revenues, so customs tariffs, for example, should only have a limited effect on Frequentis.”

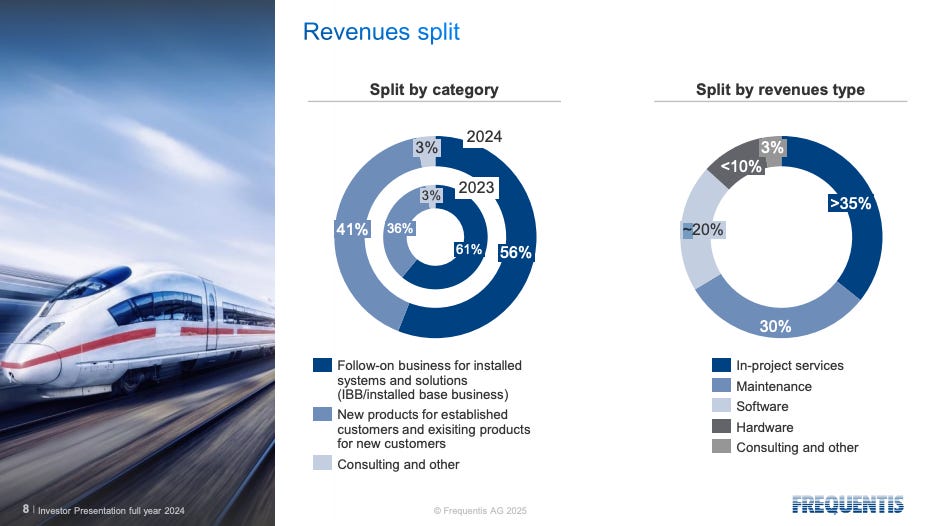

56% of revenues are generated by follow-on orders for installed systems and solutions, 41% by new products for established customers & existing products for new customers and 3% by consulting and others. Frequentis is still working on converting their product portfolio from hardware to software. As most of the customers are governmental, this process takes much more time than unusual, but Frequentis already generates ~20 % of revenues with software products.

Interesting is also that Frequentis is generating around 20% of revenues with defence customers. A number that has not yet been shared publicly, as far as I know. So it is likely that Frequentis can be a beneficiary of the worldwide increased investments in defence.

“As a result of the altered geopolitical situation, in the coming years we expect to see rising investment in military safety and security, in other words, air traffic control and air defence. However, we do not anticipate an immediate hike in order intake and revenues because procurement processes often take several years, with investment initially concentrating on hardware components (e.g. air defence systems) before these are integrated into control centres via software solutions.”

Frequentis’ ATM portfolio for the defence sector for example comprises communication and information systems for air defence and military air traffic control, systems for networked operational management and tactical networks, management and information systems, including systems for integrated use by different authorities, and encrypted, interoperable communication systems for mission-critical applications.

The order intake during the year was at a record high and the orders on hand jumped to over EUR 700 million. It is good to see that both segments increased the order intake during the year.

Let’s have a closer look at the two segments and what happened in these during the year:

Keep reading with a 7-day free trial

Subscribe to Under-Followed-Stocks to keep reading this post and get 7 days of free access to the full post archives.