#13 ErreDue SpA

High-quality traditional business combined with new business at an inflection point

Disclaimer: The following write-up is no investment advice. The author may own, buy and sell securities mentioned in this post. Please always do your own due diligence! This company is a micro-cap. Keep in mind that even a small investment from your side can move the share price due to the low liquidity of shares. It's not easy to liquidate if you want to get out.

Welcome,

in this issue of Under-Followed-Stocks, I will present you ErreDue SpA ($RDUE).

Investment Summary:

traditional on-site gas generation business with high margins (>20% EBIT margin) and steady double-digit growth

new green transition business in the large hydrolyser market at a pivotal point

high growth expectations in the new business, confirmed by a high order backlog

one of the few companies able to capitalize on the H2 opportunity while remaining highly profitable thanks to the combination of the two segments

pioneer in electrolytic hydrogen generation with multi-decade experience

25 employees collectively holding 70% of the company

Revenue CAGR of 17 % from 2016-2023 (traditional business) and expected growth of over 50 % in 2025 and beyond (thanks to the green transition business)

temporary headwinds in the domestic (Italian) industry and large investment in the new business negatively affected 2024 results, presenting a good opportunity at a low valuation

EV/EBITDA of 3.4x and EV/EBIT of 5.4x for 2025 while growing by 50 %

If you aren’t a subscriber yet and enjoy the content I share, feel free to subscribe so that you won’t miss any new content. The company write-ups I share are free. But if you want to keep up-to-date about the companies in my portfolio, you can voluntarily choose the paid option :)

Let’s go!

1. Introduction

ErreDue designs, manufactures and markets highly innovative and customized solutions for the on-site production, mixing and purification of technical gases (hydrogen, nitrogen, oxygen) for use in small, medium and large industrial sites, laboratories or medical applications. Thanks to its multi-decade expertise in electrolytic hydrogen generation, ErreDue looks well set to contribute to the energy transition process with new, larger-size hydrogen electrolyzers to be applied to green mobility and power-to-gas systems where they have already won multiple large contracts.

The combination of the two segments (“traditional” on-site generators & large “green transition” generators) makes Erredue one of the few companies able to capitalize on the H2 opportunity while remaining highly profitable.

Erredue is listed in the Euronext Growth Milan since 2022 under the ticker $RDUE. The current market cap is EUR 44 million (USD 45 million).

2. The company

ErreDue was founded in 2000 by Enrico D’Angelo and is based in Livorno, Italy. The company was able to play a leading role immediately, thanks to the background of its founder, who as early as the mid-1980s began to take a strong interest in the hydrogen market, producing its first alkaline generators. Over the years, the company added multiple other generators to its portfolio like their own “Ultrapure Nitrogen Generator” and oxygen generators. In 2016, Erredue developed the PEM technology, thanks to which it was able to diversify its commercial offerings and also offer small generators for laboratory applications.

Thanks to its internal research laboratory and collaboration with private and public entities operating in the technological and scientific research sector (in particular ENEA, of which ErreDue has been a privileged partner for hydrogen research since 2006, as well as other entities such as CNR and the University of Pisa), Erredue can be considered a pioneer in the production of electrolytic hydrogen generators. As proof of its experience in the sector, in 2014, ErreDue was one of the first companies to achieve cells capable of producing hydrogen with alkaline technology at pressures up to 30 bar, enabling significant energy savings during the compression phase, whereas in 2016 it developed its proprietary PEM technology for electrolysis, an alternative method to the classical alkaline one. Thanks to continuous research and innovation, ErreDue has developed and currently markets 33 different models of gas generation and treatment plants.

In June 2023, ErreDue purchased an additional industrial building, which, following expansion and renovation, will become the main headquarters. The new production facility, which will be developed on a total area of 16,000 m2, will contain approximately 10,000 m2 for the production of generators and their components, including mechanical ones, storage warehouses, in addition to the technical, administrative and management offices. The flagship of the new facility will be an area specifically dedicated to the construction of larger generators, equipped with special means of lifting and moving materials. In July 2024, the municipality of Livorno finally granted the authorizations for the modifications and the expected date for the completion of the works is now the end of 2025, but the production of the large plants could probably start a few months earlier.

The overall costs of the new industrial site will be around EUR 12 million which will be financed by loans of EUR 9.3 million and non-repayable grants of EUR 2.3 million. In addition, the company can sell 2 “old” buildings no longer needed for around EUR 1.5 million. Thanks to the IPO in 2022, the company also still has around EUR 20 million in short-term available funds.

Its multi-decade in-depth knowledge in the field of hydrogen electrolysis has led in the past years to more than 2,000 generators and other equipment installed in over 50 different countries for more than 2,300 clients served since its foundation.

The fully internalised know-how and production footprint (every key component is designed and produced in-house) enables ErreDue to offer customised solutions according to the specifics required by clients, allowing for competitive differentiation.

The on-site generators from ErreDue allow customers to self-generate technical gases, replacing the purchase of the product stored in cylinders, thus preventing the risks and costs associated with the transport of such gases at high pressure. To avoid higher upfront costs for its customers, Erredue also offers to rent the generators. On-site gas generation plants offer several appreciable advantages for customers, in particular:

independence from gas suppliers

greater safety, as they do not require storage in high-pressure tanks

no costs for transporting the cylinders, with the related reduction in environmental impact

constant gas quality, without fluctuations due to different gas batches or contamination of the same

no interruption in production operations for the replacement of gas cylinders

no waste of gas due to the low residual pressure inside the cylinders

immediate savings with the rental formula option

Technology & Products

Technology

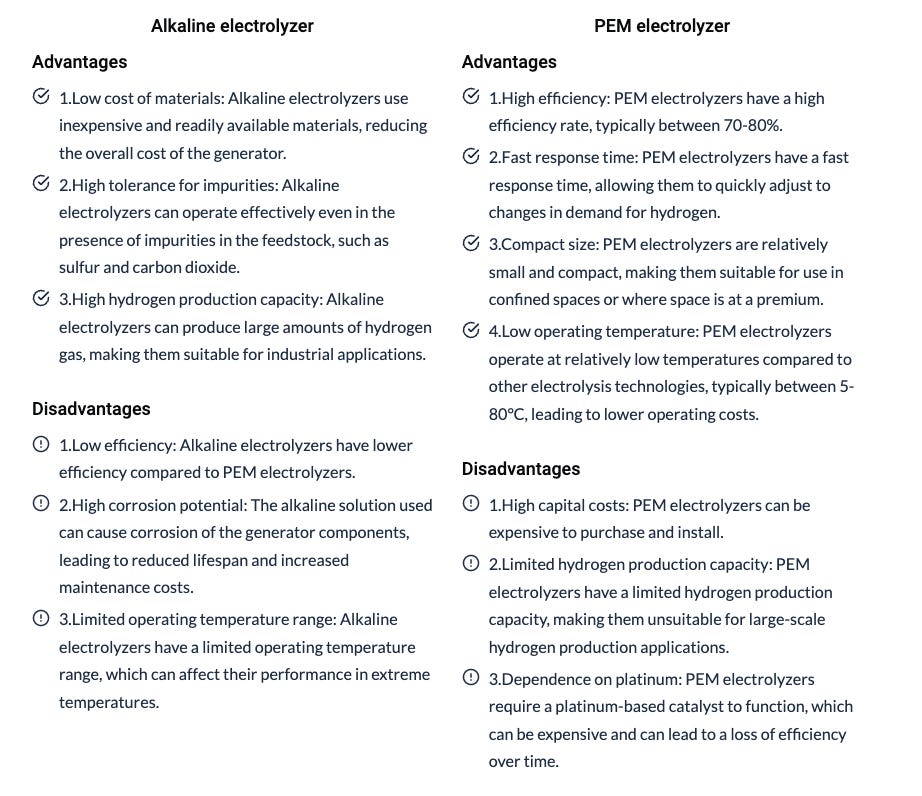

The technology used by ErreDue for the production of gas generators is based on the development of electrolytic cells. Electrolysis is a process that uses an electrochemical device called an electrolytic cell to produce hydrogen gas by splitting water molecules as the raw material, releasing oxygen as the only waste product of the process.

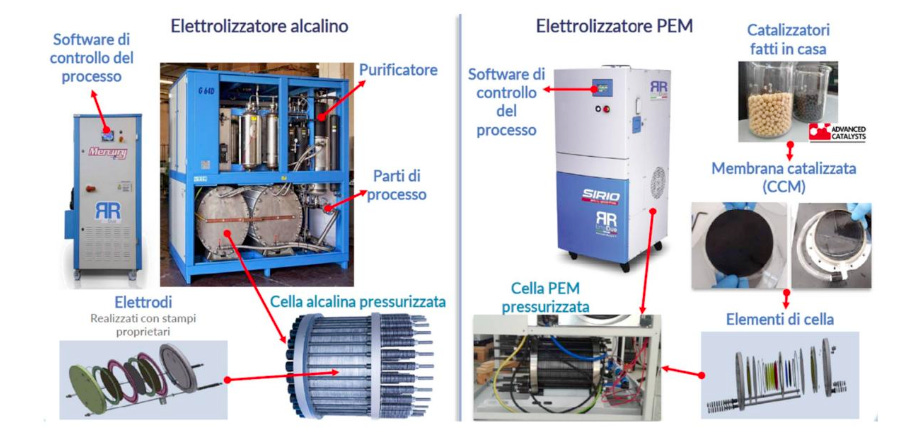

Electrolyser generators are mainly made of five key parts:

Electrolytic cell: the heart of the machine, ErreDue developed 7 cell models (5

alkaline and 2 PEM) for different equipment models optimised for various end-

applications. The alkaline cells feature polymeric components then stacked

together, produced with proprietary molds, designed in-house. PEM cells feature

membranes that are catalysed with internally researched and produced

catalysers

Electric system: Internally designed and assembled

Software: Fully internally developed, both for process control, and remote control

once installed allowing for constant performance monitoring and predictive

maintenance

Process components: Tanks, tubes, manifolds, generator sealing plates (both for H2 cells and N2 generators); produced internally in the Lavaiano “workshop” plant

Metal shell: Component without any specific know-how, whose production is

generally outsourced to clients in the metal cutting and treatment business renting ErreDue generators.

The electrolytic cells, based on the two different technologies, can be declined in different sizes, with different gas generation capacities, to meet the specific needs of the customers.

The PEM technology is more efficient and compatible with the intermittent power supply provided by renewable energy sources but it’s also more expensive as precious metals are needed. ErreDue will soon publish the results of a research project aimed at replacing precious metals with something less precious, which will Erredue enable to reduce the costs of the stacks and increase the margin. Additionally, Erredue is developing a new PEM cell with high current density for megawatt PEM electrolyzers.

On the other hand, alkaline technology is cheaper and the better choice if the main production line has a parallel production line that requires oxygen, which is a secondary product of alkaline electrolysis.

The management believes that in the medium-term alkaline will be better suited to meet the demand for 1 to 5 MW plants, as alkaline production costs, and therefore sales prices, are currently significantly lower and it is a mature technology with performance levels largely supported by data (e.g. electrolytic cell life, maintenance frequency, etc.). For the medium to long term, however, management believes that PEM will play a much more central role, given its promising performance levels in terms of energy consumption and operational efficiency and given that, through research into rare earth reduction, Erredue aims to reduce production costs without lowering performance.

Products

ErreDue produces the following families of products:

Industry

Laboratory

Energy transition

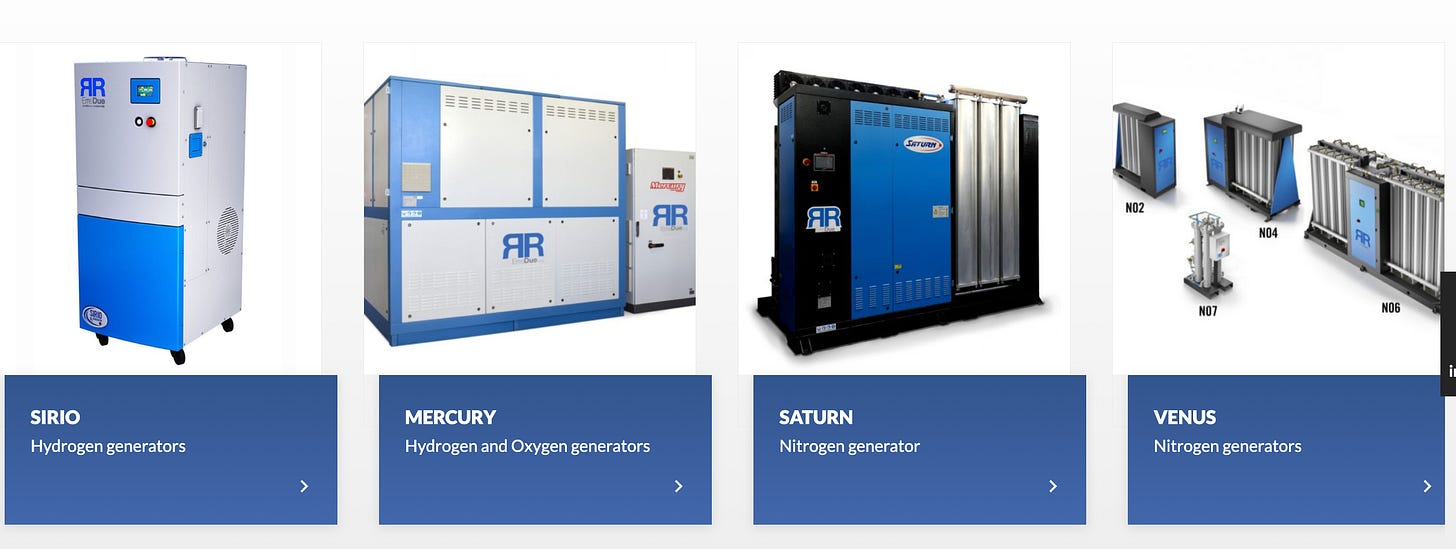

Generators for industrial applications:

Sirio: plug & play on-site hydrogen generator with very high levels of purity using the PEM technology used for heat treatment of metals or Biomethane production processes

Mercury: alkaline hydrogen & oxygen generators for any industrial need with up to 1MW production

Saturn: ultra-pure nitrogen generator with a purity of up to 99.9999%

Venus: modular nitrogen generator with automatic regeneration so that maintenance work is minimized

Nitrobox: simple and compact plug & play system for producing pressurized nitrogen directly where it is needed for laser cutting and other applications

Mizar: oxygen generators using PSA technology with automatic regeneration so that maintenance work is minimized

GN INOX: pure nitrogen generator (up to 99.9999%) for all those applications where special attention to hygiene is required in addition to gas quality

Others: gas purifiers, electronic mixers, special applications

Generators for laboratory applications:

This is the miniaturized declination of the entire offer of ErreDue systems such as ultrapure hydrogen generators (Mars), nitrogen generators (Galileo), oxygen generators (Gemini), pure air generators (Orio P-Series), air purified from hydrocarbons (or pure air generators, Orio Z-Series). PEM technology is particularly useful for these machines due to the possibility of miniaturizing the system, thanks to the elimination of additional components to balance hydrogen and oxygen.

Generators for the energy transition:

The energy transition requires a trial period utilizing smaller MW-scale facilities. That’s why ErreDue will focus on the niche of 1-5 MWplants. During 2024, Erredue continued its development activities for the construction of plants for the hydrogen production with alkaline electrolysers of 1 MW and above. They have already received some important sales orders for modular plants with increasing capacity with the first delivery scheduled for the end of 2024. In addition, the first PEM Megawatt generator will be delivered in the first 6 months of 2025. In November 2024, Erredue signed another agreement for two 1 MW PEM generators to Agrobiofert as part of an “H2 Farm” project, worth EUR 3.4 million. The delivery is scheduled for December 2025.

If this Under-Followed-Stock sounds interesting to you, you can have a look at my full portfolio with this 1 day free trial for the premium subscription. In addition, you always get the latest information about the companies I own and a review of their earnings.

4. Business Model

R&D

ErreDue is a fully vertically integrated company. The deep-rooted know-how of every single process and component (manufactured internally) enables the company to efficiently control costs and at the same time offer innovative solutions tailored to customer specific needs, with a fast time-to-market. ErreDue can be considered a full electrolyser supply-chain in one company and this is a key competitive advantage in terms of:

possibility of customization

faster time to market (4 months on average from order specifications to installations)

more effective R&D thanks to an all-round knowledge of the final product

more reliable after-sales services, as every component and related underlying technology is under control

R&D is the beating heart of ErreDue. The management is strongly committed to the continuous research and testing of different materials, new technologies and product applications and they have already successfully launched several innovations in their industry. The company has decided not to patent any of its proprietary technologies due to the following reasons:

as a producer of full generators and not just of a specific component, all the proprietary hardware and software in the generator are strictly interconnected and hard to reverse engineer effectively

as the underlying technologies are quite complex and testing times to guarantee product safety are very time-consuming, product imitation has been slower than the company’s product innovation pace

patenting exposes publicly the proprietary designs, without being able to enforce properly legal IP protection at the worldwide level

Therefore, ErreDue strategically prefers, at the moment, to protect know-how with non-competition agreements on key personnel, who also own company shares, and by avoiding the outsourcing of all components with relevant embedded technology. For the newer large-scale systems, ErreDue for example purchased a milling machine dedicated to special processes in order to not disclose the design drawings of these solutions to external suppliers.

Sales

The company manufactures based on clients’ demand and not to build inventory stocks. Once orders are confirmed, machines are delivered within an average period of 4 months. As already mentioned, ErreDue’s machines are offered either for sale or for rent:

Sale

If the customer decides to directly buy the machine, the contractual conditions typically include an advance payment upon order confirmation amounting to 30 % of the total contract value, which increases to 50% for machinery made with solutions that must need specific client requests. For sales within Italian territory, the balance of the payment, after deducting the aforementioned advance, is made in installments at 30, 60, and 90 days from delivery, while for foreign clients, the balance is usually settled before delivery. The machines enjoy a twelve-month warranty, which, however, does not cover components subject to wear and is typically provided ex-works from the Livorno plant.

Rental

The rental option is currently limited to the Italian territory, but could be expanded in the future. The rental of a machine allows customers to avoid upfront costs for equipment investments while it generates predictable and recurring revenues for ErreDue. Rental contracts are fully indexed to inflation and have an average duration of 65 months. At the end of the contract, machines still have a market value (even if fully depreciated), of approximately 60% of the initial one. They can be rented again to the same customer or sold to 3rd parties with a capital gain. The average payback time on these machines is around 2.6 years on average.

After-Sales

Generators can only and exclusively be maintained by ErreDue technicians, using only and exclusively components developed in-house. A highly specialised technical department takes care of clients along all the journey from plant design to installation and keeps following it in the after-market. After installation and testing, ErreDue performs continuous remote monitoring of each installed machinery, promptly performing both routine and extraordinary maintenance, avoiding sudden production stops.

After-sales services provide a steady flow of recurring revenues to ErreDue with very attractive margins, thanks to the fact that machinery's estimated useful life is around 15-20 years and the supply of spare parts typically entails nice operating margins.

In H1 2024, Erredue generated ~62 % of revenues with the sale of generators, ~15.6 % with the rental of generators and ~22 % with the sale of spare parts and services. So over 35 % of revenues have recurring characteristics.

Product-wise, the company generated ~62 % of revenues with hydrogen-related products, ~34 % with other gases (nitrogen, oxygen) and ~4 % with other products.

Around 59 % of revenues are generated in Italy, 12 % in the EU and 29 % in the Rest of the World.

5. Market, Customers & Competition

Market

Traditional business

In the traditional business, Erredue is active in all industrial verticals where technical gases are needed, which is the case for nearly all manufacturing companies. This means that Erredue is to some extent dependent on the general economic development. In Italy for example, there was a significant slowdown in the automotive and textile sectors in the first half of 2024, which have a big portion of the overall industry in Italy. And in economically uncertain times, companies tend to postpone larger investments (like for generators). Although ErreDue is counteracting this trend with its rental model and by showing the advantages of on-site gas generation, it is much more difficult to convince new customers of such a change in difficult times. For industrial applications, it can therefore be said that ErreDue is dependent on the cyclical nature of industrial development. ErreDue already generates 40% of its revenues outside of Italy, so the company is not purely reliant on the Italian market and the share outside the EU increased to around 29% H1 2024.

In the traditional business, ErreDue also diversified into laboratory applications. This market, on the other hand, tends to be counter-cyclical and kept growing in H1 2024 while the on-site industrial gas market struggled.

Green transition business

In the Green transition business, ErreDue is active in the hydrogen market for the global energy transition. The EU's hydrogen strategy and REPowerEU plan have put forward a comprehensive framework to support the uptake of renewable and low-carbon hydrogen to help decarbonise the EU. In 2022, hydrogen accounted for less than 2% of Europe’s energy consumption and was primarily used to produce chemical products, such as plastics and fertilisers. 96% of this hydrogen was produced with natural gas, resulting in significant amounts of CO2 emissions.

The priority for the EU is to develop renewable hydrogen. The REPowerEU Strategy of 2022 set out the aim of producing 10 million tonnes and importing 10 million tonnes by 2030. By 2050, renewable hydrogen is set to cover around 10% of the EU’s energy needs, significantly decarbonising energy-intensive industrial processes and the transport sector. Hydrogen stands as a key component in the EU's strategy to the energy transition, net-zero, and sustainable development.

To reach these ambitious goals, huge investments in the whole H2 industry are needed. The EU and several governments have committed large funds to support these initiatives like the REPowerEU plan, the NextGenerationEU (NGEU) plan or the National Recovery and Resilience Plan (NRRP) in Italy.

Only 5% of the cumulative clean Hydrogen production volume that has already been announced by 2030 has reached a Final Investment Decision, according to a BloomberNEF analysis, but the numbers are starting to improve.

The initial progress towards the 2030 targets has been slower than anticipated, which is a common occurrence in the early phase of such ambitious projects, especially when large governmental fundings are involved. But it seems like the numbers are starting to accelerate.

From a regional perspective, the current electrolysers’ capacity is dominated by China, although European markets will gradually rise in relevance.

To sum up, the global green hydrogen market is expected to grow a lot in the coming years. If all the countries actually stick to their targets, it is only a matter of time before the really big investments are made in infrastructure and the production of hydrogen. As we will see later, ErreDue's order intake is already showing a significant increase in this respect and this is probably just the beginning.

Customers

In the traditional business, ErreDue’s customer base is diversified with more than 2,300 customers in over 50 countries and 400 different customers on average per year. In the IPO document from 2022, one can see a detailed summary of the customer concentration. In 2021, the largest customer accounted for 4.8 % of revenues, the Top 3 for 11.5 %, Top 10 for 25.5 % and the Top 20 for 39 %. Of course with large orders/deliveries for bigger generators in one year, these numbers can vary from year to year, but ErreDue was able to continuously expand their customer base in the past.

In the Green transition business, ErreDue has two kinds of customers. The big energy companies that use ErreDue’s generators to start the pilot projects to test the hydrogen applied in several applications and the other companies that received funds from the multiple governmental/EU projects regarding H2 like for example Agrobiofert, an agricultural company that is part of the “H2 Farm” project, funded by the NRRP funds and who recently ordered 2 large electrolyzers from ErreDue.

Competition

ErreDue has a strong and consolidated presence in the sector of alkaline and PEM electrolysers, especially in the market of smaller laboratory or on-site generators. When looking for companies that offer on-site gas generators like ErreDue, you will most likely land on the website of one of the big industrial gas companies like Linde, Sol or Sapio. But these companies are actually customers of ErreDue as the logistics of transporting the gas to some of their customers is complicated so the gas companies prefer an on-site solution with electrolysers from ErreDue.

However, the market for large Megawatt electrolysers will rapidly evolve in the foreseeable future, with new emerging technologies for hydrogen production (like the Anion Exchange Membrane technology) or new entrants in the market, such as low-cost manufacturers from China that can build generators with mature alkaline technology at cheaper prices. Below you can see a compilation of some of the larger players active in the market of large electrolysers.

In this field of companies, ErreDue is a small player, but one with extensive experience in the business. That’s why they decided to focus on their niche with smaller 1-5 MW generators that are used for pilot plants of the energy companies or individual customers like Agrobiofert while other competitors are aiming for the largest generators needed once the pilot projects are approved. Nevertheless, ErreDue will have to stay ahead of the competition with its technological know-how. Especially when they are able to replace some of the precious metals that are needed for the PEM technology to reduce the costs and then increase the output of these generators, this could be a big advantage for the company.

6. Growth Drivers & Catalysts

Large megawatt plants for the generation of green hydrogen for the energy transition

The biggest growth opportunity is of course the emerging large megawatt electrolyser market for the green transition. ErreDue intends to become a recognised reliable partner for the supply of generators from 1 to 5MW capacity with their newly developed large-scale alkaline and PEM generators. Anticipating substantial demand for these types of application, ErreDue is already expanding production capacity to at least 60MW annual production, expected to be fully operational by end-2025. In the H1 2024 report, the management confirmed that 2025 will be the start-up of the first pilot plants. In the H1 2024 report, ErreDue reported an order backlog of EUR 24 million (compared to total revenues of EUR 16.5 million in FY ‘23) of which 65% or EUR 15.6 million refers to 2025. The major part of this backlog for 2025 is linked to the energy transition market, confirming the expected growth and the ability to acquire significant contracts in this market, despite the small size of the company.

Increasing market awareness of the advantages of on-site industrial gas generators

In the industrial market, on-site generators are not yet as widespread as cylinders. They represent less than 1% of the global hydrogen production and consumption. ErreDue intends to invest in marketing activities to educate potential customers, illustrating the advantages of on-site generators compared to traditional formulas for supplying technical gases via cylinders. ErreDue intends to continue to use the rental commercial proposal as an effective marketing lever, offering customers the opportunity to experience the advantages of on-site generation. In particular, this formula allows customers to avoid significant investments and allows them to enjoy immediate savings in terms of operating costs. Besides these cost savings, the on-site gas generation is also more sustainable which becomes more and more important for companies with ESG pressure. ErreDue posted a 17% revenue CAGR from 2016-2023 in its traditional business, showing that on-site gas generation is a growing market.

International Expansion

In the medium term, ErreDue intends to start a greater penetration in foreign markets, by opening branches in the main geographical areas, where it already sells its products, starting from the European countries for which it already holds all the required product certifications. The company has started an internal training program for future Country Managers, with skills in the production, maintenance and sales departments. Furthermore, the presence of local personnel with knowledge of the specific regulations of the country would allow to start proposing the rental formula also abroad, thus encouraging a further adoption of on-site, while at the moment the rental business is mainly limited to Italy. The share of revenues generated in Italy already dropped from over 65 % in H1 2023 to 59 % in H1 2024.

Expansion of the product portfolio and development of new applications

ErreDue is constantly committed to innovation and market development of its product portfolio, seeking new applications in sectors with high growth potential. With the development of their laboratory line, the company has shown that they are able to find new end markets and establish itself as a new player.

7. Management & Shareholders

Enrico D’Angelo is the founder, President & CEO of ErreDue. He has multiple years of experience in the technical gas sector and as a founder of companies. After graduating as electronic technician, D’Angelo founded several companies over the years, demonstrating his entrepreneurial spirit:

GDF, Livorno (1974-99), focusing on customer-specific solutions and product sales

Megabyete, Livorno (1981-85), exclusive IBM dealer for the Livorno area

Tecnimat (1976-86), administrative, accounting, tax and financial management

Idroenergy(1985-2000)

He was also managing partner at Bulleri Macchine Srl (1987-99).

Francesca Barontini is the company's CFO. She began working as a consultant in Livorno in 1997, focusing on legislation and technical finance facilitation for businesses. In 2001, she joined ErreDue as an employee in the Finance & Administration department and Head of HR. She was appointed Sole Administrator in 2010, a position she held until 2018, when she was appointed as the CFO.

The COO of Erredue is Emiliano Giacomelli. After obtaining his diploma as an electronic technician, Emiliano served in the Italian Army from 1993 to 1994 in the firefighting unit. In 1994, he joined Idroenergy with roles of increasing responsibility until 2000. In 2001, Emiliano became part of the newly founded ErreDue as the Chief Operating Officer, overseeing the Production, Procurement, and Logistics departments.

ErreDue’s shareholders structure is characterized by a significant degree of employee ownership, with ca. 25 employees collectively holding 70% of the Company's share capital. This ownership is distributed between the Green H2 Holding, which owns 54% of share capital, and individual direct shareholdings, making up 16%. This shareholding structure ensures that the employees are deeply invested and actively involved in the business operations of ErreDue. It should also be noted that the Green H2 Holding has multiple voting shares (2 votes per share), so even if the shareholding would be below 50% they could still control the company.

Additionally, the Company's share capital includes several institutional investors such as Arca Fondi (7%), Axon Partners (5.3%), First SICAP (3.2%), or Chelverton (2.6%), leaving a free float of only 11.9%.

There haven’t been high related party transactions with major shareholders or the management in the past and the compensation is also not exceptionally high with around EUR 140.000 for the CEO per year. A conflict of interest is not recognizable.

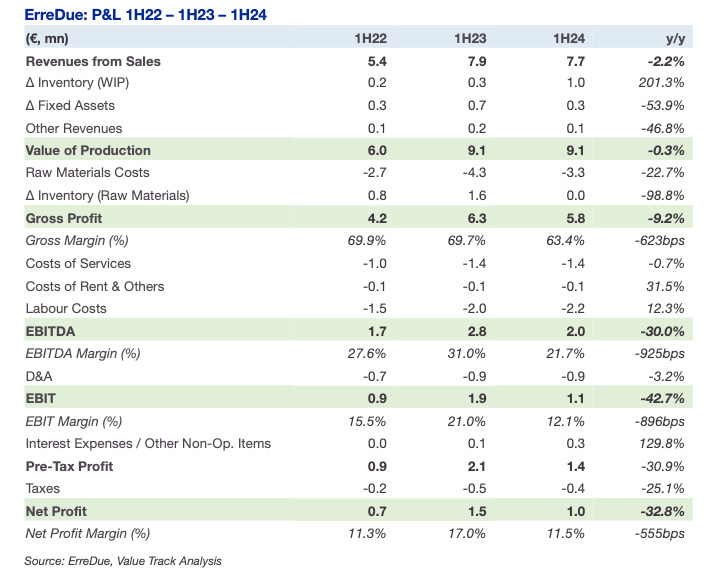

8. Financials

Erredue has a long history of organic, profitable growth with a revenue CAGR of 17 % (2016-2023), high margins, and a good cash flow generation.

Nevertheless, the sales revenues in H1 2024 declined slightly by 2.2% yoy, while the value of production was flat yoy. The reduction in sales was primarily due to two factors:

the postponement of generator deliveries at the request of purchasing companies (turnover of EUR 1 million)

a sharp slowdown in domestic demand in the traditional on-site generator sector for industrial activities, especially from the Italian automotive & textile sector

The first factor is just a temporary issue, the deliveries have taken place in the second half of 2024. Including these orders, revenues in H1 2024 would have been up by 10 %. The situation regarding the domestic demand is more difficult. In July 2024, the domestic (Italian) production reached its lowest point since the post-pandemic period (according to ISTAT). According to the management, the distrust generated by the current industrial crisis led to a postponement in the conclusion of new contracts. Due to that, the revenues generated in Italy fell by 11.6 %, while the revenues generated in the Rest of the World increased by 27 %.

Despite this significant slowdown, the turnover achieved in the traditional sector remained at a good level due to 3 factors:

the sale of laboratory generators, which due to their use are intended for so-called "counter-cyclical" markets (+13% in the first half of 2024 compared to the first half of 2023)

the growth in rents, which is less affected by the crisis as it is based on multi-year contracts (+8.50% in the first half of the year compared to the same period of the previous year)

the Aftermarket (+10.8 % compared to the first half of 2023) which is not directly connected to the sales of the period, but rather to the generators sold at any time as long as they are still active

In the hydrogen sector, on the other hand, ErreDue had a significant increase that derived from the green transition business. Sales of hydrogen products increased by 40 % yoy to EUR 4.8 million. Compared to that, revenues generated by hydrogen products have only been at EUR 1.8 million in H1 2022 confirming the growth prospects in this sector. In addition to the good increase in turnover in the first half of the year, the company has recorded a significant increase in orders for generators to be delivered in the remainder of 2024 and even more in the next year.

The slowdown in the industrial demand was particularly significant in the nitrogen sector (-58 % yoy). As the nitrogen products of Erredue have the highest margins in the product portfolio, this slowdown also affected the margins of the company.

The EBITDA was down by 30 % yoy (EUR 2 million vs. 2.8 million) with an EBITDA margin of EUR 25.7 % (vs. 35.9 %). The decrease in EBITDA can be mostly explained by three (temporary) factors:

postponement of large orders (amounting to EUR 1 million) where the costs for the production of these generators are fully included in the P&L of H1 2024, while the corresponding revenues are recorded in the second half

high R&D costs for the first prototypes of Megawatt hydrolysers which are fully expensed in the P&L

increase in the number of employees in view of the developments expected for the next few years

The EBIT decreased by 43 % (EUR 1.1 million vs. 1.9 million) with an EBIT margin of 14.3 % (vs. 24.4 %) while the net profit decreased by 32.8 % (EUR 1 million vs. 1.5 million) with a net profit margin of 11.5 & (vs. 17 %).

The management’s optimism for the coming years is underlined by the total backlog of EUR 24 million (compared to revenues of EUR 16.5 million in 2023). Approximately 35 % of the backlog refers to H2 2024 (EUR 8.4 million) and 65 % to 2025 (EUR 15.6 million). According to the management, the green transition business is able to fill the gap of the temporary slowdown in the traditional business to be in line with the analyst’s targets for 2024. In January 2025, the management indicated that they have the perception that the manufacturing industry has restarted by looking at the current backlog and that they are confident for 2025.

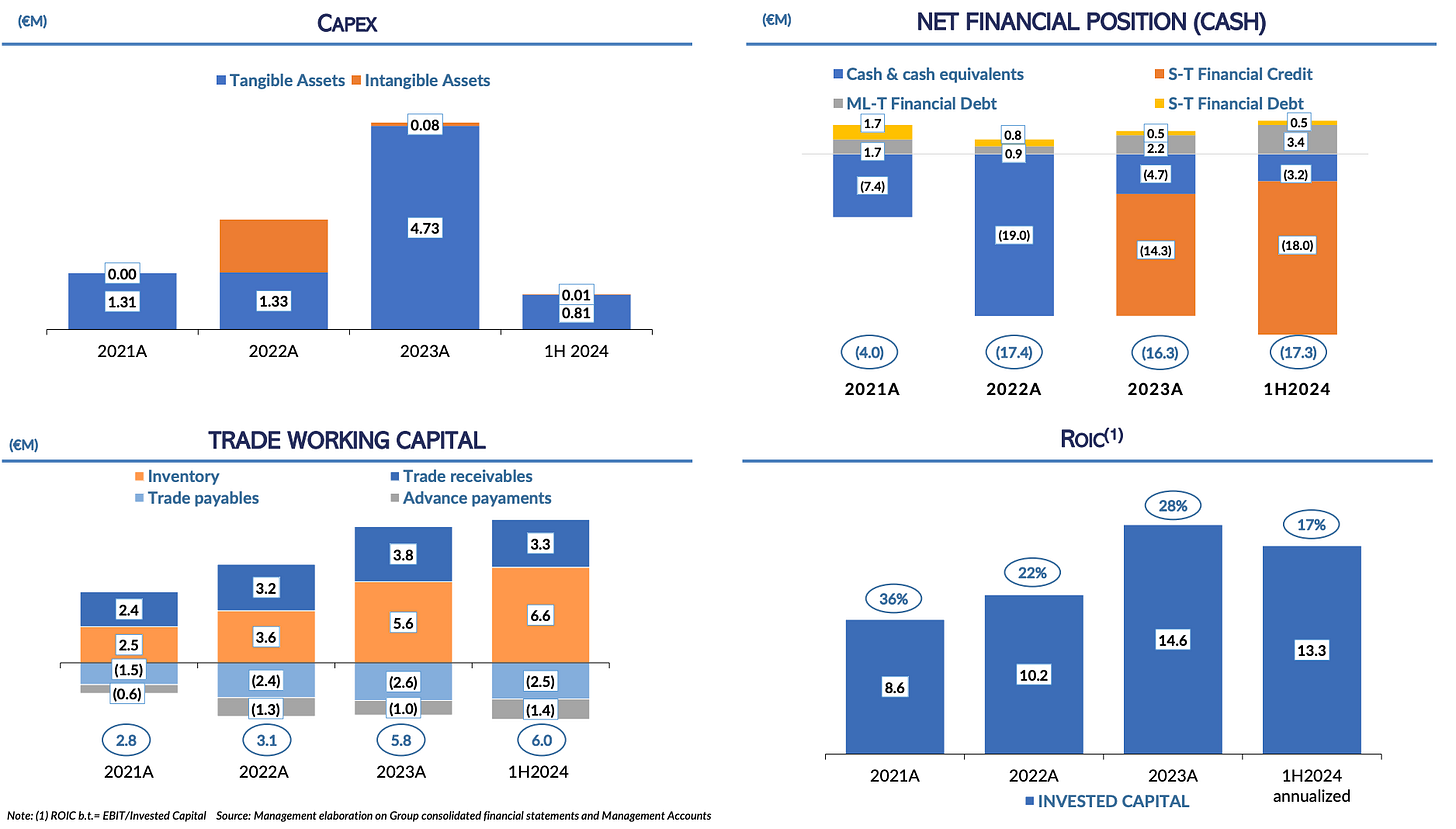

The operating cash flow on the other hand increased from EUR 1 million to EUR 2.2 million yoy (+113 %), showing the strong cash generation capabilities of the business. The net financial position of the company increased by EUR 1 million to EUR 17.3 million (37 % of the current market cap).

The ROIC decreased to 17 % (annualized) in H1 2024, compared to 28 % in 2023.

9. Valuation

ErreDue has a market cap of EUR 44 million and an enterprise value of around EUR 26 million thanks to its net financial position of EUR 17.3 million.

Despite the slowdown in the traditional business, the management is confident to reach the analyst’s targets for 2024, thanks to the acceleration in the green transition business. The robust order backlog could even mean that they could beat the analysts' targets for 2025. The analysts (consensus of 2 analysts) are expecting revenues of around EUR 18.1 million (-6.3 % yoy), EBITDA of EUR 5 million (-15 %), EBIT of EUR 2.5 million (-38 %) and net income of EUR 2 million (-41 %) reflecting the continues slowdown in the traditional business in H2 2024 hitting the profitability even more as these generators have higher margins compared to the large electrolysers as explained in the previous section.

Based on these forecasts, ErreDue currently trades at an EV/EBITDA multiple of 5.2x, EV/EBIT of 10.4x and EV/E of 13x. As it is likely that the company will spend most of its current cash position in the development/production facilities of large electrolysers, one could argue that a valuation excluding the cash position would make more sense as this cash will not be distributed to the shareholders and the returns on this invested capital could not materialize in the short(er) term. Based on the market cap, ErreDue currently trades at a P/EBITDA of 8.8x, P/EBIT of 17.6x and P/E of 22x.

Based on first recovery signs of the traditional business and strong backlog in the green transition business (EUR 15.6 million for 2025 at H1 2024), analysts are expecting revenues of EUR 27.7 million for 2025, an increase of 53 % compared to 2024. Since the publication of the H1 report, ErreDue has announced new contracts worth EUR 3.7 million, so around 70 % of the expected revenues for 2025 are already secured by the backlog at the beginning of the year. This jump in revenues is mainly related to the sale of large generators for the green transition. This combined with a return of sales for high-margin nitrogen generators, could lead to significant earnings growth in 2025, compared to the (depressed) earnings in 2024. Analysts expect an EBITDA of EUR 7.7 million (56 %), EBIT of EUR 4.8 million (+94 %) and net income of EUR 3.8 million (+92 %). For 2026, expectations are even higher, with growth expected at a similar pace, but due to the political nature of the green transition and the corresponding uncertainties, it makes more sense to evaluate the business prospects from year to year.

Based on these estimates for 2025, ErreDue trades on the following multiples:

EV/ EBITDA of 3.4x and P/EBITDA of 5.7x

EV/EBIT of 5.4x and P/EBIT of 9.2x

EV/E of 6.8x and P/E of 11.6x

A peer group comparison with these multiples to most of the listed companies active in the hydrogen electrolyser market like ITM Power, Nel ASA, Plug Power, Enapter or McPhy Energy wouldn’t make much sense, as they are not even profitable on an EBITDA level yet. As the high profitability of ErreDue is mainly attributable to the more mature on-site gas generator business, it makes more sense to also compare the multiples with other (more mature) companies that are active in a comparable branch.

Even compared to these more mature & profitable companies, ErreDue stands out in terms of valuation, margin and expected growth.

10. Risks

Uncertain development of the green hydrogen market

Growth in the green hydrogen production and electrolysis and electrolyzer solutions sector is highly dependent on increased renewable energy production, continued political and industrial commitment and the development of an adequate global outlet market for green hydrogen, with the risk that the latter will not be able to establish itself as a competitive alternative, in terms of costs, to fossil fuel-based hydrogen and other energy carriers or will not be able to do so in the timeframe envisaged by the management. The development of the market is highly dependent on subsidies granted by governments or organizations like the EU to incentivize companies to make these large investments needed for a green hydrogen infrastructure. While many institutions and companies have already committed to invest in the market, it remains a highly political decision. And as we all know, political decisions can be revoked or at least the realization of the projects take much longer than initially anticipated. Donald Trump for example announced that he will stop the Green Deal and favors fossil fuels instead of (green) hydrogen. This is likely to hamper the investments in the USA in new hydrogen electrolysers and similar could happen in the EU or member countries in the EU. Erredue plans to invest a lot in a new “Gigafactory” for large electrolyzers. If the expectations of the management don’t materialize, the company will have large overcapacities.

Technological risks / Absence of patents

The green hydrogen market is exposed to competition from other technologies that provide decarbonisation solutions not necessarily derived from currently consolidated electrolysis technologies, such as, for example, the development of “blue hydrogen” solutions based on the reforming of natural gas and subsequent capture of the carbon dioxide produced (whose production technology is supported by companies in the Oil & Gas sector). Technological development may stimulate the adoption of a number of new technologies or improve existing technologies.

ErreDue is also working on new electrolyzation technology such as the AEM (Anione Exchange Membrane) electrolysis and improvements for the alkaline and PEM methods. In the past, ErreDue has shown, that its R&D department is able to deliver disruptive developments. However, the company has decided to not secure this know-how with patents. The absence of patents could lead ErreDue’s trade secrets to be copied or replicated by competitors. However, the company does not exclude to patent specific breakthrough components, e.g. new PEM catalysers, in the future.

Competitive pressure

Competition will likely intensify on the back of the sound investments expected to be channeled into hydrogen. Some players with deeper pockets than a small company like ErreDue may adopt aggressive commercial strategies leading to pricing pressure in the electrolysers manufacturing market. Moreover, the mature alkaline process, with relatively simple manufacturing and low capital costs, may allow new entrants to carry out Manufacturing and EPC services, therefore crowding the competitive arena. International competitors from countries with lower wages like China or India could probably offer large alkaline electrolysers at a fraction ErreDue’s costs. We have seen a similar development for example in the solar market, where initially European countries have been market-leading in producing PV modules, but over time, Chinese modules became so cheap that the whole industry in Europe died as they were not able to compete against these prices. The management of ErreDue is currently seeing at least three obstacles for Chines player to penetrate the European market:

technological: Chinese electrolysers are not yet ready to be used on a production line that operates 24 hours a day, 360 day a year making them less reliable

political: The EU Commission has set a cap of 25% of extra-EU technology to recognise incentives for projects

economical: Exporting raw materials like iridium or palladium (needed for PEM electrolysers) is easier and more profitable for China now as these precious metals are very present in Chinese territory

Weak demand in the traditional business

A big part of the investment thesis for ErreDue is, that they have a traditional business, that was historically able to grow at a steady pace with high margins and cash generation. This significantly reduces the overall risks associated with the green transition market as described above. As we have seen in the results for H1 2024, part of this traditional business is cyclical and dependent on the economic situation in the industrial markets. If the industrial crisis, especially in the domestic Italian market continues, the sale of new generators will likely weaken further. On the other hand, ErreDue also has the counter-cyclical laboratory segment, and recurring revenues from the rental & after-service business. Especially the expansion of the rental business could become more interesting for customers during a longer economic trough as this allows them to directly save costs.

11. Summary

ErreDue is one of the very few companies able to capitalise on the huge H2 opportunity while remaining highly profitable. The traditional business grew steadily with double digits in the past and the various advantages of on-site gas generation will remain a tailwind in the coming years and continue to generate excess cash. This high-quality traditional business will act as downside protection for the risks that come with the high opportunities in the green transition business. There are political, technological, timing or execution risks. And some of these risks are beyond ErreDue's control, which makes them even more serious. Investing in a company that is solely reliant on a successful ramp-up in green hydrogen demand while generating huge losses in the meantime is a bet. For ErreDue, success in the green transition business is basically a free option as the downside is protected by the highly profitable traditional business and cheap valuation. The backlog already shows initial success in the new business and if ErreDue is able to reduce the costs for PEM generators by replacing rare metals with cheaper alternatives, the company would have significant advantages in their competitive positioning in the medium term. The mainly temporary hurdles in 2024 could present a good opportunity to profit from the potentially pivotal year 2025 for ErreDue.

Congrats!

You are one of the few who have actually read the write-up until the end. To say thank you, I am offering every survivor a 10% discount on the annual premium subscription, where you can see my full portfolio and get all the relevant news regarding these stocks.

Thanks for the interesting write-up. I think DeNora is in a very similar position with their traditional Chlor-Electrolyzer and the Hydrogen business.

However, I do expect the H2 business to remain very tough for the next 2-3 years.

I’m a big fan of synthetic biology, and some of the biggest projects in SAF and other applications like animal feed ingredients use gas fermentation. Do you think ErreDue may play a role in this industry? How can they compare to some of the deep pockets like Linde?

Also curious if their software is a subscription based revenue generator? Or are they purely equipment vendor with not recurring revenue?