#12 Arcure S.A.

AI pioneer for the digitalization of industrial vehicles

Disclaimer: The following write-up is no investment advice. The author may own, buy and sell securities mentioned in this post. Please always do your own due diligence! This company is a micro-cap. Keep in mind that even a small investment from your side can move the share price due to the low liquidity of shares. It's not easy to liquidate if you want to get out.

Welcome,

in this issue of Under-Followed-Stocks, I will present you Arcure S.A. ($ALCUR).

Investment Summary:

pioneer in embedded AI for industrial vehicles

benchmark solution for industrial safety and productivity

named as one of Europe’s long-term growth champions

huge untapped market potential

39 of the Fortune Global 500 are customers

revenue CAGR of over 33 % since 2013

high potential of further increasing margins

H1 revenues +24.5 % & profit up >9x

EV/ EBIT ‘25 of 9.7x

If you aren’t a subscriber yet and enjoy the content I share, feel free to subscribe so that you won’t miss any new content. The company write-ups I share are free. But if you want to keep up-to-date about the companies in my portfolio, you can voluntarily choose the paid option :)

Let’s go!

1. Introduction

Arcure is an industrial pioneer in artificial intelligence (AI) solutions for enhancing the safety, productivity and autonomy of machinery. Its flagship product, Blaxtair®, sold more than 22,000 units in more than 50 countries and is today a standard in its markets, offering a cutting-edge pedestrian detection solution to improve safety around industrial vehicles used by world industrial leaders and gradually adopted by machine manufacturers. 39 of the Top 500 global companies are end customers of Arcure. This expertise is crucial for the robotics of the future, constantly striving to be more autonomous and synergistic.

With this in mind, the company’s development is based on three pillars: UNDERSTAND customer needs, INNOVATE to maintain a leading position and ESTABLISH A STANDARD for perimeter protection around machinery.

Arcure is listed on the Euronext Growth Exchange in Paris since 2019 under the ticker $ALCUR.PA. The current market cap is EUR 30 million (USD 32 million).

2. The Company

Brief History:

founded in 2009 by Franck Gayraud and Patrick Mansuy, two engineers from the aerospace and defense industry, born out of a major need identified by industrial players and machine manufacturers: safety around vehicles.

set up of a joint R&D laboratory in 2009 in the fields of vision & video recognition technologies with the CEA (French Alternative Energies and Atomic Energy Commission), the INRS and manufacturers

after having the first Proof of Concept (POC) models with customers such as Alcan and Eurovia the series production of the first generation of Blaxtair started in 2012

In September 2014, Arcure signed its first OEM partnership with SICK, one of the world leaders in industrial sensors and automation for the development and production of Visionary-B, a 3D vision solution for the outdoor automation segment. At this time, Arcure was already active in 15 countries.

In 2016, the Blaxtair solution was validated and integrated by Jungheinrich, the world’s 3rd largest manufacturer of forklifts.

Continuous R&D resulted in a third generation of Blaxtair in 2017, which was more robust and compact and had significantly lower production costs. At this time, Arcure was already active in 30 countries.

After the IPO in 2019, the company expanded to North America with a new subsidiary in Chicago. This strategic location in the United States represented a strong development potential for the company, as more than one in ten forklifts are involved in an accident every year in this territory.

In November 2020, Arcure expanded its product range with Blaxtair Connect. The Blaxtair Connect dashboard allows users to quantify and locate accident risks so that action can be taken before they happen. In 2023, Arcure released further additional features like Blaxtair Zoning & Checklist

In May 2024, Arcure presented the fifth generation of Blaxtair with onboard AI that allows the easy addition of numerous functionalities, à la carte, by simple download. The Blaxtair offering now includes a broad portfolio of software solutions to improve safety and productivity in the industry

Nowadays, Arcure is a global company, active in over 50 countries via local distributors and an internal sales force (Europe & North America). 81 % of Arcures revenues are generated outside of France.

Among its customers are world-leading companies like Arcelor Mittal, Linde, Jungheinirch, Still, Liebherr and many more. Over time, the Blaxtair solution has become the standard solution in its market. The management estimates Blaxtair’s market share at around 80 %.

Multiple awards have already been given to the company in recognition of its technological leadership. The professional association for the construction industry in Germany (BG BAU) for example, has published an information sheet regarding the requirements to get subsidies when a company aims to implement a camera-based pedestrian detection system. The only mentioned solution in this sheet is Blaxtair.

If this Under-Followed-Stock sounds interesting to you, you can have a look at my full portfolio with this 1 day free trial for the premium subscription.

3. Technology & Products

Technology

The company has developed cutting-edge technology, the result of nearly 10 years of development, designed for the extremely harsh environments that equipment on board of industrial vehicles operating in the most demanding conditions may encounter. The first generation of Blaxtair was based on a machine-learning algorithm (developed in partnership with the CEA) and a robust stereoscopic camera, whose performance remained limited (detection distance of 5 meters maximum, basis of several tens of thousands of data).

Over time, the exploitation of the database from Blaxtair's fleet in operation with customers (more than 22,000 currently) and the improvement of its proprietary algorithms in the field of AI have made it possible to considerably improve the performance of products over generations, to raise barriers to entry and to distance themselves from competitors whose offerings struggle to be relevant. The barriers to entry that protect the Group reside in the construction of the learning database, the iterations that exploit it and the programming of the neural network. Especially the large database that neural networks can be trained on, represents a unique asset. Data mining work (construction of the learning database) requires strong expertise, which is fundamental to constitute a sufficiently diversified and non-redundant database so that the algorithm can extract generalizable criteria and avoid it being oriented towards overly specific criteria, which would distort the analysis and constitute "overfitting".

Arcure has gathered data for nearly 15 years from private industrial sites worldwide. This is completely different from data that you can openly access. The typical “AI” that we currently use like ChatGPT, is mostly trained on open information from the Internet. The algorithms for autonomous vehicles like Waymo are based on data gathered on the open street, which everyone can access. This makes it easier for potential competitors to gather a similar database. Getting a similar database from private industrial sites is much more difficult for potential competitors of Arcure. And that’s also the reason why Arcure focuses on its “industrial niche” and will not try to develop solutions for “normal vehicles”.

In 2022, Arcure moved from “Machine Learning + Stereovision” to “Deep Learning + Monoscopic Vision”, with very extensive performances (up to 15 meters distance) and at the same time massively reduced production costs. This AI camera can detect and precisely locate pedestrians in real-time, in any posture (standing, crouching, or hidden) and in all the most demanding work environments. The latest Blaxtair version has been released in April 2024. This fifth generation of Blaxtair has onboard AI, the true technological heart of the vehicle, allowing the easy addition of numerous functionalities, à la carte, by simple download. The Blaxtair offering now includes a broad portfolio of software solutions to improve safety and productivity in the industry.

Products

Blaxtair Pedestrian Detection

This is the core solution that Arcure offers. They developed the Blaxtair technology and AI cameras to save lives, with the goal of zero accidents at industrial sites. The solution has the following features:

Improves safety, working conditions and productivity

Prevents collisions between industrial machinery (reverse and forward) and pedestrians

Avoids unnecessary alerts that tire the driver

Control & reduction of accident risks thanks to the integrated Blaxtair Connect

Future-proofed: online maintenance & remote software updates

Scalable: ready for future additional features or cloud services

In the video below, you can see how the solution works (the video is based on an older Blaxtair version).

Around this core solution, Arcure has developed additional features that complement the aim of zero accidents and simultaneaously increase the revenue per customer with optional recurring revenues.

Blaxtair Connect

The Blaxtair Connect dashboard provides access to relevant metrics and hot-spot mapping to enable occupational health and safety managers to take proactive action every day to drastically reduce the risk of machine/pedestrian collisions. The solution allows you to manage a fleet of Blaxtair systems, identify danger zones and actively prevent accidents. It helps to decrease the machinery/pedestrian coactivity on sites by at least a factor of three and measures the effectiveness of the preventive actions implemented.

Blaxtair Checklist

The 'Blaxtair Checklist' solution allows the operators to create a checklist on a tablet before starting their vehicle. It strengthens personal safety, improves the availability rate of machines, and optimizes maintenance. Upon start-up, the Blaxtair Checklist ensures the safety and proper functioning of the machine through a series of questions. The responses are stored directly in the cloud, and in the event of noncompliance or malfunction of the machine, maintenance is notified, and the start-up of the machine can be limited or prevented. This functionality is sometimes mandatory, particularly in North America because it is imposed by the Occupational Safety and Health Administration (OSHA).

Blaxtair Zoning

The Blaxtair Zoning technology automatically reduces the speed of vehicles entering high-risk areas, such as:

areas with high vehicle/pedestrian co-activity

narrow aisles

dangerous intersections

doors

When a vehicle leaves these risk zones, normal speed is automatically applied again, guaranteeing optimal fluidity of operations. By integrating Blaxtair Zoning, businesses can not only create a safer work environment, they can also optimize their operations for better overall efficiency.

Blaxtair Vehicle & Obstacle Detection

By going beyond pedestrian detection, Blaxtair detects and localizes vehicles & specific obstacles around one another, thus guaranteeing more complete collision prevention.

Blaxtair Shock Detection

The ‘Blaxtair Shock Detection’ solution makes impacts visible and traceable. Equipped with an inertial sensor, it detects and localizes impacts in real time and transmits critical data to Blaxtair Connect. It allows each impact to be tracked, specifying their exact location, detection times, vehicles involved and the severity of the impacts. Additionally, visual evidence such as photos and video footage of the incidents are provided for in-depth analysis. By cataloging and evaluating every impact, even the most minor ones, companies can prevent more serious problems, significantly reduce the risk of equipment damage, and improve overall safety. Blaxtair Shock Detection provides unprecedented visibility and indicators to optimize operations and enhance the safety and reliability of vehicles and facilities. It also enables proactive management of any impact as soon as it occurs, providing increased peace of mind.

4. Business Model

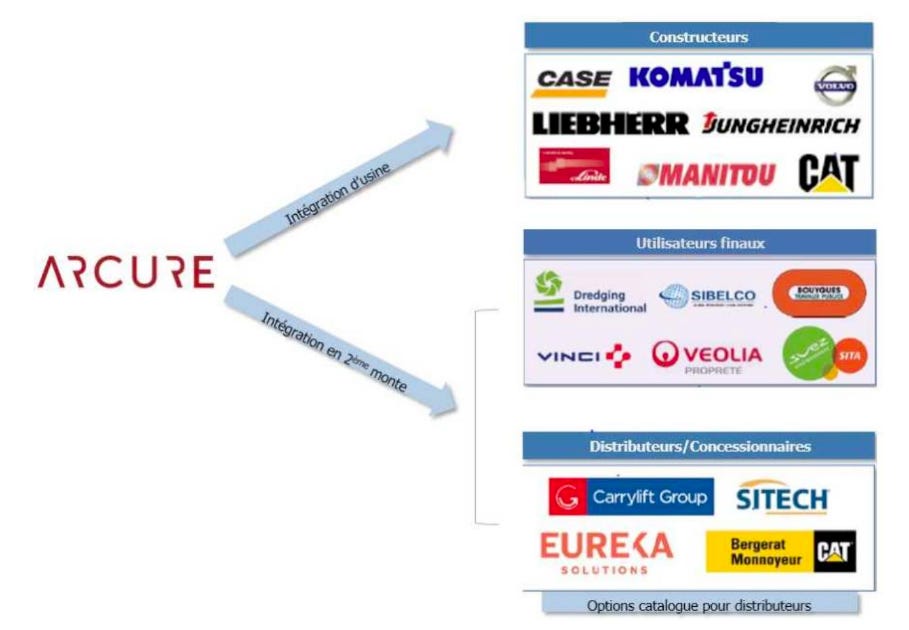

Arcure is selling its products via dealers and distributors (62 % of revenues), direct sales to end users (14 % of revenues) and OEMs (24 % of turnover).

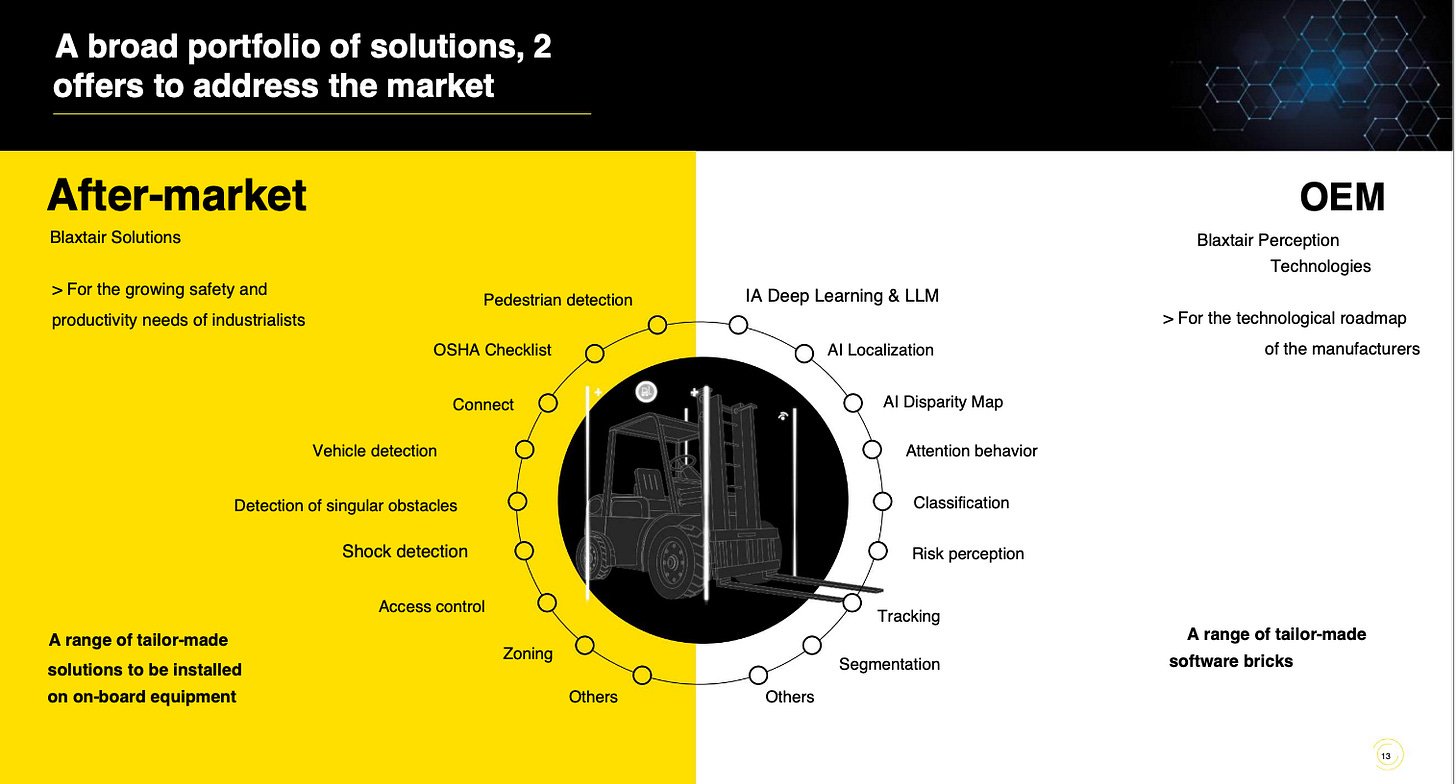

Arcure offers its “After-market” Blaxtair solutions to the end users and dealers/distributors. This is a range of tailor-made solutions to be installed on-board equipment. This means that the customer already has a certain industrial vehicle like a forklift and now wants to equip the fleet with a pedestrian detection system, for example. On the other side, Arcure has developed a range of tailor-made software bricks for the technological roadmap of manufacturers. This allows, for example, the forklift manufacturers to directly embed Blaxtair software into their newest forklifts. For example, when ordering a forklift from Jungheinrich, you can choose Blaxtair as a factory option.

The innovative nature of Blaxtair leads to a relatively long sales process despite its limited price in relation to the value proposition in terms of safety and productivity, which is often explained by the complex organisation of these large groups that are Arcure's customers.

While the initial sales cycle is quite long, Arcure on the other side has very low visibility on the final orders. Delivery plans are based on oral commitments made by customers and on probability approaches. The order book typically has a low level (around 6 weeks) and relatively short delivery times (2–3 weeks after receipt of the order). The average effective selling price of a Blaxtair is around EUR 3,600, which ultimately weighs little in the overall cost of the machine (EUR 15,000–20,000 for small forklifts and up to EUR 1 million for the largest). The product life cycle is mainly linked to the operating duration of the equipped machines. For a typical forklift, this is probably around 6-7 years.

The manufacturing of the hardware components of Blaxtair is subcontracted to third-party suppliers as Arcure wants to focus on the development of the technology. The company significantly reduced the hardware components needed from generation to generation, resulting in higher gross margins.

5. Market, Customers & Competition

Market

Arcure’s technology addresses the risks associated with industrial vehicles. Thus, various industrial sectors globally like logistics, transport, mining, defense, energy, chemistry, metallurgy, construction and many more are their potential end markets. According to the management, the company is not heavily dependent on one of these sectors alone.

Historically, the primary end market was the construction sector, as the initial products were mostly installed in construction vehicles. However, over time the forklift market has grown considerably and is now the primary market for Blaxtair. Forklifts of all types are used in nearly every industrial company, so the potential end market is high.

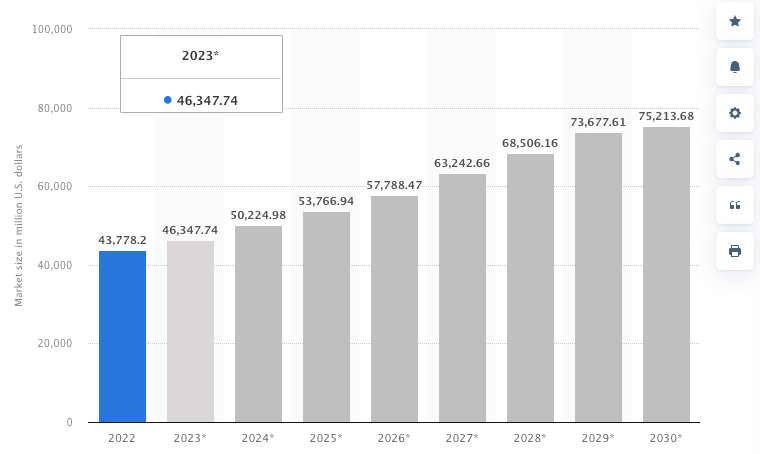

According to Statista, the global forklift truck market size is expected to grow with a CAGR of ~7 % from 2022-2030.

According to the company, around 1.4 million forklifts (excluding China) and 0.9 million construction vehicles (excluding China & India) are produced every year and can potentially be equipped with intelligent perception systems like Blaxtair. The management is estimating that currently only ~0.5 % of this fleet is equipped with such a system, leaving a high potential for further growth and achieving more security for the staff.

But why should companies invest in such systems at all?

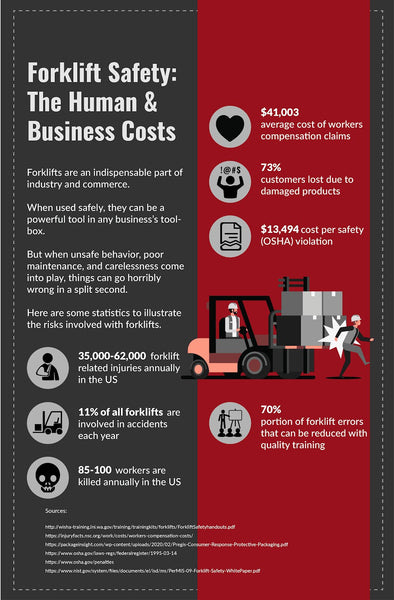

According to the OSHA (Occupational Safety and Health Administration) forklift accident statistics, approximately 11 % of forklifts are involved in some kind of accident each year and 25% of workplace transport injuries are the direct result of forklift truck accidents. In the US alone, there are around 35,000 to 62,000 injuries every year related to forklifts and 85-100 workers even die as a result of such an accident. The average cost of workers’ compensation claims is USD 41,003 and the average cost per OSHA safety violation is USD 13,494. So each prevented accident saves the company money.

Customers

As already mentioned, 39 of the Top 500 global companies are end customers of Arcure. But many more large companies across mutiple industrial verticals are trusting Arcure’s solutions. You can see some of the largest end customers in the picture below like Coca-Cola, Nestlé, Renault, Arcelor Mittal, Nippon Steel, Vinci and many more. Besides these large end customers, some of the largest OEM’s are also trusting Arcure like Jungheinrich, Liebherr, Manitou, SICK, Kalmar or Still.

Competitors

As a specialist in artificial intelligence applied to image processing to increase the safety around industrial vehicles, Arcure is active in a relatively niche but emerging market. With over 22,000 installed systems, the company sees itself as the clear market leader in its niche, with an estimated market share of around 80%. According to the management, the competitive landscape is emerging, but they are (yet) not reaching the same level of performance. The company mainly observes local distributors of cheap Asian solutions on the market. In addition, some OEMs are also trying to develop proprietary solutions, so far without success.

Most of the “cheap” solutions are based on devices, that every worker/pedestrian has to wear, like wristbands/tags that communicate with the vehicle as soon as both are close to each other. Then either the vehicle stops or the device is alerting the worker. This is a simple way, but not comparable with “real machine vision” that Arcure offers. Once a worker forgets to wear his device, the solution doesn’t work anymore. Below you can see different technologies that are used to avoid collisions ranging from device/badge detection to a “normal” camera or microwave/laser detectors that can’t distinguish between humans and obstacles.

But of course, competitors exist that are offering similar technological solutions like Blaxtair. For example DotNetix with its Safeye & Argos solution. The Safeye solution looks like one of the first generations of Blaxtair, while the Argos solution more looks like the newest monoscopic Blaxtair generation, but offers reduced capabilities like a lower detection range. In addition, it seems like DotNetix is more focused on the mining vehicle market. Other pedestrian detection systems based on “AI cameras” for forklifts can for example be found from FTC safety soltions or AiVA but the informations that can be found on these products also indicate that the capabilities are lower compared to Blaxtair.

Nevertheless, there is definitely competition and Arcure will have to further invest in R&D to stay ahead of the competition by increasing the accuracy of their system, reducing the costs & offering additional features and functionalities. As soon as the adoption of advanced pedestrian systems increases competition will heat up.

6. Growth Drivers & Catalysts

Expanding the (international) customer base

Although Arcure is already generating 81 % of its revenues outside of France, the company is still seeing a lot of opportunities in the expansion of its international customer base. As part of their efforts to increase their international presence, Arcure opened a new office in Barcelona, Spain with a sales, marketing and R&D department. With 53 % of revenues, Europe (excluding France) is the largest market for Arcure (especially Germany/Austria with 29 %). The second largest market is North America with 21 %, but the market is currently growing faster with 34 % yoy and Asia has a share of 7 %. So especially in North America, there is a lot of potential for further growth.

What helps Arcure is also that most of its customers are multinational companies. Once they have tested and equipped their fleet with the Blaxtair solution in one country and see its benefits, there is the potential that this customer will roll out the solution on its global fleet. Such a partnership has recently been signed with Arcelor Mittal France. Initially, Arcelor Mittal equipped several hundred industrial machines in North America and Europe with Blaxtair’s pedestrian detection solution. Arcelor Mittal was happy with the results, especially the exceptional performance, including its ability to detect pedestrians in difficult conditions, as well as its connected solution Blaxtair Connect and thus decided to extend the use of Blaxtair to its entire fleet. The final equipment of this fleet of vehicles is in the hands of each subsidiary and each site in the world, so Arcure hasn’t published any exact numbers, but the potential is immense. At the Florange site of Arcellor alone, there will be 200 forklifts equipped by the end of the year and they will also equip multiple Canadian sites this year.

Increase revenue per customer

After building a larger customer base and building a market leading position, Arcure has expanded its offering with new functionalities around its core Blaxtair product. Some of these high-added value solutions, like “Checklist” are even mandatory in certain countries. Once a vehicle is equipped with Blaxtair, Arcure can easily expand the functions of the system without high initial integration costs for the customer. The share of sales for services increased by 45 % in 2023. As these additional features don’t need further hardware, these sales also have a higher margin profile compared to the initial hardware-based Blaxtair sale which contributes to the structural improvement of the companies profitability profile.

Regulations & ESG

As already mentioned, there is a legal requirement for the “Checklist” solution in the US. Other countries may introduce similar regulations or even additional ones to increase the safety of the people. But even when it is not mandatory, there is an inherent interest for the companies to avoid accidents at their industrial sites. Every accident costs the company real money as the workers are absent for some time after an accident. In addition, ESG (Environmental, Social, Governance) criteria become more and more important for companies. Part of the “Social” goal (8.8) is also to promote safe and secure working environments for all workers.

Improved Margin

Thanks to the continuous innovation and development of Blaxtair, Arcure was able to significantly reduce the hardware costs and ultimately improve its gross margins. Since 2021, the gross margin increased from 49 % to 58 % in H1 2024 as the newer versions of Blaxtair became the main growth driver. In H1 2024, the company still delivered a substantial volume of older Blaxtair 3 orders as a large European customer ordered them in advance for their needs and spare parts for 2024-2025 before Arcure will end the product life of this old version in H2 2024. In contrast, the newest Blaxtair generation will start selling during the second half of 2024. So one can expect that the share of newer (high-margin) generations will be even higher in H2 which should positively impact the overall gross margin.

Besides the improved gross margin, the new generation of Blaxtair has another advantage for the companies margins. The older versions were still based on “older” algorithms that were initially co-developed with the CEA in 2009 and Arcure has to pay royalties to CEA based on the product volumes sold that use this technology. In 2023, Arcure paid EUR 328,000 to CEA as license costs while only generating an operating profit of EUR 957,000 (excluding CIR tax credits). So when Arcure would not have to pay these royalties, the operating profit would have been over 30 % higher in 2023.

The good thing is that the new Blaxtair generations no longer use the old machine-learning algorithms that are covered by the license agreement with CEA. Arcure has developed proprietary deep learning algorithms, and thus the new versions are based on purely Arcure technology. The end of the sale of versions Arcure has to pay royalties on is planned for 2025. So the licensing costs should significantly decrease in 2025, and then finally end in 2026 which will further contribute to the companies margins.

But the biggest impact on improved future margins is a bigger share of OEM software sales. The company has developed a tailor-made software bricks portfolio for OEMs and as you can imagine, these software sales have a much higher margin compared to hardware sales. In the past, Arcure was already able to significantly increase its OEM sales. In 2023, 20 % of revenues have been directly to manufacturers (growing by 26 %).

But these sales are still based on old agreements, where the manufacturers offer Blaxtair equipment in its factory setting on new vehicles. So in the end, Arcure is still delivering the hardware components to the manufacturer, who is then equipping the vehicle. In the medium term, it is planned that the hardware (camera etc.) is already implemented by the manufacturer (as part of their technological roadmap) and Arcure will only grant software licenses to use their technologies. Discussions and calls for tenders are underway with the main manufacturers, according to the company. In the report for the H1 results, the management stated that:

“Discussions of agreements with builders (OEM) and partners stepped up. These discussions will be our main growth drivers for volumes in 2025 and beyond.”

Digitalization of industrial sites

Vehicles & industrial machines are no longer “dumb”. As with everything nowadays, they also become connected and smart. The trend is clear that industrial machinery will be increasingly equipped with smarter features and functions to ensure greater safety, autonomy and productivity. With the recent hype in AI solutions, this trend has even accelerated.

This trend will probably not stop with “intelligent vehicles & machines”. Similar to Smart Home solutions, where you start with automating some basic things like automatically switching the lights off or closing the shutters and then you go on with window sensors, power measuring, etc. And ultimately you can manage that your dryer should only start when your solar system produces excess power. So you developed from smart gadgets to a real smart home. The same will probably happen at industrial sites, where we are now digitalizing vehicles, but in the end we want a fully digitalized industrial site. Thanks to Blaxtairs embedded AI, Blaxtair can produce digital twins from the industrial site thanks to the forklifts that are driving at the site and capturing real-time dynamic 3D recordings.

Takeover / Partnership with major industrial player

With ChatGPT, the AI hype has started and everyone realized how powerful real artificial intelligence can be. Since then, many “AI companies” have been acquired by larger companies. And of course, AI is also an important factor for industrial companies and manufacturers. So Arcure could be a logical target for an industrialist in this sector. According to the management, they are always in discussions with industrial groups that wish to strengthen their position in these areas. However since Arcure was still reliant on CEA technology in the past, an acquisition was not that interesting for these players. As this will change in the future, this topic could become more interesting. The management is recently often talking about partnerships with major industrial players. So it could also be possible that, for example, a large OEM could buy a bigger stake in Arcure or establish a joint venture.

If this Under-Followed-Stock sounds interesting to you, you can have a look at my full portfolio with this 1 day free trial for the premium subscription.

7. Management & Shareholders

Franck Gayraud is the Co-Founder, Chairman and CEO of Arcure. He began his career at Arianespace as a Project Manager, then became Program Manager at Sagem Défense Sécurité in 2001 before heading the Strategic Planning department until 2007. At that time, he became director of Airborne Optronics programs before co-founding Arcure in 2009 and leads the business development, international growth, communication and finance operations.

Jean-Gabriel Pointeau is the Deputy CEO & Director of Strategic Partnerships. He began his career in the aeronautics industry as a systems engineer and project manager at Thales and Sagem (Safran Group). He joined Arcure in 2013 to create and lead the Sales Department until 2022. He graduated from EMLyon’s Executive MBA program in 2018 and joined Arcure’s Executive Board in 2020.

Sabri Bayoudh is the Chief Innovation Officer. After his first job at CEA, he joined Arcure in 2010 and became Technical Director in 2012. After a decade of technical experience, he completed his education with an Executive MBA at HEC in 2020. With these technical and business skills, he created the Innovation Department, which he now heads.

The other Co-Founder of Arcure, Patrick Mansuy, is a non-executive Member of the Board of Directors. Together with his wife, he is also the largest shareholder of Arcure with a combined 13.04 % of the company. He no longer exercises any operational responsibility in the company since September 2023. It should be mentioned that he recently sold around 44,000 of his shares (around 5 % of his shares).

The second largest shareholder is Co-Founder Franck Gayraud with 8,19 % and other Arcure employees own around 2.34 % of the outstanding shares. CEA ( (French Alternative Energies and Atomic Energy Commission) who initially researched on the algorithms with Arcure, still owns 2.59 % of the company.

Other shareholders are A.T.I. SA with 5.36 %, Seven Canyons Advisors with 4.39 % and Odyssey Venture with 3.82 %. The free float is around 57.5 %.

8. Financials

Since its foundation in 2009, Arcure was able to organically grow its top line to EUR 18.2 million in 2023. The company grew with a CAGR of over 33 % from EUR 1 million in 2023 to EUR 18.2 millon in 2023. Arcure is named as one of the European long-term growth champions, a ranking published by the Financial Times that lists the 300 companies in Europe (private & publicly listed) with the highest disclosed CAGR over the 10 years to 2023. Arcure ranked 123rd in the overall ranking and 20th in the IT sector.

Especially since 2021, the turnover increased significantly and the company finally turned profitable in 2023.

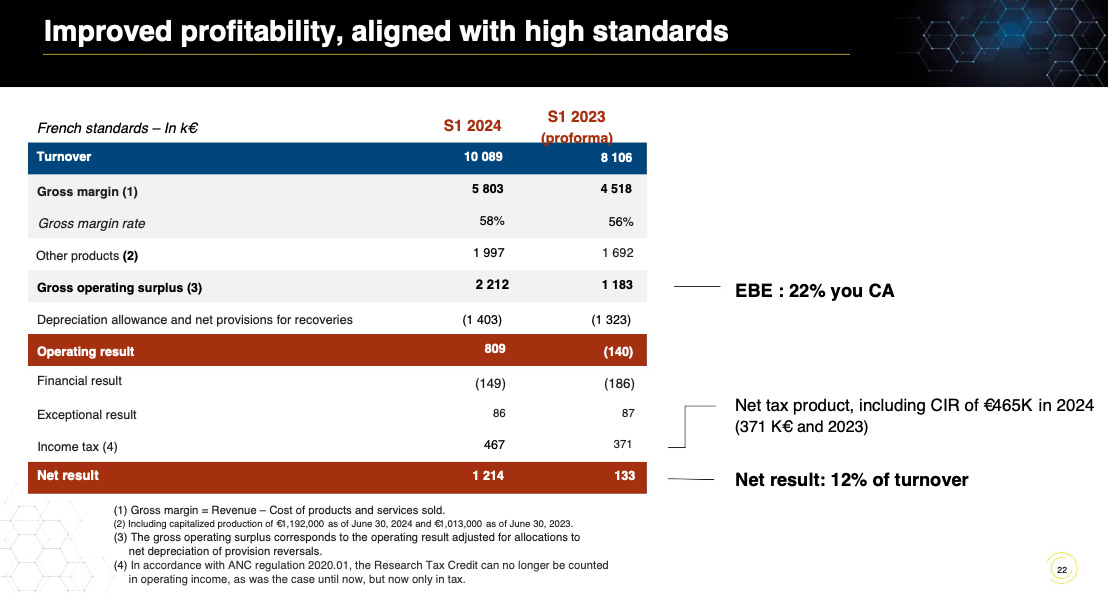

In H1 2024, revenues increased by 24.5%, and EBIT turned positive from EUR -140,000 in H1 2023 to EUR +809,000 in H1 2024 with an EBIT margin of 8%. The net result benefitted from Research Tax Credits (CIR, subsidy for R&D costs) of EUR 465,000 in H1 2024 and EUR 371,000 in H1 2023. In previous years, this subsidy was included in the operating result (EBIT), but since 2024, the company has to include it in the income tax line of the P&L. That’s why you can see below the 2023 numbers as pro forma to compare them on a like-for-like basis. On a like-for-like basis, the net income increased by >9x in H1 2024.

It should also be mentioned that the H1 results are burdened by an increase in provisions for warranties of EUR 426,000. The increase in this provision is particularly related to the impact of a one-off customer service issue encountered with certain equipment from two suppliers on certain batches of equipment, totaling €426k. This provision covers the estimated retrofit and after-sales service costs. Although this type of event is part of the life of an industrial company, one could ideally assume that these should not be recurring costs. So if no additional events happen in the next year, one should expect margins to be even higher going forward, just by excluding these non-recurring costs. Excluding these additional (one-off) costs, the EBIT margins would have been around 12 %.

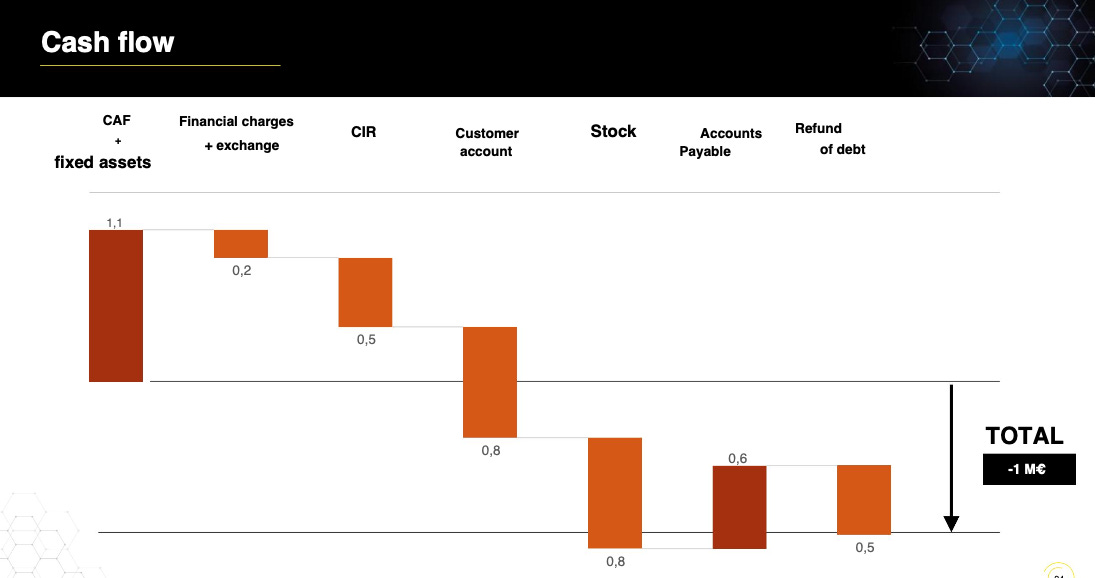

Self-financing capabilities net of fixed assets amounted to €1.1 million over the half-year. To be noted, the company has continued investing in R&D (-€1.2 million), which is necessary to maintain its technological leadership.

The contribution to the change in cash from the change in working capital amounted to -€1,5 million, related to an increase in trade receivables (-€0.8 million), in Research Tax Credit (CIR, -€0.5 million), inventories (-€0.8 million) and trade payables (+€0.6 million). The impact of financial expenses paid amounted to -0.1 million. The Company has also continued to decrease its debt steadily and viably (-€0.5 million). Therefore, cash declined by €1 million over the half-year. As of 30 June 2024, gross cash amounted to €2.7 million and financial debt totaled €7.3 million, which comprised a majority of long-maturity convertible bonds (2027). Post-closing, Arcure has secured two additional credit lines for €1.75 million to be cashed in the second half of the year.

Arcure has tax loss carryforwards of EUR 17 million in France and EUR 1.6 million in the US. So Arcure will not have to pay a lot of taxes in the near term on its profits as these can be offset by the tax loss carryforwards. Due to that, Arcure has capitalized deferred taxes of EUR 2 million, corresponding to an amount that has a high likelihood of being recovered over the short term.

The management expects that their working capital needs will be reduced as they will only have one product line starting in 2025 (with reduced hardware costs). They are currently not planning any financial operations on the market in the short term to raise money. However, they remain open to opportunities (like the already mentioned strategic partnerships with major industrial players) that would allow them to increase their operational capacities for future growth.

9. Valuation

Arcure has a market cap of EUR 30 million and enterprise valuation of around EUR 35.75 million (including new debt after H1 2024).

The management has recently confirmed its previous guidance of achieving (at least) EUR 20 million in revenues in 2024. As Arcure already generated EUR 10.1 million in revenues in the first half, this would leave (only) EUR 9.9 million for the second half. As already mentioned in the Financials section, the H1 results were burdened by one-off costs and that the adj. EBIT margin excluding these one-off costs would have been around 12%. As the share of revenues of the new Blaxtair generation with a higher gross margin should increase in the second half of 2024, it is likely that the margin will continue to improve in H2. Estimating that the margin will increase to 14 % in the second half, Arcure could generate around EUR 1.39 million in EBIT in H2 ‘24, just by achieving the minimum of the revenue guidance. Totalling H1 & H2, Arcure could achieve a normalized EBIT of EUR 2.62 million for the full year 2024. Based on this number, the company trades at an P/EBIT multiple of 11.4x and an EV/EBIT multiple of 13.6x. A multiple based on the net profit of the company would be even lower as the research tax credits are added at the tax level of the P&L since 2024. But as such subsidies are based on political decisions that may change, valuing a company without these additional (external) profits is more conservative.

Given the various growth drivers described in chapter 6 of this write-up, it is likely that Arcure will continue its growth path in the coming years. Although industrial companies will probably invest more in new technologies for the safety of their employees in the future, the current economic environment could hampen their willingness to increase these investments in the short term. To be conservative, one can calculate with (just) 15 % revenue growth in 2025 year-over-year, which is well below the historical growth rate. In 2025, the margin profile should continue to improve, as the newest version Blaxtair will be the primary product. Besides the better gross margin profile, Arcure will also not have to pay royalties for these new products. This aspect, combined with some scale effects could lead to an improved EBIT margin of 16 % in 2025, resulting in an EBIT of around EUR 3.68 million in 2025. Based on these estimates, Arcure trades at a P/EBIT of 8.2x and EV/EBIT of 9.7x for 2025.

Considering the huge untapped market potential, Arcure has the chance to continue to grow its top line with double digits for a long time, even if they lose some market share to emerging competitors. On top of that, there is the huge potential for the margin profile, if Arcure is able to sell its software products to the OEMs. In the IPO document of Arcure, they said that they could achieve EBIT margins of 25 % at revenues of around EUR 60 million, just by the new products with higher gross margins and some scale effects. Software revenues with even higher margins weren’t even included in these estimates. So a long-term EBIT margin profile of around 25% seems to be achievable for Arcure. One could start to make some estimates based on these numbers for the years after 2025, but the multiples one can calculate with conservative assumptions for 2025 already indicate, that the current valuation is not too demanding given the revenue & margin potential.

Arcure is active in a very small niche and the management is claiming, that they have around 80 % market share in this niche. So it’s not easy to find a suitable peer group and it would have been easy to pick some hyped AI stocks and compare them to the valuation of Arcure. This would probably not have been that helpful. But as the technology of Arcure allow the industrial vehicles to “see” obstacles, a comparison to some publicly listed companies in the field of “machine vision” could be helpful.

Even compared to this “not so hyped” group, the valuation of Arcure still looks attractive.

10. Risks

Low visibility of orders

As already mentioned, Arcure has a relatively short order book of just around 6 weeks. This makes it difficult for management to predict revenues and recognize orders' slowdown. Especially as the economic development in many European countries is currently uncertain and many industrial companies had to publish declining revenues, this could become a problem for Arcure. In uncertain economic environments, companies will not likely start new investments. So the business of Arcure is sensible for the current industrial situation, but due to the short order book, they will recognize this later, making it more difficult to react.

Competition

The competition in Arcure’s emerging niche will heat up. Manufacturers of industrial vehicles will further invest in digitalizing the vehicles they sell. In the world of artificial intelligence, data is the new gold and everyone wants to collect data to analyze & use it. For a small company like Arcure it will not be easy to always stay ahead of the competition, especially when competitors are large industrial players with much deeper pockets.

New technologies

The cheaper (Asian) solutions for pedestrian detection are mainly based on tags, that the workers have to wear, which is clearly a disadvantageous solution. But over time, these cheaper solutions could become better and if the results can be nearly as good as the Blaxtair solutions, customers could decide to safe some real dollars instead of getting a slightly better product.

Dilution

The company is not planning to raise money in the short term. But as previously explained, the current economic environment is uncertain and if some of Arcures major customers start to struggle, this will also affect Arcure. At the same time, Arcure will have to further invest in its R&D to technologically stay ahead of the competition. If Arcure is not able to increase its cash flow to cover its costs, the company will have to raise more money, as there is not much more room for additional debt. And if they have to raise cash during an economic downturn, this could result in heavy dilution for its shareholders.

Co-Founder selling shares

As mentioned, one of the co-founders (and currently the largest shareholder) has recently sold some of his shares (around 5 % of his holding). In September 2023 he left the active management of Arcure and is now just a non-executive member of the Board of Directors. Arcure is a microcap company with a market cap of around USD 30 million and very low liquidity. So if a major shareholder would continue to sell his shares, this would probably have a bigger impact on the share price. But it is good to see, that the other co-founder who serves as the CEO, hasn’t sold any shares. As always, there can be multiple reasons for selling shares.

11. Summary

Arcure combines nearly all aspects of a hidden champion with multibagger potential. It is a market-leading microcap in an emerging niche with a lot of growth potential, high-profile customers and increasing margins at a low valuation. As always, these high (potential) rewards are inherently connected with some risks. Europe is still the biggest market for Arcure and the economic development there is more than uncertain. This combined with the low visibility of orders can become a serious problem for Arcure and once the growth story is broken, it could be more difficult for Arcure to continue to fund their necessary R&D to keep the increasing competition at a distance. But Arcure is not a young AI startup funded by some VCs who wanted to participate in a new hype. Arcure’s developers have been able to adapt new technologies and significantly improve hardware for 15 years. The management has shown, that they are able to deliver consistent organic growth since 2009, even in economically difficult times. There is no reason why they should stop now.

Congrats!

You are one of the few who have actually read the write-up until the end. To say thank you, I am offering every survivor a 10% discount on the premium subscription, where you can see my full portfolio and get all the relevant news regarding these stocks.

Great write-up as always. One quick question: How about liability for accidents that happen despite the technology ? Are there any cases where victims try to sue them (meight be a bigger issue in the US) ?

Je souhaite aussi un sujet qui n'a pas été abordé.

Comme pour un choix de logiciel, lorsque une entreprise fait le choix d un système comme le Blaxtair d'Arcure qui intègre tous l'environnement logiciel associé (comme la gestion de la flotte d'engins et toute les options proposées), c'est un choix pour de nombreuses années. Les entreprise ne change pas de système tous les 2 ou 3 ans. Et lorsque la société investi dans un système qui lui convient, il y a une recurrence dans ce choix pour avoir une homogénéité. Les nouveaux engins qui rentrent dans le parc de la société seront donc automatiquement équipés du même système.

Cela donne une recurence dans le business d’Arcure dès lors que les entreprises font le choix du Blaxtair, et c'est essentiel dans la réussite d'un business efficace .