Disclaimer: The following write-up is no investment advice. The author may own, buy and sell securities mentioned in this post. Please always do your own due diligence! This company is a micro-cap. Keep in mind that even a small investment from your side can move the share price due to the low liquidity of shares. It's not easy to liquidate if you want to get out.

Welcome,

in this issue of Under-Followed-Stocks, I will present you Elliptic Laboratories ($ELABS).

Investment Summary:

Software solution that replaces Hardware sensors with the help of AI

Reducing costs and allowing new design options for OEMs

Leading market position with 500 million devices already equipped

6 of the top 10 smartphone OEMs are customers like Xiaomi, Transsion or Lenovo

248 granted and pending patents that are protecting the IP

highly scalable business model with potential EBITDA margins of >50%

New sensor fusion solution aims to break up the Apple ecosystem

2025 will already be a record year within laptops, which will be the major driver of growth going forward

Revenue growth of 93% in 2024, reaching profitability for the first time with an EBITDA margin of 19%

clean balance sheet with net cash and no need for further dilution

If you aren’t a subscriber yet and enjoy the content I share, feel free to subscribe so that you won’t miss any new content. The company write-ups I share are free. But if you want to keep up-to-date about the companies in my portfolio, you can voluntarily choose the paid option :)

Let’s go!

1. Introduction

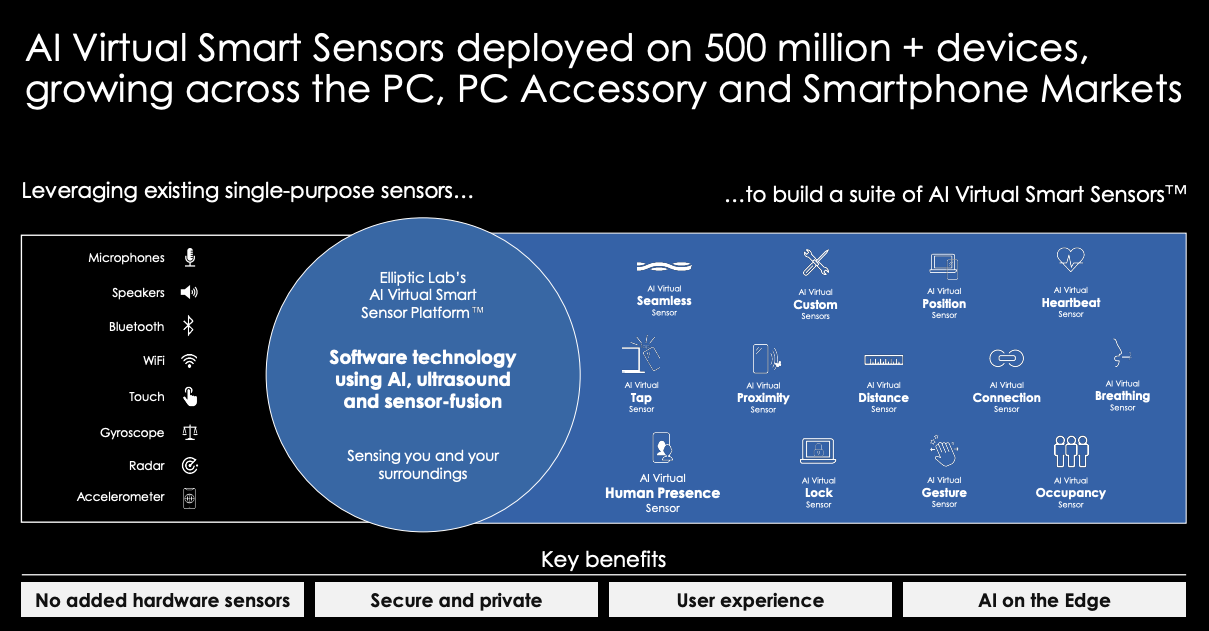

Elliptic Laboratories (ELABS) is a software company that develops and sells licenses to a patented AI Virtual Smart Sensor Platform. Thanks to the software-only sensors by Elliptic Laboratories, smartphone or laptop manufacturers can replace hardware sensors, which allows them to cut costs, reduce sourcing risks, minimize their CO2 footprint and enable new design options for the devices. ELABS uses proprietary deep neural networks to create AI-powered Virtual Smart Sensors that improve personalization, privacy, and productivity.

Some of the biggest manufacturers in the world are among ELABS customers like Lenovo, Xiaomi, Vivo, Motorola or Honor and they are partnering with companies like Intel, ARM, Texas Instruments or Qualcomm. Over 500 million devices are already equipped with AI virtual smart sensors by ELABS. No other company has deployed AI virtual smart sensors at scale.

“Our vision is to build the leading AI software platform for all user experiences, making every device smarter, more human- and environmentally-friendly.”

Elliptic Laboratories ASA had its IPO in 2020 and is now listed on the Oslo Børs in Norway under the ticker $ELABS. The current market cap is NOK 1,320 million (USD 139 million).

2. The company

Elliptic Labs was founded in 2006 as a research spin-off from the University of Oslo and is still based in Oslo, Norway. After years of R&D work, ELABS launched the first SDK for touchless gesturing on Android smartphones using ultrasound in 2013 and entered into a first sales partnership with Murata Electronics in 2014.

The business gained real traction with the presentation of its BEAUTY proximity sensor in 2016 which was able to replace hardware proximity sensors in smartphones, making them sleeker and less expensive. In 2017, Xiaomi launched the MIX phone, the first one with an ELABS sensor onboard, followed by the Mi MIX 2 which went into mass production in September 2017. Xiaomi was able to create the thinnest bezel on any phone at that time, thanks to the technology of ELABS.

In 2019, Elliptic Labs signed additional licensing agreements with 2 major Asian smartphone manufacturers and over the years, the INNER BEAUTY proximity sensor by ELABS became a dedicated solution among multiple large Asian smartphone manufacturers. 6 of the Top 10 smartphone manufacturers worldwide are among ELABS customers and to date, 166 smartphone models have been launched with its virtual sensors.

After succeeding in the smartphone space, ELABS announced a first Proof-of-Concept contract with a top 3 PC manufacturer, which was followed by the first enterprise software license contract with a leading laptop OEM in 2021. In 2022, ELABS & Lenovo jointly launched the first software-only human presence sensor on Lenovo’s ThinkPad T14. In addition to that, ELABS also started to target additional markets like IoT devices, smart TVs or the automotive market with first PoCs.

In the past years, ELABS was able to continuously add new customers, new products and the types of devices.

To accelerate growth and invest more in R&D, the company carried out an IPO in the Euronext Growth market in October 2020 and transferred to the Oslo Stock Exchange main list in Q1 2022. It is headquartered in Oslo, Norway, with a presence in the USA, China, South Korea, Taiwan, and Japan. Its technology and intellectual property (“IP”) are developed in Norway and solely owned by the company. In 2024 alone, ELABS had 49 newly granted and pending patents. They have a total of 248 granted and pending patents that are protecting the IP.

3. Technology & Products

Technology

ELABS uses existing hardware sensors like speakers and microphones or any other on-device sensors. The speaker transmits an ultrasound wave and the microphone receives the ultrasound wave. Advanced machine learning and proprietary deep neural networks are translating these ultrasound waves into contextual information. This approach offers highly accurate sensing capability that delivers up to a 360-degree field of view and works in all lighting conditions and even around corners.

The AI processing happens completely on the device as it only requires 25 MIPS and less than 100K memory which makes it highly secure and safeguards user privacy with no need for a camera or network connection.

Over the years, Elliptic continuously improved its platform, moving up the software stack of its solutions and creating more value for its customers. It started by simply replacing hardware sensors, which allowed the customers to reduce costs and power. Currently, the company is in the second phase, where they focus on device interoperability. Thanks to their AI sensor fusion solution, they can leverage the information of multiple already existing hardware sensors into completely new use cases like enabling easy “Apple-like” sharing between two devices. Going forward, they are working their way into the third phase with their partners like Intel or Qualcomm, to deliver contextual intelligence. With contextually aware AI agents, they intend to unlock actionable insights and generate groundbreaking AI-driven use cases by adapting to real-world context and user behavior.

With its technology, Elliptic is, for example, able to replace the following hardware sensors:

Infrared hardware sensors

Time-of-flight hardware sensors

Radar hardware sensors

Ultrasonic hardware sensors

Products

AI Virtual Proximity Sensor “INNER BEAUTY”: Proximity sensors are an indispensable part of every smartphone, alerting the phone to turn off the screen and to disable touch functionality whenever a user is on a call. Before INNER BEAUTY’s debut, this functionality was provided by hardware-based optical proximity sensors, which took up important device real estate, increased manufacturing complexity and cost, and required thick bezels to operate. According to the company, INNER BEAUTY was the world’s first software-based proximity solution to match and even exceed hardware-sensor performance. ELABS’ highly accurate proximity detection has already been shipped on hundreds of millions of devices and was Elliptic’s breakthrough product in the smartphone market.

AI Virtual Tap-to-Share Sensor (Seamless sensor): While the proximity sensor was the breakthrough in the smartphone market, the AI Virtual tap-to-share sensor has the potential to become the next bestseller. It allows devices to share photos, contact information and more between iOS and Android smartphones with a simple tap, all without a pre-existing connection between the two phones. With the AI Virtual Tap-to-Share Sensor, users can effortlessly tap their iOS or Android phone against another to instantly exchange information, eliminating the need for Bluetooth pairing, Wi-Fi setup, or other complex configurations. The process is fully automated, ensuring a smooth, intuitive experience for users. The solution was presented at the MWC in Barcelona in March 2025. It doesn’t only work between two smartphones, but also between a laptop and a smartphone. The new “Aura” laptops from Lenovo have the Lenovo Smart Share function, which is based on Elliptic’s technology. In the video below you can see how easy this works.

This smart share function was already recognized as a breakthrough solution for seamless device-to-device interaction and was celebrated as the “AirDrop” killer by the press.

CEO of Elliptic, Laila Danielsen, also commented on this in the last earnings call:

“Let's face it, most of you are sitting with an Apple device, a lot of you, and then you have a Mac and you have this really tight ecosystem within Apple. One of the things that we've been really focusing with Lenovo is to figure out like how can we position them to try to break up this ecosystem from Apple? Because it is important to have an ability to seamlessly interact, particularly with this iPhone. So, we've been working really, really hard to come out with a big statement to make sure that we can truly create this interoperability.”

The Smart Share function by Lenovo was presented in 2024 and it is actually less seamless than it looks at first glance, as it still requires that both devices have the Intel Uniso app. But now in March 2025, Elliptic presented the improved AI Virtual Tap-to-Share sensor that doesn’t need any pre-existing connection or work to share data and this really has the potential to become the airdrop killer in the smartphone and laptop market.

AI Virtual Human Presence Sensor: The sensor delivers presence-detection capabilities that enable a device to respond automatically when a user enters or leaves an environment. For instance, a device might “wake” itself up when a user enters the room and then go to sleep/turn off to save power when it perceives that the user has left. In addition, the automated lock of the screen helps to protect sensitive data. Typically, laptop manufacturers do this with a hardware time-to-flight sensor, which can simply be replaced by ELABS, reducing costs and materials.

AI Virtual Connection Sensor: The sensor provides a convenient way to pair and authenticate smart devices that are in the same room. It uses ultrasound to provide a quick, simple, direct, and accurate connection, eliminating the possibility of private information being accidentally received by a device in another room or even outside the building. The AI Virtual Connection Sensor also allows for easy network authentication by enabling building visitors whose devices have the sensor to join a Wi-Fi network without needing to type in a code or password, while still keeping external users out.

AI Virtual Position Sensor: The AI Virtual Position Sensor allows a laptop/display to correctly extend itself onto an ancillary device by determining the position of that device relative to the main display. This eliminates the need for users to use complicated settings menus to correctly link the displays together. The secondary display can even be moved around the main display and the sensor will correctly track its position and update the content it displays in accordance with the primary system.

AI Virtual Gesture Sensor: Elliptic Labs’ AI virtual gesture sensor is a 3D touch-free gesture technology based on ultrasound that enables simple, intuitive user interactions. It features a 180-degree-wide field of view that allows users to perform natural hand movements in the air above, below, in front of, or to the side of their device. The AI Virtual Gesture Sensor enables many types of 3D gestures that can be customized to produce a variety of effects, such as swiping the air to scroll through pictures without touching a screen, double tapping in the air to turn off alarms and take pictures remotely, and approaching a phone with one’s hand to increase/decrease its volume.

AI Virtual Vitals Sensor: The sensor detects a person’s heartbeat and breathing rates. Elliptic Labs’ AI Virtual Smart Sensor Platform leverages the increased granularity and sensitivity of mm Wave radar hardware sensors. The sensor uses AI and signal processing to successfully handle the complex process of detecting the micro-movements involved in a person’s breathing motions and heartbeats. The sensor can help to detect when a person is starting to experience respiratory distress or detect when a child is left alone in a car or just help to provide health data to the user.

If this Under-Followed-Stock sounds interesting to you, you can have a look at my full portfolio with this 1 day free trial for the premium subscription. In addition, you always get the latest information about the companies I own and a review of their earnings.

4. Business Model

Elliptic Labs is licensing its patented software to OEMs (Original-Equipment-Manufacturers). ELABS typically receives a milestone payment at the beginning of a contract. This milestone payment is a minimum fixed fee that is paid for a certain number of devices sold. Once the number of devices sold exceeds this minimum volume commitment, Elliptic generates additional revenue with every new device sold by the manufacturer to the end customer. Below, you can see a typical revenue journey for a laptop model. In Q2, the contract is announced and ELABS receives a certain amount for a minimum volume. Two quarters later, the actual product is launched on the market and then around 3 quarters later, the number of devices exceeds the minimum volume and Elliptic is getting paid a fee per device until the manufacturer decides that the model is too old and stops selling it. So if a model is very successful, ELABS also profits from it.

Due to the relatively high milestone payments at the beginning of the contract, the revenues of ELABS can be lumpy from quarter to quarter. But as long as the products that are in the market continuously increase, the lumpiness will decrease as the ongoing pay-as-you-go revenues will have a bigger share. Below you can see the number of models & products launched in the past years. The number continuously increased over the years from 1 product in 2016 to 241 in May 2025. The start in 2025 has been very encouraging as ELABS has already launched with 23 new smartphones and already secured minimum commitments for 45 additional models so far. The development in the laptop market is even more encouraging as ELABS already launched 23 of its sensors in 16 different laptop models so far, compared to “only” 15 sensors throughout full year 2024. Why especially the high number of launches in laptops is very promising will be covered in the “Growth Driver” section. So after nearly 6 months of 2025, ELABS can already announce that they will again increase the number of models launched year-over-year. And remember that from the launch date, it typically takes 2-3 quarters until further revenues per device are recognized, so ELABS will continue to profit from the strong number of product launches in 2024 and from the already very strong numbers from 2025 in the coming quarters and years. For royalty-based contracts, payments are invoiced quarterly, based on actual shipment data received from the customer.

Elliptic Labs uses a partnering and collaboration strategy. It leverages its partners’ sales organizations to identify and drive sales opportunities and also works with its ecosystem partners to embed its AI Virtual Smart Sensor Platform into their respective platforms. Finally, Elliptic Labs collaborates with these partners to create new standards for ultrasound and AI virtual smart sensors. The platform partners include Intel, Qualcomm, Samsung, Cadence, MediaTek, Knowles, and others. Go-to-market partnerships promote Elliptic Labs’ solutions to potential new platform partners and include companies such as Infineon, ARM, AAC Technologies, Cirrus Logic, and Texas Instruments.

Over the years, ELABS has also continuously improved the integration process of its products into the devices to make it as easy and smooth for its customers. In the beginning, every new smartphone model had to be manually fine-tuned, which was very labor-intensive. The process has been mostly automated between 2018-2020, which significantly reduced the manual labor needed. From 2021 on, Elliptic has developed its full AI Virtual Smart Sensor Platform, which is already pre-loaded on the chipsets of the devices. This makes it even possible that customers could retrospectively add Elliptic’s functionalities like tap-to-share with a software update to older models.

5. Market, Customers & Competition

Market

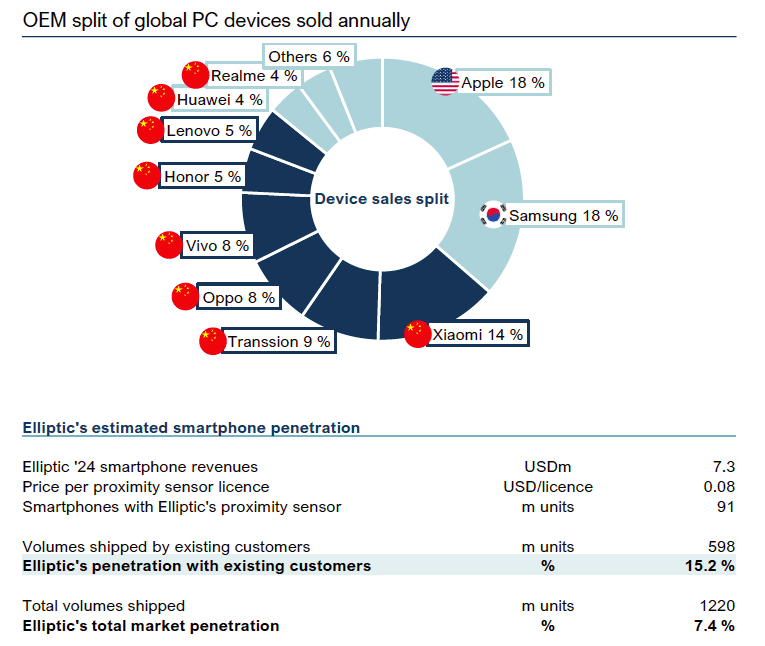

As Elliptic is selling its sensors mainly in smartphones & laptops and gets paid per device, they are reliant on the overall smartphone & PC/laptop market. After reaching a top in 2017, global smartphone shipments continuously decreased until it reached a low in 2023. In 2024, the numbers started to increase again by 7% yoy and the market is expected to continue to slowly grow by around 2% until 2028. So the market is not expected to grow fast (if at all). But ELABS was able to successfully establish its software sensor solution while the market was shrinking and to continuously increase its market penetration. Below, you can also see that ELABS customers were able to outgrow the market by 6 percentage points in 2024, which was also helpful.

Pareto estimates that ELABS only reached a market penetration in the smartphone market of 7.4% by 2024, which leaves a lot of opportunity to continue to grow fast inside this slowly growing or stagnating market.

Since 2022, ELABS has also generated revenues in the PC market. The market dynamics in the PC market are similar to the smartphone market. PC shipments reached a low in 2023 and are expected to grow slowly by 2% in the coming years. Officially, ELABS has only announced one PC OEM as a customer (Lenovo) and Pareto is estimating Elliptic’s market penetration at only 2.6% of the total PC shipments worldwide. So the opportunities in this market are even higher and as already outlined, the number of laptops with Elliptic’s sensors already increased significantly in 2025.

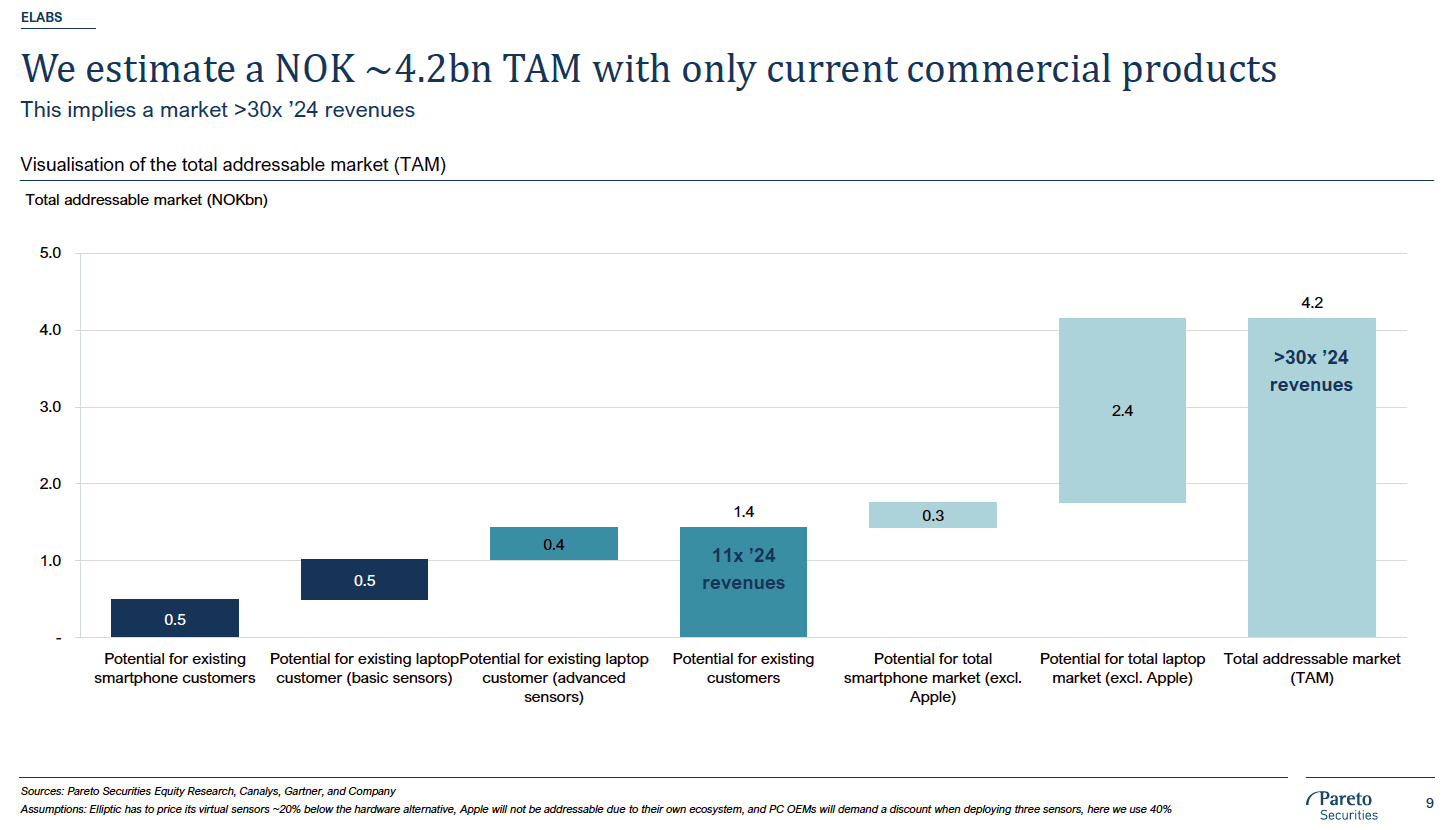

With the current offering, Pareto is estimating a TAM of USD 400 million for ELABS products, This equates to more than 30x of 2024 revenue.

Besides the smartphone and PC market, ELABS will also target the IoT/Accessories, smart TV and automotive market in the mid-term. Especially the Accessories market can be interesting as ELABS has already developed the virtual tap sensor for easy Bluetooth connection with devices. Apple devices are loved because the connection between the devices is so easy for users & Elliptic can deliver a similar seamless integration of all non-Apple devices with its solution. But as the adoption in the smartphone & laptop market took years until it took off, these new verticals will also probably take years until they can contribute meaningful revenues.

Customers

Among the Chinese smartphone manufacturers, ELABS is already well established with customers like Xiaomi, Transsion, Oppo, Vivo, Honor or Lenovo. The largest smartphone manufacturers in the world, Apple & Samsung, are not customers and it is not likely that they will become customers in the foreseeable future. But as already outlined, the Chinese manufacturers are outgrowing the “established” and in the past, all new aspiring OEMs came from China and most of them became customers from ELABS soon. So I believe that if a new large (Chinese) OEM were to emerge in the future, the chances are high that they would become ELABS's customer soon. The Chinese smartphone market is the most important one anyway and recently, China started to subsidize smartphones up to CNY 6,000, so it is likely that the Chinese smartphone OEMs continue to outperform and ELABS alongside.

As already mentioned, in the PC market, ELABS only officially disclosed Lenovo as a customer. Below you can see the list of smartphone & laptop launches since Q4 2024 and by looking at the laptop OEMs, one can see that the majority of the OEMs are undisclosed, as ELABS is not allowed to mention them publicly. Statements from the call suggest, however, that these are also Lenovo laptops and not a new laptop OEM.

The management states that they are actively working with several other OEMs and in the previous year, they mentioned that they would expect to announce a new OEM during 2024, but so far, it hasn’t happened. CEO Laila Danielsen commented on that topic:

“We are still continuing working with several OEMs. This is up to the customers' overall strategy when they're planning to launch or not. We see that for sure, the PC market is stabilizing. But for -- when we look at some of the bigger PC OEMs, there's been a lot of reorg and so forth. So -- but now we see things are stabilizing.”

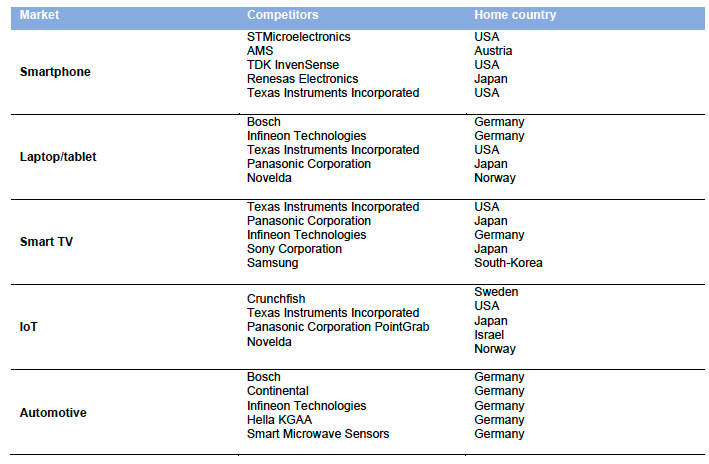

Competition

So far, Elliptic Labs has been the only company that implemented pure software-based sensors on devices at scale. So in this particular space, there is no real competition and ELABS is protecting its know-how with its patent portfolio. But other technologies could potentially offer similar solutions in the future. The new Wi-Fi standard, for example,e also offers Wi-Fi sensing which could also maybe be used to replace some functions of Elliptics sensors, but according to the management, this is not the case as this solution is not precise enough.

“Wi-Fi sensing has approved. Does it offer the same precision level as this -- the capability that we are delivering for the Virtual Human Presence Sensor? It doesn't. And let me also just underscore this and be crystal clear how -- when we are making our technology for Human Presence Sensor, there's about 30 different components and sensors on a laptop that we can leverage, including if we wanted to, Wi-Fi. However, we have looked at that ourselves because we could easily just put that -- pull that information into our Virtual Smart Sensor Platform and use as part of our Human Presence Sensor. The capability, the underlying capability for Wi-Fi is not good enough. And also with our customer, we get the feedback that Wi-Fi is not good enough. So they told us to not even spend time on it.” CEO Laila Danielsen

Elliptic’s main competitors are hardware sensor manufacturers. ELABS’ value proposition compared to hardware sensor manufacturers is that it reduces costs, supply chain risk, and the carbon footprint of devices, while giving similar or enhanced performance. Most of Elliptic Labs’ competitors are large corporations with significant financial resources compared to Elliptic Labs. Below you can see some examples of industry players/competitors.

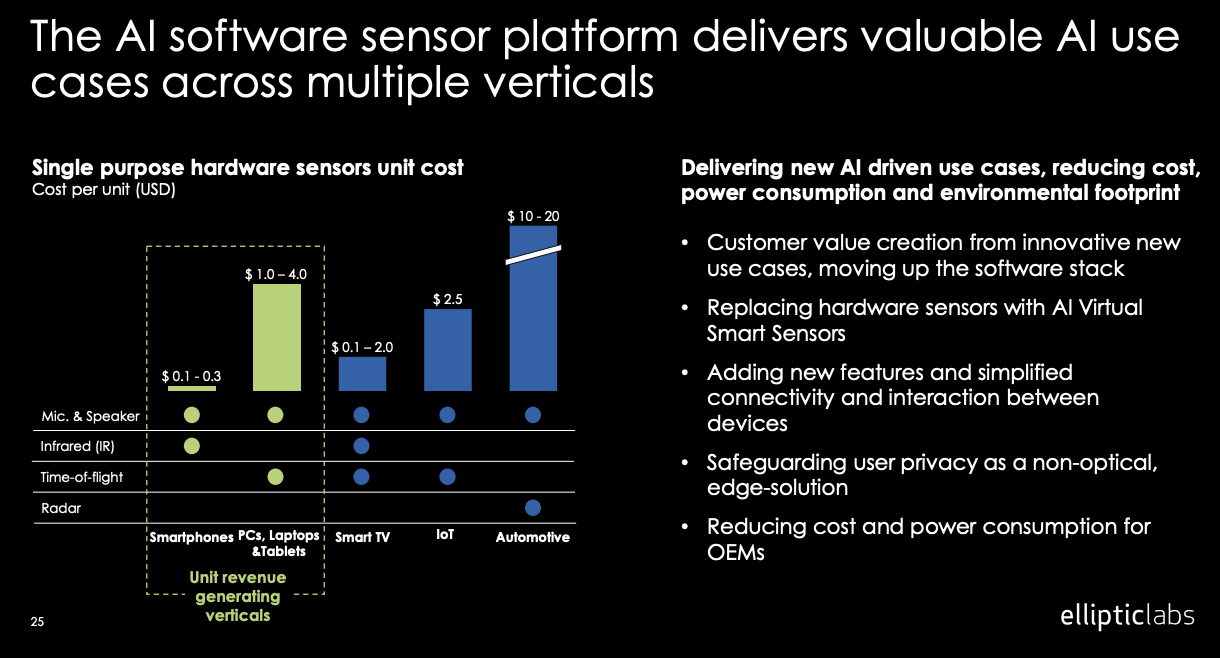

Some of Elliptic Labs’ hardware “competitors” like Infineon or Texas Instruments have nonetheless chosen to partner with Elliptic Labs as either a platform partner or a go-to-market partner, to take advantage of the enhanced performance that Elliptic Labs’ software may bring to their hardware sensors. Hardware sensors are still the default choice for many use cases and OEMs and besides the already mentioned advantages of the software alternative, ELABS of course also competes on the price of the hardware solution. Elliptic’s products are typically priced cheaper than the comparative hardware alternative. Below you can see the typical costs of the respective hardware sensors and you can also see that the average price of a hardware sensor for laptops is significantly higher than smartphone sensors.

So software-based sensors seem to be superior to hardware sensors in all aspects. Nevertheless, it took ELABS a lot of time to convince OEMs that these are reliable alternatives. But so far, once a customer has been convinced, they have continuously expanded the number of models that are equipped with ELABS sensors, starting with just one model and one sensor and then expanding to multiple models and sensors.

6. Growth Drivers & Catalysts

Elliptic Laboratories expects to reach NOK 500 million in revenues (133 million in 2024) and an EBITDA margin of more than 50% in the mid-term.

More Products

In 2016, Elliptic started with just one sensor (proximity). Thanks to its scientific background, the company continued to invest in R&D, which resulted in multiple more products. Now, they have a complete suite of a dozen different sensors for multiple applications. The new tap-to-share sensors are proof that ELABS is still able to develop sensors that evoke highly positive market reactions, and the fact that they were granted 49 new patents in 2024 shows that they are not stopping here.

More devices

In the smartphone market, Elliptic was already able to acquire a lot of the OEMs as its customers and as already explained, it is unlikely that the two largest players (Samsung & Apple) will become customers in the short term. But for Elliptic, there is still a ton of opportunities just with the existing customers as currently just a few of their models are equipped with Elliptic sensors. Pareto estimates that Elliptic’s penetration with existing customers is at about 15 %, leaving a lot of room for further growth with existing customers.

As already mentioned, customers often start with one model and then continuously expand the models equipped with ELABS sensors as you can see in the graphic below.

More customers

Besides the device expansion with existing customers, there are also big opportunities to expand with new customers, especially in the laptop/PC segment. Officially, only Lenovo is a customer of ELABS in this segment and Pareto is estimating Elliptics’ penetration within Lenovo laptops at just 10%. Compared to the smartphone market, the PC market is much less fragmented. That’s why Elliptic’s total market penetration is estimated at only 2.6%. Winning just another customer could significantly expand the market reach. According to the management, the company is in direct contact with multiple other laptop OEMs and was already expecting to present another OEM during 2024, but due to a difficult market situation in the PC market, it hasn’t happened so far. The market is now stabilizing, so ELABS might be able to present a new OEM, which could be a game changer for the company.

In addition to the smartphone & PC segment, Elliptic has also done multiple Proof-of-Concepts with OEMs in the IoT device, smart TV and automotive sectors.

Breakthrough in the PC/laptop segment

In less than six months of 2025, ELABS launched 23 sensors in 16 laptop models, which is already 50% more than in all of 2024 and it is likely that in the second half of 2025 some more models will be launched.

So it seems like the ELABS PC segment is taking off. AI-capable PCs/laptops are a megatrend and Elliptic is well-positioned to capitalize on this trend with its AI Virtual Smart sensor platform.

Recently, ELABS and Intel also expanded their long-term partnership to bring smarter, more intuitive AI features to Intel’s next-gen laptops. Together, they’re turning PCs into intelligent devices that can sense and respond to their environment, like knowing when you're present or automatically connecting and sharing across devices.

“At Intel, we believe AI isn’t just a feature – it’s a fundamental transformation in how people interact with their devices. Our collaboration with Elliptic Labs reflects that vision. Together, we’re delivering intuitive, responsive AI capabilities that run efficiently on-device, enabling laptops to sense, adapt, and respond in real time. This marks a shift from passive machines to active partners – where your PC doesn’t just compute, it collaborates with you.” - Ken McKee, VP of Customer Engineering, Intel Corporation:

Another encouraging trend in the laptop segment is that the number of devices with 2 Elliptic sensors is strongly increasing. A driver for this is the new Seamless/Tap-to-share sensor. Typically, the laptop models are equipped with a Virtual Human Presence sensor and this sensor is now more and more supplemented with a Seamless sensor as we have seen in the Laptop launches since Q4 2024.

But why can a breakthrough in laptops be a major catalyst for the company?

Let’s again have a look at the prices for the sensors of smartphones & laptops.

One can see that a typical laptop sensor is approximately 10x the price of a smartphone sensor. Currently, the main ELABS sensor placed in a laptop is the Virtual Human Presence sensor, which is a sensor that replaces the hardware Time-of-Flight sensor. And as already mentioned, when replacing a specific hardware sensor, ELABS is pricing its solution below the price of the hardware sensor. But with the new interoperability sensors like seamless/tap-to-share, ELABS is not just simply replacing another sensor, they are adding completely new capabilities to the device. That means they are not bound to any hardware sensor prices and they were able to increase prices for these.

“So initially, when you are replacing a physical hardware sensor, you are bound by the price of the hardware sensor. And then in general, we have been saying that we're going a little bit below the hardware sensor. For this, we have actually increased the price to create true interoperability. If Apple is spending like billions of dollars, the price point here should naturally be higher.” - CEO of ELABS, Laila Danielsen

So while the laptop devices sold with ELABS sensors will be significantly lower compared to smartphone sales, revenues can potentially be way higher and the laptop segment is just starting to take off. Below you can see that laptop revenues already had a big share of revenues in 2024 (41%), although the number of models was still low. But as we have seen, a lot of laptop models have already launched in 2025 and a lot of initial milestone payments for these launches are likely included in the 2024 numbers, so this might not paint the right picture.

But it is for sure that the opportunities, especially concerning revenue opportunities, are immense. Pareto is estimating that the potential TAM for advanced sensors just with the existing customer could be NOK 0.4bn, which is around 8x the revenues that ELABS generated in the laptop segment in 2024. For the total laptop market (excl. Apple), Pareto is estimating a TAM of NOK 2.4bn.

Profitability

Ellitpic Labs has a highly scalable business model and its mid-term target is to reach EBITDA margins above 50%. But this is just possible with a certain scale of the business. 2024 was the first full year for Ellitpic where they reached profitability on an EBITDA basis, thanks to the strong increase in revenues while costs were relatively stable. The biggest costs for Ellitpic are R&D costs and employee expenses. These costs can stay relatively flat while more ELABS sensors are deployed on more devices. If ELABS can continue growing the top line while maintaining the cost basis stable, they will be able to show high(er) margins and profitability in the coming years. When a historically unprofitable company turns to (high) stable profitability, this can be a major catalyst for the stock.

7. Shareholders & Management

Laila Danielsen is the CEO of ELABS since 2013. She is a serial entrepreneur and an experienced tech executive with expertise in enterprise software and technology at both Fortune 500 companies and Silicon Valley start-ups. Due to her exceptional leadership skills and strong customer orientation, Ms. Danielsen has a long history of success in bringing technology to market and building focused teams, including FastScale Technology Inc. (acquired by EMC/VMware), Scali (acquired by Platform Computing), and HotLink Corporation. She was awarded an MS at the Norwegian School of Economics and a BA at the University of San Francisco.

Lars Holmøy is the CFO since 2021. Before joining Elliptic, he served as CFO at two different international tech companies with a focus on finance, business development, strategy, and mergers and acquisitions. Prior to joining the tech industry as a CFO he worked seven years at PwC. Holmøy has a Master of Accounting and Auditing from NHH, and a Master of Law from UiB, specializing in cross-border taxation for e-trading companies, with additional international law studies from the University of Alberta Law, Canada.

Espen Klovning is the EVP of Engineering. He has more than 16 years of engineering proficiency in his position as VP of Engineering at Elliptic Labs. Previously, he was director of engineering at Cisco Systems, worked for Tandberg and was VP, R&D at Birdstep Technology. He is the author of several Institute of Electrical and Electronics Engineering (IEEE) RFCs and has written over ten scientific papers on communications protocols.

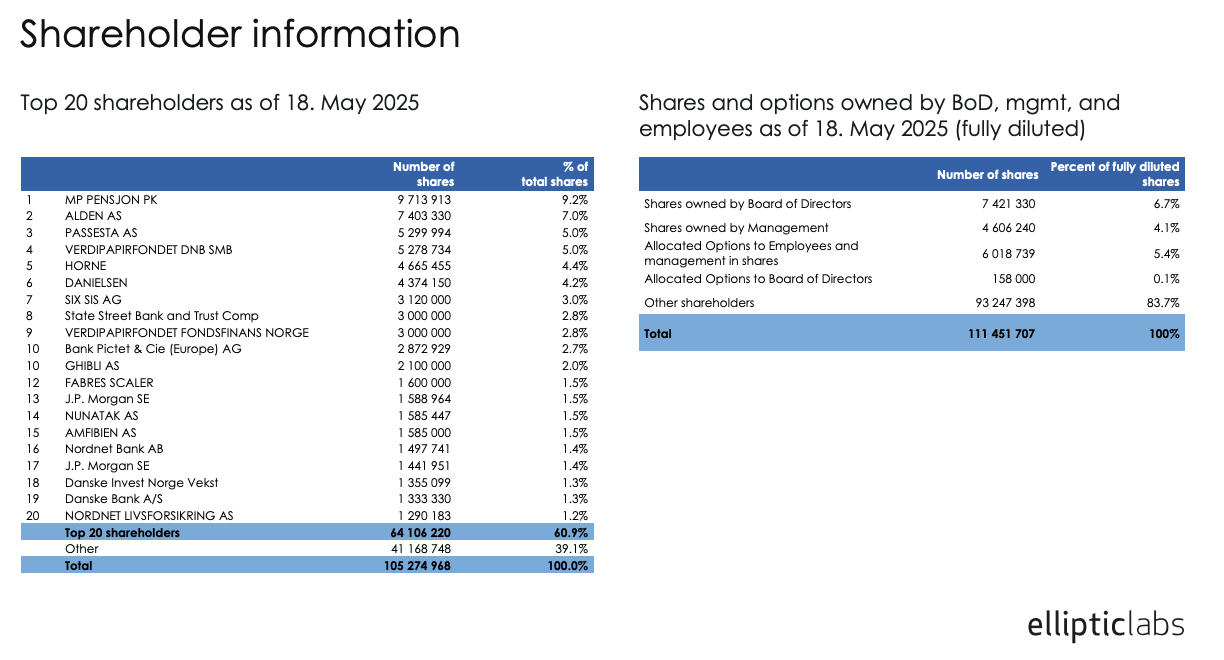

The biggest shareholder with 9.2 % of ELABS is MP Pensjon PK, a Norwegian pension fund. The second largest shareholder is ALDEN AS with 7%. ALDEN AS is indirectly controlled by Edvin Austbø, a member of the Board of Directors. The CEO of ELABS, Laila Denielsen owns 4.2 % of the company. Company insiders collectively own around 10.8 % of the company.

The company has a share option program in place that includes a total of 70 employees and 4 board members. The option program entitles the employees to approximately 5.54% of the fully diluted outstanding shares, which includes all outstanding options. The fully diluted outstanding share count on 31 March 2025 was 111,451,707.

8. Financials

Elliptic Laboratories increased revenues from only NOK 10 million in 2017 to NOK 132 million in 2024 (CAGR of 43 %). In 2024, ELABS achieved revenue growth of 93 % and EBITDA profitability for the first time for the full year with an EBITDA margin of 18.8 %.

In 2024, 41% of revenues were generated from laptops, while 59 % were generated with smartphones, showing how important the laptop segment already is for the company’s financials, although the number of deployments there is still at a low level, showing the huge financial opportunities that exist there.

In Q4 2024, they even reached an impressive EBITDA margin of 34.5 % and the operating cash flow turned positive thanks to multiple milestone payments that ELABS received for future product launches. However, as already mentioned, these milestone payments are lumpy and don’t happen every quarter in that size. Due to that, EBITDA turned negative again in Q1 2025 (NOK -1.6 million) as ELABS only generated NOK 26.6 million in revenues in Q1 ‘25 vs. NOK 47.5 million in Q4 ‘24. But this quarter-over-quarter decline is normal for the business as ELABS is (besides the lumpy milestone payments) reliant on the sale of the smartphone & laptop models. Electronic devices are usually sold the least in the first quarter, and then more and more in the following quarters, peaking in the last quarter with major events such as Black Friday or Christmas. So there is some kind of underlying seasonality in ELABS’ business. But Elliptic is full on track as one can see in the year-over-year numbers, where revenues increased by 20 % and EBITDA improved from NOK -3.3 million to NOK -1.6 million while Elliptic was able to announce again a positive operating cash flow of NOK 12 million.

The company is capitalizing some of its R&D costs as intangible assets if they meet the capitalization criteria according to accounting standards and is amortizing these over the expected useful life. If fully expensed in the income statement, the EBTIDA would have been lower in the past, which should be taken into account when looking at the profitability of the business. However, ELABS is amortizing its R&D costs over 5 years, which is not that much, so the capitalized costs will have an effect on the P&L over the next 5 years, which will lower the EBIT. So, when looking at the EBIT, one can still get a fair impression of the underlying profitability of the business. In 2024, Elliptic capitalized NOK 22.3 million in R&D work while the amortization charges amounted to NOK 14.1 million and in addition to that, Elliptic also recognized NOK 12.5 million in the income statement that is related to R&D.

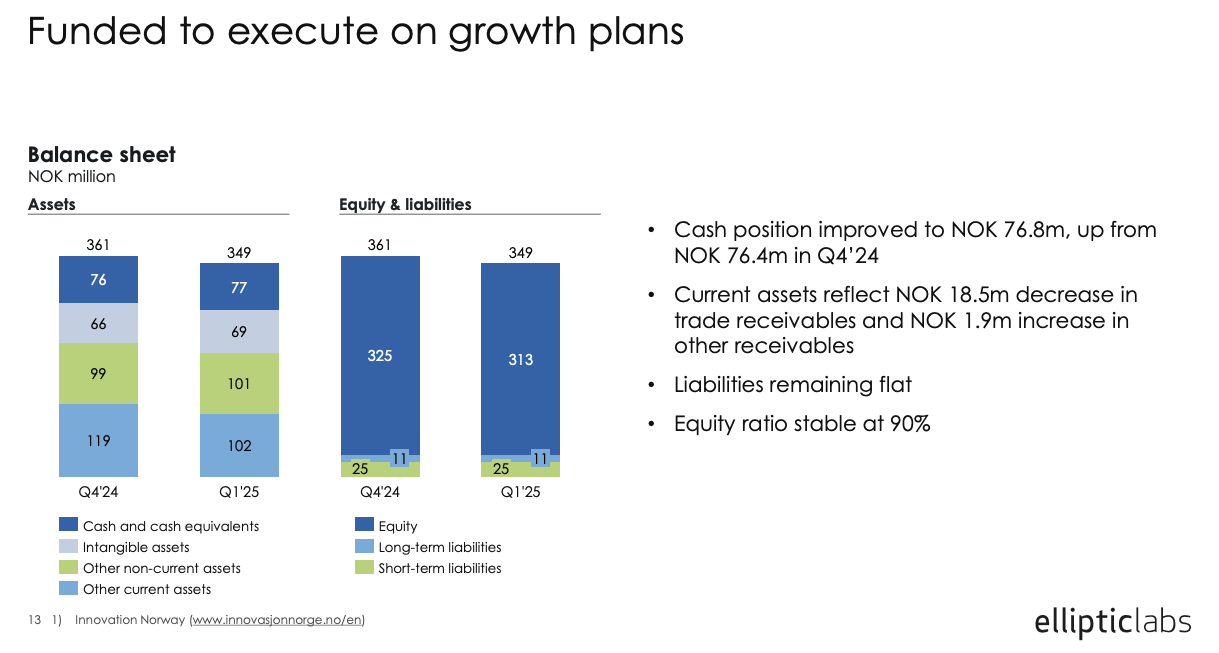

ELABS has a clean balance sheet with cash on hand of NOK 76.89 million, no long-term debt and an equity ratio of 90 %, so that there is no need for dilution to fund further growth.

At the end of 2024, the company had unused loss carry forwards of NOK 331 million. So the company will not have to pay taxes on future profits until these are used up. The value of these loss carry forwards is estimated at NOK 75 million and the company expects to utilize these remaining tax losses within the next 3-4 years.

9. Valuation

As Elliptic Laboratories is a company that is still on the cusp of profitability, it will be necessary to look several years into the future to grasp the company's true potential. Although the implementation of the products has been slower than initially expected, the company has proven that there is a large market for its products and has been able to show that its customers are gradually equipping more and more models with ELABS products. Even just with the expansion of current customers, ELABS still has a large untapped addressable market. Assuming that ELABS will reach its target of NOK 500 million in revenues and an EBITDA margin of more than 50 % within the next 5 years, it could reach more than NOK 200 million in EBIT at the end of 2030.

The assumptions are based on a more gradual growth curve, where the growth mainly comes from the existing customers that are adding more models with Elliptic products as well as some additional second sensor based on sensor fusion (like tap-to-share) in the high(er) end models at the beginning (what we already see in 2025) and then gradually in more models over the years. Based on the highly scalable business model and on the margins that Elliptic already showed in Q4 2024, the company could theoretically reach the 50% EBITDA margin probably earlier than the NOK 500 million target, but in these assumptions, a more conservative approach was chosen that margins are gradually increasing until they reach 50% in 2029.

Assuming an Exit multiple of 15x on the EBIT number in 2029, you end up with a share price of NOK 28 per share (fully diluted). This would mean a doubling of the share price by 2029, which would correspond to an IRR of approx. 17% p.a. It is very hard to estimate if and when Elliptic would be able to ship more of its (new) sensors to customers or add another OEM customer so it should be noted that these assumptions are likely completely wrong. This is just meant as a starting point for a valuation scenario, which has now to be updated once more detailed information is available.

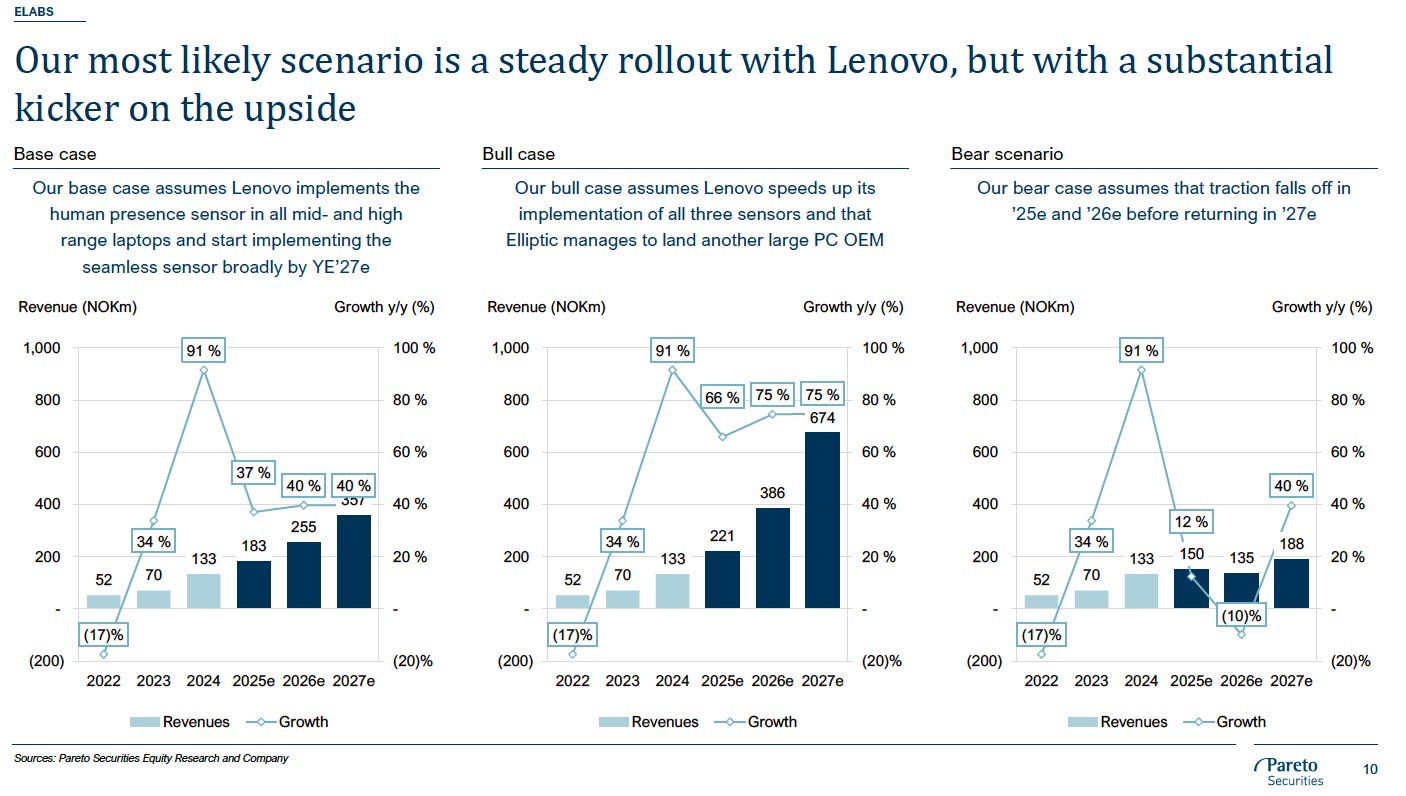

As outlined in the “Growth Driver & Catalyst” section, a new PC/Laptop OEM could have a material impact on the company’s financials. Such a scenario is not included in the previous assumptions. Pareto has developed three different scenarios in its initiation coverage. The scenarios are mainly based on changes in the PC/Laptop segment as these are the key drivers for higher profitability. In the base case, Pareto assumes that the current PC OEM, Lenovo, implements the human presence sensor in all mid- and high-range laptops as well as the seamless (tap-to-share) sensor broadly by 2027. The bull case scenario includes a third sensor in Lenovo laptops, as well as another large PC OEM. In that scenario, Pareto assumes that ELABS already reaches NOK 674 million by 2027, compared to “only” NOK 357 million in the base case. This shows the major changes a new OEM or another „breakthrough“ sensor can have on a forecast. In contrast to that, in the bear scenario, Pareto assumes that in 2025 & 2026 the traction of the past years falls off before returning to growth in 2027.

Therefore, it will be necessary to keep up to date with the company's developments and news to quickly incorporate them into the assumptions.

If you want to stay up to date, I release a Portfolio Update every month and share all new information regarding the stocks I own, as well as detailed Earnings Updates for my paying subscribers. Save 10% now for the annual subscription :)

10. Risks

Chinese Customers

All customers from ELABS are based in China. This is a significant country concentration risk, especially in the current uncertain geopolitical environment. However, although there are other smartphone & laptop manufacturer that are not based in China, nearly all of them are also still producing their products mainly in China. So the risks with these OEMs would practically be similar. It was also significant that Trump had to withdraw or pause his tariffs on smartphones and laptops from China relatively quickly, as the government probably quickly realized that they were quite dependent on them. Nevertheless, there are tensions between China and multiple other countries (especially Western) and political risks are often unpredictable. So a more diversified customer base would still be a big win for ELABS.

Technological / IP risks

The technology in the markets in which Elliptic operates is rapidly evolving and has been through a series of disruptive changes. To survive and grow, it must continue to enhance and improve the functionality of its products and technology to address the customers' changing needs. If new industry standards and practices emerge, the group's existing products and technology may become obsolete. The Group's future success depends on its ability to:

Develop new products and technologies that address the increasingly sophisticated and varied needs of prospective customers; and

Respond to technological advances and emerging industry standards and practices on a cost-effective and timely basis.

Elliptic is securing these technological advantages with patents. If the ELABS’ protection of its intellectual property rights is not sufficient or if the group does infringe third party intellectual property rights, this may result in an adverse effect on its business, results of operations and prospects.

Continued unprofitability

If the market for ELABS products does not evolve as the Group anticipates, this could have a materially adverse effect on the Group’s business, prospects, financial position, and results of operations. Although the company has been cash flow positive in the past two quarters and EBITDA profitable in 2024, there is no assurance that this trend will be sustained, as the revenues will continue to be lumpy. If the turnaround from unprofitability to profitability can not be confirmed in the current year, this could have a severe impact on the stock as investors are calculating on this turnaround.

Bad guidances

In 2020, Elliptic released its target of reaching NOK 500 million and an EBITDA margin of 50 % within the next three years. A very bold guidance for a company that had only NOK 30 million in revenues in 2020. Three years later, the company had revenues of NOK 68 million and was unprofitable. Today, the company still has the target of reaching NOK 500 million in revenues and an EBITDA margin of more than 50 %. They have just cut the exact time frame and now it is just a “mid-term” target. So the management is pretty bad at giving guidance and one should not count on that and instead have a look at the development from quarter to quarter. Another example is that the management announced during a call that they expect to announce another PC OEM in the second half of 2024, but so far, they haven’t presented any. While the management is still expecting another PC OEM, it seems like they are significantly underestimating the time frame of the adoption processes of its technology. Such statements fuel investors' expectations and if these cannot be met, this will have a negative impact on the share price

11. Summary

Elliptic Laboratories is a highly interesting company. With its unique AI software technology, it can bring its customers several advantages compared to the legacy hardware solution. These advantages alone have already convinced a large number of customers. Thanks to Elliptic's new sensor fusion and interoperability solutions, you can now offer existing and potential new customers even more reasons to choose Elab's products. If devices can share data and connect with each other in a similar way to Apple devices, then this could be a key selling point. More sensors in more devices will lead to a further increase in sales and Elliptic Laboratories can finally demonstrate the high profitability of its highly scalable business model. The prospects are therefore excellent at first glance, but the risks remain due to the high concentration of customers and the high expectations raised by the management to date, which have only gradually been fulfilled. Investors should therefore keep a close eye on operational developments. The financial development can sometimes deviate more strongly from the underlying operational development when milestone payments fluctuate, but product launches continue to accelerate. The share price has already risen in recent weeks, even if the full potential has not yet been exploited. Should investors be disappointed by the financial development in the future, even though everything is going well operationally, this could be a good entry point for long-term investors.

Congrats!

You are one of the few who have actually read the write-up until the end. To say thank you, I am offering every survivor a 10% discount on the annual premium subscription, where you can see my full portfolio and get all the relevant news regarding these stocks.

Very well written and researched. It helped a lot to develop an understanding of the company.

The technology and the recent launches by Lenovo make the company very interesting. However, its so difficult to forecast revenue and net income going forward. Somehow the business seems to be at an inflection point to profitability - but very lumpy with the current pricing model. The upside and leverage is still a big questionmark to me...

Is there any possibility to increase margins beyond the number of devices?

# Increasing prices?

# Switching to an ARR model?

Adding: The ex-CEO selling 2 M shares at ~11 NOK and leaving in November doesn't give much confidence. Though after 11 years it is ok to move on...

I am at the EK Forum Forum in Frankfurt in a week. Maybe I will find a slot to talk to them.

Thanks, very interesting write-up. I haven't found anything about significantly rising receivables, which worries me a bit. From the reports, I gather they recognize revenue upon contract signing. Excerpt from Q1'25:

"Initial milestone revenue from the Q1'25 laptop launches was recognized at contract signing in 2024."

This seems like a rather aggressive accounting approach. The level of receivables at the end of 2024 was almost equal to the full year's revenue. Perhaps these receivables aren't entirely unconditional? I think the market might be a bit concerned about this, and probably rightly so.

I would appreciate your thoughts on this matter.